The Truth Behind the FDIC's First Innovation Officer

Hey FinTech Fanatic!

The Information published an mind-blowing deep dive on Sultan Meghji, the Federal Deposit Insurance Corporation (FDIC)'s first ever Chief Innovation Officer.

In a revealing investigation, Sultan Meghji, has been spotlighted for his pattern of embellished stories and inconsistencies. Once a FinTech founder, Meghji's career took a significant turn when he joined the FDIC, shortly after being asked to step down from his company due to ethical and performance issues.

Interviews and documents highlight Meghji's tendency to overstate his achievements, including his supposed contributions to banking in Africa and inventing web technology alongside Marc Andreessen.

Despite his claims of facing gunfire (!) in various scenarios, those stories lacked consistency.

His tenure at the FDIC was marred by previous controversies, including questionable claims about his involvement with technology and advisory roles, and his FinTech startup faced significant challenges and unfulfilled promises, such as AI technology that never materialized.

This must be one of the craziest stories in the FinTech industry I read for a long time. What's the wildest story you every heard or read about in FinTech? Let me know in the comments below!

Have a great start to the week and I'll be back in your inbox tomorrow.

Cheers,

INSIGHTS

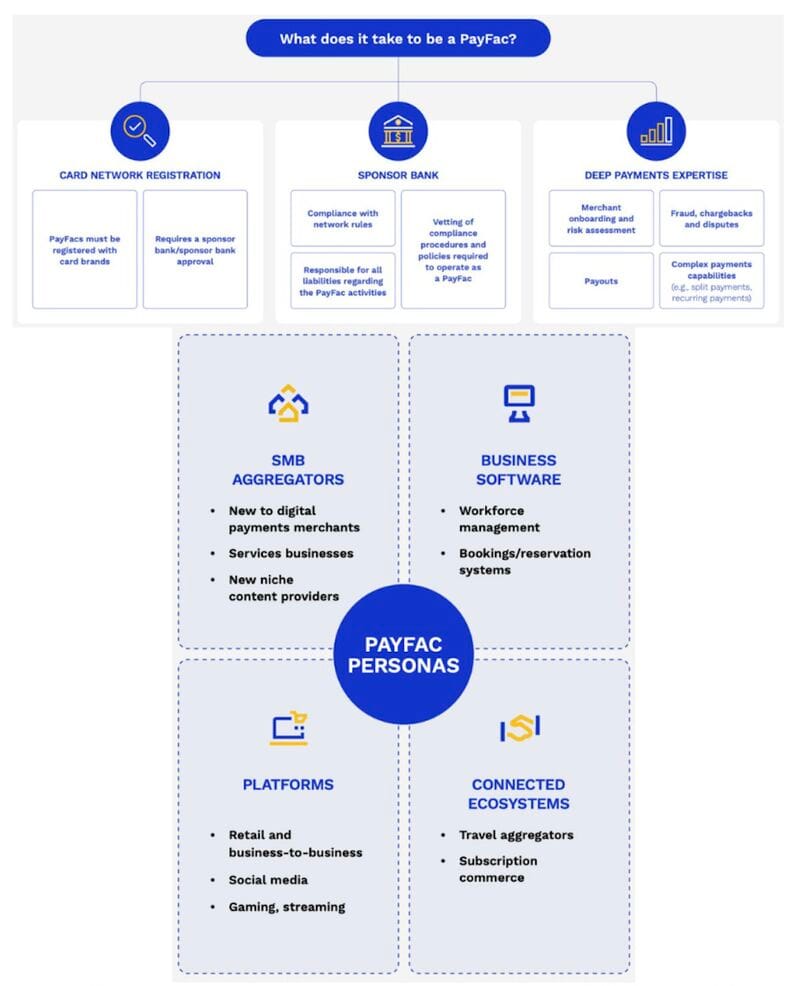

What doest it take to be a PayFac?

Here are ⓺ steps to get there:

FINTECH NEWS

🇯🇵 IDEX Biometrics and KONA I are partnering to deploy biometric payment and access cards in Japan. With credit card fraud in Japan rising by 30% year over year to USD 294 million, banks are keen on biometric smartcard solutions, particularly metal cards. KONA I anticipates banks offering advanced biometric cards to consumers by the second half of 2024.

PAYMENTS NEWS

Marsh McLennan’s Oliver Wyman to acquire Innopay, a leading consultancy firm specialized in digital transactions. Innopay will complement Oliver Wyman’s existing payments consulting capabilities. Terms of the transaction, expected to close before the end of the first quarter of 2024, were not disclosed.

Visa 🆚 Mastercard on Performance FY 2023. Visa and Mastercard reported strong annual performance due to increased consumer spending and cross-border volumes, with cross-border growth slowing to 16% for Visa and 18% for Mastercard from previous higher rates.

OPEN BANKING NEWS

🇺🇸 FIS drives secure Open Banking for financial institutions and consumers. FIS' Open Access platform offers secure and streamlined access for consumers to share their financial data. It also provides banks with visibility and reporting on customer data sharing, fintech interactions, and frequency.

DIGITAL BANKING NEWS

Here are 7 digital banking trends to look out for in 2024. Click here to get the full article.

🇦🇺 Revolut is set to introduce credit cards and expand unsecured lending in Australia, responding to the increasing reliance on debt by households facing rising living costs.

Here’s a glimpse into Revolut’s 2024 market rankings across Europe. Read on and let’s dive into 7 Key Takeaways from the rankings.

🇮🇳 Fintech firm One97 Communications, which owns Paytm brand, announced setting up of a group advisory committee headed by former Sebi Chairman M Damodaran, amid its associate payments bank entity facing regulatory action for non-compliance with RBI norms.

🇺🇸 JPMorgan Chase dominates AI research in banking. The bank has consolidated its reputation as an AI research powerhouse, according to new data from benchmarking platform Evident. Read more

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Wirex CEO says money mules are a massive issue in FinTech and crypto. In an insightful interview with Cryptonews, Pavel Matveev, CEO and co-founder of popular global digital payment platform Wirex, discussed what money mules are and how big of a problem they pose in the crypto and FinTech industries. The short answer is: big.

DONEDEAL FUNDING NEWS

🇲🇽 Paytech startup Coba has successfully raised $2.2 million to streamline cross-border financial services in LatAm, marking a significant step towards simplifying the financial transactions of remote workers across the region. It provides clients with a U.S. deposit account to receive USD payments and Mexican financial features for local spending in pesos.

🇺🇸 Fintech firm Pagaya Technologies has secured a new $280 million credit facility led by investment management giant BlackRock with participation from Israel Discount Bank, UBS O’Connor, JP Morgan Chase, and Valley Bank. The facility comprises a $255 million term loan and a $25 million revolver.

M&A

🇬🇧 Barclays to buy most of Tesco’s banking business for £600mn. Barclays recently said that it would take on Tesco Bank’s credit cards and unsecured personal loans, totalling about £8.3bn of lending balances. It has also signed a 10-year distribution deal to sell financial products under the Tesco brand.

🇯🇵 Digital Wallet Corporation acquires International Money Transfer Service from Seven-Eleven Group Japan. This acquisition will allow DWC and Seven Bank to collaborate in redefining and improving the landscape of international money transfer services and financial inclusion for foreign residents in Japan.

MOVERS & SHAKERS

🇺🇸 SoFi Just Hired a New Chief Risk Officer. SoFi has named JPMorgan Chase veteran Arun Pinto as its new Chief Risk Officer (CRO). The firm previously added Federal Reserve veteran Dana Green to its board. More here

🇺🇸 Plaid has named Jennifer (Jen) Taylor, who most recently served as Cloudflare’s chief product officer, as its first president. In a blog post, Plaid co-founder and CEO Zach Perret wrote that Taylor’s “experience scaling products to meet increasing customer demand will be invaluable” as Plaid continues to expand its platform “to support ongoing innovation in financial services.”

🇺🇸 Stash’s new CFO Steven Hodgeman says joining the $1.4 billion fintech firm is about having ‘real impact on folks across the country.’ Hodgeman joins Stash from Getir, the global delivery service at which he served as CFO of international, overseeing financial responsibilities for the U.S. and all of Europe.

Rod Ashley has announced he will be stepping down as CEO of Alba Bank after six years. Jonathan Thompson, currently chief commercial officer, will take the role of acting CEO. Before joining Alba, Thompson was CEO and co-founder of Bank North.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()