The Metro Bank Saga

Hey FinTech Fanatic!

Metro Bank Holdings Plc's recent journey is a key example of resilience in banking. Facing short seller pressure and a need for a capital boost, the bank announced a major refinancing plan, including a £325 million capital raise led by Spaldy Investments and £600 million in debt refinancing.

This move was critical, as failure could have led to the bank being deemed "unviable" by the Bank of England.

The shareholder vote proved decisive, with over 90% approving a £150 million equity raise, integral to the £925 million rescue deal. This marked a turning point, allowing Colombian billionaire Jaime Gilinski's Spaldy Investments to increase its stake to about 53%. Metro Bank then took bold steps, like tripling interest rates on deposits and shifting focus to higher-margin specialist mortgages.

Concurrently, Metro Bank entered talks with Barclays for the sale of its US$3.74 billion residential mortgages portfolio, a move likely to realign its assets and improve liquidity. These developments showcase Metro Bank's strategic navigation through financial challenges, signaling a potential turnaround in its fortunes.

To be continued...

Cheers,

POST OF THE DAY

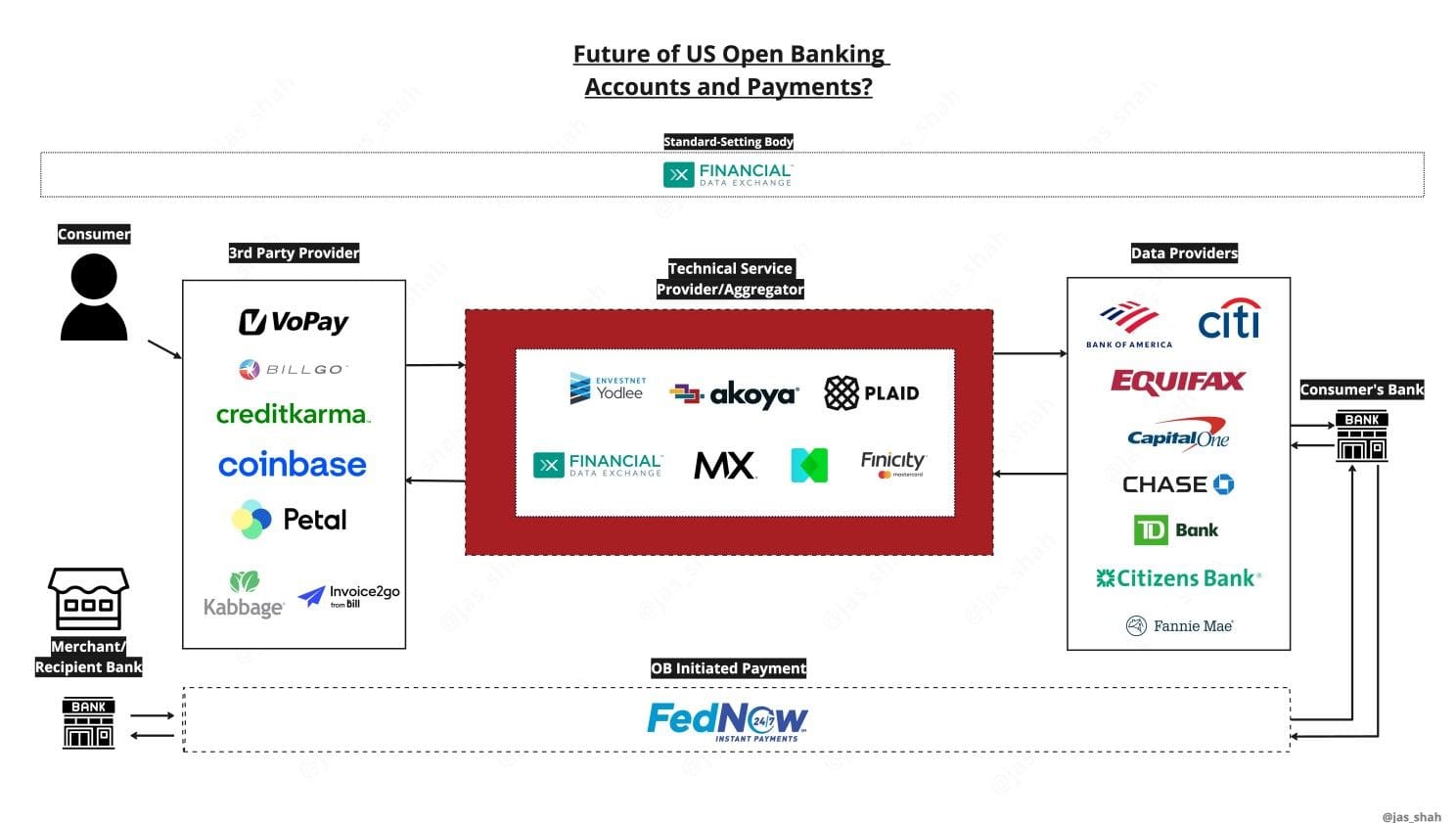

The new 🇺🇸 US Open Banking (1033) proposal, what it might mean for consumers and what the US learned from the 🇬🇧 UK's Open Banking successes and failures. Explore the details here

FEATURED NEWS

Walmart-Backed PhonePe likely to enter consumer lending space by Jan. Marking its foray into the consumer lending space, PhonePe is likely to operate initially as a distributor for personal loans. The firm plans to introduce a range of consumer credit products within the next six to seven months.

#FINTECHREPORT

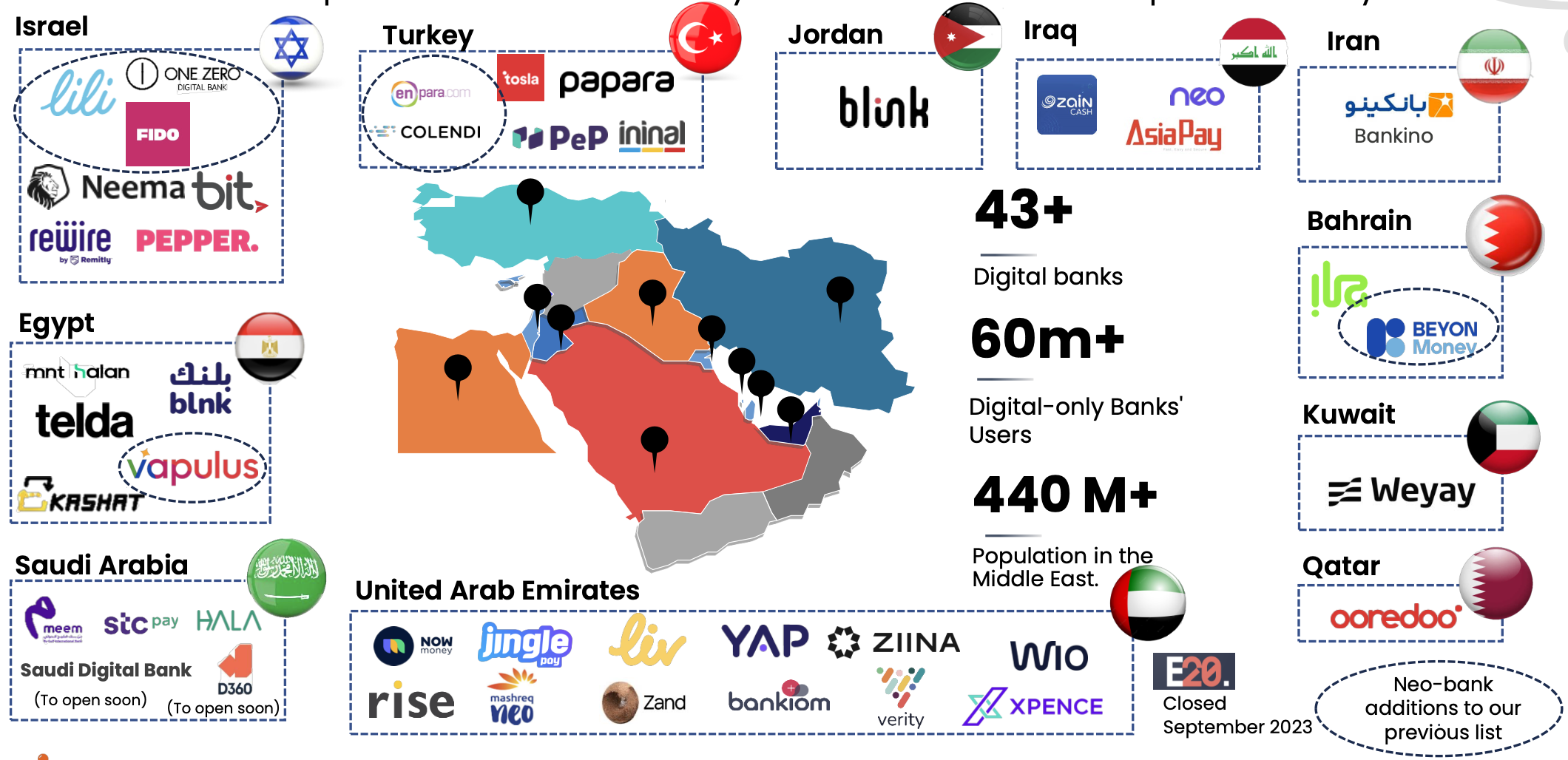

Middle East's FinTech Leap: The Rapid Transformation of Digital Banking. The digital banking sector in the Middle East is undergoing a significant transformation, marked by an impressive surge in digital payment adoption and technological advancements. Read my deep dive analysis to learn more.

“Global state of open finance” report. Open finance is now a new paradigm in the financial industry. It has evolved in the past decade from open banking to new revenue models such as BaaS and BNPL. Download the complete report for more interesting info. Link here

INSIGHTS

🇧🇷 Lula’s debt-relief program serves 7 million Brazilian consumers: The initiative allows consumers to renegotiate liabilities and wipe their slates clean, in a push to jolt the economy. Access the complete report here

FINTECH NEWS

Global investment firm Lunate with $50+ billion AUM and BNY Mellon are investing in Alpheya, a new firm that will develop a customized wealth management technology platform for wealth and asset managers in the Middle East and North Africa (MENA).

🇦🇪 Etoro receives approval from ADGM. This approval marks a key milestone in eToro's global expansion, allowing the platform to operate as a broker for securities, derivatives, and cryptoassets in the United Arab Emirates.

🇦🇪 Robo-advisor Wahed launches in the UAE. The Fintech aims to advance financial inclusion through accessible, affordable and value-based investing. Wahed will become the UAE’s first dedicated Islamic digital investment management platform.

Kushki has become the first non-banking regional acquirer for merchants in Latin America. Operating in Mexico, Chile, Peru, and Colombia, it enables merchants and payment processors to overcome the fragmentation of dealing with local acquirers in each country.

PAYMENTS NEWS

🇬🇧 Manchester-based Fintechs Ryft and Collctiv partner to simplify group payments. The two companies are partnering to shake up the group payment sector with a customisable checkout experience. Read more

REGTECH NEWS

🇮🇹 Trustfull joins Provenir Data Marketplace. This partnership will benefit Trustfull customers from a truly global data source, allowing integration with any international market offering clients an easier, single point of integration for organisations looking for comprehensive risk orchestration.

🇮🇹 MIA-Fintech brings AI-assisted credit checks to embedded finance platform after announcing a new partnership with Genio Diligence. The partnership will be delivered via Mia-FinTech, Mia-Platform’s vertical solution focused on developing capabilities and solutions specifically for the finance sector.

DIGITAL BANKING NEWS

🇳🇱 a.s.r. considers selling Dutch Online Bank Knab valued between €590 million and €700 million. This move comes after receiving multiple bids for the digital bank, which ASR acquired earlier this year through its takeover of Aegon Netherlands. ASR confirms exploring Knab's sale but hasn't decided yet.

Worldline and Volksbank commence card issuing partnership. This new agreement enables Volksbank to provide its customers with stand-out services in the current marketplace, and to rely on additional innovative tailor-made products that will be developed in collaboration with Worldline.

🇨🇭 Neon offers zero-fee trading on two Invesco ETFs. With this cooperation, Invesco and Neon are jointly spearheading investment savings for the Swiss and their basic provision with ETFs.

🇺🇸 Chime teams up with games and media company Cut.com to bring its Dollars & Sense game to Walgreens in time for the Holidays. Dollars & Sense, supported by Chime, fosters financial conversations that go beyond traditional literacy. It encourages people to explore their ideas about shopping, saving, tipping, sharing, wasting, and hoarding.

BLOCKCHAIN/CRYPTO NEWS

🇰🇷 South Korea preps 100,000 person-strong CBDC pilot. Participants in the pilot, set for the fourth quarter of 2024, will be able to make purchases with deposit tokens issued by commercial banks in the form of CBDC, says The Korea Times.

🇦🇺 Swyftx and TRM Labs launched a world-first trial that will pay crypto users to protect themselves against fraudsters. The program offers $10 worth of Bitcoin to Aussies who activate two factor authentication on their cryptocurrency accounts, amid a surge in reported scams in the country.

🇵🇦 Panama-based Towerbank is set to expand its services into virtual assets next year, aiming to strengthen its regional presence with a focus on cryptocurrency. To achieve this, Towerbank is undergoing a significant digital transformation.

DONEDEAL FUNDING NEWS

🇨🇦 Peloton Technologies is announcing the close of their late seed round after securing $2M in investment. This funding is earmarked for activities that contribute to the company’s rapid growth trajectory. The new investment bolsters Peloton’s growth strategy through the acquisition of additional ISOs.

MOVERS & SHAKERS

🇸🇪 Froda appoints Klarna's Roger Forsberg as CTO. “Roger’s expertise will be central in the development of our technical platform and for future innovation work”, says Olle Lundin, CEO, and founder of Froda.

Former Onfido CTO Dan Teodosiu joins Revolut board. Martin Gilbert, Chairman of Revolut, added: “I am thrilled to welcome Dan to the Revolut Board. Dan’s expertise and experience across multiple technology sectors further strengthens the governance and oversight of the Board.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()