The FinTech Buzz in the Middle East Is Real

Hi FinTech Fanatic!

Yesterday I asked which FinTech events I should hit this fall, and wow—you guys came through. A lot of you flagged Money20/20 in Saudi Arabia next week. Still on the fence, but it’s the only regional M2020 I haven’t checked off the list yet 👀.

The Middle East has been buzzing lately—remember my piece on Revolut’s UAE approval earlier this week? (👉 link here). But that’s just one headline.

When I was in Dubai a few months back, I got a behind-the-scenes tour of the MAF mall, and the FinTech demos blew me away. I even wrote a short series on it (worth a read if you missed it).

So here’s the deal: give me one good reason why I should hop on a plane, drop it in the comments, or reply to this email—and who knows, maybe I’ll see you there in person.

Until then, enjoy today’s curated dose of FinTech updates, and have an amazing weekend.

Cheers,

INSIGHTS

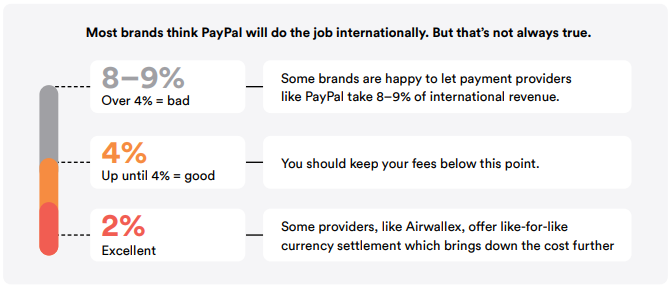

🇬🇧 Peak Season Payment Playbook by Airwallex. Many eCommerce brands enter peak season focused solely on discounts and marketing spend, often overlooking a critical factor for success: their payment infrastructure. Fragile systems, sluggish checkouts, and fragmented data can quickly turn high-intent shoppers into lost sales. This playbook offers a strategic framework to help businesses move beyond survival mode and unlock scalable, profitable growth during seasonal surges.

FINTECH NEWS

🇸🇪 Sweden's Klarna shifts AI focus from cost cuts to growth. The CEO of Sweden's Klarna, one of the early adopters in Europe of AI, says the company may have gone too far in using the technology to cut costs and is now focusing on improving its services and products.

PAYMENTS NEWS

🇬🇧 Banking on inclusion: What instant payments could mean for millions. Craig Ramsey, Head of Account-to-Account Payments at ACI Worldwide, explores research that establishes an empirical link between instant payments and financial inclusion. Read the complete article

🇬🇧 Revolut introduces Pay by Bank option. Pay by Bank payments offer a more secure solution for merchants and reduce costs by skirting card-based interchange fees. Customers can pay directly from their bank account without the need to manually enter card details.

🇺🇸 Early Warning lands new distribution deals for Zelle and Paze. Early Warning's P2P payment network has been looking to boost small business payment volume after surpassing $1 trillion in payment volume in 2024. It has been securing distribution deals in an effort to help its bank owners secure a larger share of e-commerce transactions.

🇦🇺 Stripe to launch Capital in Australia as it passes 1 million users across Australia and New Zealand. Stripe Capital will provide eligible small and medium-sized businesses access to fast, flexible business financing through the Stripe platform, helping them invest in growth and manage cash flow.

🇦🇺 PayPal launches Fastlane to boost guest checkout in Australia. The service is designed to accelerate the checkout process, particularly for guests who do not wish to create accounts at individual retailers. By recognising shoppers using their email addresses and then verifying them with a one-time code, Fastlane enables users to access their saved payment and shipping details.

🇺🇸 FedNow increases transaction limit to $10 million. This shift, the second increase this year, is designed to let financial institutions and businesses support higher-value use cases and reflects a rising need for speed and certainty in the payments ecosystem.

🇬🇧 Contactless card payments could become unlimited. The proposals from the Financial Conduct Authority mean that entering a four-digit PIN to make a card payment could become even more of a rarity for shoppers. If approved, purchases that can cost more than £100 could be made with a tap of a card.

🇬🇳 PayCard launches international money transfers with Thunes. Available 24/7 through the mobile app, users can now send funds to over 60 countries (Africa, Europe, the Americas, Asia, the Middle East) to e-wallets or bank accounts, with transparent fees, fast processing, and strong security.

🌎 Jeeves launches Jeeves Instant Pay, a stablecoin payment. With Instant Pay, companies can access 24/7/365 settlement rails across major currencies, while reducing foreign exchange costs by up to 80%. This new solution has been integrated directly into Jeeves’ existing cards, credit, and spend management platform.

🇸🇪 Moonrise by Lunar announced the launch of its RIX indirect product, enabling payment service providers (PSPs) to connect both directly and indirectly to Swish, the country’s most widely used payment method, through Moonrise. Keep reading

FINTECH RUNNING CLUB

🇩🇪 Robin Binder in Berlin is setting the pace! Don’t miss our September Network & Run events, join us and be part of the movement!

OPEN BANKING NEWS

🇬🇧 Paytently and Mastercard partner to launch Paytently Open Banking, a next-generation open banking payment solution. The solution is an account-to-account payment option at checkout that lets customers pay directly from their bank and helps merchants increase conversion rates and improve cash flow.

🇳🇿 Worldline launches Online EFTPOS Repeat Pay, and POLi moves from 'overlay service' to APIs. Repeat Pay is essentially an attempt at replacing direct debits, which are cumbersome and slow to set up, with payment authorisation forms to process.

DIGITAL BANKING NEWS

🇵🇪 Peru prepares to welcome its first fully digital bank. The Peruvian financial system could enter a new era with the arrival of the first 100% digital bank. Revolut has submitted its license application to the Superintendency of Banking, Insurance, and Pension Funds. If authorized, it would mark a milestone in the modernization of the local financial market.

🇮🇹 Revolut is "the fifth-largest bank in the country". Revolut has reached 4 million customers in Italy and claims to have become "the fifth largest bank in the country" by customer base. The group, which has a branch in Italy supervised by the Bank of Italy, had 3 million customers last January.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Nubank Crypto records a 400% increase in exchanges between digital currencies, and the platform expands its functionalities. This growth reflects the maturity and confidence of Nubank Crypto customers, who use swaps to manage their portfolios more strategically.

PARTNERSHIPS

🇺🇸 Carta and the New York Stock Exchange form a strategic partnership. The partnership underscores both organizations’ commitment to supporting the most ambitious companies and founders throughout their journey from the private to public markets.

🇺🇸 Leading US neobank Current signs contract extension with Stakk. Stakk will continue delivering Current, a solution encompassing its image capture, authentication, and transaction processing capabilities. Continue reading

🇺🇸 dLocal joins the Fireblocks network for payments. With dLocal joining the Fireblocks Network for Payments, its local infrastructure across emerging markets becomes part of that ecosystem, while Fireblocks expands its ability for institutions to build robust and scalable stablecoin payment flows.

🇨🇳 Ant International and AlipayHK launch digital wallet partnership. The initiative aims to develop risk management technologies, share best practices, and promote awareness campaigns targeting fraud and account takeovers. Read more

🇺🇸 Brex partners with DoorDash for business to deliver DashPass to Brex corporate cardholders. Through this collaboration, employers who offer Brex cards to their teams can now extend DashPass as a built-in seamless way to offer a high-impact perk through a card employees already use for business expenses.

🇵🇱 Mastercard, NCR Atleos, and ITCARD to enhance contactless experiences at ATMs. Innovation allows cardholders to withdraw cash with a mobile device for a more seamless, secure, and smarter ATM experience. Keep reading

🇬🇧 AsiaPay taps Hands In to roll out split payments for merchants in Asia-Pacific. The collaboration will enable AsiaPay’s extensive network of businesses to natively integrate multi-card and group payment options directly within their online checkouts.

DONEDEAL FUNDING NEWS

🇮🇹 Tot secures €7 million to boost SMEs' growth. This fresh capital reinforces the company's mission to free entrepreneurs from the burden of banking and administrative red tape, supporting the growth and competitiveness of Italy's productive ecosystem.

🇮🇳 FinTech startup GrowXCD to raise Rs 200 Cr in Series B, led by Swiss-based Blue Earth Capital, with the participation from Prosus and existing investors including Lok Capital and UC Impower. Continue reading

🇿🇦 Float secures $2.6M to transform South Africa’s credit landscape. The capital injection will fuel Float’s expansion in the country, enhance its proprietary technology, and prepare the business for international growth. The round was co-led by Invenfin and SAAD Investment Holdings, with participation from Lighthouse Venture Partners and existing backers, including Platform Investment Partners.

M&A

🇵🇹 Portugal's Sibs to buy Polish payments firm ITCard. Rui Lima, CIO, Sibs, says: "Sibs’ acquisition of ITCard represents a key step in consolidating our European presence and in delivering long-term value for our clients and partners through technology-driven innovation."

MOVERS AND SHAKERS

🇺🇸 Varo Bank hires Asmau Ahmed as the first AI and Data Chief. Ahmed joins from Google, where, as Senior Director of Product Management, she oversaw a number of initiatives focused on AI and machine learning, covering Google Ads, Search, Gemini, Maps, and Commerce.

🇦🇺 ANZ Risk Chief Kevin Corbally Steps Down amid Revamp and stays with the bank. Corbally will become managing director of Capital Management Institutional and report to the firm’s institutional head, Mark Whelan, according to a statement. Read more

🇬🇧 Moneybox expands leadership team to drive innovation and growth. Danielle D’Lima as Vice President of Operations, Alex Hayman as Director of Strategic Growth, and Marko Katavic as Director of AI and Decision Intelligence. The three senior leadership appointments underscore Moneybox’s commitment to accelerate its next phase of growth and help millions more people build wealth with confidence.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()