The Final FinTech News Roundup Of 2023

Hey FinTech Fanatic!

As the sun sets on another vibrant year in the world of financial technology, I'm reaching out to you from the warm and sunny shores of Curacao for the final roundup of 2023.

It's been an incredible journey through the ever-evolving landscape of FinTech, and there's no place I'd rather be than here, sharing this moment with you.

First off, I want to extend a heartfelt thanks to each and every one of you. Your unwavering support and interest in my content have been the driving force behind our community.

This year alone, we've hit a staggering milestone with over 100 million views on LinkedIn. It's an achievement that speaks volumes about your passion for FinTech, and for that, I am immensely grateful.

As we reflect on the year that's been, I've curated a special treat for you - a compilation of the 18 best performing FinTech updates from 2023.

These highlights represent the pulse of our industry, capturing the innovations, disruptions, and conversations that have shaped our sector. You can dive into this treasure trove of insights here.

But the journey doesn't end here. As we step into the new year, I'm already gearing up to bring you more cutting-edge industry news and enriching educational content. The world of fintech never sleeps, and neither does our quest for knowledge and innovation.

So, stay tuned for more exciting updates and deep dives into the FinTech universe.

As we bid farewell to 2023, take some time to enjoy the year's end, reflect on our shared learnings, and gear up for an even more thrilling 2024. I'll be back next week with more news, fresh off the press.

Here's to a prosperous and innovative new year!

Cheers,

Marcel

BREAKING NEWS

JPMorgan clashes with partly owned Greek Fintech. It’s been just 12 months since JPMorgan Chase spent $800 million to buy 49% of Greek fintech startup Viva Wallet. But already the two companies appear to have fallen out. Two of JPMorgan’s three representatives on Viva’s board have quit in recent weeks, just a few months after joining the board.

FEATURED NEWS

Musk disclosed plans for the introduction of in-app payment services on his comprehensive ‘everything app,’ referred to as ‘X,’ with an expected launch around mid-2024. Crypto will not be included. Musk shared this insight during a conversation with Cathie Wood of ARK Invest at a recent X space event on Dec. 21.

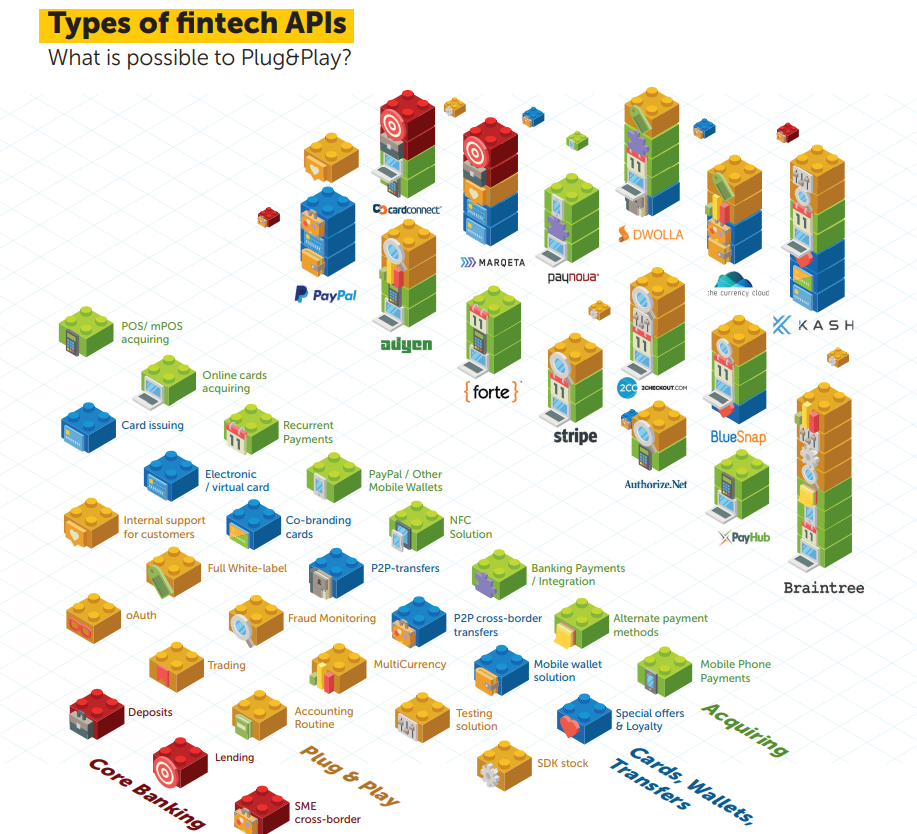

#FINTECHREPORT

Overview of APIs and Bank-as- a-Service in FinTech👇

FINTECH NEWS

🇨🇱 Mercado Pago, the digital account of Mercado Libre, has announced a product in Chile that allows users to earn daily returns on the balance available in their digital accounts. The new feature will be available to all individuals residing in the country who are of legal age

🇺🇸 WealthKernel expands into US equities with first client now live. Wealthyhood is WealthKernel’s first client to go live with US equities, with the addition being a major feature launch for the Greek fintech. Read more

🇲🇽 Briq.mx, has secured definitive approval to operate as a Collective Funding Institution (IFC) under the Fintech Law after a four-year process. The platform allows investments with relatively small amounts in real estate projects.

🇧🇷 Cumbuca has launched an innovative application designed to simplify the division of expenses among couples and friends. The Cumbuca app and its associated payment card are specifically tailored to address the challenges faced by couples and groups of friends in managing shared expenses.

🇨🇴 Digital credit fintech ExcelCredit evolves into KOA and receives authorization from the SFC to become a Neo-Financial entity in Colombia. This development is a direct result of the Fintech Law of 2020, which allows financial technology companies to offer regulated financial services under SFC supervision.

🇮🇳 Indian FinTechs struggle after crackdown on unsecured loans. The Financial Times (FT) examined the state of companies such as Paytm in a report on Dec. 17, following the Reserve Bank of India (RBI) announcing last month that lenders had to change their capital requirements.

🇮🇩 What GoPay’s new standalone app says about GoTo’s ‘super-app’ strategy. According to Hans Patuwo, GoTo's president of financial technology, the app will allow the company "to reach a much wider range of people in Indonesia, including those who are not Gojek and Tokopedia users."

PAYMENTS NEWS

iDEAL Leads the Way in Dutch 🇳🇱 E-Commerce Evolution: Insights from Q3 2023 Thuiswinkel Markt Monitor👇

🇧🇷 Hubla, a Brazilian platform dedicated to helping content creators scale their online businesses, has teamed up with Yuno, a global payment orchestrator, to enhance its payment capabilities and provide an improved shopping experience for its clients and partners.

How Google’s settlement will change in-app payments. The settlement with attorneys general includes a lengthy list of changes Google must make in its approach to in-app payments. As part of the list, it will give application developers the option to let users pay via alternatives to the tech company’s billing system for at least five years.

OPEN BANKING NEWS

🇸🇦 Inside Saudi Arabia’s Open Banking Boom: A 2023 Snapshot. Let’s dive into a fascinating synergy in Saudi Arabia and explore how it’s setting the stage for a major leap in Open Banking in 2024. Link here

🇧🇷 Klavi now has the 'key' to regulated Open Finance. In a strategic partnership with Iniciator, Klavi, a leading fintech company, is set to transition into the regulated open finance ecosystem this January. The CEO anticipates a growth of 3 to 5 times in 2024.

DIGITAL BANKING NEWS

🇫🇷 Digital banks in France in 2023: reshaped strategies, rebranding and new outlook for 2024👇

🇧🇷 Nubank app now offers vehicle registration for DETRAN bill payments: 'Contas do Detran.' The latest addition to Nubank’s suite of tools is the 'Contas do Detran' feature, designed to streamline the bureaucratic processes related to vehicle debts in São Paulo.

🇺🇸 Apple Savings account holders have received a Goldman Sachs interest boost even as it plots its Apple Card exit. This is the first increase in the interest rate since the feature launched back in April. The Apple Savings account is still only available in the US thanks to its Goldman Sachs affiliations, much like the Apple Card.

🇨🇱 Baaskit launches in Chile with Financial Market Commission approval, introducing ‘Banking as a Service’ for enterprises using API technology. The BaaS model focuses on providing businesses, especially large brands, with embedded financial services within their value offerings.

🇬🇧 Revolut's Annual Report 2022 is out. Explore the complete report for more in-depth insights. Link here

BLOCKCHAIN/CRYPTO NEWS

🇳🇬 Yellow Card seeks exchange license after Nigeria lifts crypto ban. In a phone interview, Ogochukwu Umeokafor, director of product management at Yellow Card, said: “We want a regulated environment because it’ll help the business move; it will help people have more confidence in doing business with us.”

🇭🇰 Hong Kong releases crypto ETF requirements ahead of US approval. The Hong Kong SFC issued a joint circular with the city’s Monetary Authority earlier this month detailing the requirements under which the securities regulator would greenlight ETFs with more than 10% of holdings in crypto.

🇫🇷 Coinbase secures crypto license in France, pushing deeper in Europe amid rift with the SEC. France’s AMF watchdog gave Coinbase virtual asset service provider (VASP) approval, which is effectively a green light for the company to operate crypto services in the country. Coinbase is making a big move into Europe as it faces a tougher time stateside.

🇳🇬 Nigeria lets banks open accounts for crypto firms: BusinessDay. The easing of rules will be a boost for crypto exchanges, which have been seeking to expand in the nation that ranks second in blockchain data company Chainalysis Inc.’s adoption index. Read more

DONEDEAL FUNDING NEWS

Flipkart said that its largest shareholder, Walmart will be investing $600 million into the company, as part of its $1 billion fund raise plan. The company will use the money to expand its operations, strengthen its supply chain and bolster its tech capabilities.

🇬🇧 Digital identity company Yoti receives £12.5 million funding from HSBC. This funding has enabled Yoti to develop proprietary technologies covering identity verification, age assurance, authentication and esignatures, including world class in-house facial age estimation, liveness and facial recognition AI.

🇸🇦 Spare closes USD3 Million investment to lead Open Banking innovation in ME. Other participants in the round include Wa’ed Ventures, Seedra Ventures, global investment firm 500 Global, and notable angel investors. This funding will be used primarily for talent acquisition, marketing, and operations in Saudi Arabia.

M&A

Blackstone signs agreement to acquire Sony Payment Services. Following the acquisition, Sony Bank will reportedly retain a portion of its equity in SPSV and will continue to support its growth. Read more

MOVERS & SHAKERS

🇬🇧 OakNorth appoints Adair Turner as chair as it mulls IPO: Turner, who served as chair of the Financial Services Authority during the financial crisis, rejoins OakNorth after previously sitting on the board as senior independent director until 2017.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()