The Final Countdown for Klarna’s Listing?

Hey FinTech Fanatic!

Klarna is quietly stepping back into IPO mode.

Fresh off its EMI license in the UK, the Swedish FinTech is reportedly preparing for a New York listing as early as September or October.

Whether Klarna will hold onto its $15 billion valuation from earlier this year remains to be seen.

Will Klarna going to wait for the perfect timing, or does it need someone to give it a good push? Time will tell.

Scroll down to read more on Klarna's IPO plans and other FinTech updates below👇

See you on Monday!

Cheers,

P.S. Taktile just unveiled its Top Voices in Risk 2025, spotlighting standout leaders across four key categories: Innovation, Impact, Progress, and Leadership.

Here’s the official list of voices worth following.

Stay Ahead in FinTech! Subscribe to my Telegram channel for daily updates and real-time breaking news. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

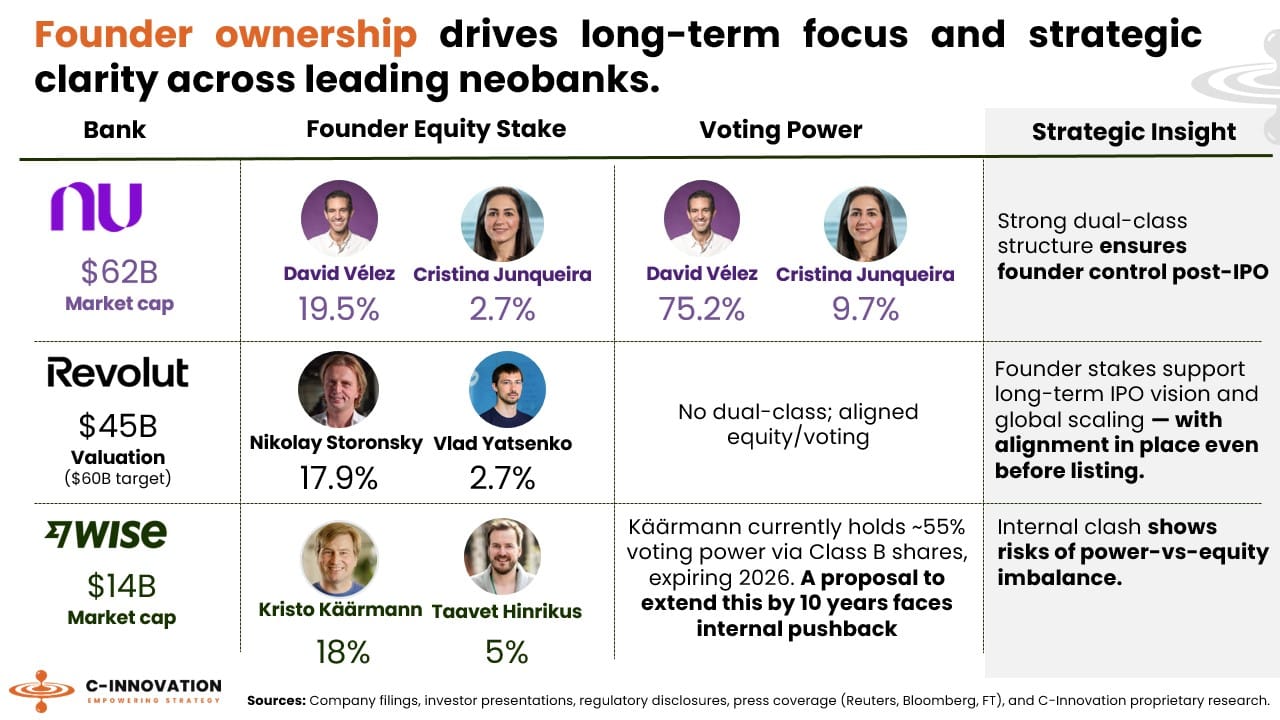

📈 Founder ownership and voting power: Nubank 🆚 Revolut 🆚 Wise

FINTECH NEWS

🇺🇸 Klarna prepares for autumn bid to revive $15bn New York float, months after being forced to abort a previous attempt amid tariff-induced market turmoil. The buy-now, pay-later company's Finance Chief has told investors that it is "closely monitoring market conditions and will move swiftly" when the timing is right to launch an IPO.

🇦🇺 NAB and Cannon-Brookes-backed pocket money FinTech Spriggy is shutting down its invest app, promising an all-in-one reboot. In a message, the company thanked users for their support over the past four and a half years and reflected on its mission to create a simple, jargon-free investment tool for parents.

PAYMENTS NEWS

🇺🇸 Visa expands stablecoin settlement support. As global interest in stablecoins takes center stage, Visa is building on its leadership in the space and enabling support for more stablecoins and more blockchains to facilitate settlement transactions for issuers and acquirers.

🇮🇳 After RBI nod, FinTech Xflow plans global payments expansion. RBI’s in-principle approval to operate as an online payment aggregator for cross-border transactions is a major milestone in our mission to make global payments seamless for Indian SMBs, says Anand Balaji.

🇨🇦 Canada's Real-Time Rail set for testing phase. RTR will allow Canadians to initiate payments and receive irrevocable funds in seconds, 24/7/365. The system will also tap the ISO 20022 messaging standard to support payment information traveling with every payment.

🇸🇬 Ant International’s Antom and KASIKORNBANK announced the launch of K PLUS, a new local payment method on Google Play, marking the first time that a SEA mobile banking app is made available as a payment option in the platform. Android devices will be able to pay for global and local digital content on Google Play using their everyday banking app.

🇲🇽 Oxxo launches cash back tool. The tool is designed to enable businesses in Mexico that need to make refunds, make payments to customers, or offer cash pickups to quickly send money through Oxxo's nationwide network of more than 23,000 stores.

🇺🇸 Nuvei expands global platform to North America, unlocking 60% faster reconciliation with Granular, transaction-level Intelligence. U.S. and Canadian merchants now benefit from per-transaction interchange prediction, real-time settlement visibility, and a unified global experience across all payment operations.

DIGITAL BANKING NEWS

🇬🇧 Leaked documents reveal Revolut's plans for 2026 product blitz. Europe’s most valuable FinTech plans to offer more lending services in Britain next year, according to sources, with a blitz of previously unreported products set to launch in different countries around the world.

🇮🇹 Revolut revolutionizes connectivity: eSIM and global data plans for Italian travelers. This innovation allows users to stay connected anywhere in the world, eliminating the dreaded roaming costs and ensuring a stable and affordable connection in over 100 countries.

🇨🇳 Mox launches digital bank's insurance arm. Mox Insure, with its first product being a personal accident insurance plan called Personal Accident Cushion. The policy covers both local and overseas protection, offering up to HK$2 million in compensation for accidental death or permanent disability.

🇺🇸 Lili launches BusinessBuild Program to empower small businesses to build their credit profile. The BusinessBuild Program is designed to change awareness and improve understanding by embedding smart credit-building tools into everyday financial operations.

🇮🇩 Superbank hits $1.3M in profit and gains 4 million users. Indonesia's Superbank reported a net profit of 20.1 billion rupiah (US$1.3 million) and nearly 4 million customers in the year since it launched its digital banking application in June 2024.

🇬🇧 Starling revaluation jump-starts shares in Chrysalis. They said: The material increase in the valuation of Starling was a function of both the progress made in the core UK bank, but also the inclusion for the first time of a valuation for Engine, its banking-as-a-service technology platform.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Kraken sees revenue rise 18% in the second quarter. Revenue increased 18% to $412 million from the year-ago period, according to a company statement. Adjusted earnings before items like taxes reached $79.7 million, down about 7% from $85.5 million, as the company invested in new products and geographic expansion.

🇪🇸 Bitstamp, by Robinhood, partners with BBVA to provide Bitcoin and Ethereum trading for retail customers. Bitstamp is serving as one of the first liquidity providers for BBVA’s new offering, now available to all eligible retail customers in Spain. This enables clients to buy, sell, and hold cryptocurrencies directly through the BBVA app.

🇺🇸 Robinhood crypto revenue doubles as CEO bets big on asset tokenization. Robinhood saw its crypto revenue almost double to $160 million as CEO Vladimir Tenev confirmed plans to keep pushing its tokenization strategy in the US and abroad.

PARTNERSHIPS

🇪🇬 ContactNow and PayTabs Egypt are integrating BNPL services to expand digital payment access. This integration aims to make digital payments more accessible for merchants and consumers across Egypt. The collaboration allows merchants using PayTabs Egypt’s platform to offer ContactNow’s BNPL solution at checkout.

🇬🇧 NatWest to deliver buy-to-let mortgages on Landbay. The agreement will see NatWest Group enter the growing Limited Company buy-to-let mortgage market, leveraging Landbay’s award-winning lending platform and extensive broker distribution network.

🇿🇲 Western Union, Zoona, and Chipper Cash launch money transfers in Zambia. Chipper Cash app enables customers in Zambia to send and receive money globally. In a joint statement, the partners said the service will empower customers to connect financially with over 200 countries and territories.

DONEDEAL FUNDING NEWS

🇨🇳 HongShan-backed Hong Kong FinTech startup raises $40 million to advance stablecoin plan. RD Technologies said the fresh funding will support the company to “drive the next phase of digital currency transactions and asset tokenization through secure, enterprise-grade infrastructure.”

🇧🇷 Tako raises R$100 million. The company now intends to serve larger clients, in addition to the startups it already serves, such as Warren, Tractian, and SouSmile. The funds will also be used to open an office in San Francisco, California, to bring the company closer to the epicenter of artificial intelligence.

🇬🇧 U.K. Startup InTick nets £2 million to expand derivatives block trading. The new funding, backed by undisclosed angel investors, will be used to extend platform functionality and support wider market rollout. The company’s software targets pain points in the existing system, offering instead a streamlined electronic network that automates pricing and matching in a centralized order book.

🇺🇸 Tether-Focused Layer 1 'Stable' closes $28 million funding. The funding round comes on the heels of Stable's emergence from stealth and will be used to build out the network's infrastructure, grow its employee base, and increase worldwide USDT distribution.

M&A

🇩🇪 Bling acquires financial education app Finstep. By integrating Finstep's proven learning content, Bling strengthens its position as the leading platform for financial literacy in families. The integration creates a unique ecosystem of financial education, pocket money management, and family organization, bundled in one app that supports families in their everyday lives.

🇺🇸 Euronet and CoreCard announce merger agreement to unlock global opportunities in credit card issuing and processing. Acquisition aims to accelerate Euronet’s digital transformation strategy, expand the company’s U.S. footprint, and extend CoreCard’s access to global markets.

🇺🇸 EquiLend acquires trading apps to advance front-office automation. By integrating Trading Apps’ solutions, EquiLend expands its capabilities and offers clients tools that can be used independently or integrated with existing services. Keep reading

MOVERS AND SHAKERS

🇬🇧 ClearBank appoints David Samper as group CFO. Samper will lead the organisation through its European expansion, as well as its next phase of international growth. Continue reading

🇬🇧 Atom Bank expands Technology Leadership Team with key appointments. Ges Richmond and Orla Codyre have joined as Heads of Lending Delivery, while Kath Langlands has been appointed as Head of Platform and Enterprise Delivery. Rob Smith as Head of Engineering, with Rob Butcher named Head of Architecture. Faizah Rafique has been appointed Head of Business Analysis, and James Kerruish will serve as CISO and Head of Service.

🇮🇹 Nexo hires Lorenzo Pellegrino as Chief Banking Officer. At Nexo, Lorenzo will lead the expansion of the company’s industry-leading infrastructure, including digital asset accounts, global on- and off-ramps, cross-border settlements, and the pioneering dual-mode Nexo Card.

🌍 Openbank Appoints Gonzalo Pradas as Head of Retail. He will be responsible for the retail business strategy in Spain, Portugal, and the Netherlands, as well as the products and digital platform across Europe. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()