The $2B FinTech Fighting Fraud with AI

Hey FinTech Fanatic!

AI fraud just hit another milestone. Feedzai raised $75M, pushing its valuation past $2B.

The Portugal-based RiskOps platform now protects over $70B in payments and claims to have prevented $2B in losses last year alone.

With new products like Feedzai IQ and Orchestration, they’re doubling down on faster, smarter, and more responsible fraud detection, because let’s face it, fraudsters aren’t slowing down..

Scroll on for more FinTech stories and start your week strong 💪

Cheers,

ARTICLE OF THE DAY

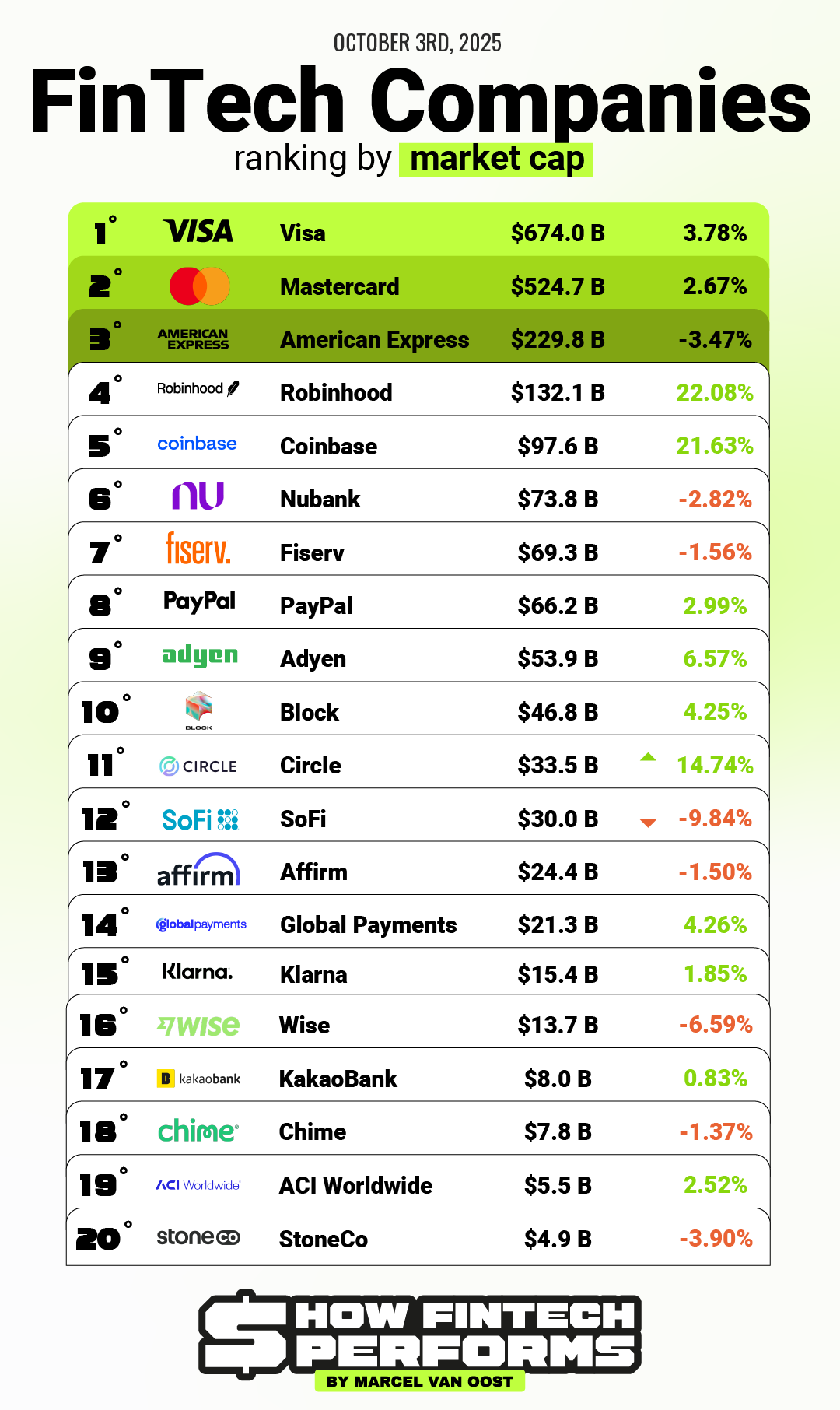

🇺🇸 Bakkt steals the spotlight while FinTech steadies. After ending last week in the red, crypto markets rebounded, and one small-cap name stole the spotlight. Subscribe to my newsletter, How FinTech Performs, for more

FINTECH NEWS

🏃➡️Peruvian magazine Gan@ Más recently featured the FinTech Running Club, highlighting its unique origin and growing international presence. The club was created by blending FinTech and running, aiming to offer a space for networking, physical activity, and community building. What started as a local initiative is now evolving into a global movement.

PAYMENTS NEWS

🇬🇧 OSO is a Cellpoint Digital platform that is redefining airline payments. One Source Orchestration was developed as the first airline-native payments control platform, designed to unify orchestration, optimisation, and operations. It enables localized payment experiences, boosts profitability through smart routing, and reduces cost and complexity across the payment stack.

🇧🇷 Binance and Pomelo have formed a strategic partnership in Brazil, combining Pomelo’s infrastructure technology with the crypto exchange to launch innovative crypto-powered cards. This collaboration strengthens the connection between the crypto ecosystem and traditional finance, delivering regulated, scalable solutions ready for regional expansion across Latin America.

🌍 ACI Worldwide CEO, Thomas Warsop, said that risk Europe is left behind on stablecoins. In a wide-ranging interview, he said that ACI is well-positioned to support stablecoins and tokenized deposits as a new payment type, enabling interoperability and clearing capabilities for financial institutions, merchants, and billers globally.

🇪🇺 Key EU payment deadlines loom. Ahead of the EU’s October 2025 Instant Payments Regulation deadline, banks and PSPs must support real-time euro credit transfers and Verification of Payee (VoP). ACI Worldwide’s Jeremy McDougall highlights the complexity of integrating VoP and other regulatory demands, noting that banks are prioritizing back-office systems and compliance over user experience

🌍 Flutterwave CEO, Olugbenga “GB” Agboola, bets on Stablecoins as Africa’s next financial leap. He emphasized the company’s strategic pivot toward stablecoin payments, positioning them as foundational to Africa’s economic future through partnerships and infrastructure development.

🇮🇪 Irish banks to launch instant payments across the euro zone. Banks and credit unions have begun rolling out SEPA Instant payments, which will enable personal and business customers to make euro payments within ten seconds, 24 hours a day. Continue reading

🇮🇳 FinTech firm Kiwi launches interest-back EMI on UPI, allowing consumers to convert high-value purchases into instalments while receiving a portion or full interest refund as cashback. The feature comes ahead of the Diwali season, a period when festive spending across categories such as electronics, gold, home appliances, and travel typically rises.

🇮🇳 UPI races ahead, accounts for 84% of total digital payments in FY25. A recent study from the Reserve Bank of India showed that higher adoption of UPI is associated with lower cash demand at both national and subnational levels. Keep reading

DIGITAL BANKING NEWS

🇺🇸 SoFi is expanding its options offerings. The new offerings come with no commissions or contract fees, and SoFi said it will provide built-in educational resources to help members understand how they work. SoFi said users will be able to apply for approval in the company's app, and that it plans to make the feature available to all eligible members.

🇺🇸 NCino unveils mortgage-focused AI innovations. The new wave of mortgage-focused AI innovations is designed to accelerate loan origination, reduce underwriting touches, and deliver more responsive borrower journeys. Read more

🇲🇽 Ualá launches "Reserva a Plazo" in Mexico. Ualá Bank announced the launch of Term Reserve. This new investment tool will enable its customers to protect and grow their money in a simple, secure, and flexible manner, creating reserves for various purposes.

🇲🇽 Mexican FinTech Kapital plans IPO within three years, Chief Executive Rene Saul said. "In the next three years, we would be looking for the IPO," he said at a press conference, adding that he would favor a dual listing in the U.S. and Mexico. Continue reading

🇨🇭 Revolut aims to expand the Swiss market amid global growth. In an interview, David Tirado, Vice President Global Business and Profitability at Revolut, described the country as “one of our five key projects”, noting that Swiss users are among the most profitable in its portfolio due to strong demand for currency exchange and investment products.

🇨🇦 Plumery expands digital banking platform to Canada. The digital banking experience platform has expanded into the country with the launch of market-specific capabilities designed to empower Canadian credit unions to deliver personalised, compliant, and future-ready digital banking experiences.

🇺🇸 Walmart-backed FinTech OnePay is bringing crypto to its banking app. By allowing OnePay users to hold bitcoin and ether in their mobile app, customers could presumably convert their crypto into cash and then use those funds to make store purchases or pay off card balances.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Wallet in Telegram just announced something big: we’re bringing an entirely new product to our users - tokenized US Stocks & ETFs.

🇺🇸 Uphold CEO Simon McLoughlin on Bitcoin, Regulation, and the Road to IPO. In a recent podcast episode, McLoughlin discusses Bitcoin, regulatory clarity in 2025. He also emphasized its role in broadening access to finance, calling it a transformational technology that enables people around the world to use financial services without intermediaries.

PARTNERSHIPS

🇹🇿 I&M Bank Tanzania, Mastercard, and OpenWay launch world elite debit and multi-currency cards. The cards aim to support Tanzania’s growing demand for digital payments, offering features such as enhanced payment security, lifestyle privileges, and multi-currency functionality.

🇮🇳 Tamilnad Bank partners with Wegofin for digital banking. Through this collaboration, TMB will enhance its role as a trusted banking partner while enabling seamless UPI merchant acquiring, automated payouts, fraud risk management, and compliance-driven financial operations, the bank said.

DONEDEAL FUNDING NEWS

🇵🇹 AI fraud platform Feedzai hits $2bn valuation. This new investment round enables Feedzai to continue driving innovation to defend against whatever comes next, so that every form of payment, even those yet to be imagined, can be trusted and adopted safely.

🇬🇧 Wealth app Chip scores £6m investment from Channel 4 VC arm. The deal with Channel 4 Ventures not only brings in funds but also puts "our brand in front of millions of people across the nation," via TV exposure, says Chip. Read more

🌍 Remitee has raised $20 million in a funding round led by Krealo, with participation from strategic and institutional investors. The investment will boost Remitee’s mission to enable embedded remittance solutions for banks, FinTechs, and retailers across Latin America, the US, and Europe.

🇺🇸 MokN tricks attackers into surrendering stolen credentials, raises €2.6 million to expand to the U.S. With this Seed round secured, the French startup now sets its sights on the United States. Part of MokN’s leadership team will relocate stateside to be closer to its future customers.

M&A

🇬🇧 Indian FinTech Pulse to acquire the UK’s Nucleus for Rs 500 crore. The deal boosts Pulse’s UK presence ahead of a planned Rs 1,000 crore IPO in 2026. The combined business aims for a Rs 500 crore turnover, with Pulse seeking more funding for growth and acquisitions.

🇺🇸 OpenAI has entered the FinTech space by acquiring Roi, a New York-based AI-powered personal finance app that consolidates users' financial data, including stocks, crypto, DeFi, real estate, and NFTs, into one platform. The move aligns with OpenAI’s broader push toward personalization and life management through AI.

MOVERS AND SHAKERS

🌍 Western Union appoints Nicolas Levi as regional VP, Middle East, Pakistan & Afghanistan. Levi brings 20 years of experience to his new role, spanning the FinTech, telecom, and financial services sectors, with a strong leadership and growth track record in digital finance.

🇺🇸 DailyPay named Chairman Nelson Chai its Chief Executive Officer. Chai, with experience at Uber, Merrill Lynch, and the New York Stock Exchange, takes over from Stacy Greiner, who will stay on as adviser. The leadership change comes amid continuing regulatory scrutiny of the earned‑wage access (EWA) sector.

🇬🇧 Santander UK boss to exit ahead of TSB merger. Mike Regnier said he will exit in the first quarter of 2026 after stating he intended to “move on after 4-5 years” due to “other interests he would like to pursue”. Continue reading

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()