Tether’s Not Done Yet - And Now It Wants Wall Street

Hey FinTech Fanatic!

Well, that didn’t take long. Less than a week after Trump signed the Genius Act into law, Tether is already plotting a U.S. return: four years after being booted from New York and slapped with $60 million in fines.

This time, the world’s largest stablecoin issuer is targeting Wall Street, not Main Street. Tether CEO Paolo Ardoino says the goal is to attract institutional clients, rather than fueling retail hype and perhaps even challenging Circle’s U.S. dominance. Regulatory baggage? Still there. An audit? Still pending. But with $162B in USDT and D.C. warming up to stablecoins, Tether sees its opening.

Don't we all love a good comeback story?

Scroll down to see how this could reshape the U.S. crypto landscape and other FinTech updates below👇

Cheers,

P.S. Follow me on Threads for daily scoops!

#FINTECHREPORT

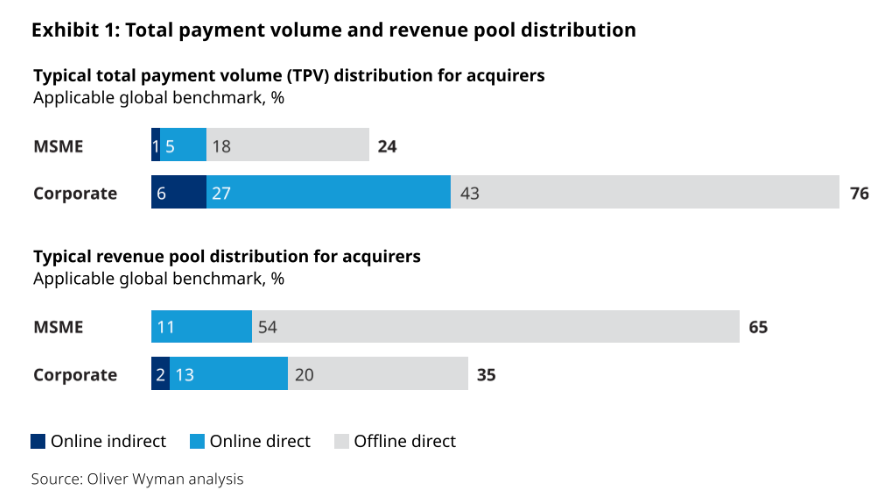

📊 Unlocking the MSME payments market. Across the Asia-Pacific region, micro, small, and medium-sized enterprises account for more than 97% of the total number of businesses. They contribute significantly to the region’s economic development and play key roles in driving innovation and competition.

FINTECH NEWS

🌎 Mastercard expands global relationship with Uber to enhance payment experiences for drivers, couriers, and consumers. “This partnership connects over 3.5 billion cards and more than 150 million merchants that accept Mastercard globally, together with Uber’s community of over 8.5 million earners and 170 million users worldwide,” said the co-president, Global Partnerships at Mastercard.

PAYMENTS NEWS

🌏 Ecommpay empowers global businesses to unlock the Asian market. The payments platform is enabling businesses worldwide to capitalise on the booming digital economy of Asia with a wide choice of Alternative Payment Methods that are popular across the region. This strategic move addresses the increasing demand for localised payment options and facilitates seamless expansion for merchants.

🇺🇸 Taktile named Category Leader in G2’s Summer 2025 Report for the fourth time in a row. This achievement reflects the strong feedback from customers who rely on Taktile’s platform to enhance decision-making processes. As risk teams increasingly prioritize automation, self-service, and experimentation, the need for agile, AI-powered decision infrastructure continues to grow.

🇬🇧 Pinterest selects Checkout.com to strengthen global payment performance for its clients. The company will help Pinterest deliver a better payments experience for its advertisers, supporting its mission to bring everyone the inspiration to create a life they love.

📰 Fulfilling the Promise: Making Real-Time Payments a Reality. This article examines the increasing influence of real-time payment networks. ACI Worldwide and Global Data forecast the market to grow at a 63% annual rate through 2027, reaching $511 billion in annual transactions. Despite healthy adoption, more is needed.

🇮🇱 Tipalti lays off dozens as FinTech unicorn shifts sales focus. This marks the company’s second significant round of layoffs, following a cut of 123 employees in January 2023. Tipalti currently employs about 1,000 people and is estimated to have recently raised around $100 million in credit.

🇿🇦 Visa opens first Africa data centre in Johannesburg. "Visa continues to be very committed to the growth of the economy on the continent and building the data centre, which is frankly one of the very few that are built outside of our core locations, which are the U.S., the UK, and Singapore, is evidence of this commitment," Michael Berner said.

🇮🇪 FinTech firm PayPal to create 100 new jobs in Ireland. The 100 new positions will be in highly skilled data science roles, spanning a range of specialties, including AI engineering, data science, software development, risk modelling, and cybersecurity.

🇧🇷 Pix data of 11 million people leaked; access to accounts was preserved. The CNJ states that the incident that occurred between Sunday (20) and Monday (21) caused the leak of data from 11,003,398 people. Data such as the person's name, Pix key, bank name, branch number, and account number was accessed.

🌎 Mastercard unveils AI Card Design Studio: A smarter, faster way to design your perfect card. The tool enables the creation of stunning cards with a single click, streamlining market readiness and enhancing brand impact. Read more

🇺🇸 New Samsung Wallet feature offers more flexible payment options, powered by a partnership with Splitit. The new feature offers greater flexibility and convenience when paying in-store with Samsung Wallet, allowing customers to separate their purchases into smaller payments. Users in select states beginning July 25, with expansion to all states planned by the end of 2025.

🇺🇸 Wise co-founder accuses £10bn FinTech of 'misleading' investors. Taavet Hinrikus's investment vehicle, Skaala, said Wise's claim that its proposals to extend its dual-class share structure by a decade when it moves its main listing to the US should have been updated through a formal stock exchange announcement.

🇨🇱 Mercado Pago launched a buy now, pay later model. To offer a financial option to the 10 million people who currently lack Access to credit cards or cannot pay in installments. The model allows users to pay in fixed installments without the need for a credit card or bank paperwork.

REGTECH NEWS

🇺🇸 ED files Rs 913-crore FEMA violation case against FinTech Simpl. The company received foreign investment for technology-related products and services, but used it for financial services without the approval of the government or the regulator, the ED alleged.

🇺🇸 OpenAI CEO Sam Altman warns bankers, regulators of a coming fraud crisis. The CEO said he is concerned that financial firms aren’t adequately dealing with a rise in AI-enabled scams against bank customers, highlighting a chief concern of lenders as the emerging technology grows more sophisticated.

🇱🇹 IDenfy adds Sweden’s BankID verification. The new integration is particularly valuable for strictly regulated sectors, such as FinTech, banking, and other online financial services, to ensure better adoption and accessibility of various online platforms through a log-in and onboarding method familiar to the Swedish audience.

DIGITAL BANKING NEWS

🇵🇹 With Portuguese IBAN, Revolut reaches high-interest deposits. The launch of the branch in Portugal is expected to provide a new boost to Revolut, which has nearly 1.9 million customers in the country. The FinTech's CEO revealed to Negócios that deposits will begin to be accepted in August.

🇳🇱 Finom expands credit lines to all eligible customers in the Netherlands. Key features include credit lines from €2,000 to €50,000 with six-month repayment terms, decisions are delivered within minutes through proprietary AI-powered credit assessment, flexible repayment options with no penalties for early repayment, and a simplified application process fully integrated within the Finom platform.

🌍 N26 expands Ready-Made Investment Funds across Europe. Users in Portugal, Poland, Slovakia, Estonia, and Lithuania can now choose from three professionally managed funds, each aligned with different investment goals and risk levels. These funds are designed for convenience and simplicity, offering a straightforward entry point into investing without requiring prior expertise.

🇲🇽 Plata, Nubank, and Revolut are better equipped against FinCEN. The three FinTech companies have received multiple banking licenses in Mexico and are currently preparing to launch operations. This comes amid heightened oversight from Mexico's financial regulator, following recent interventions in banks like Intercam, CI Banco, and Vector.

🇬🇧 Atom Bank founder Anthony Thomson announces plans to launch his fourth bank. Anthony Thomson plans to raise £100m in an initial fundraising for the fresh venture, a global bank aimed at family offices and ultra-high net worth individuals. He says early interest “has been extraordinary”.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Brazil's VERT debuts tokenized credit platform on XRP ledger with $130m issuance. The process promises faster and more efficient settlements and broader investor access compared to traditional banking channels, especially in emerging economies with less developed capital markets.

🇺🇸 Tether eyes the US market return. Tether CEO Paolo Ardoino said that his company is developing plans to serve US institutional clients following President Trump's approval of new stablecoin regulations last week. The El Salvador-based firm would target banks and trading firms rather than retail users, Ardoino said.

🇬🇧 Clear Junction launches on-chain stablecoin transfers service for regulated institutions. The service allows clients to send, receive, and convert stablecoins, starting with USDC (Circle) and USDT (Tether), across the Ethereum, Solana, and Tron blockchain networks.

🇺🇸 SEC halts approval of Bitwise ETF offering broad crypto exposure. Typically, the agency can approve financial products through a vote. However, if a product is approved at the staff level, any one of the commissioners can intervene and place a hold on that approval by requesting a formal review.

🇺🇸 Anchorage Digital is launching a stablecoin issuance platform to help clients participate in the expected frenzy around the asset-backed tokens following the passage of key legislation in the US. Keep reading

PARTNERSHIPS

🇬🇧 Solidgate teams up with Tuum to power global money movement. Tuum Solidgate Treasury marks a major step in powering global B2B payments through modern FinTech infrastructure. This partnership enables seamless cross-border transactions for digital businesses, offering speed, scalability, and security.

🌍 dLocal and RizRemit team up to accelerate cross-border remittances across Africa and Asia. This collaboration empowers faster, more reliable delivery through popular eWallets and local bank rails. Through the integration with dLocal, RizRemit is gaining the tools to make delivery simpler and more in tune with how people move money.

🇦🇪 MultiBank.io partners with Fireblocks and Mavryk to launch $10b real estate tokenization platform. The platform aims to bring approximately $10 billion in real-world assets (RWAs) on-chain, with a focus on enhancing asset security, regulatory compliance, and accessibility.

🇦🇪 UAB and Lune partner to deliver AI-powered, personalised banking experiences. This collaboration is set to enhance UAB’s upcoming mobile banking experience by delivering smarter, data-driven, and hyper-personalised customer journeys, further positioning the bank as innovation-led and customer-centric.

🇬🇧 NatWest to overhaul digital banking with AWS, Accenture. The initiative targets NatWest’s 20 million customers, promising smarter, more responsive services driven by enhanced data capabilities and automation. Employees will also benefit from access to modern AI tools designed to simplify internal processes.

🇬🇧 Trustly and Virgin Media O2 partner to revolutionise payments with cutting-edge pay by Bank Solutions. The partnership will enable VMO2 to streamline payments and onboarding processes as part of its commitment to making customers’ lives easier.

🇺🇸 Alkami and HubSpot partner for personalized digital banking solutions. This collaboration aims to empower financial institutions with data-driven engagement strategies, ultimately driving measurable marketing return on investment (ROI). Continue reading

🇬🇧 Afin Bank seals distribution partnership with Norton Finance. With Norton’s insight and distribution network, the bank will be able to reach the advisers and clients who will benefit most from a lender that looks at the full picture and not just a credit score.

🇺🇸 PayPal and Wix advance a strategic relationship to deliver a unified payment experience for merchants. With the integration, PayPal is now available directly in the Wix Payments platform. Merchants can connect their PayPal Business account and manage all transactions from a single dashboard alongside their Wix activity.

DONEDEAL FUNDING NEWS

🇦🇪 Abu Dhabi FinTech firm Synervest nets $4M series A. The capital will support Synervest’s plans to grow internationally. The company said it would use the funds to increase its regulatory footprint and enhance services aimed at institutional clients.

🇬🇧 Lightyear closes $23M and launches AI-powered market intelligence. Access to clear, high-quality insights on stocks, funds, and market sentiment is often restricted by paywalls and subscriptions. These new features aim to change that, unlocking expert analysis and financial news, all summarised within the context of each user’s portfolio.

🇸🇬 Chocolate Finance raises US$15 million; CEO says it may still offer instant withdrawals in the future. The FinTech firm plans to use the capital to expand across the region, starting with Hong Kong, where it recently obtained regulatory approval to operate.

M&A

🇧🇷 iFood wants to buy Alelo. With negotiations to acquire Alelo in advanced stages, iFood aims to accelerate its growth in the sector and become a key player in this space. And in the process, support the ambitious goals of Prosus. Read more

🇩🇪 Regnology to acquire Risk & Regulatory Reporting Business Unit. The proposed acquisition represents a strategic step in Regnology’s ambition to deliver regulatory intelligence at scale, bringing together complementary capabilities across finance, risk, and regulatory reporting. It also expands its presence in key markets.

MOVERS AND SHAKERS

🇧🇷 Nubank appoints Ethan Eismann as Chief Design Officer, deepening commitment to customer experience. Eismann will oversee the global strategy and execution of design across all product lines, driving innovation at scale, in close collaboration with Product, Engineering, Marketing, and Business teams.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()