Tether Goes on the Offensive Across Gold, Custody, and Payments

Hey FinTech Fanatic!

Today’s story is really one story told in three moves… all coming from Tether.

First, Tether invested $150M in Gold.com, taking a 12% stake and pushing its gold-backed stablecoin XAUT closer to both tokenized and physical gold distribution.

This lands at a moment when gold prices are surging again as a macro hedge.

Then came a $100M strategic equity investment into Anchorage Digital, the first federally regulated digital asset bank in the US. Regulated custody, staking, and settlement.

In this case, it refers to the institutional and operational aspects of cryptocurrencies.

And finally, Tether-backed t-0 network, a USD₮-powered settlement network designed to make cross-border payments behave like local ones, with near-instant settlement and lower FX friction.

Three moves. Same direction. This feels less like expansion and more like plumbing being laid very deliberately.

Put together, the context goes beyond simply launching another token. It’s about owning the rails: store of value, regulated custody, and settlement infrastructure, all tied together with stablecoins.

Curious where this direction leads next? I’m watching closely👇 I'll be back tomorrow with more updates!

Cheers,

INSIGHTS

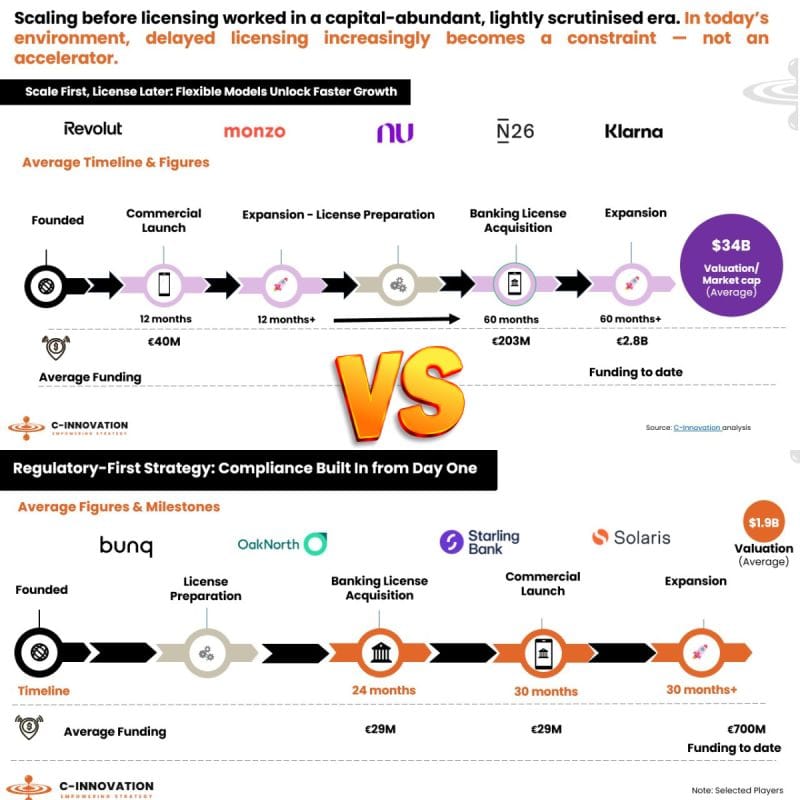

📈 “Scale first, license later” used to accelerate FinTech growth. Owning a licence allows FinTechs to launch products faster, capture deposits and lending margins, and reduce reliance on Banking-as-a-Service partners.

FINTECH NEWS

🇦🇪 Are you in Dubai? Time to network the right way! Join our first FRC Dubai run on Feb 15th! RSVP for free! 🏃➡️

🇬🇧 Cleo brings AI-powered money management back to the UK. Founder Barney Hussey-Yeo described the return as a homecoming and the start of a new chapter, with the app offering personalised coaching and straightforward answers to users’ everyday financial questions.

🇬🇧 Starling founder Anne Boden cuts stake in £4bn FinTech. Anne Boden cut her holdings in the digital bank to near 2.7% from a previous 4.3%. It comes after Starling launched a secondary share sale last year in a bid to enable its current investors to sell down stakes and open up new opportunities.

PAYMENTS NEWS

🇺🇸 Zip US expands flexible payment options with launch of Pay in 2. Pay in 2 offers customers more control and flexibility to choose the payment plan that works best for them, making everyday purchases more manageable. Pay in 2 is designed to help manage cash flow and everyday spending within a single billing cycle.

🇺🇸 AmEx debuts flexible payments for small businesses. The new offering is aimed at giving businesses more control over their cash flow needs with an instant line of credit. Flexible Payment Option (FPO) is available for AmEx Business Gold and Platinum cardholders, giving them the option to repay their statement balances in full or pay in portions over time and with interest.

🇳🇴 Moonrise by Lunar launches instant payments in Norway via NICS Real. By connecting directly to NICS Real, Moonrise enables partners to send and receive Norwegian Krone (NOK) in real time, 24/7/365. Continue reading

🇧🇩 Bangladesh central bank backs PalmPay smartphone financing pilot in first-of-its-kind approval. The approval allows PalmPay Bangladesh Limited to offer affordable, instalment-based smartphone financing under a closely supervised framework aimed at low-income individuals and first-time smartphone users.

PODCAST RECOMMENDATION

🎤 Why are taxes stuck in the paper age? by DashDevs. In episode 132 of FinTech Garden, Igor Tomych spoke with Roman von der Höh about modernising withholding tax, highlighting how outdated tax systems require digital transformation. The discussion explored growing complexity driven by cross-border investments and new regulations, while banks face pressure to deliver efficient end-to-end tax workflows with lower costs and fewer specialists. Watch the full episode

Why are taxes stuck in the paper age? by DashDevs

REGTECH NEWS

🇦🇪 Mastercard collaborates with the Cyber Security Council to safeguard the UAE’s digital ecosystem. Through this collaboration, both entities will work together to advance cybersecurity resilience by sharing global best practices and supporting the development of forward‑looking cybersecurity policies.

🇮🇳 Over 400 Indian banks shift to secure ‘.bank.in’ domain to boost cybersecurity, complying with RBI mandate. This new top-level domain (TLD) is exclusive to verified banking institutions, making it easier for customers to distinguish genuine bank websites from fraudulent or phishing sites that often mimic official portals to steal credentials or carry out financial fraud.

DIGITAL BANKING NEWS

🇦🇺 ANZ launches agentic AI-powered CRM to transform business banking. The new CRM platform delivers improved customer outcomes and helps bankers work smarter and automate routine tasks. The technology will help boost bankers' capabilities and productivity, allowing more time for bankers to focus on customers.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Gemini to exit U.K., EU, and Australia, reduce staff by 25%, and focus on U.S. and prediction markets. Customer accounts in the affected regions will enter withdrawal-only mode on March 5, 2026, ahead of full closures in April, with Gemini partnering with brokerage platform eToro to help users transfer their assets.

🇷🇺 Russia's Sberbank plans crypto-backed loans to corporate clients. Sberbank is moving to offer loans secured by cryptocurrency and says it is ready to work with the central bank on a regulatory framework. Sberbank's planned program will extend crypto-backed lending beyond miners to businesses holding digital assets.

🇺🇸 Block expands OpenIP with Bitkey and Proto Patents. Building on the OpenIP launch in October 2025, the company said the move reinforces its commitment to open innovation by pledging additional patents to support builders and encourage hardware development across the bitcoin ecosystem.

PARTNERSHIPS

🇸🇬 Hecto Financial signs MOU with TripleA on stablecoin payments and settlements. Under the agreement, the companies plan to keep pursuing efforts, including jointly reviewing and discussing cooperation models for stablecoin-based payment and settlement structures, and building a cooperative relationship to respond to rapidly changing global payment trends.

🇿🇦 POSB collaborates with Mastercard to launch a new outbound money transfer service. The service aims to provide a fast, secure, and cost-effective way for customers in Zimbabwe to send money directly to bank accounts, mobile wallets, and cash abroad. Additionally, Riyadh Air and Mastercard take off together to redefine the global travel experience through multiple touchpoints. The partners will develop a portfolio of innovative consumer products, including Riyadh Air-branded credit and prepaid cards built for the next generation of travelers.

🇻🇳 Cake Digital Bank pioneers bank-led cross-border receivables with Visa. By integrating cross-border receivables within an onshore digital banking framework, it reduces reliance on intermediary layers while improving transparency, settlement efficiency, and oversight of international cash flows.

🇸🇬 FOMO Pay taps BNY to deliver an institutional-grade business account solution for cross-border payments. Through this joint effort, FOMO Pay will utilise BNY's Virtual Reference Number solution to enable its corporate clients to collect and send payments directly within the U.S. domestic banking system.

🇩🇪 Akbank goes live on Mambu core in Germany. Operating under a German banking licence from BaFin, the division serves customers in Germany and the wider EU market, providing banking services and supporting cross‑border financial activity between Europe and Turkey.

🇺🇸 Kraken Institutional announces first bespoke investment solution with Bitwise Asset Management. Eligible Kraken Institutional clients can access the Bitwise Custom Yield Strategy, delivered by Bitwise Asset Management as an external strategy manager and executed entirely within Kraken’s qualified custody, execution, and risk framework.

DONEDEAL FUNDING NEWS

🇺🇸 Tether announces $100 million strategic equity investment in Anchorage Digital. Both companies are focused on strengthening the core infrastructure required for digital assets to operate safely, at scale, and within clear regulatory frameworks. Additionally, Tether makes a $150 million strategic investment in Gold. com, expanding global access to tokenized and Physical Gold. As part of this investment, Tether has acquired approximately 12% of Gold.com.

🇺🇸 Tether announces investment in t-0 Network to support USD₮-powered payments system. The platform operates as a non-custodial network that connects institutions through a single API, matches transactions on a global ledger, and settles only net balances, aiming to make international payments function as seamlessly as local ones.

🇺🇸 Sapiom raises $15M to help AI agents buy their own tech tools. The platform aims to simplify how nontechnical creators connect AI-built apps to paid external services like SMS, email, or payments by enabling seamless authentication and micropayments.

🇭🇰 Waffo secures 30 million USD to accelerate global payment infrastructure. The platform enables digital businesses to manage global collections, subscriptions, compliance, risk management, and settlement, simplifying cross-border operations and driving global revenue growth.

🇺🇸 Veritus raises $10.1m seed funding to power voice-first AI agents for lenders. The funding will help to accelerate the deployment of its AI agents across the consumer lending value chain, company co-founder and CEO Joshua March said.

🇬🇧 Taxnova secures funding following a16z speedrun accelerator. Taxnova said its platform identifies projects, generates technical narratives, calculates eligible costs, and produces documents ready for audit. Read more

🇺🇸 FinTech, Advance, raises $8.55m to turn insurance payments into revenue. The new funding will support product expansion and go-to-market growth with MGAs, wholesalers, and high-volume agencies that face increasing pressure from premium volume, audit scrutiny, and operational complexity.

M&A

🇺🇸 UiPath acquires WorkFusion, strengthening agentic solutions for financial services. The acquisition expands and strengthens the UiPath portfolio of agentic AI-powered industry solutions for financial services and banking, including processes and workflows for financial crime compliance.

🇺🇸 Broadridge to acquire CQG, expanding global futures and options trading capabilities. Clients will benefit from flexible, scalable solutions designed to support their growth objectives, accelerate speed to market, and deliver a powerful, fully integrated trading experience for both institutional and professional retail market participants.

MOVERS AND SHAKERS

🇸🇬 EBANX appoints Eduardo De Abreu as Chief Product Officer to lead global product strategy from Singapore. By placing the Chief Product Officer on the ground in a major Asian FinTech hub, EBANX is committing to deep integration within this critical region, ensuring its roadmap is informed by real-time dynamics rather than remote planning.

🇬🇧 XTB hires ex-Revolut marketer Zoe Gralinska-Sakai as it ramps up marketing spend. Her appointment comes as XTB expands its European footprint and targets serving more than 2 million users globally through its multi-asset investment app, with Sakai focused on driving growth and improving local market relevance.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()