Stripe Rockets Toward $140B Valuation... And Still Says No Rush to IPO

Hey FinTech Fanatic!

Stripe is setting up a new tender offer that would push its valuation to $140B, a jump of more than $30B from last year.

For a company that hasn’t gone public, that’s a loud signal. Stripe has been using tender offers as its pressure valve since 2024. Employees get liquidity. Investors get a price discovery moment.

And the company stays firmly private. In other words, many of the benefits of an IPO, without the noise or scrutiny.

Stripe hit full-year profitability in 2024, hasn’t raised primary capital since its $6.5B Series I in 2023. It’s redefining what “late-stage” means in FinTech, and showing how private liquidity can scale without ringing the bell on Wall Street.

Look at the recent moves. The acquisitions of Bridge and Privy aren’t random. They point to a deliberate push to embed stablecoins and crypto infrastructure directly into Stripe’s core payments stack, quietly, without the hype.

I also delve deeper into this, in an analysis, including 👉 Why Stripe brought Metronome into the picture. And despite a modest workforce reduction last year (around 3.5%), Stripe keeps hiring and investing.

Want to see other stories that are shaking up the FinTech industry today? Scroll down and check them out firsthand. 👇 I'll be back tomorrow!

Cheers,

INSIGHTS

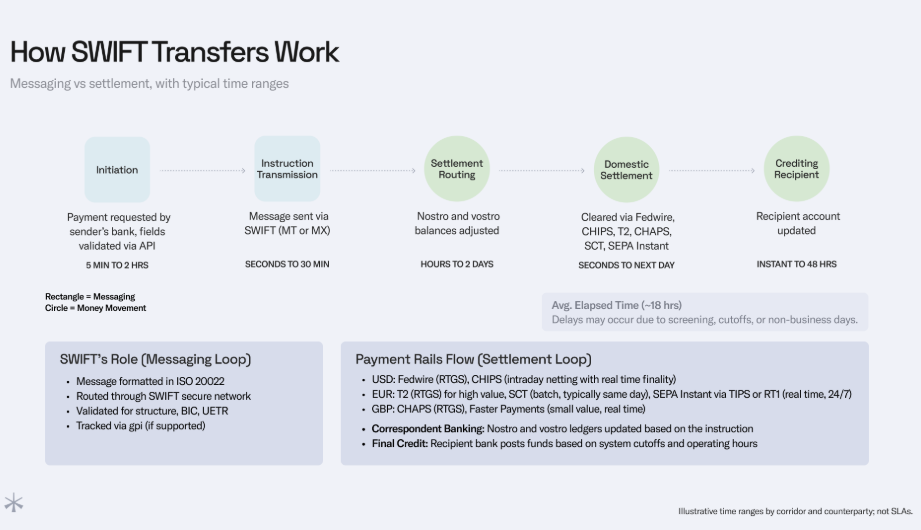

➡️ Stablecoins vs SWIFT: Routing Value by Logic, Not Legacy by Noah. Stablecoins bridge traditional finance and programmable payments, enabling faster, cheaper transfers than legacy rails. Bank cross-border payments still rely on BIC/SWIFT codes for secure messaging, but SWIFT only sends instructions; it does not move money. Read the full article here

FINTECH NEWS

🇵🇦 Join our Panamá city group this week! Mauricio Villarreal is ready to lead the run and talk FinTech.🏃➡️ RSVP here!

🇬🇧 The FCA authorises Crowdcube as a retail Public Offer Platform. Under the new POP regime, Crowdcube can now facilitate uncapped primary public offers by private, unlisted companies, up to and including large-scale pre-IPO rounds, without a prospectus.

🇺🇸 Stripe valuation set to hit $140 billion in new tender offer. The company, one of the most closely watched potential candidates for an initial public offering, has set up frequent tenders since 2024 as a way to let employees sell shares without going public. The latest deal is a sign that Stripe may continue to delay an IPO.

🇺🇸 Experian introduces high yield digital savings account. With the ability to save built directly into the Experian ecosystem, members can track their savings growth alongside credit improvements, creating a clearer picture of their overall financial health.

🇺🇸 Hobbit-inspired startup Erebor Bank becomes first new bank greenlighted by Trump 2.0, launching with $635 million in capital to serve startups and wealthy clients. The bank aims to fill the gap left by Silicon Valley Bank’s collapse, focusing on defense and industrial tech companies.

Q&A

📰 Building Trust in the World’s Toughest Payments Market: Checkout.com’s North American Playbook. Arthur Bedel and Zack Levine, Head of North America at Checkout.com, discuss Checkout.com’s rapid expansion in the highly competitive North American payments market, highlighting the importance of performance, reliability, and trust. The conversation explores the company’s customer-first strategy and new partnerships with major merchants. Read the full interview here

PAYMENTS NEWS

🇺🇸 Circle supports Fed plan to integrate stablecoins into core payment systems. The proposal would allow eligible non-bank financial institutions, including stablecoin issuers, to access Fed payment infrastructure without becoming fully chartered banks.

🇩🇪 Lidl in Germany now allows paying via SEPA bank transfer, circumventing American VISA/MasterCard. Lidl shoppers can now complete purchases by paying directly via SEPA bank transfer through the Lidl Plus app, effectively avoiding reliance on major U.S.-based card networks.

🇬🇧 Amazon has introduced Pay by Bank in the UK, allowing customers to pay directly from their bank accounts without using cards. The move signals growing mainstream adoption of account-to-account payments, offering biometric approval through banking apps, faster refunds, and upcoming support for Prime subscriptions.

🇨🇴 Digital lending FinTech Addi accelerates its growth in Colombia and reaches 2.7 million customers, adding 33,000 partner businesses. It also reported US$3.6 billion in pre-approved loans and a presence in 1,034 municipalities, equivalent to 94% of the national territory, placing it among the platforms with the widest coverage within the FinTech ecosystem.

🇦🇪 FinTech Alaan launches new product SuperPay to enable supplier payment transfers globally. With SuperPay, Alaan now combines card payments, invoice automation, approvals, accounting, and international transfers in a single workflow - a major step in the company’s expansion into a complete finance-operations platform for the region.

🇦🇺 Para announces REST API. The software enables FinTechs and consumer applications with existing userbases to integrate the security, speed, and utility of blockchain wallets without changing the app’s UI or asking users to onboard to new systems. This launch accelerates the convergence of traditional FinTech and crypto by treating blockchain as background infrastructure.

🇩🇰 Unzer expands Danish footprint with in-store POS launch in partnership with Verifone for SME merchants. The expansion is designed to bridge the gap between digital and physical storefronts, providing the 30,000 Danish merchants already using Unzer’s backend with a hardware solution to match their online capabilities.

🇫🇷 Ingenico launches next-generation AXIUM payment device family and Ingenico 360 unified cloud platform. The new portfolio provides a modern foundation that accelerates innovation, streamlines estate management, and supports the rapid rollout of new services worldwide.

DIGITAL BANKING NEWS

🇲🇽 Revolut believes its goal of two million customers in Mexico, its first banking launch outside Europe, and expects rapid growth in the market. CEO Juan Guerra said strong demand during the beta phase prompted the company to double its first-year customer target, aiming for two million users in 2026 instead of one million.

🇧🇷 Nubank is highlighting the security tool Street Mode. This feature limits transactions outside of trusted Wi-Fi networks, allows partygoers to enjoy the festivities safely, and provides protected Pix insurance, covering fraud after theft or coercion up to R$5,000 per year.

🇬🇧 Nationwide allows mortgage deeds to be signed digitally. Anyone purchasing a property or looking to remortgage with Nationwide will now be able to sign their mortgage deed electronically if their solicitor or conveyancer is set up to use Qualified Electronic Signature (QES).

🇺🇦 Monobank will offer currency transactions with euros and dollars. Funds remain available for withdrawal at any time. The launch was announced by monobank co-founder Oleg Gorokhovskyi. According to him, now currency savings can bring profit without blocking funds.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Visa goes on-chain with Ethereum stablecoin settlements. By moving payments on-chain, Visa allows 24/7 transactions for institutional clients. This bypasses the delays that often happen with banks. In fact, Visa’s on-chain analytics show that the system has already processed over $3.5 billion in annualized volume.

🌎 Bitso transforms cross-border payments with Ripple’s RLUSD and XRP to enable near-instant, lower-cost cross-border settlements between the US and Latin America. The integration aims to eliminate costly pre-funding, provide regulated dollar liquidity on blockchain rails, and improve transparency for businesses making international transfers.

PARTNERSHIPS

🇪🇬 Bosta and Mastercard announce strategic collaboration. The collaboration delivers a comprehensive ecosystem designed to help businesses streamline operations and scale efficiently. Aditionally, Liv and Union Coop enter a strategic partnership to offer more value and rewards to UAE consumers. In collaboration with Mastercard, the companies will launch two co-branded credit cards that aim to enhance the shopping experience and reward everyday spenders in the UAE.

🇫🇷 Fireblocks and Thales expand partnership to deliver bank-grade Digital Asset Security. The collaboration integrates Fireblocks’ digital asset platform with Thales’ Luna HSMs, enabling institutions to extend their existing certified hardware infrastructure into digital asset operations without having to re-architect security models.

🇦🇪 Zand and Ripple are in a strategic partnership to power the digital economy with stablecoin and blockchain innovations. The partnership will see Zand and Ripple work together to explore initiatives, including enabling support for RLUSD within Zand’s regulated digital asset custody and issuance of AEDZ on the XRP Ledger (XRPL).

🇺🇸 BitGo Bank & Trust, N.A., and InvestiFi partner to support nationwide digital asset investing for banks and credit unions. Through the partnership, InvestiFi will offer digital asset trading capabilities to participating banks and credit unions across all 50 states, supported by BitGo’s Crypto-as-a-Service (CaaS) infrastructure.

🇸🇦 DriveWealth powers InvestSky’s expansion into Saudi Arabia, growing global footprint. Through this collaboration, the platform will leverage DriveWealth’s always-on, API-first brokerage infrastructure to deliver seamless access to U.S. equities within a fully regulated, scalable environment, embedding global market access directly into its social investing experience.

🇺🇸 Deel partners with MoonPay to enable stablecoin salary payouts for global workers. Together, MoonPay and Deel will further enhance stablecoin salary payouts for workers and expand these capabilities to employees around the world, offering a faster and more flexible way to get paid.

🇺🇸 NBA and American Express announce multiyear partnership extension. American Express and the NBA will launch a connected member program with NBA ID, the NBA's free membership program that provides fans access to a variety of benefits, including exclusive offers from NBA partners, ticket promotions, and members-only voting campaigns.

🇺🇸 Bottomline and Koxa partner to deliver ERP-Banking. The collaboration enables Bottomline’s bank clients to offer a fully integrated ERP-banking experience to their corporate and treasury customers, but without the cost, risk, or complexity of building and maintaining custom API infrastructure.

🇺🇸 accesso® and Adyen expand strategic partnership to enhance platform payments capabilities at global scale. Together, accesso and Adyen's partnership is designed to deliver the scale and reliability required for complex, high-volume environments spanning multiple regions and sales channels.

🇨🇦 Uber now accepts WeChat Pay in Canada. The integration is specifically aimed at visitors and residents who rely on the WeChat mini app to book rides. By adding WeChat Pay to its local acquiring network, Uber is removing the need for users to have a traditional credit card or a local data plan to get around.

DONEDEAL FUNDING NEWS

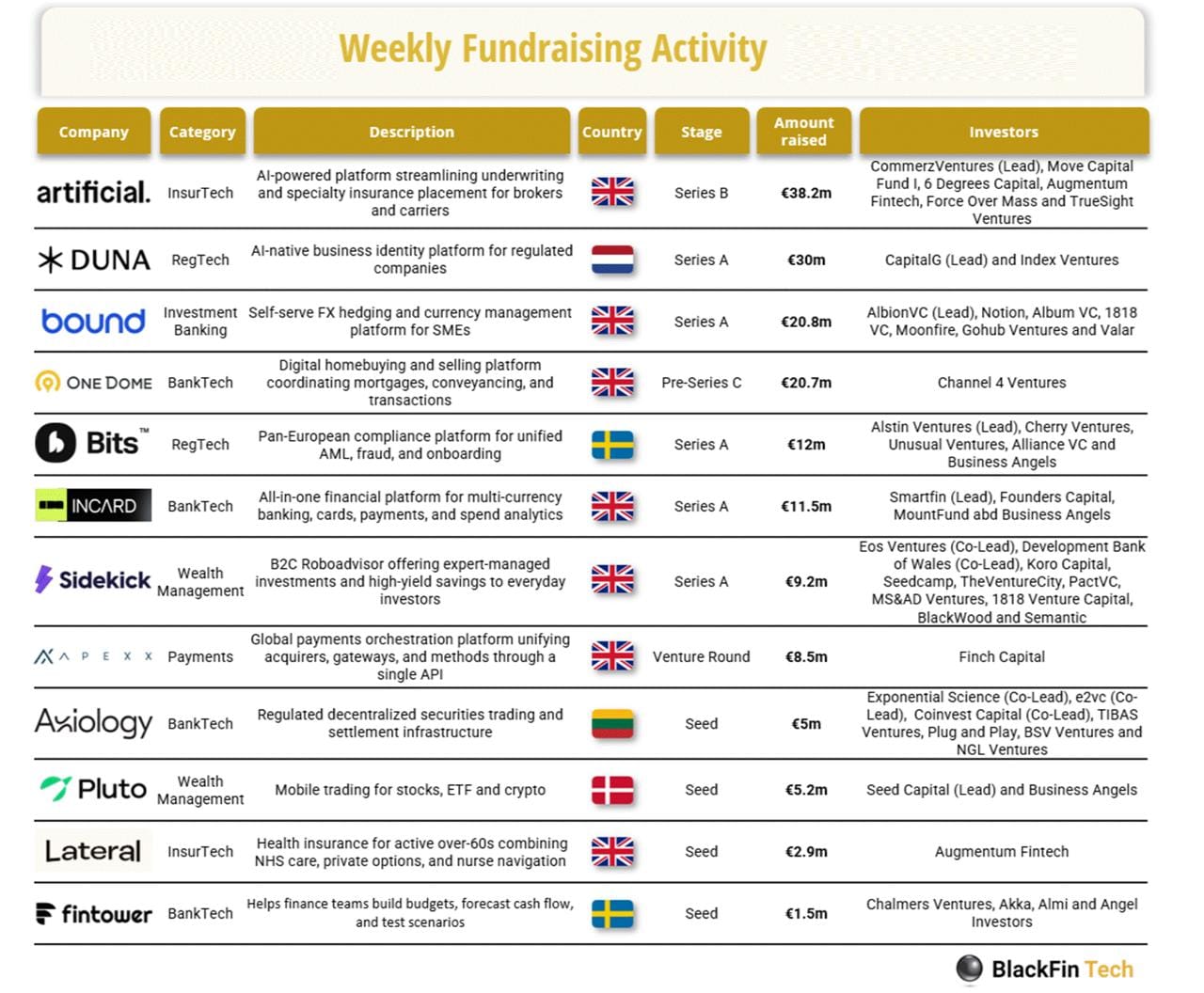

💰 Over the last week, there were twelve FinTech deals in Europe, raising a total of €165.5 million, including seven transactions in the UK, two in Sweden, one in the Netherlands, one in Denmark, and one in Lithuania.

🇧🇷 Avenia raises US$17.3M to expand in Latin America and the US. With the funds, Avenia intends to expand its operations in Brazil, including the launch of new products such as performance solutions and cards. The strategy also envisions expansion into other Latin American countries and the North American market.

🇮🇳 FinTech Startup Olyv secures USD 23mn in Series C Round led by Fundamentum Partnership Fund with participation from SMBC Asia Rising Fund. The company said the new capital will be used for general corporate purposes. Continue reading

🇮🇳 Afinit raises 32 billion won in Series E, and is strengthening its pre-IPO push. Afinit plans to focus the new capital on expanding partner financial companies in India, strengthening new financial product businesses such as insurance, and hiring talent to advance its AI technology.

🇺🇸 Backpack Exchange raising at $1B valuation. The exchange, aiming to expand the trading of tokenized assets and fractional ownership throughout the United States and global markets, co-founder Armani Ferrante describes tranche structures to protect retail investors from IPO dilution.

🇺🇸 FinTech Agibank slashes price, size of US IPO hours before sale. Agibank is now offering 20 million shares at $12–$13 each after market volatility and a sharp decline in competitor PicPay’s stock. Despite strong investor demand, orders were concentrated at the lower end of the original range.

🇫🇷 Naboo raises $70M from Lightspeed for AI-powered events procurement. Naboo plans to expand beyond corporate events into broader procurement use cases, using AI to automate booking, payments, and tender management, while exploring adjacent categories with complex spending, compliance, and supply chain requirements.

MOVERS AND SHAKERS

🇬🇧 Revolut hires JPMorgan Chase UK CEO Kuba Fast to head Eastern Europe. Fast, who announced his departure from Chase this weekend via social media, will inherit the responsibilities currently held by Joe Heneghan. He will oversee the neobank's operations and lead Revout's business in Eastern Europe.

🇧🇷 PicPay recruits João André Pereira, former Central Bank governor, to lead Risk Management. With an 18-year career at the Central Bank, he worked in the areas of Regulation and Supervision. Read more

🇸🇬 Crypto.com appoints Vivian Wan as Chief People Strategy Officer. In this role, Wan will play a central role in designing the operating framework that enables growth, speed, discipline, and impact. Wan will be supported by Mavis Liu, Crypto.com’s EVP, People & Culture.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()