Stripe Hits $1 Trillion Volume & Klarna's Open Banking Play

Hey FinTech Fanatic,

Stripe's performance in the financial sector has been remarkably strong, as evidenced by its recent achievement of processing over $1 trillion in total payment volume in 2023, marking a significant 25% increase from the previous year.

This surge in transactions underscores Stripe's capacity for generating substantial revenue, further bolstered by its effective fee structure. Impressively, the company reported being "robustly cash flow positive" in 2023, projecting a similar outlook for 2024. This financial stability suggests that Stripe is well-positioned for growth without needing additional capital for a public offering in the near future.

A noteworthy aspect of Stripe's success is its ability to retain major clients, with 100 companies each processing over $1 billion annually through its platform. This client base contributes to around 10% of Stripe's total payment volume, indicating both a high level of customer loyalty and a concentration of significant accounts.

Additionally, Stripe's "Revenue and Finance Automation" services are expected to achieve a $500 million annual run rate, highlighting the company's diversified revenue streams and potential for further growth.

In the context of declining venture capital funding, Stripe observed a record number of startups in 2023, particularly in the U.S., Canada, the Netherlands, and Sweden.

These new businesses are quickly generating revenue, with many surpassing the $1 million mark in their first year. Stripe's influence extends to the incorporation process, with a significant number of new Delaware corporations using Stripe Atlas for their business needs.

Looking ahead, Stripe's valuation stands at $65 billion, and while an initial public offering (IPO) may not be imminent, the company's strategic acquisitions and focus on enhancing customer relationships suggest a continued trajectory of growth.

Here is what co-founder John Collison has to say about it:

I have to catch a plane back to Amsterdam now after a nice week in the snow. And I'll be back with more FinTech updates in your inbox on Monday!

Cheers,

POST OF THE DAY

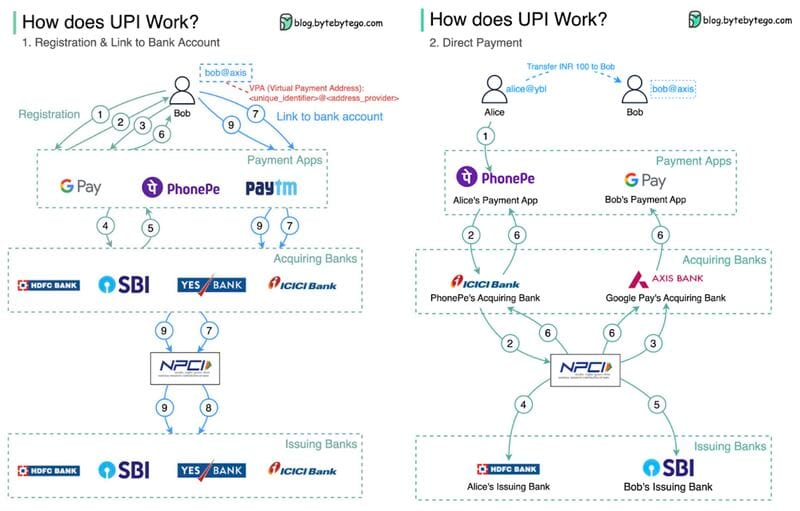

UPI is an instant real-time payment system developed by the National Payments Corporation of India 🇮🇳

FINTECH NEWS

🇩🇪 Berlin-based brokerage-as-a-service platform lemon.markets has gone live in cooperation with Deutsche Bank, BNP Paribas, and Tradegate. The startup is now ready to offer its white-label solution to FS providers and FinTechs, giving them the regulatory, operative and technological infrastructure for processing securities transactions via an investment API.

🇺🇸 Adyen expands presence in San Francisco after signing a new sublease to a 150,000-square-foot office building at 505 Brannan Street. The lease will extend through December 2032, subject to all appropriate regulatory approvals, and Adyen’s new office will span all six floors of the building.

🇹🇿 UK-headquartered FinTech Unlimit is set to launch operations in Tanzania following its authorisation as a payments service provider (PSP) by the country’s central bank. The firm plans to leverage its new licence from the Bank of Tanzania to introduce “new offerings such as business payments, merchant services and outbound payments” to the Tanzanian market.

PAYMENTS NEWS

🇮🇹 In 2023, Nexi recorded an 88% increase in the value of in-store mobile payments and smartwatch transactions in Italy, new data reveals. The technological infrastructure of the group is proving indispensable for driving the growth of an evolving sector.

OPEN BANKING NEWS

🇬🇧 Tell Money supports Griffin’s launch as a fully operational UK Bank with tell.gateway. Leveraging its advanced tell.gateway service, Tell Money will aid Griffin Bank by providing crucial compliance and Open Banking capabilitiesthus supporting innovation and advancement within the dynamic FinTech sector.

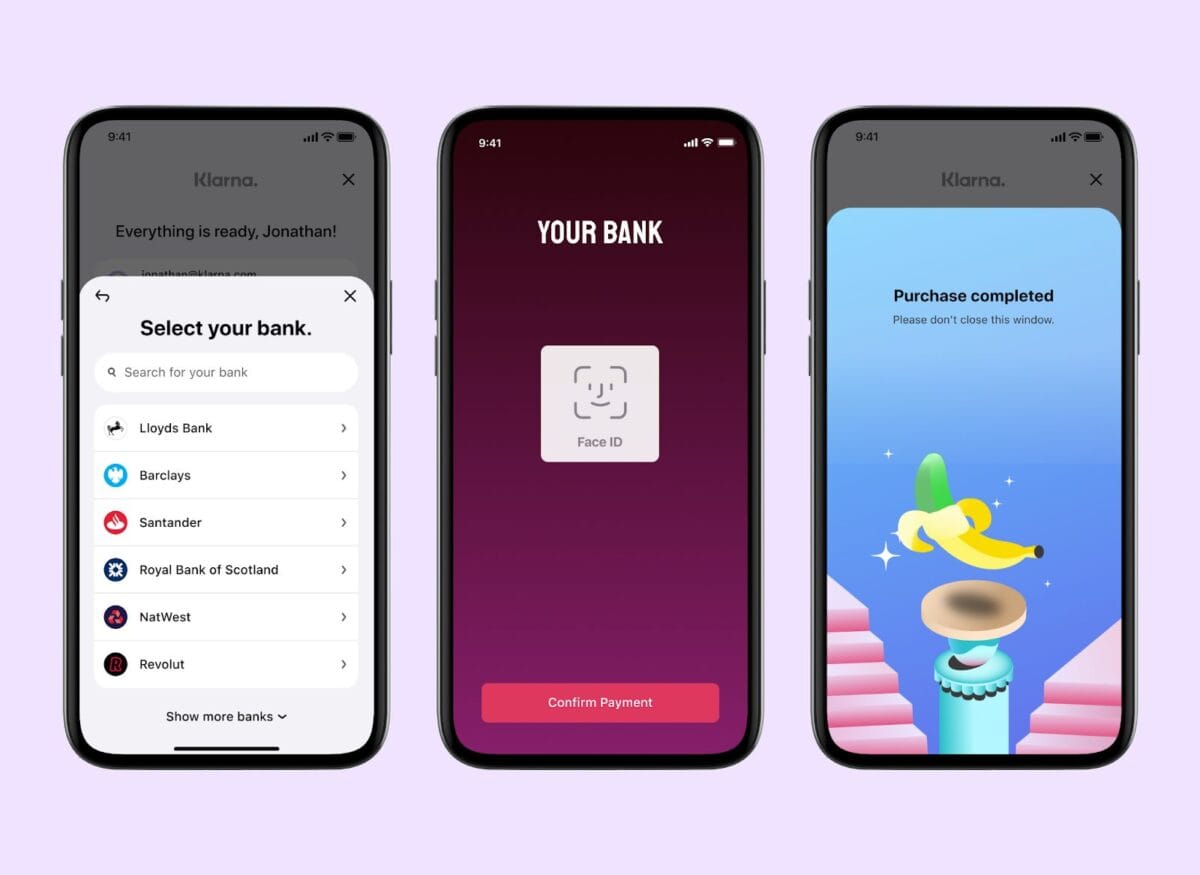

🇬🇧 Klarna adds open banking settlements for 18 million consumers and 32,000 retailers. Klarna has begun to roll out open banking-powered settlements in the UK, meaning that consumers can now pay Klarna directly from their bank account instead of using a debit card, bypassing card networks.

REGTECH NEWS

🇵🇱 Nethone, a Mangopay company, wins Fraud Prevention accolade at FinTech Breakthrough Awards. Facing strong competition from more than 4,000 global nominations, Nethone was named Best Fraud Prevention Company at the 2024 awards. With first-hand fraud intelligence, Nethone can reverse engineer fraudsters' tactics and adapt their risk detection system to existing and emerging fraud trends.

DIGITAL BANKING NEWS

🇵🇹 Portuguese bank Banco BPI and Personetics announced the introduction of Pulsoo, an independently branded application that empowers small and medium business (SMB) owners to manage their businesses. Pulsoo provides updates, hyper-personalized insights and recommendations that are tailored to the financial literacy level of SMB owners.

🇬🇧 Lloyds teams with FinTech startup ApTap to help people manage household bills. The app provides customers with the ability to get information on savings that could be made by switching broadband provider, energy supplier, or mobile phone contract and the means to implement the switch.

🇪🇺 N26 launches Instant Savings in 13 new markets, offering customers up to 4% interest on deposits. From today, customers in Austria, Belgium, Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia and Slovenia will be able to earn up to 4% interest per annum on their savings, without deposit limits and at no additional cost.

🇵🇭 GOTYME BANK expects to be profitable within the next three years as it plans to introduce more products and as its customer base continues to grow. Sister company TymeBank in South Africa, broke even in under five years, making it the fastest profitable standalone digital bank in South Africa.

DONEDEAL FUNDING NEWS

🇪🇪 Tuum announced that Citi Ventures has become a strategic investor in the company as a follow-on from Tuum’s recently announced fundraising. At the start of February, Tuum announced a EUR25m Series B fundraise led by CommerzVentures, with the proceeds intended for product and market development.

M&A

🇬🇧 Anna.Money sets sights on entering Australian market following GetCape acquisition. This move signals Anna.Money’s ambition to create a new SaaS category to take on the likes of ANZ, CommBank, NAB and Westpac, offering services that hope to save small businesses time and money.

MOVERS & SHAKERS

🇺🇸 PayPal names SoFi's Aaron J Webster as EVP, Chief Enterprises Services Officer. Aaron will have end-to-end accountability for global financial crime and fraud prevention programs, regulatory and government relations, and risk and compliance management. Read more

🇸🇪 Tink strengthens senior leadership team in the UK with three new appointments. Ian Morrin, Andrew Boyajian and Jack Spiers have been appointed as Head of Payments & Platforms, Head of Products for Payments & CX, and Banking and Lending Director (UK&I), respectively.

🇬🇧 Following investments by BNP Paribas and Citi, United FinTech names Troels O. Lindblad as CFO and Rasmus Bagger as CCO while Marc Levin advances to CEO of Athena Systems in a strategic management reshuffle to adopt even more customer-centric ways of working, says United FinTech CEO Christian Frahm.

🇺🇸 Stash, last valued at $1.4B, lays off 25% of staff. The layoffs impact about 80 people, bringing its total headcount to around 220. At its peak, Stash had a roughly 500-strong workforce. CEO Liza Landsman announced the layoffs in a note to employees Wednesday morning.

🇬🇧 Gill Lungley joins LHV board. As of 1st April 2024, Gillian Lungley will become a member of the Board of Directors of LHV Bank Limited. She is the fourth Independent Non-Executive Director (INED) to join the Board of Directors of LHV Bank Limited, and will also become a member of the Risk Committee and Remuneration Committee of LHV Bank Limited.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()