Stripe Courts Banks on Stablecoin-Powered Global Payments

Hey FinTech Fanatic!

Stripe is in talks with banks about using stablecoins for cross-border payments, according to co-founder John Collison, who told Bloomberg that financial institutions are “very interested” and no longer see stablecoins as “just a fad.”

This comes as Stripe doubles down on crypto and AI, two of its biggest bets for the future. The company, which processed $1.4T in payments last year, is building aggressively in both areas.

Last year, Stripe acquired Bridge, a stablecoin platform with clients like SpaceX and Stellar, in a $1.1B deal, and followed up with the announcement of a US dollar stablecoin product aimed at businesses outside the US, UK, and EU.

Just this month, Stripe launched:

- Stablecoin Financial Accounts in 101 countries

- A new AI model (Payments Foundation Model) to reduce fraud and improve approval rates

Behind the scenes, Stripe now has a 100-person team focused on stablecoins and crypto, with plans to scale across SF, NY, Dublin, and London.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

Only 2 days to go until Checkout.com's Pick Up the Pace Run!

June 4th, 7:00 AM — start your day right from RAI Amsterdam.

Network, get active & be among the first 50 runners to score exclusive swag.

Spots are filling fast — register today!

FINTECH NEWS

🇮🇳 Indian FinTech startup Oxyzo’s revenue jumped 33.6% to $145.3m. This growth was primarily driven by a 32% rise in interest income. The company recorded a net profit of 339.1 crore rupees (US$39.69 million), up 16.7% from 290.5 crore rupees (US$34.02 million) in the previous fiscal year.

🌍 Visa taps Ant, Grab, and Tencent for AI-powered payment. This marks its key initiative, Visa Intelligent Commerce, which offers integrated APIs and a partner program for AI-driven commerce. Read more

🇺🇸 Plaid expands business banking data coverage in the US market. The company has launched Transactions for Business, a data processing solution designed to help FinTech companies build financial management tools for small businesses.

🇺🇸 The Chime IPO: What Investors Should Know About Its $31 a Share Private Market Valuation and More. In this article, Luisa Beltran breaks down what investors should know about Chime’s upcoming IPO. Access the full article here

🇺🇸 Wealthsimple acquires Plenty Team to improve family finance. By integrating a team with deep insight into modern household finances, the Wealthsimple Plenty acquisition exemplifies a way a startup can continue its work after it closes its doors. Keep reading

🇬🇧 Payment firm Stripe is in early talks with banks about stablecoins. The talks come as Stripe has debuted a number of products related to stablecoins in recent months, including a platform allowing FinTechs to quickly start their stablecoin-linked card programs for customers.

🇺🇸 Building on Bedrock: a practical guide to core & ledger choices in embedded banking. In this practical, plainspoken field manual, Ingo‘s CPO Lisa McFarland walks you through the real-world decisions product leaders and bank execs make when faced with modern embedded banking demands. Download here

🇮🇳 PayU boosts board in run-up to IPO. With the board expansion, the FinTech giant aims to establish new governance and compliance standards while accelerating its investments in next-generation technology. The board expansion comes days after PayU India received final authorisation from the RBI to operate as a payment aggregator.

🇮🇹 Bank of Italy Chief Fabio Panetta urges EU to launch digital Euro. Panetta argued that only a central bank–issued digital currency could offer the trust, resilience, and transparency needed to support digital payments in an era of globalized cryptocurrency finance.

PAYMENTS NEWS

🇪🇸 José Luis Calderón, CEO of PagoNxt Payments, offers crucial insights in Payment Expert. José Luis explores why there's still resistance to real-time payment adoption among leading financial institutions, and why failing to implement their convenience risks them falling behind next-generation FinTechs and neobanks.

🇮🇳 Payment aggregator licences are India’s next fight club. A payment aggregator licence is beginning to look like a scarce operating permit, one that could decide who gets to dictate price, data access, and bargaining power in India’s booming merchant-acquiring market.

🇺🇸 Mastercard launches financial and cybersecurity tools for small businesses. The company’s Small Business Navigator program offers small businesses real, actionable support. The program includes an AI-powered chatbot that acts as a mentor for business owners and educational content covering cybersecurity, marketing, and digital tools.

🇺🇸 Stablecoin payment volume reaches $94B, driven by B2B transfers. The report shed light on a few specific rising areas for stablecoin payments. Business-to-business transactions made up the largest block, accounting for an annual run rate of $36 billion.

🇬🇧 PPRO launches subscriptions for local payments. The new solution is expected to enable clients to optimise their payment strategy and checkout experience through the use of dedicated and secure access to functionality. This will drive revenue by expanding access to local clients.

🇮🇱 Neema launches Dynamic Routing as an alternative to the SWIFT network. It is a solution designed to improve transactions by optimising success rates and cost efficiency. The introduction of Dynamic Routing further extends Neema’s vision of building a globally connected financial ecosystem.

REGTECH NEWS

🇹🇭 Thailand moves to block Bybit, OKX, and others for unlicensed operations. "This is to protect investors and stop the use of unauthorized digital asset trading platforms as a money laundering channel," the Thai regulator said in a translated statement.

🇺🇸 Banks replace passwords with QR codes for security. Financial institutions are offering new options to traditional passwords to enhance security and sign-in experiences, and clients are opting in. The global cost of fraud and cybercrime is projected to reach $10.5 trillion in 2025.

DIGITAL BANKING NEWS

🇦🇷 Mercado Libre launches new episode of CFO perspectives, featuring Martin de los Santos reflecting on Q1’2025 highlights. The company reported impressive growth metrics, with buyer count increasing 25% YoY to 67 million in Q1. The FinTech segment showed strong performance with Monthly Active Users growing 31% YoY to 64 million, marking the sixth consecutive quarter of over 30% growth.

🇨🇦 KOHO Diversifies Product lineup with launch of international money transfers. This launch followed KOHO’s 2024 $190 million funding round toward helping the company move closer to obtaining a Schedule 1 bank license. Keep reading

🇺🇸 Revolut to relaunch cryptocurrency services in the U.S. The relaunch underscores Revolut’s strategic emphasis on expanding its presence in the burgeoning decentralized finance (DeFi) sector, aligning with a broader industry trend toward integrated financial ecosystems.

BLOCKCHAIN/CRYPTO NEWS

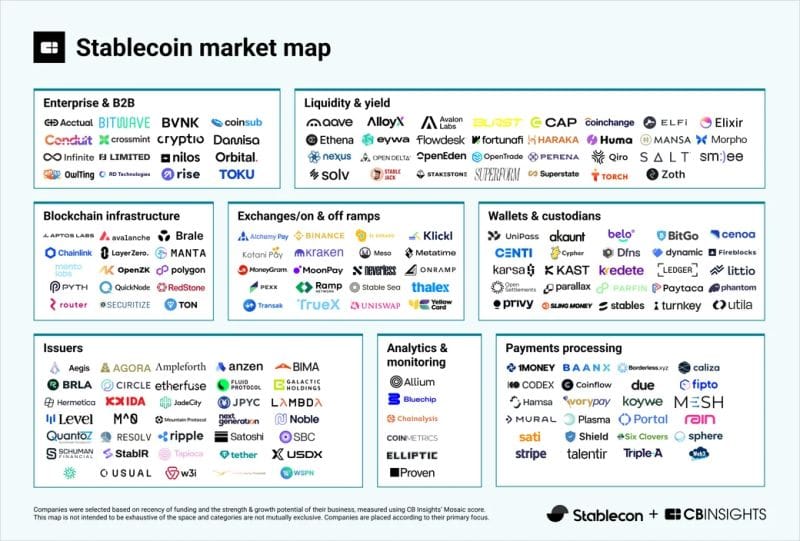

🌍 The stablecoin market map 👇

🇱🇹 The Bank of Lithuania has issued a license for crypto asset services to Robinhood Europe, a subsidiary of US-based FinTech company Robinhood. The license allows Robinhood Europe to provide crypto asset custody, administration, and transaction services in Lithuania and across the European Union.

🇩🇪 Midas launches tokenized T-Bill on Algorand, offering European investors exposure to yield-bearing government bonds with no investment minimum required. The mTBILL is a tokenized certificate that references short-term US Treasury exchange-traded funds (ETFs).

🇺🇸 SEC is dropping the enforcement case against Binance Crypto Exchange. The regulator and the exchange’s co-founder, Changpeng Zhao, filed a joint motion to stay the case in the US District Court for the District of Columbia. The move follows a joint request in February to pause the lawsuit for 60 days.

🇺🇸 Ripple’s Hidden Road Launches Crypto OTC Brokerage in the U.S. The new offering will allow U.S.-based institutional clients to execute cash-settled OTC swaps across several tokens. The product will be operated through Hidden Road’s UK-based, FCA-regulated entity, Hidden Road Partners CIV UK Ltd.

🇺🇸 SEC crypto staking guidance ‘major step forward’ for US. The US Securities and Exchange Commission’s (SEC) new guidance on cryptocurrency staking is widely seen as a major win for the crypto industry and the push toward globally consistent digital asset regulation.

PARTNERSHIPS

🇺🇸 Worldpay partners with Exodus to optimise native card payments for self-custodial crypto wallets. Following this announcement, Exodus will launch XOPay, a solution that gives customers the possibility to purchase cryptocurrencies directly within a self-custodial wallet, leveraging a credit or debit card.

🇲🇱 TerraPay partners with Wave Mobile Money to enhance remittance flows. Through the new partnership, they enable consumers in Mali to receive money from family and friends abroad directly into their Wave mobile wallets, creating a faster, more accessible, and cost-effective way to access international remittances.

🇮🇳 Jar enters UPI payments through BharatPe and Unity Bank. Jar’s integration with BharatPe’s TSP platform enables smooth UPI payment processing, while Unity Small Finance Bank facilitates the banking operations required for these transactions.

🇺🇸 Coinbase selects Irdeto to disrupt piracy and cybercrime. This partnership marks a significant milestone in the evolution of Irdeto’s Cyber Services capabilities, by enabling early identification and intervention against cybercriminals who use cryptocurrency as a tool for piracy and other illegal activities.

DONEDEAL FUNDING NEWS

🇺🇸 Rillet raises $25M Series A led by Sequoia Capital to reinvent the general ledger with AI. The funding comes just ten months after the company emerged from stealth with the ambition to rebuild the general ledger from the ground up using artificial intelligence.

🇺🇸 Uplinq secures $10 million Series A to revolutionize AI-powered bookkeeping and tax solutions for SMBs. This infusion of capital will accelerate Uplinq's growth, enhance its AI capabilities, scale customer acquisition efforts, and strengthen infrastructure to deliver seamless, automated financial management.

🇬🇧 Salad Money secures £2M investment to expand affordable lending. The infusion of capital aims to address the growing demand for affordable, mid-cost loans, offering a lifeline to workers who are often excluded from mainstream credit options.

🇬🇧 London-based Quanted raises new funding to improve data validation in finance. The capital will be used to expand Quanted’s engineering team and to support the ongoing rollout of its product. Continue reading

🇧🇪 Brussels-based FinTech startup Husk raises €1 million to help startups optimise costs and manage their cash flow. This included support from the international accelerator programme Techstars, investment funds Birdhouse Ventures, NewSchool.vc, and experienced business angels.

MOVERS AND SHAKERS

🇨🇳 PAObank appoints Mr. Ronald Iu as Chief Executive and Executive Director. Mr. Iu will lead the management team of PAObank to further leverage advanced financial technology, expanding its presence in small and medium-sized enterprises ("SMEs") and retail banking, thereby creating greater value for their customers.

🇬🇧 Barclays' FinTech strategy head Andrew Elphick departs. Andrew Elphick has announced his departure, stepping down this month as head of FinTech strategy and open innovation, ending a 14-year stint with the British bank. In a LinkedIn post, Elphick wrote, "It's time for a new chapter".

🇬🇧 Wirex Limited appoints Chet Shah as CEO to lead the next phase of strategic growth. The UK payments sector is dynamic, competitive, and fast evolving. Under Chet’s leadership, Wirex Limited is set to become a formidable force, one that is safe, sustainable, and strategically prepared.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()