Stripe Acquires Privy to Power Seamless Crypto Wallet Integration

Hey FinTech Fanatic!

Stripe is doubling down on crypto. The payments giant has agreed to acquire Privy, a wallet infrastructure startup that helps platforms like OpenSea, Blackbird, and Toku embed crypto wallets directly into user experiences, thereby eliminating friction and boosting conversions.

“Developers had to send users off-platform to get started... that friction fundamentally constrained what could be built,” said Henri Stern, Privy’s CEO and co-founder.

Privy simplifies wallet creation behind the scenes, allowing users to purchase NFTs or engage with crypto services without the need to jump through hoops, such as installing MetaMask or linking third-party wallets.

The deal, following Stripe’s recent $1.1B acquisition of stablecoin infra firm Bridge, positions Stripe to offer a unified platform that connects:

- Privy’s wallet layer

- Bridge’s stablecoin rails

- Stripe’s global money movement tools

“We’re enormously excited to enable a new generation of global, Internet-native financial services,” said Patrick Collison, Stripe’s CEO.

Founded in 2021 and last valued at $230 million, Privy will continue to operate independently. The move underscores Stripe’s intention to become the go-to partner for businesses building next-generation crypto and stablecoin products, as major banks and tech firms deepen their involvement in Web3.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

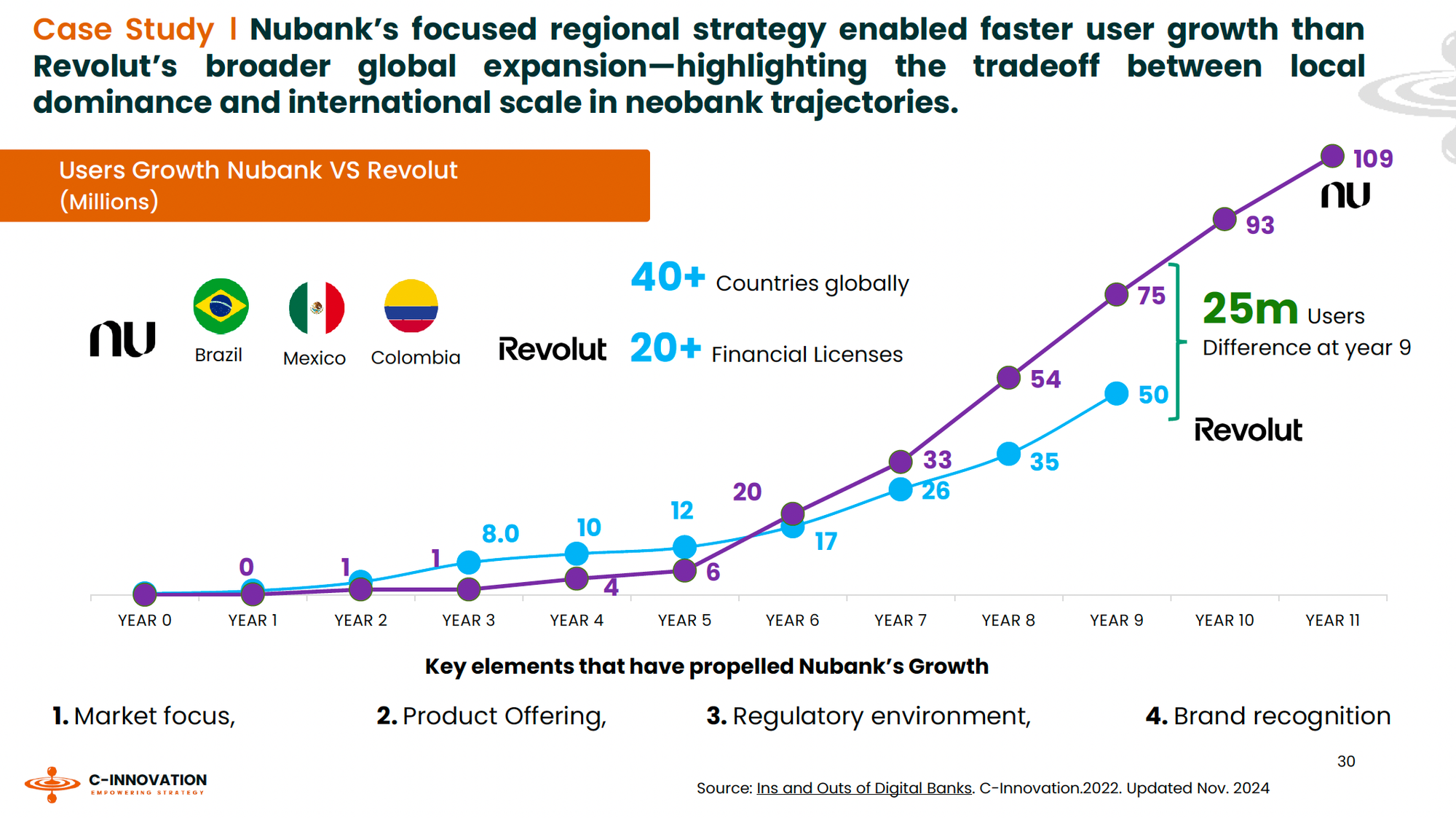

📈 Nubank 🆚 Revolut

Two very different growth strategies👇

INSIGHTS

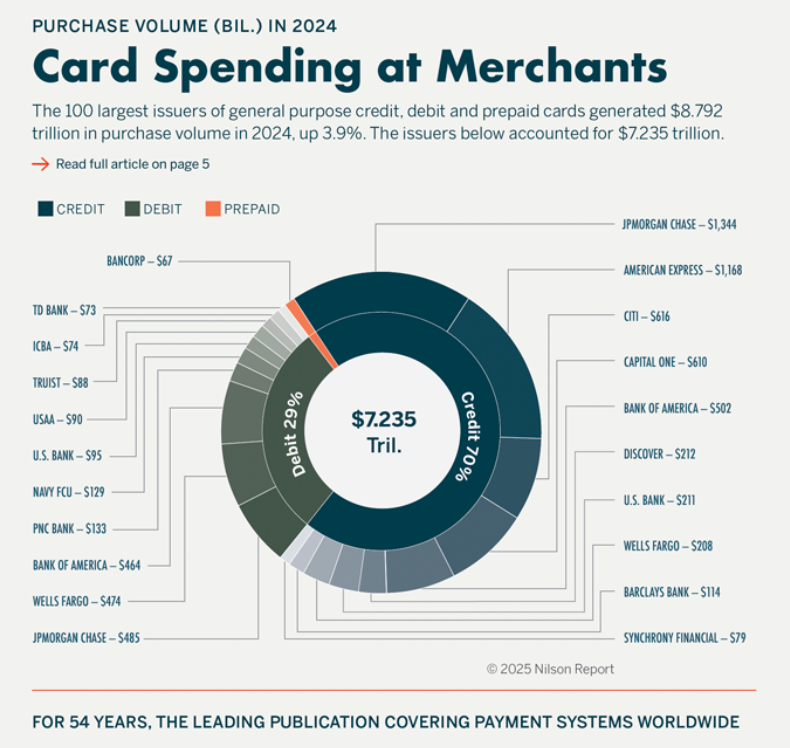

💰 The 100 largest issuers of general-purpose credit, debit, and prepaid cards generated $8.792 trillion in purchase volume in 2024 🤯

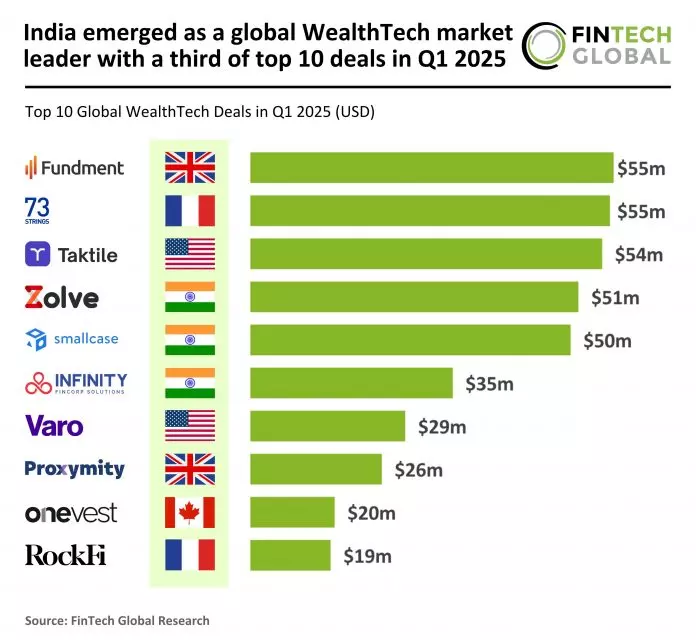

💰 India emerged as a global WealthTech market leader with a third of the top 10 deals in Q1 2025.

FINTECH NEWS

🇺🇸 Peter Thiel-backed crypto group Bullish files for Wall Street IPO. Group seeking to tap a wave of enthusiasm for digital assets as Trump vows to cut regulations. The company confidentially filed paperwork with the Securities and Exchange Commission for an initial public offering in recent weeks.

🇬🇧 Failed FinTech Zing lost $87m before HSBC axed it. The 2024 pre-tax loss for Zing’s holding company, incorporated as MP Payments, reflected a $88.4m impairment charge on its investments in subsidiaries. Zing reported an accumulated impairment loss of $131.7m since its establishment in July 2022.

🇦🇺 Afterpay users are being asked to ditch BNPL services for mortgages and then offered credit cards. According to Afterpay, over 10% of 1,000 surveyed customers reported that a bank or mortgage broker requested they close their BNPL accounts during the home loan application process.

🇮🇳 Pine Labs to file DRHP for Rs 5,000-6,000 crore IPO by June-end. The IPO could value the company at $4-5 billion. The company has appointed Axis Capital, JP Morgan, Morgan Stanley, Citi, and Jefferies as bankers to the issue. Read more

🇪🇸 Banco Santander launches Instant Euro Transfers via Bizum in Spain. According to the bank, customers will be able to receive money "by simply selecting a contact from their address book and with the same level of security and trust that Bizum currently offers between Spanish bank accounts."

PAYMENTS NEWS

🇺🇸 Fiserv CEO Mike Lyons embraces stablecoins. The payment processing giant is developing an infrastructure for its merchant customers to pay for goods and services with cryptocurrencies, the company’s CEO said in a presentation. Keep reading

🇮🇹 Klarna grows by 65% in Italy. Italian consumers are enthusiastically adopting flexible and interest-free payment formulas, both online and in physical stores. 5 million Italians are active on Klarna, equal to one in ten adults. It has also significantly strengthened its partner network in Italy, particularly in the technology sector.

🇧🇷 After Pix by approximation, Google Wallet expands features for payments with Pix. Google announced two more ways for this type of transaction: Pix in the Chrome browser and Pix in Lens (the company's object reader). The proposal is to improve the shopping journey of Google Pay users.

🇺🇸 Affirm boasts 2 million debit cards. The number of such cards the buy now, pay later provider has now made available is an increase of about 600,000 cards since January. Card users can use the Affirm card like a debit card, or they can use it to access the company’s buy now, pay later services.

🇬🇧 Yuno selects London as European headquarters to power global expansion. The announcement marks a significant milestone in Yuno’s international expansion and reinforces the company’s commitment to serving its growing base of global merchants and partners from the heart of Europe’s FinTech capital.

DIGITAL BANKING NEWS

🇨🇦 Wealthsimple takes on Big Six with launch of credit cards and loans. The company will replicate traditional retail banking services such as credit cards, loans, and even old-fashioned cheques, putting it in direct competition with other financial institutions beyond its core investing products.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Coinbase to ‘hire like crazy’ in the UK, as the country moves towards a new era of crypto regulation and increasing mainstream adoption. That expansion comes at a pivotal time, as the UK finalises a comprehensive regulatory framework for crypto, which includes consultations on stablecoins and market structure.

🇺🇸 Tokenized Treasuries Go Live on the XRPL Ondo Finance’s OUSG unlocks institutional access with seamless mint and redemptions via Ripple’s RLUSD stablecoin. This milestone expands institutional access to institutional-grade real-world assets on-chain, accessible via seamless minting and redemptions.

🇺🇸 PayPal USD (PYUSD) plans to use Stellar for new use cases. By potentially expanding to Stellar, PYUSD leverages the network's speed, low transaction costs, and ease of integration to enhance its utility for real-world payments, commerce, and micro-financing, offering an additional option to Ethereum and Solana.

PARTNERSHIPS

🇬🇧 Webull UK partners with Upvest to offer UK stocks and ETFs. Through this strategic partnership, users will be able to access fractional trading in UK stocks and ETFs for the first time via Upvest’s cutting-edge Investment API. This expansion empowers UK-based retail investors to begin their investment journey with Webull.

🇮🇳 Uruguay-based dLocal partners with India's Juspay to strengthen cross-border payment capabilities. The partnership will strengthen the synergy between the two companies, offering customers access to dLocal's over 900 local and alternative payment methods (APMs) and the broad benefits of Juspay's payment ecosystem in fast-growing markets.

🇸🇪 Mambu and Avenga power Marginalen Bank’s core banking transformation with successful cloud migration. Bo Andersson, CIO at Marginalen Bank, stated that the collaboration with Mambu and long-term technology partner Avenga has been seamless, enabling the bank to migrate to the cloud and modernize its consumer and business deposit offerings.

🇺🇸 Investment giant Guggenheim taps Ripple to expand digital debt offering. Under the partnership, Guggenheim’s subsidiary, Guggenheim Treasury Services, will make its US Treasury-backed fixed-income assets available on the XRP Ledger. Ripple will invest $10 million in the asset as part of the collaboration.

🇺🇸 Affirm partners with Optty. The collaboration is expected to enable businesses across the globe to offer Affirm’s flexible, transparent, and secure pay-over-time options through the use of a single API integration. Continue reading

🇦🇺 Australian Payments Plus and G+D integrate least-cost routing. Together, they plan to develop eftops Click to Pay with integrated least-cost routing. Click to Pay is an online checkout experience that enables consumers to make fast, convenient, and secure purchases without manually entering card details.

🇸🇬 Whalet joins forces with TerraPay to empower SMEs with seamless global payouts. This collaboration is designed to empower Whalet's core customers-cross-border sellers from the Asia-Pacific region-by simplifying international financial transactions and boosting payment efficiency.

🇬🇧 Froda and Mimo launch integrated SME lending in the UK. This collaboration is designed to address one of the most persistent challenges faced by UK SMEs, namely, access to timely and practical financing. Keep reading

🇺🇸 Treasury Prime partners with People Trust to advance financial inclusion via embedded banking. This partnership includes the possibility for future use of Treasury Prime’s front-end solution to replace the institution’s legacy online banking interface, enhancing member experience and increasing operational efficiency.

🇦🇺 Nexxtap teams up with Samsung to launch Tap to Phone payments. Through this move, Nexxtap and Samsung seek to improve the payment experience with simplified, embedded tap-to-pay functionality, with the two companies planning to eliminate the need for legacy terminals.

🇬🇧 Paragon Bank taps Moneyhub capabilities to address major UK savings challenges. By using Moneyhub’s open banking technology, Paragon can connect Spring with a customer’s existing current account. This integration enables customers to view their current account balance in the Spring app and easily move money between accounts, providing users with full control over their savings.

🇺🇸 Worldpay and Visa team to help merchants combat fraud, to enhance that company’s 3D Secure solution. This tool helps merchants reduce fraud while easing consumer friction and boosting authorizations. Read more

🇺🇸 Papaya Global and Deltek-Replicon partner to deliver a comprehensive global workforce payments and compliance solution. The partnership provides multinational enterprise clients across industries with compliant time and attendance in 85 countries, seamlessly connecting data and enhancing transparency and visibility of the full workforce management process.

DONEDEAL FUNDING NEWS

🇦🇺 Blockchain FinTech CloudTech raises $14 million Series A, mostly in crypto. The raise for CloudTech will fund the rollout of an institutional-grade custody solution for digital assets, as well as the expansion of a broader crypto-native financial ecosystem. The funding came from several undisclosed investors.

🇬🇧 OpenTrade closes $7M as stablecoin yield goes mainstream. The capital will be used to accelerate OpenTrade's go-to-market strategy through expanded product development, engineering capabilities, and operational capacity. Keep reading

🇮🇳 PowerUp Money raises $7.1M in seed funding co-led by Accel, Blume Ventures, and Kae Capital. The company will use the funding to accelerate product development, upgrade its proprietary investment intelligence engine, and scale its advisory offerings.

🇬🇧 FlexiLoans raises Rs 375 Cr in Series C funding round. The new funding will be utilised to expand operations, fuel product development, and technology infrastructure. The fresh capital raise includes primary equity to support operational growth and secondary transactions to provide liquidity for existing investors.

🇨🇦 Calgary FinTech Finofo raises $3.3m to power global payments. The startup enables mid-market companies to streamline international payments and reduce foreign exchange losses. The funding was led by Watertower Ventures, with support from Motivate Venture Capital, SaaS Ventures, and Alberta-based early-stage investors.

🇬🇧 Payroll data FinTech Teal closes £1.4m pre-seed round. The new funding will support Teal’s goal of expanding its data infrastructure beyond payroll to incorporate additional income and financial sources for a more complete view of borrowers. Read more

M&A

🇬🇧 Argentex shareholders approve acquisition by IFX Payments. The acquisition remains subject to receiving the regulatory approval from the FCA, DFSA, and Dutch Central Bank, the Court sanctioning the Scheme at the Court Sanction Hearing, and the delivery of a copy of the Scheme Court Order to the Registrar of Companies and the Scheme thereby becoming effective.

🇺🇸 Payment Company Stripe to acquire crypto wallet provider Privy. The Privy news follows Stripe’s $1.1 billion acquisition of Bridge, a deal which accelerated an already growing wave of enthusiasm surrounding stablecoin. Continue reading

🇨🇦 European FinTech Paynt acquires Canada-based E-xact transactions to accelerate North American Expansion. The acquisition of E-xact, which processes over CAD 3.5 billion annually across more than 50 million transactions, will add a new operational hub in Vancouver, Canada.

MOVERS AND SHAKERS

🇺🇸 Corpay appoints Peter Walker as new CFO. Ron Clarke, Chairman and CEO of Corpay, expressed enthusiasm about Peter joining the company, stating that his blend of experience in both public and entrepreneurial CFO roles positions him to make an immediate impact.

🇬🇧 NatWest appoints Dr Maja Pantic as the Bank’s First Chief AI Research Officer. Maja brings deep AI research expertise and is currently serving as Professor of Affective & Behavioural Computing at Imperial College London, having previously been Founding Research Director of Samsung AI Research Centre in Cambridge.

🇺🇸 Polygon Co-Founder Sandeep Nailwal takes over as CEO. This move comes as Polygon looks to sharpen its focus and strategy in response to growing competition in the layer-2 blockchain space. Nailwal’s new role signals a more centralized approach to driving future growth.

🇺🇸 Varo Bank welcomes Rathi Murthy as Chief Technology Officer, strengthening its commitment to customer financial empowerment. Rathi’s appointment highlights Varo’s commitment to empowering more customers through the development and adoption of technologies such as AI to improve access to financial services, transform how the bank assesses credit risk, and combat fraud.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()