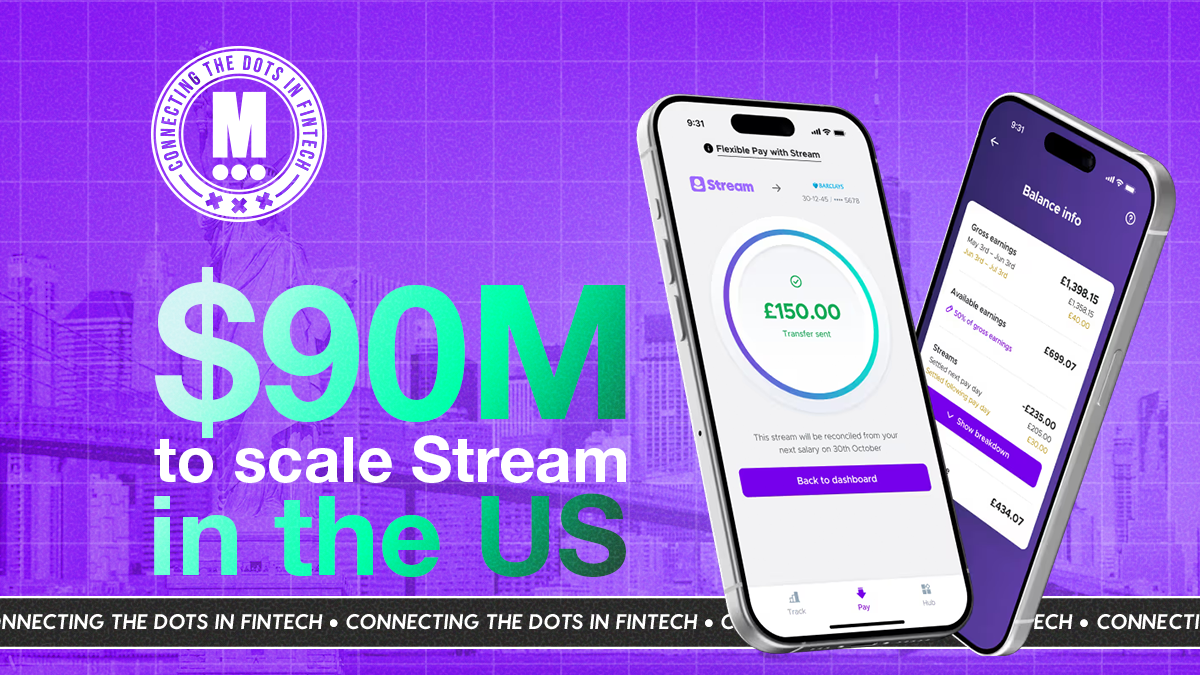

Stream Raises $90M as Workplace Finance Scales across the UK and US

Hey FinTech Fanatic!

Stream just raised a $90M Series D to scale its workplace finance platform and expand further into the US.

The round was led by Sofina. Total funding now sits at $228M. Stream plugs directly into the employer's payroll.

The big push? Pensions. After acquiring Zippen, Stream is helping workers track and combine lost pension pots. Over £31B sits unclaimed in the UK. Nearly £8M has already been recovered.

Another quick update 👇

Pennylane just raised €175M to double down on AI and push toward profitability.

This round gives the French unicorn long-term firepower as it prepares for consolidation across Europe’s accounting and financial management market.

A big moment for Revolut 👀

The Audi F1 Team just revealed its 2026 car.

Revolut is front and center as title sponsor. Reportedly, an upper eight-figure, multi-year deal. Revolut’s biggest sponsorship ever. This is brand, distribution, and ambition at global scale.

If you’re watching how the FinTech industry is evolving, scroll down to see what else is moving 👇 I’ll be back tomorrow in your inbox with more.

Cheers,

SPONSORED CONTENT

FinTech is back in execution mode, and the pipeline is once again the real priority.

That’s why FinTech Meetup 2026 is on my radar. It’s a focused environment where three days of conversations can realistically shape a full year of opportunities across banking, payments, and FinTech.

If growth and execution matter to you this year, this is worth considering. → Don’t miss out on the most valuable event in FinTech. Get your ticket today!

FINTECH NEWS

🌍 Your Chance to Host in Mexico! The FinTech Running Club is growing fast, and this could be your moment to lead! If you’re passionate about FinTech, community, and networking, why not start your own chapter in your city in Mexico! Are you curious? 👉 Sign up to become a host!

🇬🇧 Wise serves 11 million customers as volumes hit £47 billion. Wise moved £47.4 billion in cross-border transactions during its third fiscal quarter, a 26% jump from the same period last year as the London-based payments company continued adding customers and expanding its infrastructure footprint.

🇮🇳 PhonePe has secured Sebi approval for its IPO. The $14.5-billion startup plans a $1.5-billion OFS, with Walmart, Tiger Global, and Microsoft set to sell shares. Strong payments dominance and rising revenues underpin investor confidence.

🇧🇷 PicPay aims to be valued between US$2.2 billion and US$2.6 billion in its IPO. The goal is to attract investors who buy FinTech companies globally, not just in emerging markets, with a pitch focused on growth and profitability. PicPay's revenue grew 90% from January to September 2025, reaching R$7.3 billion.

🇺🇸 Affirm brings installment payments to housing costs. Affirm is piloting a new buy now, pay later option that allows renters to split monthly rent into two payments, expanding BNPL beyond everyday purchases to housing costs. The limited program is being launched in partnership with Esusu.

🇱🇺 Indian FinTech giant Paytm sets up Luxembourg entity, One97 Communications. The move aligns with Paytm’s plans to expand into selected international markets. Continue reading

PAYMENTS NEWS

🇳🇱 Wero launches in Dutch online stores in October 2026. Daniel van Delft said the shift from iDEAL to Wero will reshape Dutch payments, beginning with a dual “iDEAL Wero” brand. Wero introduces new features such as recurring payment authorisation and will expand to online and physical stores as part of the European Payments Initiative.

🇪🇺 Revolut Pay is now compatible with Google’s Agent Payments Protocol. By adapting the protocol for account-to-account flows, Revolut aims to position Revolut Pay as a default rail for agentic shopping, combining instant payments, built-in fraud monitoring, and higher conversion potential as commerce shifts toward AI-led experiences.

🇵🇹 SIBS launches Multibanco Connect and promises to revolutionise the payments market. This new solution eliminates the need for manual entry of purchase amounts at the payment terminal, offering a more efficient and fluid checkout experience.

🇧🇷 Brazil Central Bank ex-official launches stablecoin. Tony Volpon, former deputy governor at the Central Bank of Brazil, unveiled the BRD stablecoin via his firm Inovação, offering institutional investors exposure to Brazil’s high-yield government debt through a digital token.

🇺🇸 Block, Inc. surpasses $200 billion in credit provided to customers, using real-time behavioral data rather than traditional credit scores. The approach has delivered high repayment rates and low losses, highlighting how Block’s integrated ecosystem supports more inclusive and sustainable lending.

🇺🇸 Affirm enhances credit underwriting with real-time financial insights. The financial technology firm is now integrating advanced real-time data points to provide a more accurate snapshot of users’ financial health during transactions. This development aims to make credit approvals more responsive to the fast-paced changes in people’s economic circumstances.

DIGITAL BANKING NEWS

🇧🇷 Revolut is aiming for a banking license in Brazil. Valued at approximately US$75 billion, the British FinTech aims to obtain a more comprehensive banking license in the country, to expand its product portfolio, and compete for customers not only with Nubank, but also with large traditional banks.

🇰🇿 New law on banks and digital financial assets approved in Kazakhstan. The key focus of the legislation is on the development of the FinTech sector, the regulation of digital assets, the modernization of financial infrastructure, and maintaining the stability of the banking system.

🇺🇸 Federal Reserve opens door to Main Street’s post-check payments future. The U.S. Federal Reserve is nudging modernisation, with an information request that underscores the risks of maintaining the status quo, giving businesses a concrete reason to plan a phased transition to electronic payments.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 House of Doge unveils ‘Such’ app to power dogecoin payments. The Such app aims to simplify Dogecoin transactions and support new forms of digital payments across global markets. It combines wallet creation, real-time tracking, and merchant tools into one mobile platform.

PARTNERSHIPS

🇬🇧 Ecommpay has joined forces with NORBr to provide NORBr partners with instant access to Ecommpay’s full-stack acquiring and orchestration ecosystem. Through the partnership, businesses gain instant access to enterprise-grade tools to help them expand faster and operate more efficiently.

🇦🇪 Mastercard and Moneythor provide payment enrichment for First Abu Dhabi Bank. Through this collaboration, FAB’s customers now see real merchant names and logos, organised spending categories, intuitive summaries of transactions, and forward-looking cashflow forecasts. Additionally, BoxCommerce and Mastercard launch a Prepaid Card Program to give SMEs direct, instant access to their earnings. Through this collaboration, the ecosystem approach not only strengthens SME access to financial tools but also paves the way for future innovations.

🇵🇪 dLocal partners with HONOR to launch localised payments in Peru's growing tech landscape. Through this partnership, dLocal enables HONOR to accept payments from Peruvian consumers via a broad range of local payment methods through a single API integration.

🇦🇱 Jet Bank partners with Backbase to power the launch of Albania’s first neobank. "The collaboration enabled Jet Bank to move from setup to user acceptance testing in approximately three months, with full operational capability as a licensed digital bank within as little as six months," the company said.

🇺🇸 PayPal introduces Free DIY tax filing for PayPal debit card customers. PayPal today announced a new partnership with april, allowing U.S. PayPal Debit Mastercard® customers to file their 2025 federal and state tax returns for free using april's DIY tax filing service, saving approximately $1603 in typical costs.

🇺🇸 TreviPay teams with Visa to offer banks a pay-by-invoice tool. The partnership combines TreviPay’s order-to-cash automation technology with Visa’s commercial payment capabilities to help issuers transform fragmented B2B spend into strategic, issuer-financed, invoice-based transactions.

🇺🇸 Wonder partners with FormPiper and LendingClub. The partnership combines Wonder's in-store sales technology with FormPiper's waterfall FinTech platform and LendingClub's innovative lending solutions. Together, the companies are making sophisticated financing tools accessible to independent retailers at no additional cost.

DONEDEAL FUNDING NEWS

🇦🇷 Argentina’s Pomelo raises $55 million to boost payment offerings. The round will be used to grow Pomelo’s credit-processing business with a focus on Mexico and Brazil, and to support the launch of a global stablecoin-denominated credit card, co-founder and Chief Executive Officer Gaston Irigoyen said in an interview.

🇬🇧 UK FinTech Stream raises $90m to tackle £31B in lost pensions and scale in the US. Stream plans to use the new capital to grow its pensions and long-term savings offerings in the UK and accelerate its expansion in the US through new partnerships and integrations.

🇫🇷 Sequoia-backed French accounting unicorn Pennylane secures €175 million as it nears profitability. This fresh capital will be deployed towards intensifying its R&D investments across several areas. Continue reading

🇩🇪 AAZZUR closes £2m round to scale embedded finance for brands and platforms. The funding will help to accelerate the go-to-market activities of its orchestration platform, enabling brands and platforms to integrate financial products faster and more cost- effectively, without the operational burden of building in-house.

M&A

🇺🇸 Zepz acquires Pomelo to expand credit services for cross-border communities. By utilising the Pomelo product, Zepz is expanding its ability to support these broader financial needs. Pomelo’s capabilities in cards, lending, and credit building complement Zepz’s strengths in global payments, enabling customers to access a more complete set of financial tools over time.

🌍 Payoneer deepens global workforce management capabilities in Europe with acquisition of Boundless. With the addition of Boundless, Payoneer is growing its footprint in Europe and expanding its ability to serve global customers who are increasingly looking for compliant, scalable workforce solutions.

MOVERS AND SHAKERS

🇳🇱 Adyen nominates Herna Verhagen as Supervisory Board member and Chair. Herna Verhagen brings more than 20 years of experience in executive and non-executive leadership roles. Read more

🇬🇧 Conferma appoints Currencycloud's Mark Ledsham as CEO. Ledsham brings nearly two decades of experience in the financial and payments industry. He began his career as a manager at Deloitte Australia and later held senior positions at OFX, Euronet Worldwide, and Macquarie Group.

🇬🇧 payabl. appoints Breno Oliveira as Chief Product Officer. In his new role, Oliveira will lead payabl.’s product strategy and execution, overseeing the continued development of the company’s modular platform and its flagship unified interface, payabl.one.

🇬🇧 Former Barclays and Credit Suisse exec Brad Novak joins Rathbones as new CTO. Novak brings over 30 years of experience in the financial sector to the company, with the industry vet serving most recently as Chief Information Officer at DXC Technology.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()