Stitch Acquires Efficacy Payments to Tap $159B Card Market

Hey FinTech Fanatic!

Stitch just made its 2nd acquisition of the year, after ExiPay in January, by acquiring Efficacy Payments, a digital payments company with direct access to South Africa’s national clearing system.

With this move, Stitch becomes one of the few FinTechs in the region to operate as a gateway, switch, and acquirer, all under one roof.

By removing reliance on banks and third-party processors, the company now controls the full card payment stack from end to end.

Keep scrolling for more on Stitch, and your daily dose of FinTech 👇

Cheers,

ARTICLE OF THE DAY

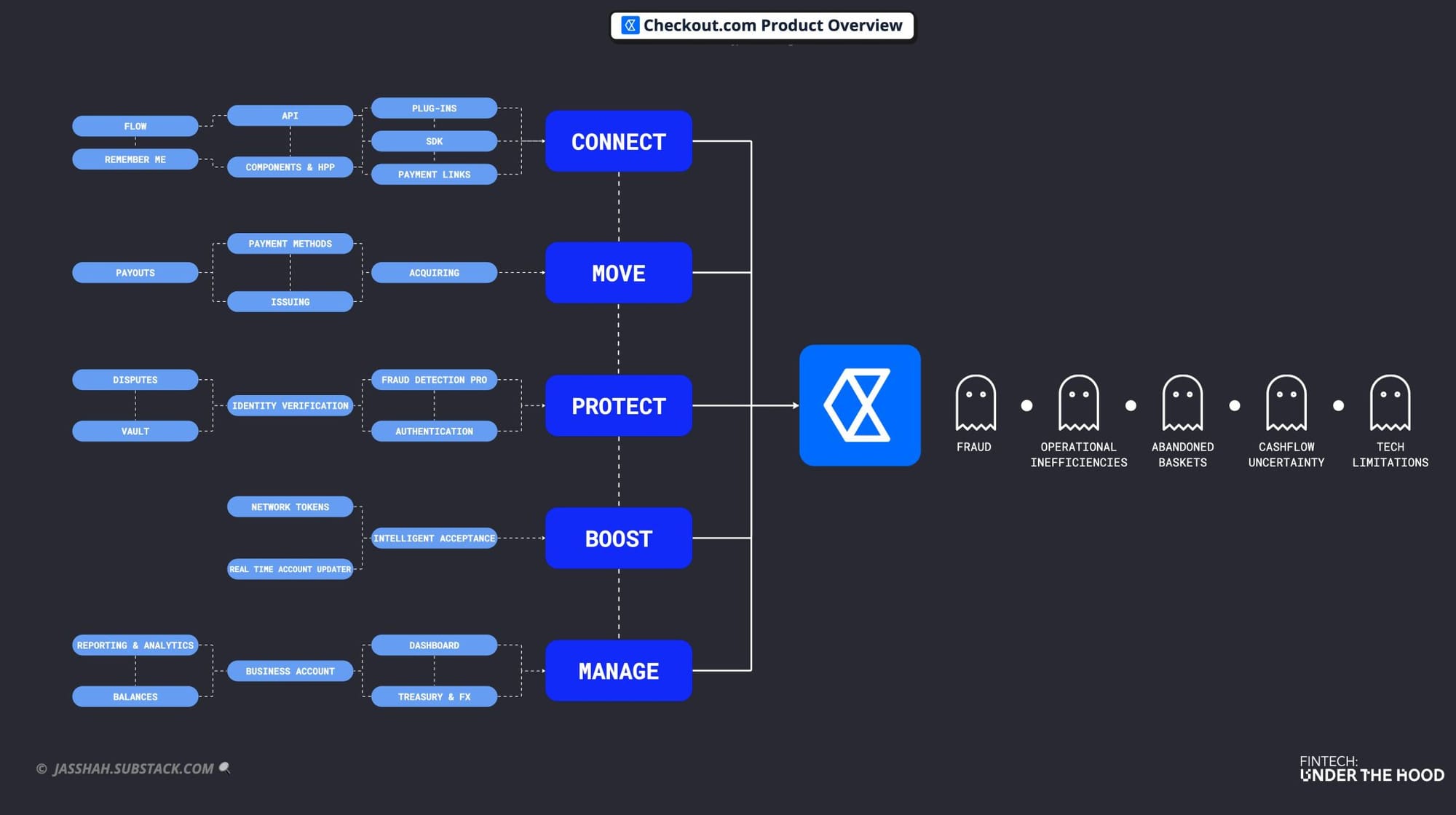

➡️ Checkout.com has evolved from a quiet infrastructure player into a global payment powerhouse.

FINTECH NEWS

🇸🇪 Zimpler introduces ID+: A next-gen identification layer for digital payments. Zimpler ID+ enables businesses to offer biometric identification and instant onboarding for their customers, streamlining user verification across devices, sessions, and payment flows.

🇦🇺 ANZ Worldline eyes more capital to address loan breach and funding. Company reports filed with ASIC this month indicate that the joint venture between ANZ and Worldline SA has experienced a significant deterioration in bottom-line performance and will require additional capital support to continue operating under its current business plan.

🇺🇸 Nayax to IPO on Wall Street. Nayax has raised approximately USD 145 million (NIS 462 million) gross for the company and its shareholders and sold shares worth around half of the amount, for NIS 205 million. Read more

🇺🇸 SoFi to give clients access to OpenAI and SpaceX through new funds. The funds will provide exposure to companies across various industries, and can be invested in through the SoFi app with a minimum contribution of $10. The company is expanding alternative investment opportunities for retail clients.

🇬🇧 Mastercard’s Vocalink hit by £11.9mn fine for risk management failings. The BoE said that the fine reflected Vocalink’s failure to comply with the central bank’s requirement for it to fix several weaknesses in its systems and controls identified by supervisors by February 2022.

PAYMENTS NEWS

🇪🇸 Getnet enhances public transportation in Madrid with contactless payment technology. This initiative is part of a broader effort, including the renewal of CRTM’s payment gateway contract, aimed at expanding the use of digital payment systems in public transportation.

🇲🇽 Mercado Pago launches a new solution and takes another step toward professionalizing Mexican SMEs. According to the firm, this new service allows for inventory integration, cash control, and access to performance metrics to reduce losses and improve sales and employee management.

🇺🇸 Venmo launches Big 12 college football debit cards. With the Venmo Debit Card, users can activate limited-time 15% cashback offers from some of their favorite brands in the app, allowing them to score more on everyday purchases in-store and online.

🇷🇴 Visa launches ePOSibil program to boost adoption of digital solutions and card payments by Romanian SMEs. The program is being implemented in partnership with local banks, together with IMM Romania, and aims to support retailers in adopting modern payment solutions to consolidate and develop their business.

🇵🇪 Paysafe launches PagoEfectivo wallet and expands payment options in Peru. Consumers in Peru already trust PagoEfectivo for everything. With the launch of our new digital wallet, we’re giving them a more convenient way to pay, one that reflects Paysafe’s commitment to powering the experiential economy, said Bruce Lowthers, CEO of Paysafe.

REGTECH NEWS

🇬🇧 Klarna supports new consumer protections in upcoming BNPL rules. Buy Now, Pay Later regulation in the UK is finally expected to be implemented by the second half of 2026. Klarna has supported regulation since 2020 and is well-prepared, already operating under FCA supervision and offering regulated credit.

DIGITAL BANKING NEWS

🇵🇭 Revolut officially launched a new Global Tech Hub in Manila, Philippines, aiming to enhance Revolut’s global capabilities and accelerate innovation. This new Global Capability Center will work across time zones and continents, supporting operations in the UK, Europe, Asia-Pacific, and the Americas.

🇩🇰 Lunar launches local virtual account numbers (vBBANs). It is designed to simplify operations, streamline payments, and unlock the full potential of this dynamic market. vBBANs do more than just handle local currency. They act as domestic bank account numbers, making it easier to collect and send funds.

🇬🇧 Kuda’s second attempt at multicurrency banking comes with lessons and $15M backing from investors. Kuda microfinance bank (“Kuda bank”) has relaunched multicurrency wallets and cross-border payment services for users in eligible jurisdictions.

BLOCKCHAIN/CRYPTO NEWS

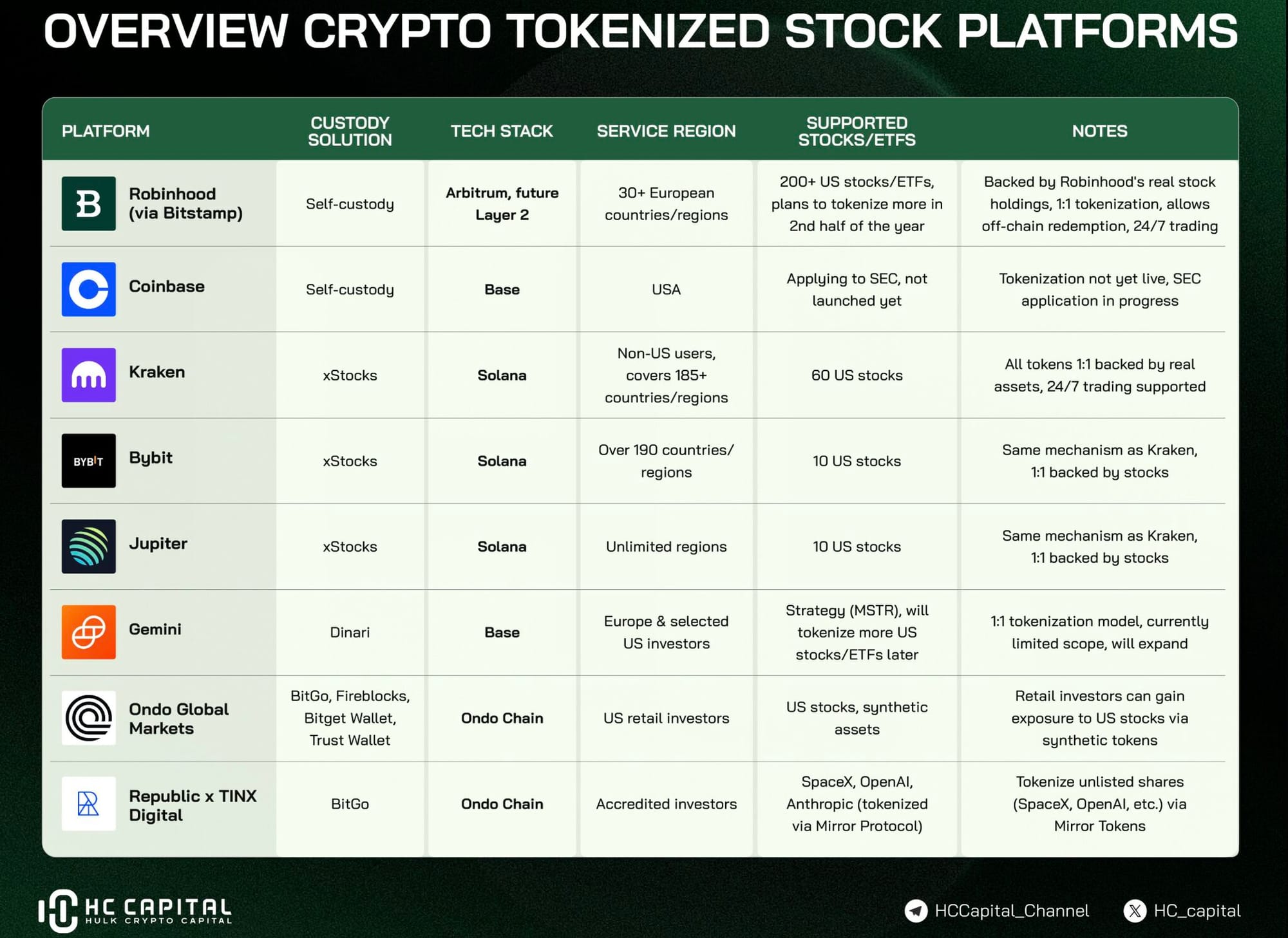

➡️ Here's a breakdown of platforms building tokenized stock offerings, showcasing the different approaches leading platforms are taking👇

🇺🇸 Tether is gearing up for a dramatic shift in strategy. Tether CEO says, “We will be the largest bitcoin miner by the end of 2025”. He believes the legislation will create a global compliance framework for stablecoins, both domestic and foreign. Read more

🇺🇸 G-Knot launches crypto wallet with vein biometrics and appoints FinTech veteran Wes Kaplan CEO to spearhead the global launch of what it describes as the world’s first finger vein crypto wallet. G-Knot leverages proprietary finger vein scanning to bind wallet access to an individual’s vascular pattern.

🇭🇺 After Revolut, Bitstamp also suspends crypto trading in Hungary. People living in the country cannot initiate new crypto transactions on the Bitstamp by Robinhood platform, but they can still use the withdrawal, deposit, staking, and lending services.

🇺🇸 BioSig and Streamex target gold tokenization with $1.1B financing. The companies say the funding will help establish a gold-backed treasury business focused on tokenized financial instruments. Of the total funding, $100 million comes in the form of convertible debentures, while the remaining $1 billion is an equity line of credit.

🇺🇸 Kraken and Backed expand tokenized stocks to BNB Chain as RWA momentum accelerates, allowing trading with stocks like Apple and Nvidia around the clock on the network. Keep reading

🇺🇸 BitGo expands services to enable seamless and secure bitcoin treasury adoption. It has expanded and tailored its integrated, full-service, and security-driven OTC desk, insured cold storage, treasury workflows, and audit-ready APIs to enable corporate entities to add Bitcoin to their balance sheet in a seamless, secure, and regulatory-compliant manner.

PARTNERSHIPS

🇺🇸 Nymbus signs agreement with Bud Financial to launch AI-powered personal financial management services. With this collaboration, Nymbus Bud Financial aims to help banks and other financial institutions use next-generation PFM services that give personalised advice and real-time information.

🌎 Strategic alliance between Prometeo and Jumio drives biometric verification and account validation in Latin America. By merging both processes into a single access point, it becomes possible to reduce operational times, prevent fraud, and deliver a faster and more secure user experience.

🇺🇸 DailyPay joins forces with Würk Payroll and HR Solutions to offer on-demand pay to thousands of working Americans. This strategic move makes the DailyPay Wurk Partnership stronger by simplifying on-demand pay in cannabis businesses and industries with a lot of turnover.

🇺🇸 Circle and OKX launch zero-fee USDC conversions to the US dollar. “The most significant update is that users can now directly convert USD to USDC and back within the OKX platform, offering a seamless and transparent on and off-ramping experience,” Circle’s Chief Business Officer, Kash Razzaghi.

🇦🇿 Mastercard and PashaPay partner to expand cross-border payments. The companies aim to work together on enhancing cybersecurity, digital identity, fraud prevention technologies, and cross-border payments. The partnership will also involve the issuance of Mastercard and m10-branded digital payment products.

🇬🇧 Dext and Airwallex collaborate to launch Dext Payments. By integrating Airwallex’s payment infrastructure into Dext’s platform, Dext Payments will provide a unified solution for managing supplier and expense payments, payroll, and simplifying the process of receiving payments directly from invoices.

🇺🇸 Crypto trading firm Galaxy expands institutional staking with Fireblocks. With the integration, Galaxy’s staking services are now natively accessible to the more than 2,000 of the world’s largest financial institutions that use Fireblocks to stake digital assets directly from their Fireblocks custody vaults.

🇺🇸 BNY Mellon will have custody of Ripple’s new stablecoin as institutional interest in crypto swells. The partnership should enhance regulatory compliance for Ripple, the issuer of Ripple USD (RLUSD), and boost institutional credibility for the company as well as the fast-growing stablecoin industry.

DONEDEAL FUNDING NEWS

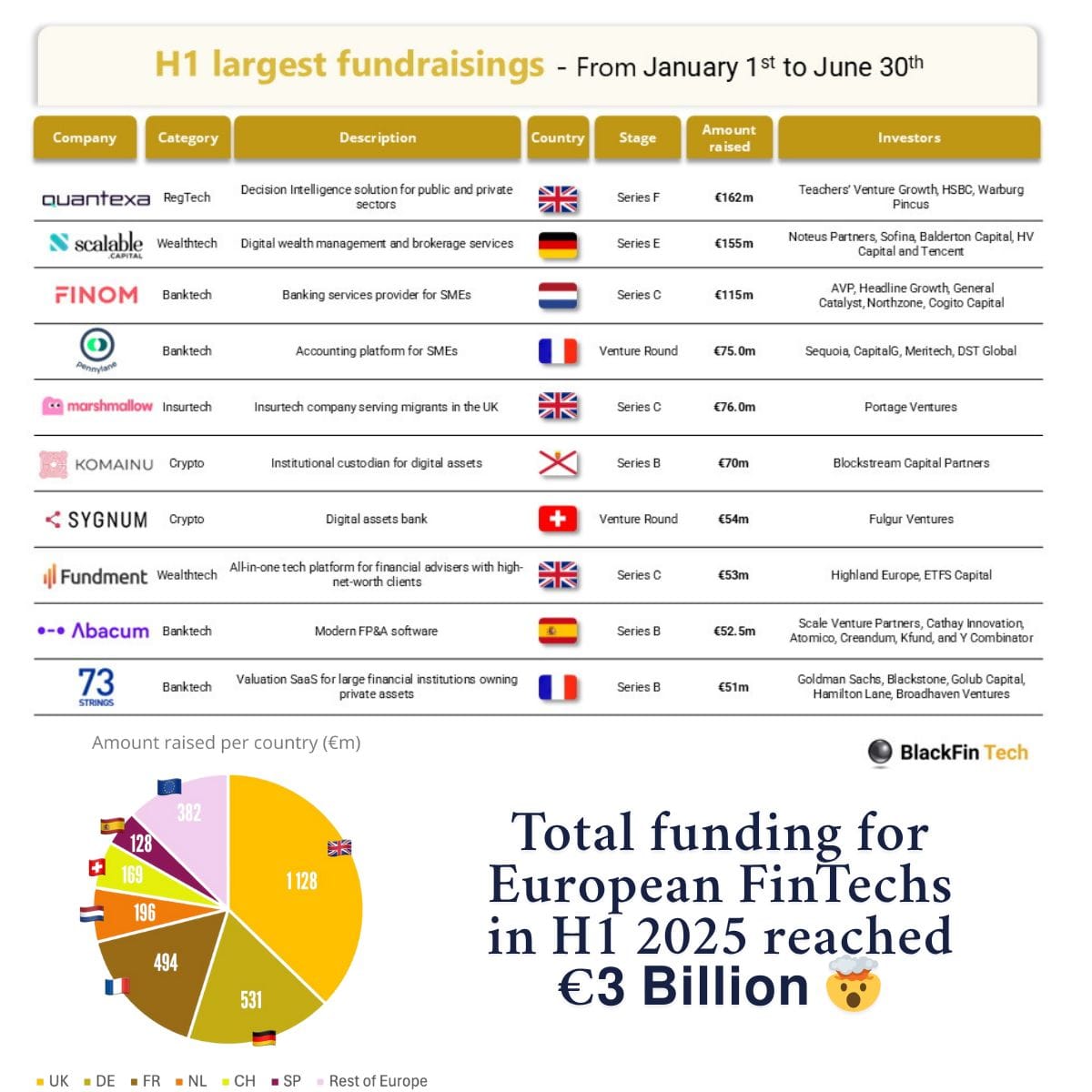

🌍 Total funding for European FinTechs in H1 2025 reached €3 Billion🤯

Let’s connect the dots... and break down the stats:

🇮🇳 NRI-focused FinTech startup Belong raises $5 million in round led by Elevation Capital. The fresh money will be used to acquire regulatory licences, build the product suite, and invest in marketing and geographic expansion. Read more

🇺🇸 Castellum.AI raises $8.5M. The firm claims to reduce AML/KYC false positives by 94% and the time spent on compliance reviews by 83% out of the box, before any tuning. Its AI agents have been trained by ex-regulators, ensuring that they passed CAMS practice exams first try.

🇺🇸 Nominal lands $20M to automate enterprise finance. Nominal's platform uses AI agents to automate key financial tasks, such as transaction matching, account reconciliations, and multi-entity consolidations, without requiring businesses to replace existing ERP systems.

M&A

🇵🇰 Bazaar acquires Keenu to create ‘integrated commerce-FinTech platform’. According to a statement, “this marks the first time a major Pakistani e-commerce company is bringing payments infrastructure in-house, a strategic move with transformative potential for millions of consumers and businesses across the country.”

🇿🇦 Stitch acquires Efficacy Payments to become a direct card processor in South Africa. The acquisition gives Stitch control over every layer of the card payment stack, making it one of the first FinTechs in South Africa to offer end-to-end card-acquiring services without relying on banks or third-party processors.

MOVERS AND SHAKERS

🇩🇪 IDnow announces expanded executive leadership team to drive global identity innovation. The appointments include Andreas Maueröder as Chief Financial Officer, Daniel Keller as Chief Product and Technology Officer, Phil Allen as Chief Commercial Officer, and Cassio Sampaio as Board Advisor.

🇬🇧 Finastra appoints Adam Banks to the Board of Directors. A recognized authority in digital transformation and technology leadership, Banks brings decades of experience across a range of industries, including banking, cybersecurity, infrastructure, and logistics.

🇬🇧 Markets.com CEO Stavros Anastasiou Departs. He is an experienced industry professional who previously worked at FXPro Group as CCO, Head of Internal Audit, and in Business Development. He also served as Group CCOr at Finalto for over five years.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()