Starling Bank Investor Eyes £10bn Valuation with Global Software Expansion

Hey FinTech Fanatic!

UK challenger bank Starling could reach a valuation near £10bn within a few years by globally rolling out its banking software, according to Chrysalis, its second-largest investor.

Chrysalis highlighted that Starling's "Engine" service, which allows companies to create digital banking products, could significantly boost the bank's revenue.

Richard Watts, co-manager at Chrysalis, emphasized Engine's potential to drive Starling's growth by opening up a global market for banking infrastructure. He projected that Engine could expand to 40-50 clients, generating substantial annual revenue.

Starling, founded by Anne Boden in 2014, initially offered retail current accounts and later expanded to business lending and mortgages.

Last year, it signed Salt Bank in Romania and AMP Bank in Australia as its first Engine clients.

In 2023, Starling generated a pre-tax profit of £195mn, a six-fold increase from the previous year, with revenues rising from £216mn to £453mn.

The bank is aiming for a public listing but has not provided a timeline.

Cheers,

#FINTECHREPORT

📊 Open Finance: The Korean Experience & Opportunities and Challenges for the East Asia and Pacific Region. Check out the full report

FINTECH NEWS

🇨🇴 FinTech ExcelCredit to launch its first $26M social bond issue in Colombia. The transaction will take place on the Colombian Stock Exchange (BVC) on May 29, 2024, with partial guarantee from Bancolombia. Read on

🇳🇬 Techstars-backed BlackCopper set out to disrupt lending, now it owes investors ₦1 billion. Despite its bright start and significant press coverage, the startup soon faced an existential crisis: it could not recover over 60,000 loans disbursed to customers.

🇮🇳 BharatPe and PhonePe settle trademark dispute on using 'Pe' suffix. The companies on Sunday announced that they have amicably settled all long-standing legal disputes pertaining to the use of the trademark with the suffix "Pe".

🇸🇦 PayTabs, NuMetric partner to enhance online invoicing in Saudi Arabia. The partnership enhances online invoice collection and automation, improving the overall platform experience for NuMetric users. Read the full piece

PAYMENTS NEWS

💳 The Credit card payments market will be worth $1.22 trillion in 2032 🤯 The sector holds importance in the world economy as credit cards are the favoured payment method for numerous individuals and enterprises globally. Read more

🇺🇸 Opus Technologies launches Payment Integration Framework for Financial Institutions. The new Paysemble helps financial institutions simplify technology adoption, migration and integration and ensure seamless operations, the company said in a May 21 press release.

🇦🇿 United Payment became the first and only Turkish company to receive the e-money license in Azerbaijan. With this licence, United Payment has gained the right to open an account, electronic money (wallet) and Virtual POS services, as well as national and international money transactions within the legal framework.

Payrails, a payment platform serving global enterprises, has announced a collaboration with inDrive, a prominent ride-hailing app. By leveraging Payrails' solutions, inDrive seeks to improve local payment experiences for both drivers and customers, thereby increasing conversion rates and reducing costs.

OPEN BANKING NEWS

🏦 𝗢𝗽𝗲𝗻 𝗕𝗮𝗻𝗸𝗶𝗻𝗴 in Latin America. Lessons from Mexico, Brazil, Colombia, Chile, Argentina and Peru on open banking and real-time Payments:

DIGITAL BANKING NEWS

🇬🇧 Starling investor targets £10bn valuation for digital lender. UK digital bank Starling Bank could fetch a valuation of close to £10bn within the next few years as it rolls out its banking software globally for lucrative fees, according to one of its top investors.

🇧🇷 Nubank announces sending and receiving Cryptocurrencies directly through the platform. Now, customers can send and receive crypto assets directly from their wallets. The solution, which is being gradually rolled out, is available for Bitcoin, Ethereum, and Solana.

BLOCKCHAIN/CRYPTO NEWS

🇦🇷 Satoshi Tango, an Argentine cryptocurrency broker, launches cashback promotion with VISA card. Users of the crypto platform will be able to take advantage of the international VISA card launched in 2022 for their regular purchases.

🇬🇧 Revolut introduces fiat-to-crypto on-ramp to MetaMask Wallets. According to the update, the integration offers a frictionless on-ramp for fiat-to-crypto purchases to the MetaMask Wallet, enhancing the process of adding crypto-assets to self-custody digital wallets.

Cristiano Ronaldo unveils 4th NFT collection with Binance despite $1B lawsuit. The collection will launch on 29 May with fixed pricing across most items. Read full article

DONEDEAL FUNDING NEWS

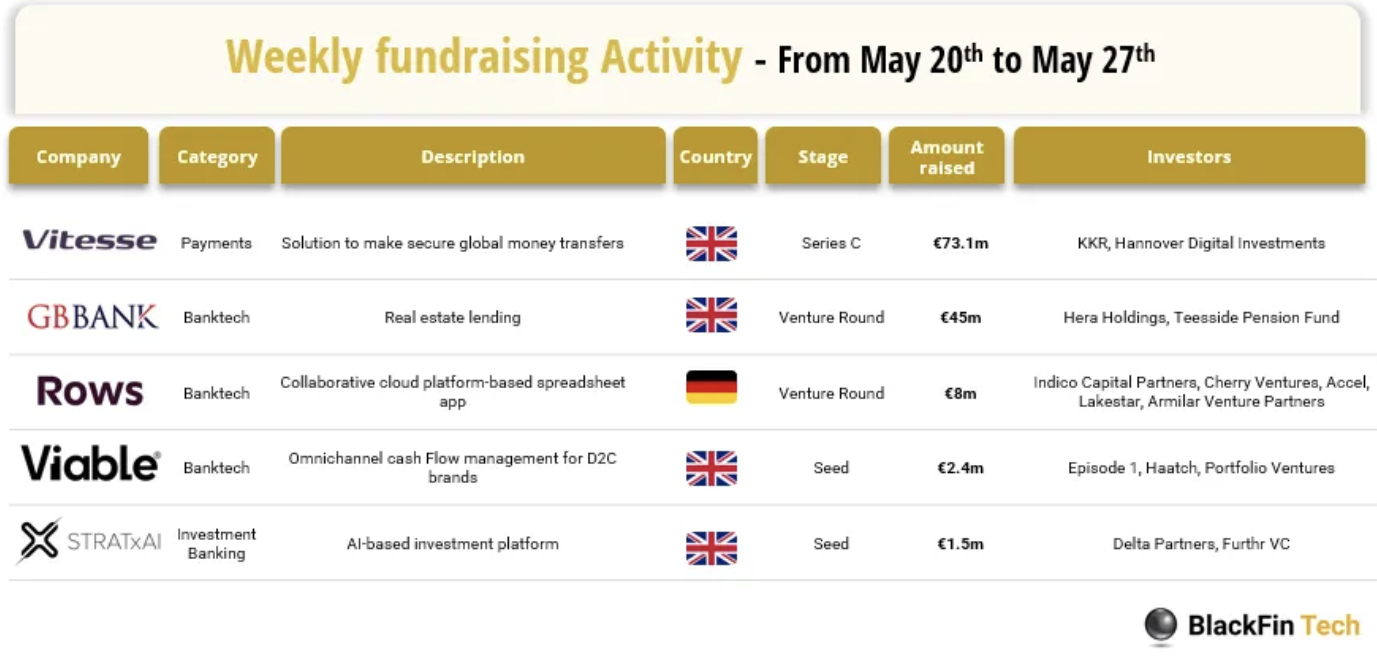

Last week we saw 5 official FinTech deals in Europe for a total amount of €130m raised with 4 deals in the UK, and 1 in Germany. Check out the full BlackFin Tech article

🇸🇦 Saudi FinTech Hala raises fresh funds from private equity giant TPG. The Saudi startup claims that it serves greater than 100,000 retailers with its POS options, driving an annual transaction quantity exceeding $18 billion.

M&A

🇲🇾 NTT DATA agrees to acquire a majority share of GHL Systems Berhad for further expansion of payment business among ASEAN countries. NTT DATA plans to propose a tender offer to its other shareholders as well.

🇧🇷 Somapay Digital Bank, a Brazil-based FinTech, has acquired a 40% stake in Bee Vale Benefícios, a Brazil-based startup specializing in flexible benefits for employees. With the acquisition, the companies expect Bee Vale to grow by about 300% in the next 24 months.

🇨🇱 Paytech Koywe acquired Chilean company Facto to enter the North American market. Mickle Foretic is the founder of Facto (finalist of MAS Pitch 2023), a company specialized in electronic invoicing and payroll that holds approximately 10% of the Chilean digital certificates market.

🇲🇦 Dublin FinTech CR2 acquired by Moroccan payments firm HPS. The acquisition will enhance HPS digital banking and payments capabilities and accelerate its growth within the space globally. Click here to learn more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()