Stablecoin Bank Built by Ex-Coinbase Exec Raises $12.5M

Hey FinTech Fanatic!

Three years after leaving his role as CEO at Coinbase Custody, Ryan Bozarth is back in the spotlight.

His startup, Dakota, has raised $12.5 million to scale a stablecoin-powered neobank that moves money between businesses and banking partners, without relying on legacy infrastructure.

Since launch, Dakota has processed $1.6 billion in volume and expects to hit $4 billion by December, serving +500 businesses, but there's more, scroll down to read the full story 👇

Cheers,

INSIGHTS

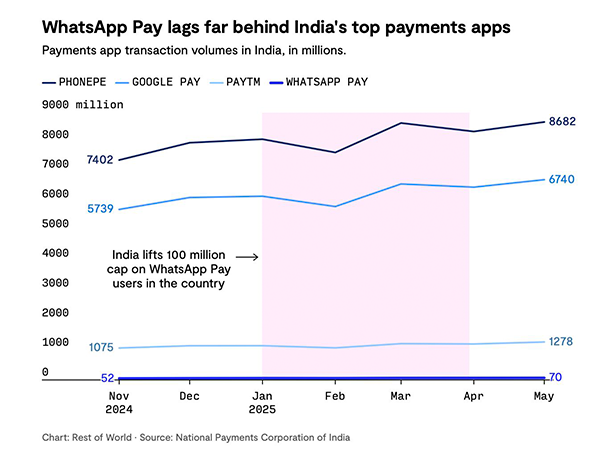

🇮🇳 Despite having 500 million users in India, WhatsApp couldn’t crack the country’s $3 trillion FinTech market.

FINTECH NEWS

🇮🇳 FinTech majors are counting on co-branded cards in returns play. Google Pay is in discussions to build a co-branded credit card with Axis Bank. This marks a shift for Google, which has so far avoided regulated businesses in India and pulled back its FinTech bets globally.

PAYMENTS NEWS

🌍 Mollie lands in Czechia, Hungary, and Slovenia to bring their businesses the financial engine. This strategic move aims to provide local businesses with a powerful and reliable financial engine to support their growth. This expansion marks more than geographic growth; it reflects Mollie’s commitment to empowering the next generation of European businesses.

🇬🇧 Clear Junction extends named virtual IBAN services to VASP‑licensed businesses. By offering this capability to European and UK-licensed crypto asset providers, it aims to strengthen the fiat infrastructure available to regulated crypto firms and help them overcome long-standing barriers to accessing reliable account services.

🇮🇳 Visa-backed PayMate has withheld, delayed salaries since April amid a cash crunch. The delays come amid delayed funding and as the company has ramped up investments in international markets following a Reserve Bank of India directive last year that destabilised its India business.

🇺🇸 Mastercard says stablecoins still face hurdles to go mainstream. Mastercard’s CPO, Jorn Lambert, said stablecoins boast incredible technical potential, fast transactions, 24/7 uptime, low fees, programmability, and immutability. But those features alone don’t make them ready for everyday payments.

🇬🇧 Corpay launches Corpay Complete platform in the UK. The move aims to help finance teams streamline operations and reduce cost and complexity, given that they are “under growing pressure to do more with less,” said the company. Continue reading

🇵🇹 Contactless payments using NFC technology are now available to the MB Way app. The entry into force of the European Union's Digital Markets Act forced the iPhone maker to open access to contactless payment technology to third-party apps, as MB Way has now announced.

REGTECH NEWS

🇵🇭 The Philippine Statistics Authority and GCash make account verification more accessible and faster with National ID eVerify integration. To streamline identity verification and make digital financial services more accessible to more Filipinos, they are working together to enable a more accessible verification process for e-wallet accounts, in line with the country’s financial inclusion agenda.

🇱🇹 Lithuanian FinTech Axiology granted its first DLT licence in the Baltics. As a result, it will ramp up its service, providing digital bond issuance, trading, and settlement to SMEs and retail investors in the region. Read more

DIGITAL BANKING NEWS

🇺🇸 Starling Bank weighs New York listing as part of US expansion plans. “We continue to observe what is happening externally with our peers, and also what is happening on the global stage in terms of the UK versus US, stock markets,” said Declan Ferguson, the Chief Financial Officer.

🇰🇷 Kbank runs a senior call center to meet the needs of the aging population. The call center for older adults opened in early June, as they increasingly make up a larger share of customers in the asset management market amid longer life expectancy.

🇬🇧 Monzo unveils flexible home insurance for homeowners. Monzo Home Insurance is available to UK homeowners, giving them a flexible and transparent approach to home protection. The Monzo app powers this digital insurance solution, which is designed to be simple, quick, and give customers control.

🇱🇹 myTU enables instant global payouts with Visa Direct and Mastercard cross‑border services. This integration empowers businesses and individuals to send real-time payouts, including salaries, insurance claims, refunds, and gig-economy payments to eligible cardholders, as well as directly to bank accounts in supported markets.

🇮🇳 Wise opens global office in Hyderabad and plans major hiring. The company, which currently has 70 employees on its rolls in Hyderabad, plans to expand its workforce over the next few years. Additionally, UniCredit picks Wise to handle FX payments in latest retail push. The partnership comes after the lender launched a review and found it had “shortcomings” in its mobile banking payments offerings.

🇮🇩 Jenius chooses Wise Platform to transform cross-border payments for millions of digitally-savvy Indonesians. Its customers will be able to benefit from faster cross-border payments, full price transparency, and real-time transaction tracking, as funds can be sent directly from their Jenius Foreign Currency accounts.

BLOCKCHAIN/CRYPTO NEWS

🌎 The LatAm Stablecoin Payment Landscape👇

🇪🇺 Gemini expands tokenized stock offering in EU with 14 new listings, including Nike and McDonald’s. This latest round expands the platform’s reach into industries like SaaS, airlines, and fast food while integrating more well-known international brands.

🇺🇸 Mercurity FinTech launches $500 million DeFi treasury strategy. The blockchain-powered FinTech group, which maintains a healthy balance sheet with more cash than debt and a current ratio of 2.59, plans to build a portfolio of established digital assets, with an initial focus on Solana (SOL).

🇬🇧 StanChart launches bitcoin and ether spot trading for institutional clients. Institutional clients, including corporates, investors, and asset managers, can now trade digital assets through familiar FX interfaces, and will soon be offered non-deliverable forwards trading, StanChart said in a statement.

🇺🇸 Kraken launches US-regulated derivatives offering, creating unified access to futures and crypto spot markets. With instant funding enabling seamless transfer of collateral, the integration gives clients a unified interface to deploy advanced strategies and manage risk efficiently.

PARTNERSHIPS

🇮🇱 IsraJets takes off with Airwallex to streamline global payments for private aviation services. Airwallex now enables IsraJets to accept passenger payments via multicurrency virtual IBANs in over 16 countries or credit cards, and to process vendor and employee payouts efficiently from a single platform.

🇬🇧 Solidgate x DRESSX: powering Web-2-App B2C expansion through payments. Through this partnership, DRESSX gains access to advanced payment solutions that support its B2C growth strategy. The partnership also enhances security with robust fraud prevention tools and adaptive 3DS, supports recurring revenue through a subscription engine and network tokenization.

🇨🇳 KN Group and AlloyX partner for tokenisation. This collaboration marks the first tokenization of individual cash loans on-chain, providing broader funding sources for the underlying assets and exploring new possibilities for traditional consumer finance businesses.

🇧🇭 EazyPay and Tamara announce strategic partnership to power seamless payment solutions across the GCC. EazyPay will serve as Tamara’s local acquirer and provide advanced payment gateway services, enabling secure, seamless, and efficient transaction processing across Tamara’s expanding network of merchants.

🌏 Chocolate Finance taps Snowdrop Solutions for an intuitive and clearer spending overview. As part of the collaboration, users can now see merchant names, logos, and customised categories, helping them quickly identify where and how they spend their money.

🇺🇸 BVNK & Bitwave announce partnership to enable real-time stablecoin payments for enterprise finance. The integration will empower enterprise finance teams to send and receive stablecoin invoice payments with compliance, security, and speed.

🇺🇸 Plaid joins forces with Xero for enhanced US bank feeds. This partnership significantly improves the way business bank accounts connect with the Xero platform. By streamlining these connections, the integration is designed to save users time and provide greater visibility into their financial data.

DONEDEAL FUNDING NEWS

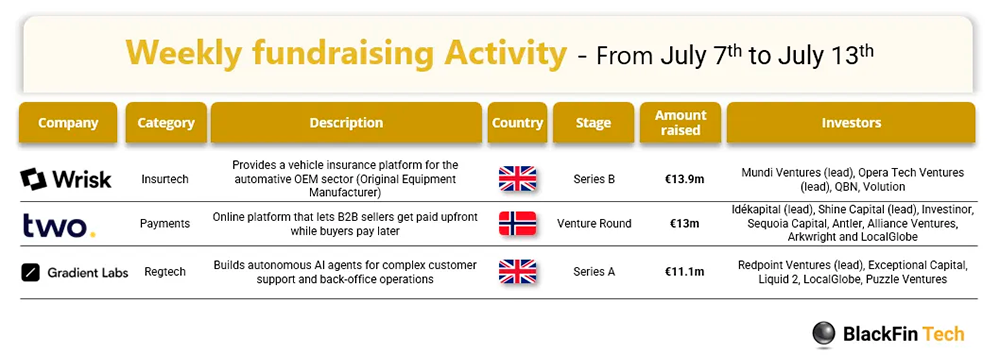

💰 Over the last week, there were 3 FinTech deals in Europe, raising a total of €38 million, two deals in the UK, and one in Norway:

🇲🇽 Mexican FinTech Mango lands $3m funding round led by Ironspring Ventures to fix construction’s cash flow crisis in Latin America. The funds will be used to deploy structured credit, expand its contractor and supplier network nationwide, and strengthen its internal teams in finance, engineering, and risk.

🇿🇦 Luno co-founder’s MoneyBadger raises $400,000 pre-seed. MoneyBadger plans to use the new capital to expand its merchant footprint through partnerships with Tier 1 payment providers, ecommerce platforms, and national QR code networks.

🇩🇪 Ordio secures €12m to revolutionize payroll automation. With this new funding, Ordio will accelerate product development in AI-powered payroll and process automation, aiming to become the backbone of the real-world workforce. Read more

🇺🇸 Panacea Financial extends series B to $62m from Valar Ventures. The Company will use the capital to further expand its vertically integrated digital platform, which currently includes banking, lending, legal, and advisory services, and to accelerate the development of intelligent tools.

🇺🇸 Former Coinbase exec raises $12.5 million for Dakota, a stablecoin-powered neobank. The injection of capital into Dakota, which uses stablecoins to move money between itself and its customers, is the latest bet from VCs on a company involved in one of the buzziest sectors of crypto.

🇪🇬 PALM successfully closes a 7-figure Pre-Seed round led by 4DX Ventures to revolutionize savings. With the new funding, PALM will focus on accelerating user acquisition, expanding its product use cases, and strengthening its network of strategic partners.

🇮🇱 Heka raises $14m to bring real-time identity intelligence to financial institutions. The Heka’s milestone will help banks and lenders find fraud more easily, streamline compliance, and make decisions based on identity more quickly, all with more confidence and automation.

M&A

🌍 Rydoo acquires Semine to power next-gen finance automation across Europe. By combining market-leading expense management with fully automated AP workflows, Rydoo and Semine are building an end-to-end solution that delivers maximum efficiency, control, and strategic insight.

MOVERS AND SHAKERS

🇮🇹 BBVA appoints Walter Rizzi as head of digital banking in Italy. His strong technical and strategic background makes him a key leader to drive the bank’s growth, aligning BBVA’s value proposition with the specific characteristics of the Italian market and cementing its position as an innovative digital banking institution.

🇺🇸 BlockFi co-founder Flori Gilroy hired to lead revamped SoFi crypto unit. The new hire was quietly made official via an update to the masthead on SoFi’s website and confirmed by a source familiar with SoFi’s business operations. It’s unclear when Gilroy took on the new role.

🇮🇳 PhonePe ropes in Meta's Shivnath Thukral as V-P for public policy. "Shivnath will be responsible for leading PhonePe's external engagement and discussions with policymakers and regulators," the company said in a statement, adding that he would work closely with the company’s founders, Sameer Nigam and Rahul Chari.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()