South Korea’s Toss Expansion Playbook: Australia, Stablecoin, Wall Street

Hey FinTech Fanatic!

South Korea’s unicorn Toss is lacing up for a global run — literally.

After conquering its home market with 30M+ users, the FinTech is setting its sights abroad, starting with Australia. CEO (and ex-dentist) Lee Seung-gun says the same playbook that let Toss go toe-to-toe with Korea’s banking giants can work in markets where people juggle multiple accounts and apps.

Australia’s open banking rules + fragmented system = prime ground for Toss’s one-stop super-app. First up: P2P transfers by year-end, with Singapore as a hub and even a won-based stablecoin in the works.

And don’t forget the IPO finish line: Toss is aiming for a $10B–$15B U.S. listing in 2026, potentially the biggest Korean debut since 2021.

Speaking of runs — tonight’s FinTech Running Club meetup kicks off in Amsterdam’s Vondelpark at 6:30 PM.

If Toss can sprint into new markets, we can at least keep pace around the park 😉 Hope to see some of you there!

Cheers,

INSIGHTS

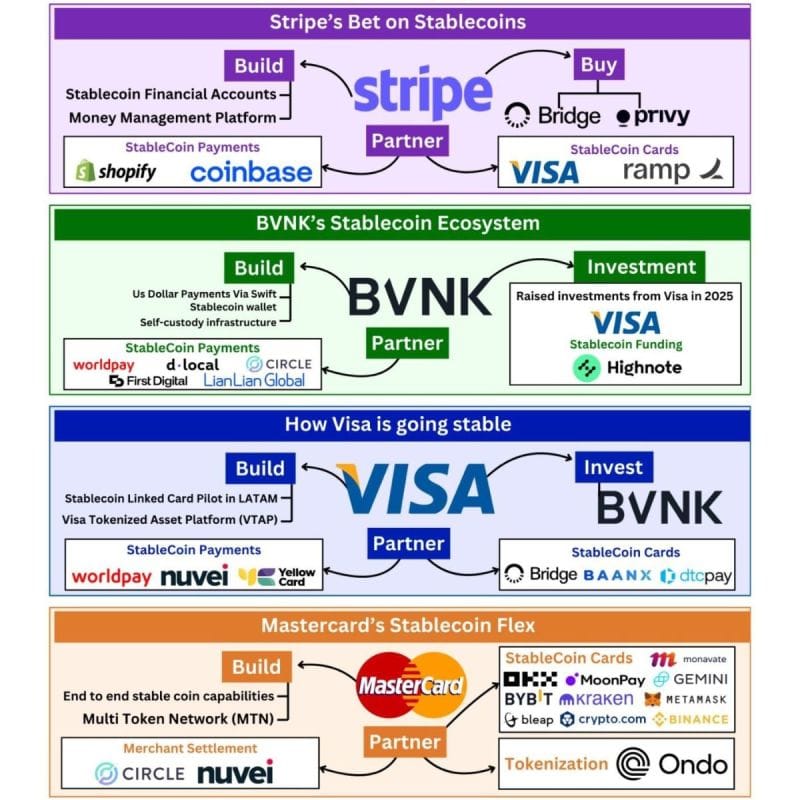

📊 Stablecoin Wars: Big Moves from Stripe, Visa, Mastercard & BVNK

FINTECH NEWS

🏃➡️ From 2 friends to 22 runs this September, the FinTech Running Club has grown into a global movement across 18+ cities. Whether you're in it for the miles, the connections, or just the vibes, there’s a run for you. Check out the schedule, find your city, and join us. Let’s keep growing, one sprint at a time.

🇺🇸 FinTech Eightco shares skyrocket on move to amass cryptocurrency worldcoin. The company plans to accumulate worldcoin cryptocurrency through a fundraiser involving Peter Thiel's BitMine. Eightco is selling more than 171,000 shares at $1.46 each in a private placement, targeting about $250 million in proceeds to buy Worldcoin.

🇳🇱 Webull launches in the European Union, debuting a retail investment platform in the Netherlands. Headquartered in Amsterdam, Webull EU will give retail investors of all experience levels access to the Webull platform, beginning in the Netherlands, with additional EU countries expected to follow in the coming months.

🇺🇸 Winklevoss-founded crypto exchange Gemini taps Nasdaq as strategic investor, as it moves forward with plans for a New York listing this week. Gemini, which could raise as much as $317 million in the IPO, has already lined up Nasdaq to buy $50 million in shares in a private placement at the time of the IPO.

PAYMENTS NEWS

🌎 The evolution of lending solutions for SMEs by Getnet. Traditional lending in Latin America has relied on rigid, collateral-backed processes that exclude many SMEs and microbusinesses lacking formal credit histories. Getnet is at the forefront of this shift, embedding credit into its payments ecosystem to provide faster, more accessible financing for businesses across the region.

🇺🇸 How ACI Worldwide plans to take APP scams head-on, part 1. An ACI report titled "Real-Time Payments: Economic Impact and Financial Inclusion" shows an empirical link between RTPs and financial inclusion. The report forecasts gross domestic product contributions from RTPs will increase from $164 billion in 2023 to $285.8 billion by 2028, a 74.2% increase over five years.

🇧🇷 Brazil’s instant payments system Pix Breaks TWO records in a single day 🤯

According to the Central Bank👇

🇲🇾 11.8 mil cross-border QR transactions recorded in the first half of 2025. These transactions include those between Malaysia and ASEAN member countries Cambodia, Indonesia, Singapore, and Thailand, and also encompass links with China and Korea, established through commercial arrangements between payment service providers.

🇲🇦 Thunes launches real-time payments into Morocco. Members of its Direct Global Network can now enable real-time payments to bank accounts in the country. The launch supports payouts in Moroccan dirhams and gives Thunes Members greater access to Morocco's increasingly connected and digitised economy.

🇬🇧 TrueLayer launches verified payouts to deliver instant, fully compliant withdrawals to the right bank account every time. The new solution guarantees funds are paid out to the same verified account they were deposited from, instantly and in full compliance with regulatory guidance.

OPEN BANKING NEWS

🇬🇧 Ozone API and Plumery partner to advance digital banking with open banking integration. This integration empowers banks and financial institutions to rapidly deploy customer-centric mobile and web applications that seamlessly incorporate open banking capabilities without compromising on compliance or security.

DIGITAL BANKING NEWS

🇦🇪 Revolut secures in-principle approval for UAE payments licence, accelerating expansion plans in the region. By working in close collaboration with the Central Bank of the UAE, Revolut is poised to deliver exceptional results for customers, ushering in a new era of financial flexibility. Additionally, Revolut will launch new accounts in Spain to attract children and teenagers. It will launch a deposit for young people between 6 and 15 years old and will give financial autonomy to those aged 16-17.

🇦🇺 South Korean FinTech Toss plans a global push starting in Australia, aiming to issue a won stablecoin. The FinTech has established an Australian unit, which plans to launch core services, including peer-to-peer money transfer, by year-end. Continue reading

🇬🇧 Plum unveils AI tool using Google’s Gemini to shake up personal money management. Called Plum AI, the service is designed to act as a co-pilot for your money, keeping customers in the driver's seat while helping them reach their goals faster through its automated features.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Rapyd has launched Stablecoin Payment Solutions. Rapyd’s new offering will allow platforms and marketplaces to accept stablecoin payments from global customers and instantly convert them into their preferred fiat currencies, as well as settle fiat payments, for example, from an e-commerce site, into stablecoin within their Rapyd account.

🇮🇳 Bybit resumes full access for Indian users, reinforces commitment to compliance and crypto inclusion. Bybit has restored full access to its Bybit app on the App Store and Google Play for users in India, marking a crucial milestone in its long-term dedication to the Indian market.

🇪🇸 Ripple brings crypto custody to Spain with BBVA. The partnership builds on Ripple’s existing work with BBVA in Switzerland and Turkey. It aims to enhance security and compliance, allowing BBVA to better serve its customers interested in digital assets with trusted custody solutions.

🇺🇸 Nasdaq makes push to launch trading of tokenized securities. If approved, the move would mark the first instance of tokenized securities being allowed to trade on a major U.S. stock exchange, and also signify the most ambitious attempt yet by an exchange operator to bring blockchain-based settlement into the national market system.

PARTNERSHIPS

🇺🇸 Green Dot adds Stripe as network partner. Powered by Green Dot’s platform, Stripe Treasury will allow users to quickly and conveniently add cash to their accounts at any of Green Dot’s more than 90,000 money processing locations nationwide, with additional enhancements and capabilities planned for the future.

🇺🇸 Zip US partners with Nift to enhance the customer experience and the value of every purchase. The partnership allows Zip to thank its users with personally tailored gift offers after they complete a purchase, enhancing the value of their shopping experience and building deeper customer connections.

🇨🇦 Nuvei adds early warning’s Paze Wallet for its e-commerce merchants. Consumers using Paze will find their card information and billing addresses preloaded. Consumers will be able to add different shipping addresses and store them in Paze, too. The wallet also features a card-updater capability.

🇬🇧 Judopay and Shift4 form collaboration pact. The collaboration cements Shift4 as Judopay’s preferred payments partner, enabling merchants to leverage Shift4’s acquiring services to deliver a seamless, scalable, and compliant end-to-end payment ecosystem.

🌍 FuturePay taps Flutterwave to simplify payments across Africa. By integrating Flutterwave’s solutions via a single API, FuturePay can now onboard merchants faster, reduce operational costs, and gain a competitive edge in Africa’s rapidly growing digital economy.

DONEDEAL FUNDING NEWS

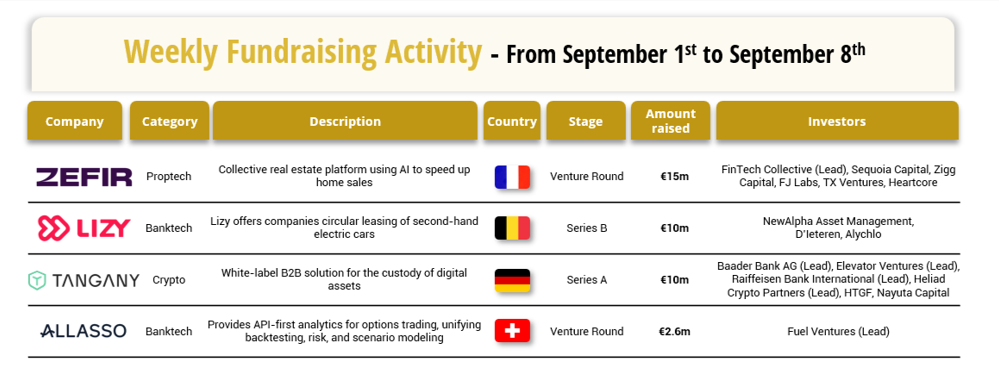

💰 Over the last week, there were four FinTech deals in Europe, raising a total of €37.6 million, including transactions in France, Belgium, Germany, and Switzerland.

🇺🇸 FinTech giant iCapital invests in Tangible for liquidity push. This will give advisors and clients access to a broad range of strategies, including private equity, private credit, hedge funds, and real assets, while offering tools such as curated auctions, real-time pricing insights, and portfolio analytics.

🇳🇱 Amsterdam-based FinTech Factris secures €100M funding facility. The facility will support Factris’ invoice factoring operations, enabling businesses to unlock working capital and manage growth. It is designed to scale according to demand for SME financing and expand Factris’ cross-border platform.

🇦🇺 FinTech Marloo receives $4.2M led by Blackbird. The funding will support the acceleration of new feature development based on customer feedback. The technology aims to address the industry challenge where advisers spend more time on paperwork than providing financial guidance to clients.

🇸🇦 Orbii Raises $3.6M USD seed round to power embedded SME lending across MENA, building the AI network of lending. The funding will go towards scaling its engineering and data science teams, deepening integrations with financial systems and platforms across the region, and expanding its footprint in Saudi Arabia and the UAE.

🇱🇹 Kashimi raises $1.36M to expand alternative payment infrastructure. The new funding will back expansion in the European and UK markets and advance entry into the US, building on steps initiated at the end of 2024. Continue reading

M&A

🇺🇸 PNC agrees to acquire Colorado's FirstBank in $4.1bn deal. The transaction has been approved by the boards of directors of both PNC and FirstBank Holding Company, consisting of around 13.9 million shares of PNC common stock, and a cash payment of $1.2 billion.

MOVERS AND SHAKERS

🇦🇪 Binance exec Reem Khayat moves to Revolut to head Crypto product marketing. Reem had been with Binance for the past three years, serving as Marketing Lead MENA, heading marketing for the Middle East and North Africa while overseeing strategy, operations, and growth at Binance, out of the company’s offices in Dubai.

🇬🇧 FinTech Wales appoints Sarah Jones as CEO. Her 20 years of industry experience also include marketing roles at Julian Hodge Bank, the New Directions Group, and Welsh recruitment agency Acorn, acquired by Synergie Group in 2006. Keep reading

🇵🇱 XTB loses AI Chief in Industry-Wide Brain Drain Battle. Gawron announced his departure from XTB in late August after nearly two years leading the broker's AI research and development team. The executive's exit comes after XTB invested heavily in building its AI capabilities from scratch.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()