Sokin Raises $50M… but Guess What’s Driving Its 100% Growth?

Hey FinTech Fanatics!

Big day for a FinTech taking cross-border infrastructure to the next level.

Sokin just secured a $50M Series B after 100% year-on-year growth 🤯

Prysm Capital led the round, and the company now sits at a $300M valuation. Revenues doubled in the past year. Eight times higher than in 2022. Clear demand. Clear momentum...

I’m very proud of Vroon Modgill, Sokin’s CEO and founder, who’s been building a global payments platform with real infrastructure and operations across more than 170 countries.

More licenses coming as expansion picks up across Asia, the Middle East, and South America.

By the way… massive news brewing in sports x FinTech

Nubank is close to finalizing a 10-year naming rights deal for Inter Miami’s new stadium, worth about $19M per year. Nearly $190M in total. Huge if it lands.

Miami Freedom Park opens in 2026 with 25,000 seats and a full commercial complex around it.

Talks aren’t exclusive. Stadium management is still speaking with other buyers. But if Nubank closes the deal, it instantly becomes one of the biggest FinTech x sports plays we’ve seen.

👉 Learn more about this story here.

If you're into open banking, definitely check out today's FinTech report I added below 👇

Cheers,

FEATURED NEWS

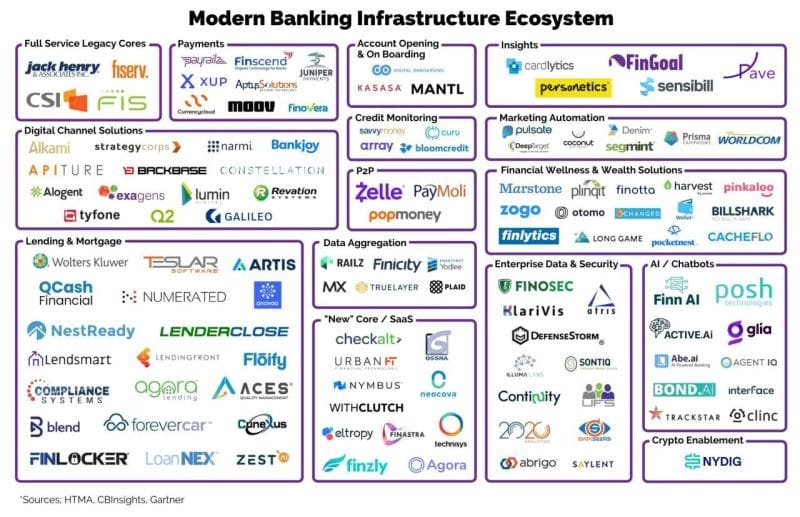

➡️ This Modern Banking Infrastructure Ecosystem Map needs an update👇

Who is missing in this overview?

#FINTECHREPORT

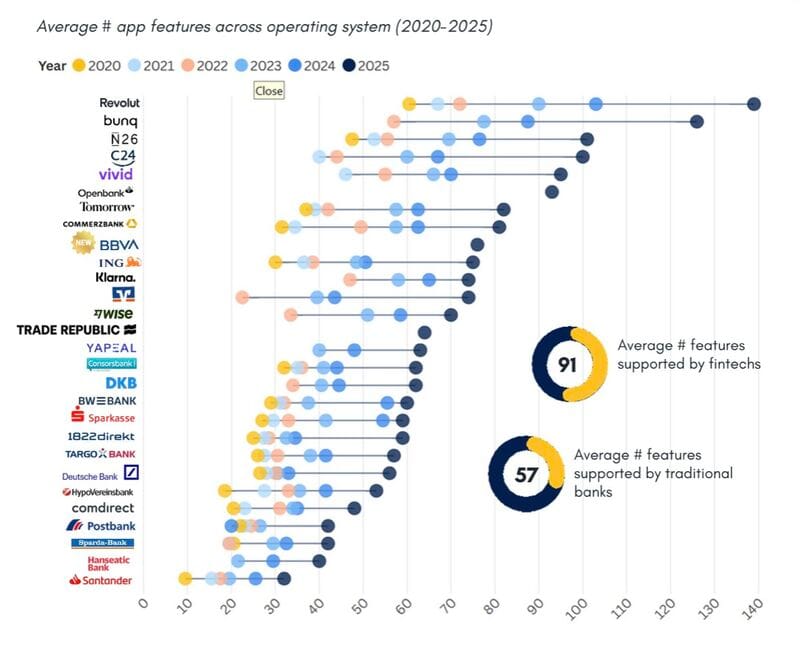

🇩🇪 FinTechs are pulling away in the banking app feature race in Germany.

And the gap with traditional banks is only getting wider👇

FINTECH NEWS

🇬🇧 Revolut is in a new spat with regulators over CEO Nik Storonsky’s shift of his residency to the UAE. Regulators sought assurances that the move wouldn’t affect Revolut’s operations or its long-pending bid for a UK banking licence. Revolut said the change relates to Storonsky’s office, doesn’t impact management, and that he continues to split his time between the UK and key global markets.

PAYMENTS NEWS

🇦🇷 Western Union and Pago Fácil launch their card powered by Pomelo in Argentina. This new offering aims to provide a safer, more convenient, and cashless alternative for those who currently rely on cash. The card, powered by Pomelo, allows users to receive remittances or loans directly into a digital account, eliminating the need to handle banknotes or carry large sums of money.

🇧🇷 Pix reaches a record mark of 297.4 million daily transactions, according to the Central Bank. "The result is yet another demonstration of the importance of Pix as a public digital infrastructure for the functioning of the national economy," says the Central Bank in a statement.

🇸🇦 Mastercard Gateway gains SAMA certification. This certification will enable Mastercard Gateway to process e-commerce transactions through the New E-commerce Payments Interface locally and securely, providing local routing, tokenisation, fraud prevention, and direct integration with the national payment scheme (Mada).

🇿🇦 Wise marks its first expansion to Africa with the new licence. With its approval secured, the group aims to begin operations in South Africa. With Wise’s expansion into the country, the firm can offer transfers for personal customers, with further ambitions to bring its full product suite to the market over time in line with these ambitions.

🇲🇾 Tencent to expand WeChat mini programme ecosystem in Malaysia as it ramps up regional expansion. The mini programme allows payment and e-commerce functions and customer engagement tools to work within the WeChat app without requiring separate installations of stand-alone mobile applications.

🇺🇿 Stablecoins become legal payment in Uzbekistan starting in 2026. Tokenised shares and bonds will be allowed, with a dedicated trading platform under regulatory oversight. The move includes a controlled regulatory sandbox and an open banking framework to support FinTech growth.

🇬🇧 PayDo introduces a direct acquiring feature. The new acquiring service allows merchants to process VISA and Mastercard transactions through PayDo’s system without external intermediaries. This change improves processing speed, increases approval rates, and significantly simplifies the settlement process.

OPEN BANKING NEWS

🇳🇿 Open Banking goes live in New Zealand under the new Customer and Product Data Act, Minister Scott Simpson says it will enable faster loan approvals, easier bill management and more personalised budgeting tools. The regime is expected to boost competition, make switching banks easier, and give small businesses better, lower-cost financial tools.

DIGITAL BANKING NEWS

🇺🇸 Nubank is negotiating naming rights for Inter Miami's future stadium. According to a journalist, a digital bank led by David Vélez is close to finalising a ten-year contract with Messi's team, worth up to US$190 million over the period; Nubank declined to comment.

🇨🇱 Mercado Pago Chile is betting on being the primary provider, not on banking. Mercado Pago wants to distance itself from any local banking model, but its growth, efficiency, and business plans are pushing it to operate like one. The Head of Legal said that becoming a bank is not a priority for the company, but that financial authorities and its market share could force it into that role.

🇺🇸 Sony Bank plans to launch USD stablecoin by 2026. The token will be used across Sony’s entire entertainment ecosystem, including PlayStation, streaming services, and anime platforms, to offer faster, cheaper, and borderless digital payments.

🇪🇸 Revolut increases its commitment to Spain and aims to exceed 7 million customers by 2027. The company is about to break the six million mark, meeting its forecasts. "Spain is one of the countries where we have been growing most rapidly," commented the Vice President of Global Business, David Tirado.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 S&P downgrades Tether’s assets to the lowest level. Tether’s ability to maintain its peg to the US dollar has been called into question by S&P Global Ratings, which downgraded the stablecoin operator’s reserves to its lowest measure due to rising exposure to high-risk assets.

🇸🇬 Ripple gains regulatory Nod to expand payment services in Singapore. The company announced that its Singapore-based subsidiary, Ripple Markets APAC, has been approved by MAS to broaden the scope of its regulated payment activities under its Major Payment Institution (MPI) license.

🇪🇸 FC Barcelona distances itself from crypto sponsor Amid Backlash. FC Barcelona has faced intense criticism after entering a sponsorship agreement with Zero-Knowledge Proof, a little-known blockchain start-up registered in Samoa. The three-year deal named ZKP as Barcelona’s official blockchain technology partner.

PARTNERSHIPS

🇩🇪 LIQID enters partnership with Upvest for its ELTIF offering. By fully digitising the integration of ELTIFs, LIQID is setting a new standard for how long-term investments can be offered in an accessible, transparent, and efficient way. For the first time, a semi-liquid fund structure is being fully mapped digitally via APIs.

🇧🇭 EazyPay partners with Optty to launch unified payment orchestration for Merchants. The collaboration enables EazyPay’s merchants to process transactions through a single interface that supports nine major payment types, consolidating payment acceptance into one seamless, centralised platform.

🇮🇹 BANCOMAT and Visa announce pilot project for BANCOMAT Pay expansion. The new functionality will allow users of the BANCOMAT Pay service, available within the BANCOMAT wallet, to make secure, contactless payments, even abroad.

🇩🇪 FIS inks deal with BMW Bank. Through this deployment, FIS is helping BMW Bank provide more efficient and meaningful financial transactions and customer service in its lending and deposits business, giving the bank greater opportunities to unlock growth and gain a competitive advantage.

🇺🇸 Visa and AWS enable next-generation agentic commerce capabilities. Through this collaboration, AWS and Visa are committed to advancing agentic workloads and commerce capabilities on AWS, with Visa deploying MCP tools to help enable fully integrated, end-to-end agentic commerce solutions on the platform.

DONEDEAL FUNDING NEWS

💰 Over the last week, there was one FinTech deal in Europe, raising €4.6m million, in the United Kingdom: Sapi, a UK-based payment-linked financing platform that enables payment providers to offer flexible funding to small businesses, has raised €4.6 million in equity.

🇮🇱 One Zero seeks $60-90 million as investors push back on its $360 million valuation. The bank projects reaching profitability by late 2026 and plans to roll out new products next year. One Zero has also halted its planned Italian expansion with Generali Bank after signing an earlier memorandum of understanding.

🇮🇳 Finfactor raises $15 Mn in Series A led by WestBridge Capital. The new capital will be used to expand its product suite for financial institutions, enhance its analytics capabilities and advance its goal of becoming a full-stack technology provider for banks and BFSI clients.

🇬🇧 Sokin raises $50m series B following 100% year-on-year growth. The company will further build out its global infrastructure and secure additional regional licenses and banking partnerships, further extending Sokin’s global reach in markets across Asia, the Middle East and South America.

🌍 Zazu nets $1M pre-seed round to transform SME banking across Africa. Zazu aims to deliver a business banking OS tailored for Africa, and the startup is already in beta with 50 SMEs and has over 1,000 businesses waiting for access. Continue reading

M&A

🇺🇸 NatWest is reportedly in talks to sell the Cushon unit to WTW. Reuters reports that its sources price the deal at over £150 million, although they add that there is no final guarantee that the potential acquisition will be completed. Keep reading

🇺🇸 PayRange to acquire KioSoft. The acquisition will allow the combined company to accelerate the transformation of millions of coin-operated machines, enabling consumers through digital payment convenience and empowering machine owners to deliver elevated engagement experiences and better insights into their business.

MOVERS AND SHAKERS

🇦🇺 EML Payments appoints Stuart Will as its new CFO to drive growth strategy. Will, who has extensive experience in the FinTech, financial services, and retail sectors, will work alongside James Georgeson to ensure a smooth transition. Will leverages his expertise to enhance the company’s global operations.

🇨🇾 Kraken adds Pepperstone alum Stavros Vassiliades to head Cyprus compliance. Stavros Vassiliades joins Kraken after serving as Executive Director for Pepperstone EU Limited, the licensed Cyprus operation of Australia-based CFDs broker Pepperstone.

🇦🇺 Coinbase Australia names Adam Judd COO ahead of regulatory shift. As COO, Judd will oversee Coinbase's local operations and guide the adaptation of its global offerings for the Australian market, ensuring compliance with forthcoming regulatory requirements.

🇬🇧 ClearBank appoints Angela Roberts as Group General Counsel. Her deep legal, regulatory and governance experience will be instrumental in navigating an evolving landscape and ensuring ClearBank continues to deliver innovative, compliant solutions for its clients.

🇪🇸 Revolut appoints Ignacio del Valle, Head of Legal, as interim CEO in Spain. While not expected to drive strategic execution, he will oversee regulatory reporting until a permanent successor is appointed. Continue reading

🇳🇱 BUX appoints Marlou Jenniskens as new CEO. Within her new role, Jenniskens will oversee the development of BUX’s savings proposition, a key strategic initiative that will bring saving and investing together in one intuitive platform.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()