Sokin Lands $100M to Double Down on Embedded Payments and Global Expansion

Hey FinTech Fanatic!

Still in the US 🇺🇸, and this one crossed my radar today while catching up on the usual conversations, meetings, and inbox updates...

Sokin just secured $100M in growth financing from Oxford Finance.

It’s long-term debt, not equity, and it’s being used to accelerate global expansion, new licenses, and embedded payments infrastructure.

This comes at an interesting moment. FinTech deal volume fell sharply in 2025, but capital is still flowing to companies with real traction.

Sokin grew revenue 100% YoY, stayed profitable, and was recently named one of the UK’s fastest-growing tech companies by The Sunday Times.

This $100M facility follows Sokin’s $50M Series B in December and adds more fuel to a platform already supporting 170+ countries, 70+ currencies, and full AP, AR, and treasury operations under one roof.

As CEO, Vroon Modgill put it, companies don’t want payments bolted on anymore. They want payments embedded directly into workflows, with fewer vendors and fewer points of friction. That’s the infrastructure layer Sokin is building.

What’s the next move in FinTech? Scroll down and check out today's stories! 👇 I’ll be back tomorrow with more updates worth paying attention to.

Cheers,

FINTECH NEWS

🇺🇸 Laser Digital seeks US banking charter amid crypto firms' push onshore. The application was filed with the Office of the Comptroller of the Currency. A federal charter would allow Laser Digital to operate nationwide without securing state-by-state custody licenses, while stopping short of taking retail deposits.

🇺🇸 Near Intelligence FinTech Firm CEO accused of $37m "juice" scheme to fake revenue. The complaint alleges the fraud inflated Near's revenue by $37.3 million out of the total reported revenue of $138.3 million during the scheme's operation.

🇧🇷 XP, BTG, and Nubank are being sued for misleading advertising regarding Master's CDBs. The lawsuit was filed by Abradecont (Brazilian Institute for Consumer and Worker Defense). According to Abradecont, the platforms omitted the real risks of the securities and failed to properly curate investment recommendations.

🇻🇳 US FinTech startup Tala invests $5 million in Vietnam. Tala has established a legal entity in Vietnam and begun partnering with a local bank to offer lending services from the first quarter of this year. Tala operates as a consumer finance company, focusing primarily on low-income segments.

🇬🇧 FinTech growth sparks London hiring spree. Across the financial sector, the number of listed vacancies rose 13% compared to the previous year despite continued inflationary pressures and lingering economic uncertainty. FinTech hiring surged 29% over the year, with particular strength in software engineering and product management roles.

🇬🇧 ClearBank founder Andrew Smith is building the home of UK sports finance with new banking venture Sporta. Smith says the inspiration for Sporta came from his own experience at his local cricket club, where he was asked to become a benefactor. "Sport has been a big part of my life since I was a child. It’s where I learned discipline, resilience, and a sense of belonging," he explains.

PAYMENTS NEWS

🇦🇺 Mastercard accelerates AI-powered commerce with Australia’s first authenticated agentic transactions using Agent Pay. By enabling fully recognized and authenticated agentic transactions, Mastercard’s trusted agentic framework process brings AI agents into the payment flow as visible, governed participants, ensuring that every transaction is secure, transparent, and trusted.

🇩🇪 Berlin plans to introduce the European payment system Wero. The aim is to enable digital payments for administrative services in Berlin via Wero. This is intended to help the relatively new service gain wider acceptance. Wero is a project of several European banks and is intended to become a European alternative to the US payment service provider PayPal.

🇬🇧 TerraPay partners with MilX to power global payouts for content creators. TerraPay’s partnership with MilX addresses these challenges head-on, enabling creators to receive earnings instantly in local currencies across 70+ markets via bank accounts, wallets, and cards.

🇱🇰 Pine Labs expands its footprint in Sri Lanka by deploying an API-first Card Issuing and Processing Platform for Pan Asia Bank. Under this partnership, Pine Labs will deploy a full-stack Credit Card Management System for Pan Asia Bank. This platform will support high transaction concurrency and uptime, giving the bank flexible and scalable product configurations.

DIGITAL BANKING NEWS

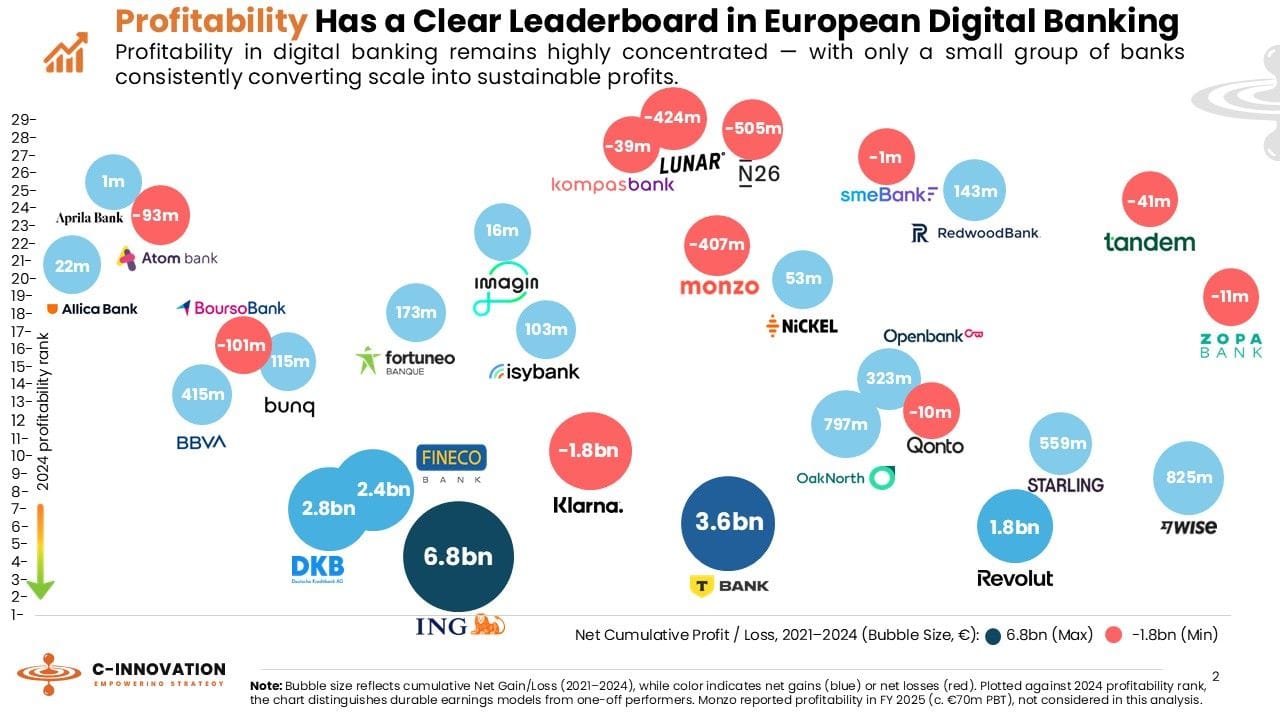

🇪🇺 Profitability in European digital banking is not evenly distributed.

🇵🇹 Bison Bank advances with first Portuguese stablecoin. Bison Bank plans to issue Portugal’s first bank-backed stablecoin, expand asset tokenization, and become the country’s first cryptobank, enabled by the EU’s MiCA framework. The bank aims to launch the services in the first half of the year, according to CEO António Henriques.

🇩🇪 Vivid Money just hit its biggest milestone so far: 100,000 SMB customers in less than two years. Alexander Emeshev, CEO of Vivid Money, said the company has shifted strategy from aggressive consumer marketing to a full focus on business clients after rapid early growth and $200 million in funding from investors.

BLOCKCHAIN/CRYPTO NEWS

🌍 Circle expands USDC payments network to Europe and India. The company announced that EU and India payouts are now live through a partnership with Saber Money. The new corridors allow businesses and users to settle locally without navigating multiple integrations or complex banking arrangements.

🇬🇧 Coinbase ‘everything’s fine’ crypto ad banned by watchdog. Coinbase has had a cryptocurrency advertising campaign banned by the UK’s Advertising Standards Authority. The ads, which used satire to link crypto to cost-of-living pressures, were found to misleadingly imply digital assets could offer a solution, and have been ordered not to appear again.

🌍 OKX Card launches in Europe to remove friction from everyday crypto payments at retailers worldwide. The OKX Card enables direct stablecoin payments anywhere in the world where Mastercard is accepted, with zero fees and instant crypto rewards of up to 20% on eligible purchases.

🇺🇸 Ripple moves into corporate finance. Following Ripple's acquisition of GTreasury, we're proud to introduce Ripple Treasury, Powered by GTreasury: a unified platform that gives CFOs, Treasurers, and Accounting teams complete control over both traditional and digital treasury operations.

🇺🇸 Gemini unveils Gemini Credit Card, Zcash Edition. Zcash Edition allows users to endorse the Zcash ecosystem. Customers can stack Zcash, an established privacy-focused token that’s gained notoriety for offering users the ability to send shielded crypto transfers.

🇺🇸 KRAKacquisition Corp announces pricing of Upsized $300,000,000 IPO. The units will be listed on the Nasdaq Global Market in the United States and trade under the ticker symbol “KRAQU” beginning on January 28, 2026. Read more

🇺🇸 Kraken introduced DeFi Earn experience powered by Ink on January 26, enabling users to access decentralized finance yields of up to 8% APY through three automated vault strategies without seed phrases or manual transactions. Users can deposit cash or stablecoins into Balanced, High, or Advanced vaults.

🇫🇷 Stablecoin player Fipto achieves dual authorisation status. This dual-authorisation status allows Fipto to manage the entire payment value chain, bridging the gap between traditional fiat currencies and digital assets under a single compliance framework.

PARTNERSHIPS

🌍 Upvest partners with Boerse Stuttgart to bring securitised derivatives trading to financial institutions across Europe. Through this partnership, Upvest significantly reduces the time and complexity required for financial institutions to launch securitised derivatives trading.

🇲🇾 Razorpay Curlec brings PayPal Payments to Malaysian SMEs, expanding international payments through a single platform. The integration allows merchants using Razorpay Curlec to accept cross-border payments via PayPal alongside local payment options already available on the platform.

🇺🇸 Elavon is collaborating with Microsoft to introduce Elavon Live Payments. Elavon Live Payments enables businesses and professional service providers to securely send invoices and collect customer payments with just a few clicks on a computer or mobile device.

🇳🇱 Plumery and Lokalise partner to embed enterprise-grade localisation functionality, including translation and market adaptation, directly into digital banking experiences. This will enable financial institutions to deliver hyper-localised experiences at scale, improving accessibility, engagement, compliance, and customer satisfaction.

DONEDEAL FUNDING NEWS

🇪🇬 Valu secures $64m credit line from National Bank of Egypt. The new facility will support Valu’s growth plans and follow its recent market entry into Jordan. The company said the funding will provide additional liquidity to scale operations and expand its product offering.

🇸🇦 NowPay secures $20m Tas'heel investment to launch Saudi JV NowAccess. The new capital will be used to support NowAccess in its market-entry phase through to its launch, creating a Saudi-based engineering and operations team, and the development of localised products.

🇬🇧 Sokin secures $100m in growth financing from Oxford Finance. The facility will accelerate Sokin's expansion across North America, Asia, the Middle East, and South America, and fast-track the acquisition of further regional licenses, banking partnerships, and global infrastructure scaling.

🌍 Ex-Revolut duo Joao Alves and Guilherme Gomes raise $6 million seed round to expand on-chain finance app Bleap. The company plans to deploy the fresh capital toward yield vaults, on-chain trading expansion, and growth across Latin America and Europe.

M&A

🇬🇧 Scoro acquires expense management FinTech Envoice. Scoro says this integration will make it significantly easier to capture accurate cost data through its professional services automation platform, which consolidates estimating, resourcing, project tracking, billing, and reporting functions for project managers.

🇺🇸 Prosperity Bancshares to acquire Stellar Bancorp in $2 billion deal. The transaction, combining cash and Prosperity shares, significantly expands Prosperity’s presence in the Houston market. Continue reading

MOVERS AND SHAKERS

🇦🇹 Bitget taps ex-Bitpanda Legal Chief Oliver Stauber to build Vienna MiCA hub. Stauber said the exchange expects MiCA approval in the second quarter of 2026 and will not serve EEA users until authorized, with strict IP and KYC controls to ring-fence EU customers and tighter token listing standards aligned with MiCA requirements.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()