SoFi Scores with Stellar Earnings and NBA Sponsorship

Welcome to today's edition of my newsletter!

In recent news, SoFi Technologies has made a remarkable surge, following an outstanding fourth-quarter earnings report that far exceeded the high expectations set by analysts. With Wall Street predicting a break-even point at $0.00 per share for Q4 GAAP earnings, SoFi Technologies took the financial community by surprise by posting a GAAP net income of $48 million, or $0.02 per share.

This achievement not only underscores the company's robust financial performance but also its potential for future growth.

Adding to the excitement, SoFi Technologies has recently announced its sponsorship of the NBA, a move that resonates deeply with me as it brings together two of my greatest interests: sports and FinTech.

This announcement is reminiscent of the synergy created by Nubank's sponsorship of a cycling team, highlighting the increasing trend of FinTech companies venturing into sports sponsorships.

But what drives FinTech firms to sponsor sports teams? To shed light on this intriguing question, I've penned a blog post that delves into the reasons behind these partnerships.

I'm eager to hear about your favorite FinTech sports sponsorships. Share your thoughts in the comments section below 👇.

In addition to these highlights, I've compiled more updates from the global FinTech industry for your perusal. Stay tuned for more insights, and I look forward to reconnecting with you in tomorrow's newsletter!

Cheers,

#FINTECHREPORT

Payment Orchestration Platform Market Forecasted to Accomplish USD 5.35 Bn by 2030.

INSIGHTS

🇺🇸 A Y Combinator-backed startup called Cambio is bringing AI to the banking world in a surprising way: It’s putting AI bots on the phone with companies and consumers. The startup began by offering an AI-powered service that negotiated debt collections on behalf of consumers.

FINTECH NEWS

🇺🇸 Neobank Dave joins the American Fintech Council. Dave joins a diverse group of AFC members to progress fintech innovation, focusing on creating inclusive digital banking services and products for consumers not well-served by incumbent banks. Read more

🇺🇸 Blue Ocean Technologies & DriveWealth announce connectivity partnership expanding geographic reach & trading services. DriveWealth will provide its global B2B partners extended real-time access to equities trading and trading data on the Blue Ocean ATS platform from 8 p.m. - 4 a.m., US ET.

Toss, a banking platform operated by South Korea’s Viva Republica Inc., is seeing a huge demand in its currency exchange service, with the amount exchanged in Japanese yen recording 2.3 times higher than that at the five major commercial banks in the last three weeks.

🇮🇳 Paytm says its QR codes will continue to function as usual, merchants don't need to look for alternatives. Despite the RBI's directive to Paytm Payments Bank to halt deposits or top-ups in customer accounts after February 29, Paytm assures that its payment devices, including Paytm Soundbox and card machines, will also remain operational.

🇺🇸 Amsterdam-based financial tech company Adyen in talks for large S.F. office lease in former Pinterest building. Adyen is slated to scoop up a sizable chunk of office space in San Francisco, two individuals with direct knowledge of the deal have confirmed. Read full article

🇩🇪 Germany's largest automotive marketplace mobile.de has appointed Mangopay, a modular and flexible payment infrastructure provider for marketplaces and platforms, to launch a tailored payment solution for its end users. Thanks to the new partnership, consumers on mobile.de can now securely pay or receive payments for their vehicles within the marketplace.

🇺🇸 Earnest and FinWise Bank announce strategic partnership. This collaboration supports Earnest’s ongoing commitment to provide innovative and impactful products that help students and their families pay for college when federal aid is insufficient.

🇦🇪 Jaywan, a new domestic payment card built on Indias digital RuPay credit and debit card stack has been launched in UAE. The payment card was unveiled by Indian Prime Minister Narendra Modi and President Sheikh Mohammed. The debut comes after the two nations signed a number of bilateral agreements among them, the connecting of rapid payment services.

🇵🇰 Mastercard expands partnership with Bank of Punjab to redefine digital payments for Pakistan’s commercial segment. BOP will become the first bank in Pakistan to issue Mastercard BusinessCards® for SMEs, offering a range of solutions designed to cater to the country’s 5.2 million-strong SME market.

After success with Swedish merchants Klarna has launched “Sign in with Klarna” to offer consumers a smoother shopping experience with increased control over their own data in the US 🇺🇸 and 22 other countries: The service saves time for consumers by fast-tracking the online purchase process and, if they consent to sharing their data, unlocks personalised offers from merchants.

PAYMENTS NEWS

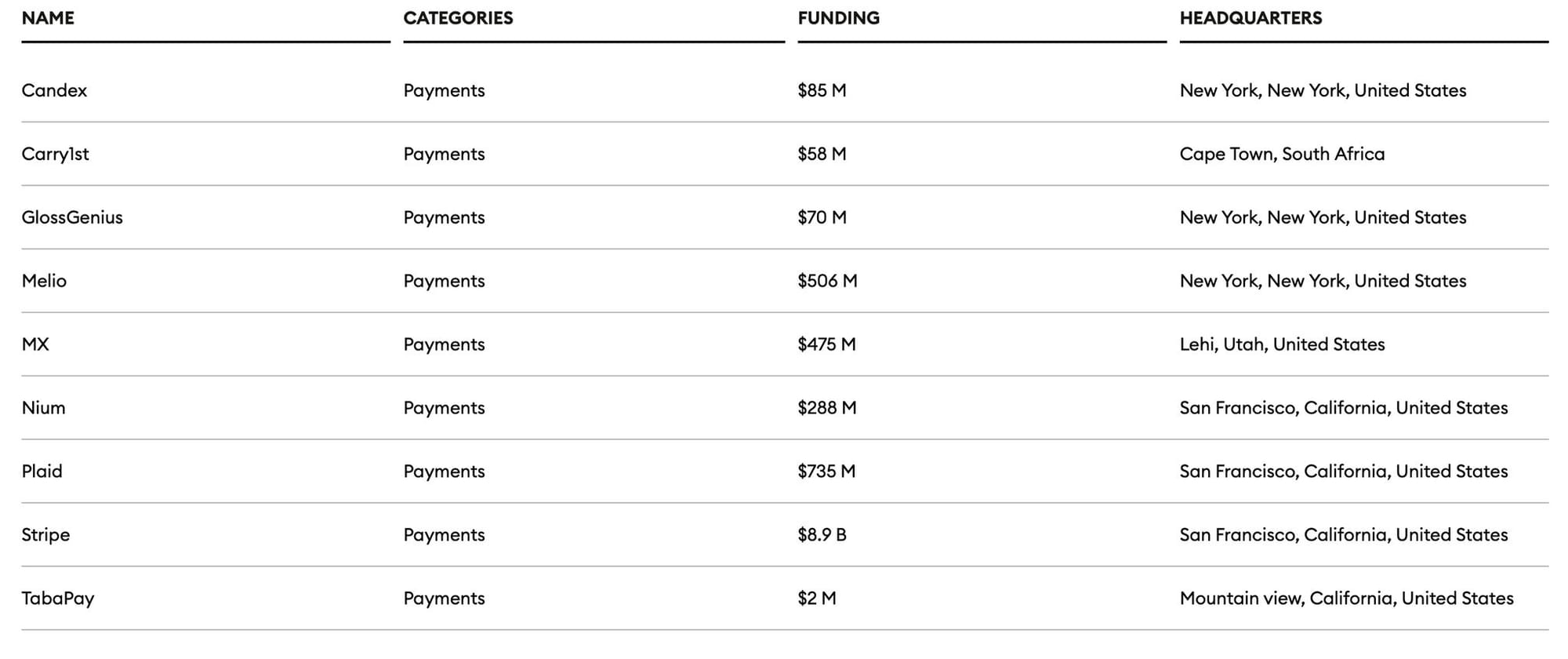

Here are the listed Payments companies in the Forbes Fintech 50 for 2024👇

Huge congrats to:

🇺🇸 New York imposes new limits on credit card surcharges. New York state has begun requiring merchants to provide greater transparency about credit card fees. A state law that went into effect Feb. 11 limits credit card surcharges to the amount charged to the business by the card company.

ACI Worldwide and RYVYL EU power merchant payments in Central Eastern Europe. RYVYL EU will board its eCommerce merchants and PSP customers onto the award-winning ACI Payments Orchestration Platform, enabling them to orchestrate payments using one solution, one platform and one API integration for optimal conversion rates at minimal operation costs.

OPEN BANKING NEWS

🇺🇸 Radial introduces Pay by Bank payment solution powered by Link Money. Radial is partnering with Link Money to introduce a cutting-edge payment solution that offers a more efficient, secure, and cost-effective payment method. Read more

🇺🇸 FIS widens access to open banking through collaboration with Banked. Pay-by-bank solutions simplify payments by combining the benefits of real-time payment rails with the flexibility and efficiency of open banking, where third-party financial service providers have direct access to banking data to complete digital payments.

REGTECH NEWS

🇺🇸 Digital onboarding infrastructure provider Signzy has announced the launch of a new product feature, One-Touch Know Your Customer (KYC). The One-Touch KYC intends to enhance the efficiency of the user experience and the accuracy of results to increase customer conversions for previously slow and complex processes.

DIGITAL BANKING NEWS

🇺🇸 Grasshopper picks Greenlite AI-enhanced due diligence suite. This strategic collaboration furthers both companies’ missions of bridging connections across the financial technology (fintech) ecosystem and driving AI investments. More on that here

🇺🇸 American Express selects Atleos’ Allpoint ATM Network for business and consumer checking accounts. By leveraging the Allpoint network, Amex will enable its business and consumer checking customers to access more than 40,000 surcharge-free ATMs in the U.S. located in trusted retail locations where they live, work, shop and travel.

Akoni Hub, ekko and BLME launch 'Planet Saver' savings account, a product for savers who want to put the world first when making decisions about their financial futures and allowing them to create a positive environmental impact. Learn more

🇬🇧 Monzo reaches nine million customer milestone. Monzo is the UK’s largest digital bank and the 7th biggest retail bank in the UK by customer numbers, capturing 1 in 7 adults and 1 in 16 businesses. After years of losses, the bank is expecting to finally hit profitability this year.

BLOCKCHAIN/CRYPTO NEWS

Former Binance CEO Changpeng Zhao’s sentencing on money laundering charges was delayed until April, according to a court notice.The delay pushes Zhao’s sentencing back two months. He originally was set to be sentenced on Feb. 23 after pleading guilty to the charges late last year. The former executive, per sentencing guidelines, is expected to face around 18 months in prison.

DONEDEAL FUNDING NEWS

European FinTechs raised a combined $104.8bn between January 2019 and December 2023:

🇺🇸 Fordefi raises $10M to make crypto safer with institutional-grade wallet to retail-facing platforms. Fordefi aims to make crypto safer with its self-custodial wallet with multi-party computation (MPC) that divides a single private key among multiple parties, eliminating a single point of failure.

🇺🇸 FinTech firm LoanStar Technologies has reached an agreement to raise around US$28 million in growth equity from a group of strategic investors. Founded by Andy Turner and Craig Haynes in 2015, LoanStar Technologies stands out as a pioneering force in banking technology, focusing on embedded lending.

🇺🇸 Anatomy unveils AI-powered financial automation for healthcare organizations. The company uses AI to automate the healthcare back-office by linking bank, claims, and accounting data to provide real-time financial insights and automated reconciliation.

M&A

🇬🇧 Virgin Money acquires abrdn's stake in joint venture wealth platform. Launched in April last year, the direct-to-consumer (D2C) platform provides both first time and experienced investors with online and mobile access to a range of three investment funds to choose from, within an ISA or GIA.

🇺🇸 Ripple has agreed to acquire Standard Custody & Trust Company, an enterprise-grade regulated platform for digital assets. The move underscores Ripple's commitment to regulatory compliance and enables the company to expand beyond its primary payments network into other blockchain-based financial products for institutional clients.

MOVERS & SHAKERS

🇦🇺 Australian fintech Data Zoo names former London Stock Exchange Group executive Charlie Minutella as new CEO. Minutella brings nearly two decades of experience leading risk, identity, and compliance teams, notably spearheading the Refinitiv risk division at the London Stock Exchange Group (LSEG).

🇺🇸 PayPal’s head of risk and compliance will depart the company after nearly eight years. PayPal said in a regulatory filing Monday that Aaron Karczmer, executive vice president and chief enterprise services officer, would depart April 30. Access full article

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()