Sinpex Raises €10M as KYB Becomes Mission-Critical Ahead of Europe’s AML Reset

Hey FinTech Fanatic!

Sinpex just raised a €10M Series A to scale its AI-powered KYB automation platform.

Europe prepares for a much stricter AML regime coming into force in 2027. The platform unifies the full KYB lifecycle, from onboarding and UBO identification to ongoing reviews and audit-ready reporting.

Sinpex says it reduces business onboarding time by around 80%. Founder and CEO Dr. Camillo Werdich, who started Sinpex after seeing firsthand at Deloitte how existing compliance tools failed banks and compliance teams alike.

His point was clear: KYB is fundamentally harder than KYC, and regulators are now demanding documentary proof, not database lookups.

As enforcement tightens and penalties grow, compliance is no longer a back-office cost. It’s becoming a growth constraint, or a growth enabler, depending on how automated and auditable your stack really is...

Wall Street goes on-chain 👇

The New York Stock Exchange, part of Intercontinental Exchange, is developing a platform for trading and settling tokenized securities on-chain, pending regulatory approvals.

The vision includes 24/7 trading, instant settlement, dollar-denominated orders, and stablecoin-based funding, while preserving traditional shareholder rights like dividends and governance.

As I’ve been following this space closely, after two centuries of shaping market structure, the NYSE is now preparing for a future where capital markets never sleep, and settlement happens on-chain, not days later.

What should you know about FinTech today? Dive into today’s updates 👇 I’ll be back tomorrow with more firsthand stories.

Cheers,

#FINTECHREPORT

📰 Payment analytics: KPIs every merchant should track by Ecommpay. This handbook explains how to use payment data to identify checkout drop-offs, spot underperforming payment methods, improve approval rates, reduce declines, and turn raw data into clear, actionable growth strategies. Download the handbook here

PAYMENTS NEWS

🇪🇺 Revolut to enable frictionless checkout across all agentic commerce platforms for the UK and EEA. This strategic focus will help position Revolut Pay as both the secure, universal, 1-tap payment solution for consumers and a powerful sales booster for Revolut Business merchants in conversational and automated shopping environments.

🇨🇳 China-led cross-border digital currency platform sees surge. According to the Atlantic Council, signaling growing traction for alternatives to dollar-based payment systems. The platform reflects a strategy of building parallel settlement rails that could gradually reduce reliance on the dollar.

DIGITAL BANKING NEWS

🇬🇧 Atom Bank tops £1bn commercial mortgages lending, with balances growing 24% year-on-year in the past 12 months. Atom said the final three months of 2025 saw it set a new record for commercial mortgage offers, which was achieved with a month remaining within the quarter.

🇬🇧 Monzo to give outgoing CEO TS Anil an expanded role after investor backlash. Monzo initially planned for Anil to move into an advisory role and leave the board, but after talks with shareholders, Monzo now intends to keep him on with a broader remit. Additionally, Monzo launches a new tool ahead of the income tax policy shift. The bank said its new, free tool will make following the MTD requirements simpler and more accessible.

🇧🇷 Nubank launches Fee Calculator, a calculator that shows the net value of a sale to the merchant. The digital tool informs entrepreneurs of the real net value they will receive in sales made through the company's payment solutions. The new feature focuses specifically on transactions made via payment link and Tap to Pay.

🇰🇷 Kbank cuts valuation by 20% in third IPO push. According to financial industry sources, Kbank filed a securities registration statement with the Financial Services Commission to officially launch its initial public offering (IPO) process for a listing on the main Kospi market.

🇨🇦 Kuda Bank to launch in Tanzania and Canada. Kuda’s expansion plans follow a strong 2025 performance, marked by significant growth in transactions, savings, and credit usage across its platform. Read more

🇵🇪 Revolut seeks a Peruvian banking license for Latin America expansion. The license would allow Revolut to offer Peruvians a range of localized products and services, giving them greater control over their finances. Revolut sees remittances and multi-currency offerings as a competitive advantage in Peru.

🇸🇸 South Sudan ends cash payments for passports, launches digital system to curb leakages. Under the new setup, applicants pay digitally through an on-site commercial bank, with receipts automatically linked to the immigration system, allowing documents to be processed without staff handling cash.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Crypto derivatives exchange Paradex reports an outage and cancels open orders. According to its public status page, the disruption affected multiple business services, including its user interface, cloud and API services, blockchain components, bridge, block explorer, and remote procedure call proxy.

🇺🇸 The New York Stock Exchange develops a tokenized securities platform. NYSE’s new digital platform will enable tokenized trading experiences, including 24/7 operations, instant settlement, orders sized in dollar amounts, and stablecoin-based funding.

🇵🇪 Bybit Pay brings crypto payments to Peru’s most popular digital wallets, Yape and Plin. This expansion brings real-world crypto payment capabilities to millions of Peruvian digital wallet users, marking another milestone in bridging traditional finance with the digital economy in Latin America.

🇦🇪 Emirates NBD issues $272 million digital bond leveraging DLT. The digital bond will be listed on Nasdaq Dubai, ensuring transparent price discovery, secondary market access, and alignment with international market standards, enhancing investor confidence.

🇰🇾 WalletConnect Pay CEO Jess Houlgrave bets crypto payments can finally scale at checkout. The WalletConnect-Ingenico partnership extends crypto payments into physical retail without forcing merchants to hold digital assets. Watch the full interview

🇮🇳 India proposes BRICS CBDC link-up to streamline cross-border payments. By connecting their CBDCs, these nations aim to make cross-border payments faster and more efficient. This shift could challenge the dominance of the US dollar in international trade and currency exchanges.

PARTNERSHIPS

🇫🇷 Worldline and YouLend launch Cash Advance to unlock fast, seamless capital for Europe’s SMBs. The innovative financing solution is designed to empower small and medium-sized businesses (SMBs) with fast, data-driven access to capital.

🇦🇪 NEO PAY and Wio Bank collaborate to launch PoS lending solution for merchants across the UAE. This partnership between NEO PAY and Wio Bank empowers SMEs with seamless access to funding, enabling them to overcome financial barriers and drive growth.

🇱🇰 Akurateco and Aquanow join forces to power the next generation of crypto payments. This collaboration empowers Akurateco’s clients to access a broader range of crypto payment options and liquidity services, strengthening their ability to operate seamlessly across both traditional and digital financial ecosystems.

🇳🇬 Sterling Bank joins Thunes’ Direct Global Network to transform cross-border payments for Nigerian expatriates. The collaboration means new and existing Sterling Bank account holders can now benefit from seamless, instant cross-border payments.

🇺🇸 Veem and Coins.ph expand partnership for cross-border payments. The collaboration aims to improve the efficiency of corporate payouts and contractor payments by introducing new settlement methods, including stablecoins. Continue reading

🇺🇸 DriveCentric and Dealer Pay announce a strategic partnership to enable payments within the CRM. The partnership is designed to bring payment capability into the natural flow of customer engagement inside the CRM, allowing dealerships to complete the workflow from conversation to revenue without introducing disconnected systems or manual handoffs.

🇸🇩 Network International partners with the Saudi Sudanese Bank to accelerate Digital Transformation in Sudan’s banking sector. Network International will provide Saudi Sudanese Bank with a full suite of end-to-end digital payment processing services, prepaid issuing, and a range of value-added services designed to support the bank’s digital ambitions.

🇺🇸 Gusto and Zerohash pilot stablecoin-based payrolls, aiming to shorten cross-border payroll settlement times from days to minutes. The initiative also comes amid intensified competition among stablecoin issuers and service providers following regulatory developments such as the US GENIUS Act.

🇺🇸 GANA and NexFi unite to revolutionize cross-border finance with PayFi innovation. This partnership signifies a major milestone in making payments globally instant, transparent, and borderless, and will address the inefficiencies that have plagued the conventional way of sending money internationally for many years.

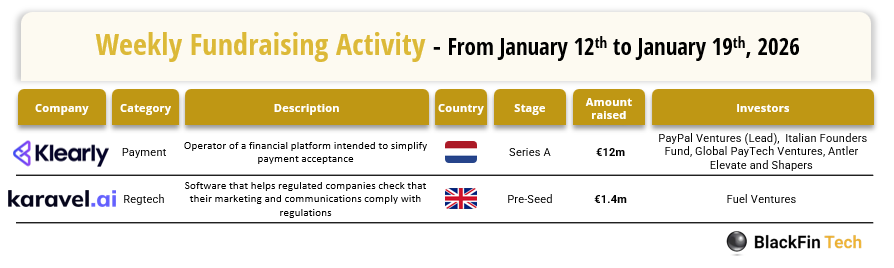

DONEDEAL FUNDING NEWS

💰 Over the last week, there were two FinTech deals in Europe, raising a total of €13.4 million, including one transaction in the Netherlands and one in the UK.

🇸🇬 Sea injects another S$75 million into MariBank amid revenue growth. The latest funding comes as digital lenders across the region place greater emphasis on improving profitability and strengthening customer engagement, following an initial phase of rapid deposit growth.

🇺🇸 Anchorage Digital eyes $400M raise as IPO speculation grows. Crypto bank Anchorage Digital plans to raise between $200 million and $400 million ahead of a possible initial public offering (IPO) expected as early as “next year.” Read more

🇳🇬 Nigerian FinTech Cardtonic secures $2.1m seed funding to launch Pil Business Spending Platform. The new platform provides businesses with labeled multi-card management, live transaction monitoring, and unified spend dashboards, along with multi-currency funding options including naira, cedis, and stablecoins.

🇮🇳 Wealthtech startup AssetPlus raises Rs 175 crore in funding from Nexus VP, existing investors. The Chennai-based startup said the fresh capital will be used to strengthen its technology platform and expand its product offerings. Continue reading

🌍 KYB platform Sinpex secures €10 million Series A. The new capital will be used to accelerate growth, strengthen Sinpex’s position as the category-defining Know Your Business (KYB) automation platform in Europe, and support expansion in key international markets, such as France and the Netherlands.

🇬🇧 Kikin lands $20m debt line for AI-driven SME lending. The facility was arranged via private credit marketplace Percent and will be used to support short-term working capital and invoice financing for consumer-facing SMEs. Keep reading

🇮🇹 CheckSig closes a €3.5 million funding round and aims for international growth. The capital raised will be used to accelerate the company’s growth in Italy and abroad, strengthening its leadership in the European crypto sector. Thanks to the resources raised, CheckSig will be able to accelerate the development of innovative crypto solutions.

🇧🇷 CashU raises $23M for credit fund. CashU will use the funds to originate credit and validate the performance of its proprietary credit models within a regulated environment. Keep reading

MOVERS AND SHAKERS

🇬🇧 eToro Money marketing head James Kassam departs. Kassam joined eToro Money as Head of Marketing in 2022. Before joining eToro, James was Head of Marketing at children-focused banking and savings startup Rooster Money (now owned by NatWest).

🇺🇸 Cetin Duransoy steps down as Raisin US CEO. Announcing his departure, Duransoy writes: "After an incredible almost three years of significant growth in revenue, people, capabilities, and offerings at Raisin US, I will be stepping down as CEO with deep appreciation for everything we’ve accomplished together."

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()