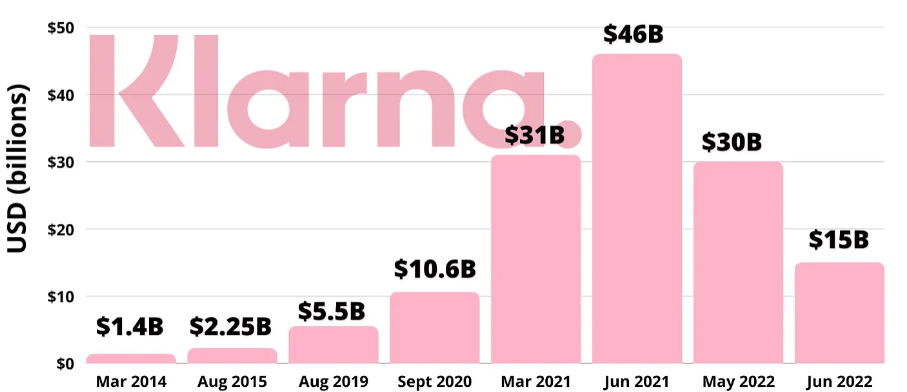

Shareholders Approve Klarna's Path to $20B Stock Market Debut

Klarna, the buy now pay later (BNPL) FinTech giant, has made significant progress towards its anticipated stock market debut, which could value the firm at up to $20 billion (£15.9 billion).

Sources have revealed that Klarna, headquartered in Stockholm, has received approval from both shareholders and regulators to create a new UK-registered holding company.

Investors were notified earlier this week that, as part of the preparations for a high-profile initial public offering (IPO), their shares in Klarna Holding will be exchanged for stock in Klarna Group plc within approximately ten days.

While investment banks have not yet been selected for the New York IPO, insiders suggest that the first quarter of 2025, following the next US presidential election, is the most likely timeframe for the flotation.

Enjoy your day and I'll be back in your inbox tomorrow!

Cheers,

FEATURED NEWS

🇱🇺 Just five months following its strategic launch in the Netherlands, Swan, a leading European FinTech specialized in embedded banking, recently announced its first customers in the Benelux. This milestone underscores the rapid market adoption of Swan's platform within the region’s already well-developed FinTech ecosystem.

FINTECH NEWS

🇺🇸 Ampla, a consumer startup-focused FinTech that has loaned money to buzzy food and beverage brands like Carbone Fine Food pasta sauces and MrBeast-backed snack brand Feastables, is trying to find a buyer after failing to raise a fresh equity round, a person who has participated in deal talks said.

🇸🇰 Klarna arrives in Slovakia with its shopping app and flexible payment services. This launch marks Klarna's expansion into its fifth market in Central and Eastern Europe, following Poland, Czech Republic, Romania, and Hungary.

🇩🇪 Tide goes live in Germany. Tide will gradually offer a full range of other services to members (customers) in Germany, including invoicing, accounting features, and eventually credit. Customer deposits are protected by the European deposit protection scheme, covering up to €100,000.

🇺🇸 Gen Z loves generative AI-powered customer service chat: Affirm CEO. Max Levchin, CEO of the BNPL lender, said recent tests show young adults prefer interacting with intelligent chatbots over phone-based agents, but the company doesn't foresee major cost savings from generative AI for a few more years.

🇨🇦 Toronto Startup Keypr is transforming Canadian real estate and saving buyers up to 80% on commission fees. Keypr, an online tool for bidding, negotiating and purchasing a home raised an undisclosed amount and launched in Toronto. Read the full piece here

🇪🇺 Wirex chooses Openpayd to launch embedded accounts across the UK and EEA. The partnership will see OpenPayd issue virtual IBANs to Wirex customers in 30+ countries across the UK and EEA. Customers will access Faster Payments in the UK and SEPA Instant payments for Euro deposits and withdrawals.

The rapid evolution of payments in Latin America. Cash is no longer Latin Americans’ preferred way to pay, as debit cards, credit cards, and mobile payments have gained fans, presenting opportunities for financial services companies.

PAYMENTS NEWS

🇺🇸 Checkout.com 's Head of US Commercial, Jim Cho spoke to American Banker about the issues that the payment processing industry faces in an increasingly digital age, and how we're using AI to boost acceptance rates and optimize costs for merchants.

🇸🇬 XREX Singapore, a blockchain-enabled financial institution specialising in cross-border payments in emerging markets, announced today that it has obtained the Major Payment Institution (MPI) Licence from the Monetary Authority of Singapore (MAS), the nation's central bank and financial regulator. This comes after it received its in-principle approval from the MAS in November last year.

DIGITAL BANKING NEWS

🇬🇧 BKN301 Group unveils Baas Orchestrator platform. The cutting-edge platform seeks to empower businesses of all sizes, particularly FinTech companies and traditional banks, with the capability to incorporate financial features into their existing value propositions.

🇬🇧 HSBC adds savings tool to mobile app in the UK to help customers identify, plan and manage their saving goals. The 'Savings Goal' tool lets users choose from a list of short to medium term goals including travel, a new car or new business venture - and set the due date and amount target.

DONEDEAL FUNDING NEWS

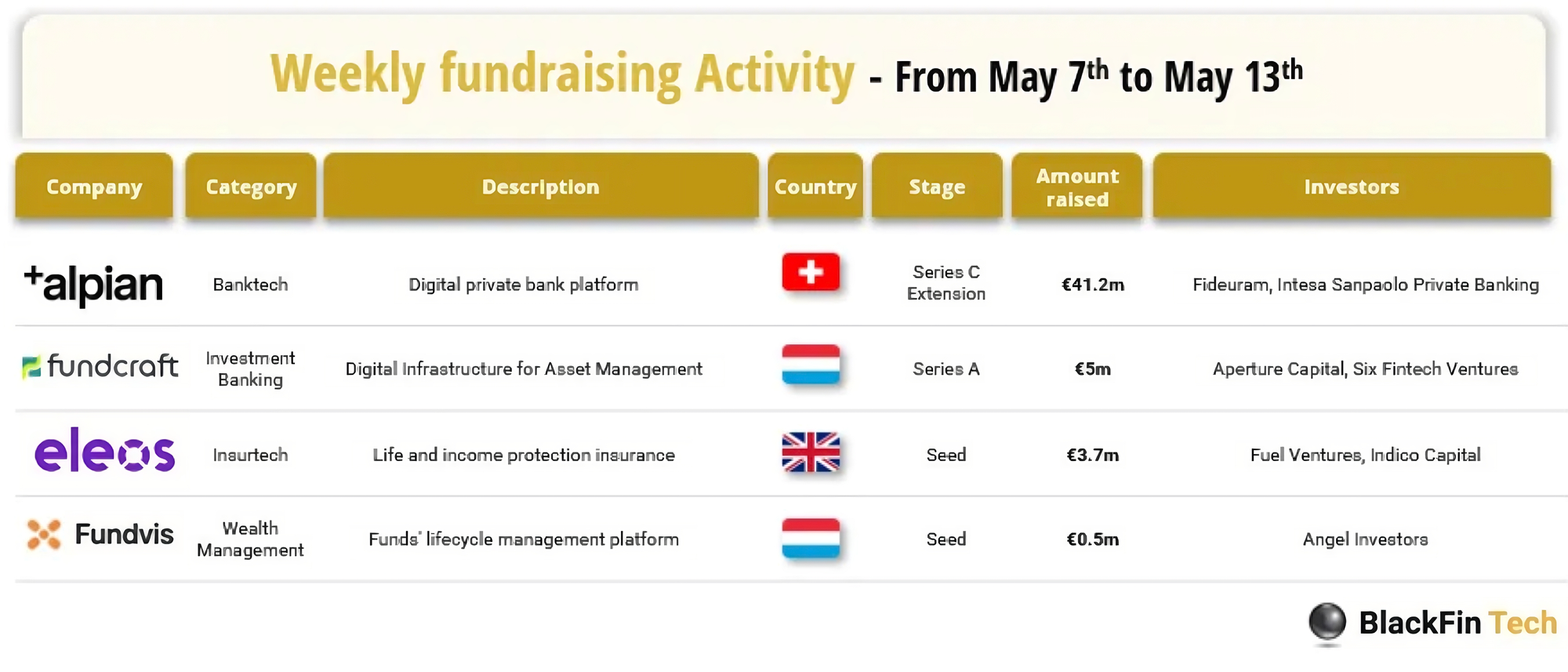

Last week we saw 4 official FinTech deals in Europe for a total amount of €50.4m raised with 2 deals in Luxembourg, 1 in Switzerland, and 1 in the UK. Check out the complete BlackFin Tech article

🇺🇸 Klarna, the BNPL finance giant, has cleared a crucial hurdle on its journey towards a stock market flotation expected to value it at as much as $𝟮𝟬𝗯𝗻 (£15.9bn). Klarna, which is setting up a new UK-based holding company, is now zeroing in on a New York listing early next year, Sky News understands.

🇲🇽 Mexico-based FinTech platform Aplazo secures $70 Million in equity funding. Aplazo, an omni-channel payment platform that offers flexible payment solutions and commerce enablement tools, announced today the closing of $70 million of additional equity financing, including a $45 million Series B.

🇸🇪 Grasp, one of the world’s first AI assistants for investment banks and management consultants, is issuing new shares worth USD 1.9 million (SEK 20 million) to Yanno Capital and Philian Invest. Together, they have acquired an ownership stake of just under 13%.

🇺🇸 Plenty, a San Francisco, CA-based provider of a wealth-building platform that helps couples invest and plan for their future, raised $5M in funding. The company intends to use the funds to expand operations and its development efforts. Keep reading

🇦🇪 Dubai’s Lune raises $1.5 million seed to supercharge financial apps with data enrichment and money management tools. This funding will propel Lune’s regional expansion, product development, and mission to revolutionize the financial services landscape.

🇦🇺 Data Zoo closes $22.7m Series A. The provider of global identity verification solutions, announced approximately $22.7M (AU$35M) in Series A funding from Ellerston JAADE, an Ellerston Capital fund. The raise will help Data Zoo drive adoption and innovation of its identity verification software.

🇪🇸 Check, a Tenerife-based startup specializing in QR-based Order&Pay technology, has secured €624,000 in a new funding round. This investment underscores the project’s considerable potential and supports Check’s strategic growth.

MOVERS & SHAKERS

🇺🇸 Stripe product head Delia Pawelke joined Bank of America last week, as an MD in payments and US banking risk in New York. This marks Pawelke's return to banking, having spent five years at JPMorgan previously.

🇺🇸 AdvicePay names head of customer success as new president. AdvicePay has promoted Kelsey Lewis as president of the leading payment processing technology platform for advisors. More on that here

🇸🇬 MoneyHero appoints Hao Qian Chief Financial Officer. Former finance executive with Alibaba, Amazon, and Credit Suisse named MoneyHero’s permanent CFO. Mr. Qian will play a key role in strategic finance initiatives, and will be based at MoneyHero’s HQ in Singapore.

🇬🇧 Freetrade, Britain’s answer to Robinhood, says its CEO is stepping down. Co-founder Adam Dodds, will step down as CEO. He'll retain his position as the largest individual shareholder in Freetrade, with about a 12% stake, according to company filings.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()