SEC Cracks Down on NFTs: OpenSea Faces Potential Lawsuit

Hey FinTech Fanatic!

The SEC has targeted OpenSea, a leading NFT marketplace, with potential litigation, alleging that some NFTs on the platform may be unregistered securities. OpenSea’s CEO, Devin Finzer, confirmed receiving a Wells notice, a precursor to enforcement action.

This move is part of the SEC’s broader crackdown on the crypto industry, following actions against companies like Coinbase and Binance. The situation has raised concerns within the crypto community, with parallels drawn to the SEC’s past cases against NFT issuers.

OpenSea has pledged $5 million for legal defense for affected NFT creators.

To be continued...

Have a great weekend!

Cheers,

ARTICLE OF THE DAY

Alex Immerman & Justin Kahl from Andreessen Horowitz explain: 👇

FEATURED NEWS

🇨🇴 Mexican FinTech startup Stori said it plans to spend $𝟭𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 on its expansion into Colombia over the next three years. Stori, which provides payment cards and high-interest deposit accounts focusing on the underbanked population, will offer credit lines starting at 200,000 pesos ($50) to Colombian users with or without a credit history, the company said Thursday in a statement. The firm also announced that it appointed Carlos Ayalde to lead its Colombia venture.

FINTECH NEWS

🇬🇧 Lemon and Wiserfunding partner to accelerate lending decisions for SMBs. Through this partnership, Lemon will integrate WiserFunding’s advanced data analytics into its platform, enabling the pre-screening of prospective borrowers.

🇺🇸 WebBank to serve as Sezzle’s exclusive bank. Buy now, pay later (BNPL) firm Sezzle plans to have WebBank serve as its exclusive bank to originate and finance products offered through the Sezzle platform, including its Pay-in-2 and Pay-in-4 products.

🇬🇧 Australian-owned FinTech company HALO to establish Glasgow base. The project is expected to cost in the region of £8 million and is being supported by £800,000 of grant funding as a contribution from Scottish Enterprise.

🇸🇪 Swedish investment platform SAVR speeds up payments on its cutting-edge investment platform with Brite Payments. With Brite Instant Payments, SAVR’s customers can authenticate larger transfers using BankID, reducing manual data entry and speeding up payment completion.

🇮🇳 The Reserve Bank of India on Wednesday granted "self-regulatory organisation" status to FinTech Association For Consumer Empowerment (FACE) to help ensure statutory and regulatory compliance in the financial technology (FinTech) sector.

PAYMENTS NEWS

🇮🇳 Mastercard selects India for the global launch of its Payment Passkey Service (which speeds up transactions using biometrics). During a keynote presentation at Global FinTech Fest in Mumbai, Mastercard announced the worldwide launch of its new Payment Passkey Service to make online shopping more secure and easier than ever.

🇺🇸 PayPal expands strategic partnership with Fiserv to streamline checkout experiences (including Fastlane) in the U.S. The expanded relationship simplifies how Fiserv clients enable PayPal, Venmo and related services, and provides these businesses with a simple connection point to Fastlane by PayPal to accelerate guest checkout flows in the U.S.

🇮🇳 Pine Labs & Visa launch soundbox device for QR payments in India. The partnership aims to upgrade the in-store payment experience of millions of merchants across the country who currently rely on only printed QR codes or low-tech solutions.

🇬🇧 CAB Payments partners with Visa to strengthen services in emerging markets. This collaboration is expected to significantly benefit sectors like remittances and charitable donations, particularly in regions with underdeveloped financial infrastructure.

🇬🇧 Numeral and HSBC Innovation Banking collaborate to empower innovative companies with embedded payments, announcing Qover as a joint customer. The offering is available to companies who are both a Numeral and HSBC Innovation Banking UK client.

🇧🇷 Nubank and 99 announce a strategic partnership to implement NuPay as a payment method for rides in the app. The solution will be exclusively available to the Nubank customer base in the coming weeks. Nu customers can enable the payment feature in the 99 app by registering NuPay just once.

🇳🇱 Silverflow powers up POS provider Halo Dot. The partnership will create a solution for clients to launch their own SoftPOS offerings with a pre-integrated solution significantly reducing time-to-market. Both companies share a tech-first DNA, driving innovation and efficiency in the payments industry.

🇺🇸 emerchantpay and Novalnet AG expand successful European partnership to the US market. This partnership aims to enhance Novalnet's capabilities and maximise its merchant growth across the US by facilitating payment acceptance with our innovative payment solutions.

🇮🇳 PayMate partners with NBBL to launch BBPS-B2B platform. The platform seeks to enable large-scale digitization of commercial processes related to invoicing, payments, and collections across India while fostering an interoperable ecosystem between buyers and suppliers.

🇮🇳 OPEN partners with NPCI Bharat BillPay Limited to Launch Bharat BillPay for Business. With this partnership, OPEN has become one of the first Indian FinTechs to offer Bharat Billpay for businesses, streamlining business-to-business (B2B) payments for over 40 lakh businesses using the Open Money platform.

🇺🇾 Dlocal partners with Grey to drive expansion into new emerging markets. Through the partnership with dLocal, Grey will provide cross-border payouts to wallets and bank accounts, expanding its services into new markets such as Brazil, Indonesia, Mexico, the Philippines, and South Africa.

OPEN BANKING NEWS

🇬🇧 Real-time credit reference agency AperiData has become an Open Banking provider to be listed as a supplier on CCS’ Open Banking Dynamic Purchasing System (DPS). The firm represents the latest Open Banking provider that has been listed as a supplier on the Crown Commercial Service (CCS) Open Banking DPS.

DIGITAL BANKING NEWS

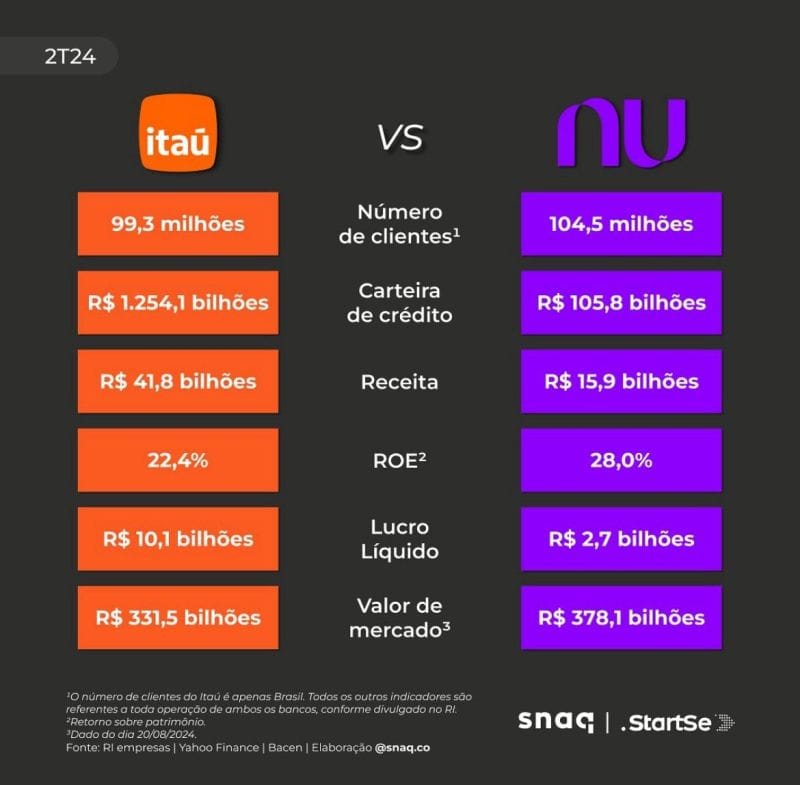

🇧🇷 Nubank has surpassed Itaú in the number of customers and market value, but it is still far from exceeding its profit and revenue.

🇳🇱 bunch embeds banking with Swan to deliver superior investor experience. With the bunch platform, funds and private investors in Germany, UK and the Netherlands, can operate more efficiently, scale more rapidly, and foster stronger relationships with LPs and other stakeholders.

🇺🇸 Greenlight CEO talks about partnerships, forthcoming features. Going beyond its banking scope, the FinTech that caters to parents and kids sees safety as an area of continued opportunity, said CEO and co-founder Tim Sheehan. Dive into the insights shared in this conversation

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 OpenSea NFT marketplace targeted by SEC in potential securities case. OpenSea, one of the world’s largest marketplaces for NFTs, said on Wednesday that it was subject to pending litigation from the US Securities and Exchange Commission. “OpenSea has received a Wells notice from the SEC threatening to sue us because they believe NFTs on our platform are securities,” co-founder and CEO Devin Finzer wrote on X.

🇺🇸 Crypto.com adds PayPal as payment method. Users in the U.S. can now transfer funds from PayPal to Crypto.com to buy crypto tokens available in their market. This feature will soon be available in additional markets beyond the U.S. Read on

🇸🇬 Unlimit partners with Alchemy Pay to streamline fiat-to-crypto purchases worldwide. Through this partnership, Alchemy Pay will streamline settlements and offer a wide range of global and local payment methods, including Visa, Mastercard, SEPA, and Google Pay, to consumers worldwide, guaranteeing a high level of security and service for individuals.

DONEDEAL FUNDING NEWS

🇪🇨 Mercately raises a $2.6M seed round. Mercately is a B2B software that builds the infrastructure brands need to sell directly on WhatsApp. The company integrates with platforms like Stripe and HubSpot and uses AI agents to help brands communicate with customers, check inventory, take payments and create purchase orders without the customer having to leave WhatsApp.

🇺🇿 TBC Bank Uzbekistan secures $25m from Swiss investor BlueOrchard. These funds will be dedicated to further expanding TBC UZ’s ecosystem. This will contribute to the ongoing growth of the digital bank’s loan portfolio and promote financial inclusion in Uzbekistan, Central Asia’s largest country by population.

🇺🇸 Parafin closes $93M debt facility with Jefferies and Trinity Capital Inc. The financial infrastructure company uses machine learning to develop their unique, robust underwriting model that includes over a billion data inputs from every industry vertical.

🇿🇦 South African FinTech Omnisient raises $7.5 million. The investment from Arise will support Omnisient’s plans to take its technology to markets in Africa, the UK, the USA and the Middle East. Read the complete article

MOVERS & SHAKERS

🇺🇸 Pat Reed has joined VGS as Sr. Director of Account Management. With an impressive background in leading client and partner success teams at Wells Fargo and Discover Financial Services, Pat brings a wealth of experience and a proven track record of driving client satisfaction and business growth.

🇺🇸 Stripe CTO David Singleton to step down after seven years to start own company. The outgoing CTO praised his engineering team’s “tremendous strength”, highlighting the company’s ability to handle over $1 trillion in transactions annually. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()