Robinhood's Global Expansion Starts With A Third Attempt In The UK

TGIF!😉

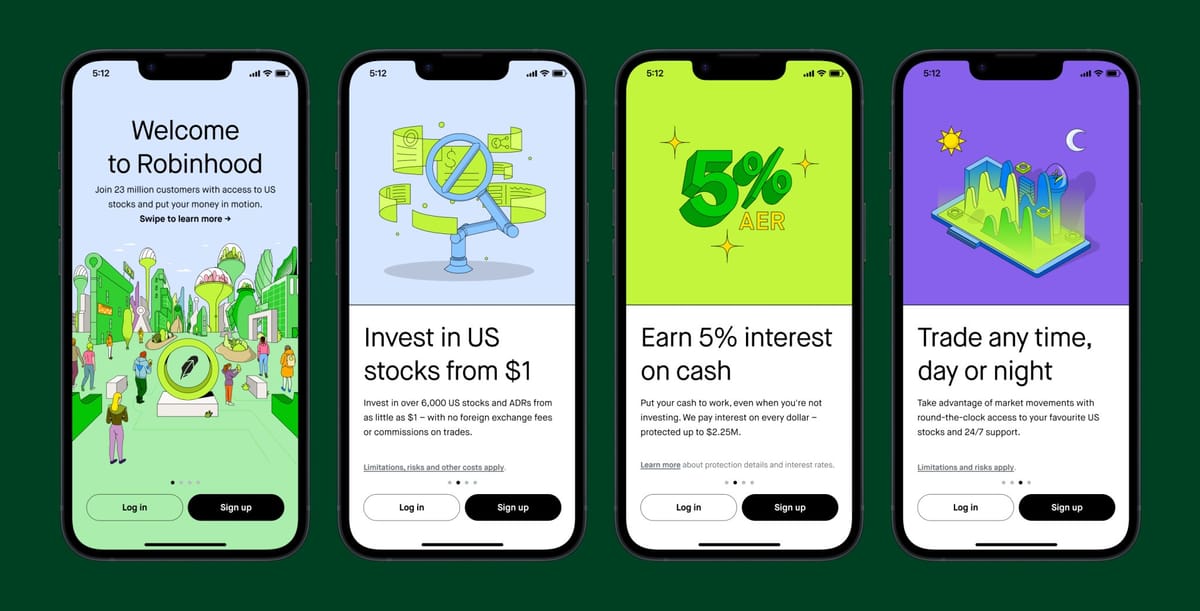

Robinhood is once again setting its sights on the U.K. market, unveiling a new waitlist for British residents. This marks the company's third attempt in four years to establish a foothold in the U.K., reflecting its persistent ambition despite previous setbacks.

In 2020, Robinhood's initial U.K. launch plans were abruptly shelved, and more recently, its ambitions suffered another blow when a proposed acquisition of U.K.-based cryptocurrency company Ziglu fell through earlier this year.

This expansion comes at a time when Robinhood is reevaluating its revenue model. Traditionally, the company has leaned heavily on 'payment for order flow' (PFOF) – a practice where brokers are compensated for directing orders to specific trading firms.

While lucrative, PFOF has been mired in controversy and criticism, leading to scrutiny from regulatory bodies and market observers. Notably, PFOF is prohibited in the U.K., compelling Robinhood to diversify its revenue streams in this new market.

The company's pivot seems timely as net-interest revenues, generated from sources like interest on uninvested cash and margin lending, have begun to surpass income from order-flow payments. This shift indicates a strategic adaptation by Robinhood, aligning its business model with regional regulatory landscapes and evolving market dynamics.

As Robinhood gears up for a 2024 full launch in the U.K., industry watchers will be keen to observe how the company navigates these challenges and whether it can replicate its stateside success in a markedly different regulatory environment.

Jordan Sinclair, who Robinhood hired as its new UK CEO in July this year from Freetrade, told Sifted the platform will look to launch in other European markets over time, but declines to comment on which markets will be first.

Sinclair also declines to comment on whether the fintech is eyeing up any struggling European rivals as potential acquisitions for faster access to these markets.

Enjoy your weekend! But before you do that, check out the curated selection of news I listed for you below👇

Cheers,

POST OF THE DAY

🤔 Digital Wallet Apps: how do they work? Basically there are 3️⃣ distinct groups of B2C wallet apps:

FEATURED NEWS

Enfuce has secured an €8.5 million follow-on investment round led by Vitruvian Partners, with participation from Visa and Maki.vc. This funding positions the company for continued enterprise growth across key European markets and strengthens collaboration with Visa for innovative financial solutions.

#FINTECHREPORT

Unlocking Financial Frontiers in the GCC Region. This white paper delves into the pivotal role of digital transformation in the GCC’s financial sector and offers a comprehensive exploration of the multifaceted realm of Digital Finance. Download and read the complete report here

The Global Payments Report. Consumer interest in alternative credit remains high as BNPL enters 2.0 phase. Let's dive in: The buy now pay later (BNPL) model featured prominently in the news in 2022. Download and read the complete report from FIS for more info.

PODCAST

The Growing Fintech Reckoning. Alex Johnson, creator of the Fintech Takes newsletter, and Jason Mikula are happy to bring the latest episode of their monthly podcast, Fintech Recap, where they unpack some of the biggest stories in fintech, banking, and crypto. Listen to the full podcast here

INSIGHTS

🇬🇧 Amazon becomes number three ad platform for UK e-commerce businesses, moving ahead of TikTok. Research released by Juni reveals that Amazon’s ad share among UK e-commerce businesses jumped from 1.7% in Q2 2023 to 6.1% Q3 2023 - knocking TikTok from third to fourth place.

FINTECH NEWS

🇺🇸 Rapid Finance and Ramp partner to provide SMEs with faster access to capital. With this partnership, small businesses on Ramp have access to more financing options to secure the capital they need to effectively run and grow their operations.

🇩🇪 Female-focused neobroker Fina shuts down after two years. This shutdown is not an isolated incident in this niche market segment. Fina's demise leaves behind a digital ghost town; for weeks now, visitors to its website are greeted with a "404 – Page not found" message.

🇸🇬 Aspire unveils new Singapore HQ, aims to double Fintech workforce by 2025. The company has also set up a new financial technology excellence hub in Singapore that will drive its focus on product development and strategic investments in key areas such as Artificial Intelligence and cybersecurity.

🇨🇦 Nuvei, the Canadian fintech company, announced that it has launched its card issuing solution in 30 markets globally. Nuvei clients can now offer their customers, employees, or contractors physical and virtual white-labelled cards. Read more

🇺🇸 Pinwheel is introducing the next generation of Automated Direct Deposit Switching in partnership with Workday. The partnership is the start of Pinwheel’s creation of a first-of-its-kind network or payroll providers, which will power a frictionless, login-free DDS experience.

PAYMENTS NEWS

🇪🇺 Swift connects instant payment systems to bring 24/7 processing across borders. Swift has connected domestic payment schemes across Europe to provide full transparency and end-to-end tracking for instant cross-border transfers destined for the EU.

REGTECH NEWS

🇬🇧 Lloyds Bank launches in-app passport scanning for customer onboarding. Lloyds Bank customers are the first in the UK enabled to support their bank account application using the chip in their passport. Read more

DIGITAL BANKING NEWS

🇲🇾 Malaysians can now download the GXBank for their first Digibank experience. The digital bank had previously undergone a beta testing phase with 20,000 local users following a successful internal testing with employees and partners. Read more

🇦🇺 Ubank is announcing a new, upcoming app and service features “to help the digital generation reach their financial goals sooner.” Ubank is continuing to serve Australia’s tech-savvy demographic, and provides a completely digital experience.

🇬🇧 Metro Bank to review store opening hours and cut 20% of staff in a bid to slash costs by £50 million per year. Implementation of the cost reduction plan is expected to complete during the Q1 of 2024 and a £10-15 million one-off restructuring charge is expected in 2023, which is lower than previously anticipated.

🇩🇪 Qred expands to Germany with the launch of savings accounts for individuals. Qred is positioning itself to reduce cost of capital and expand its support to small businesses across Europe. At the same time, it continues to report strong growth figures in the recently published interim report.

BLOCKCHAIN/CRYPTO NEWS

Cristiano Ronaldo hit with a $1 billion-plus class action suit over Binance promotion. The suit alleges Ronaldo's endorsement led to loss-making investments, with claimants stating some invested in what the suit terms "unregistered securities" like Binance's BNB token.

DONEDEAL FUNDING NEWS

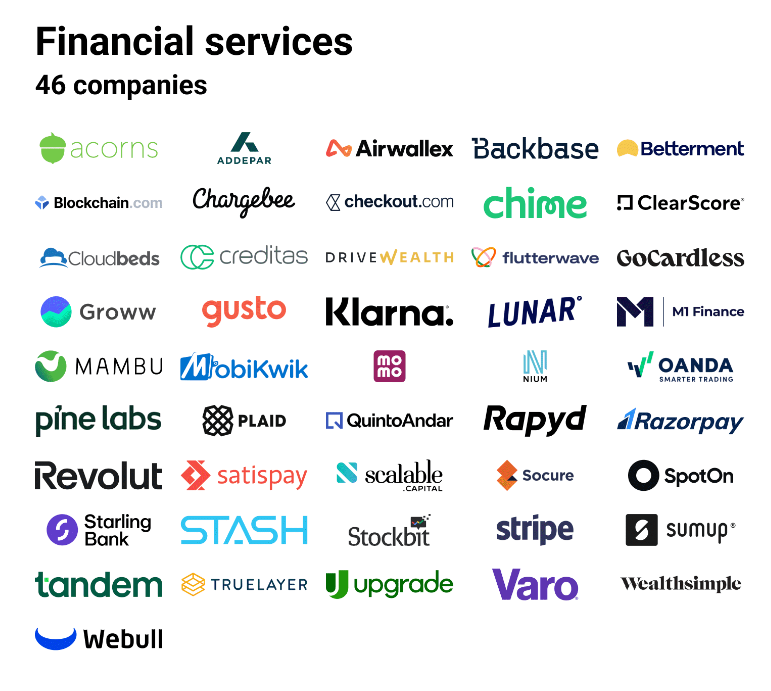

The 2024 FinTech IPO Pipeline Market map of 46 potential IPO candidates👇 Who is missing, and who is going to be first?

Source: CB Insights

🇦🇺 WLTH secures $14 million raise, acquires Mortgage Mart via new strategic alliance to become Australia’s top digital lender. The funds raised via this funding round have in part facilitated WLTH’s acquisition of Mortgage Mart, while bolstering the digital lender’s working capital provisions.

🇩🇪 Banxware raises €15m Series A to close the SME funding gap via embedded lending. The Company undertakes a "slightly reduced" valuation for the financing round. For this, Banxware is bringing a classic financial institution to the side with Unicredit.

M&A

NomuPay acquires Total Processing. Following NomuPay's recent Series A funding, this deal accelerates the Irish company's expansion into Southeast Asia, Europe, Turkey, and the Middle East. More here

MOVERS & SHAKERS

American Express appoints Sharon Chew as Vice President & General Manager of Global Merchant Services Asia. Sharon will be responsible for all aspects of card acceptance, including payments processing, client management, merchant partnerships and the development of new payment technology.

🇬🇧 Former head of Klarna UK Alex Marsh joins Salad Money as a non-executive director. As the company continues to grow, now seemed like the right point on the company’s growth journey to join. Read more

Griffin grows management team. The company announced the addition of seven new senior team members across key areas of the business to reinforce Griffin’s commitment to building the global platform for embedded finance and delivering a world-class banking experience to customers.

Adyen appoints Nicole Olbe from Barclays as UK managing director. She joins Adyen with over twenty years of experience within the financial services sector, covering strategy, solution delivery and commercial management on an international scale.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()