Robinhood to Acquire WonderFi in $179M Deal

Hey FinTech Fanatic!

Robinhood announced its agreement to acquire WonderFi, a Canadian digital asset platform with deep regulatory roots and over C$2.1 billion in assets under custody.

The C$250 million (US$179 million) all-cash deal offers WonderFi shareholders a 41% premium to the last closing price and a 71% premium to the 30-day volume-weighted average. While the numbers tell one part of the story, the broader move reflects a continued trend toward consolidation as digital asset firms seek stability, scale, and local compliance.

With the acquisition, Robinhood will take on Bitbuy and Coinsquare, two of the longest-operating crypto platforms in Canada, and fold them into its expanding international presence. The WonderFi team will remain in place post-close, joining a Canadian base that now includes more than 140 Robinhood employees and an engineering hub in Toronto.

Johann Kerbrat of Robinhood Crypto said, “WonderFi has built a formidable family of brands serving beginner and advanced crypto users alike, making them an ideal partner to accelerate Robinhood’s mission in Canada.”

The deal now heads into regulatory and shareholder review. It comes at a time when the crypto industry is showing renewed momentum, with 2025 already seeing Coinbase agree to acquire Deribit for $2.9 billion and Ripple striking a $1.25 billion deal for prime broker Hidden Road.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

P.S. My friends at Solidgate just opened a key role: VP of Sales – Orchestration. So, if this sounds like you or someone in your network, take a look at the job description. Apply or pass it along. Good luck!

ARTICLE OF THE DAY

🇧🇷 Nubank vs Brazil’s new Central Bank rule. Why Nubank might need a new name:

INSIGHTS

🇳🇱 Powering SaaS growth with embedded payments by Mollie. This report reveals best practices for partnering with payment providers, building a strong value proposition with payments, and rolling them out successfully. Download here

FINTECH NEWS

🇬🇷 JPMorgan to withdraw UK lawsuit against Greek FinTech Viva Wallet. According to legal filings, JPM plans to discontinue its claim in the UK but intends to continue pursuing it in Greece. A JPM spokesperson said: “We have not withdrawn our damages claim for €917m filed in Greece and we do not have any intention to.”

🇺🇸 Hong Kong crypto investor Animoca plans US listing as Trump lures more groups. This regulation of digital assets offers a “unique moment” to enter the world’s largest capital market. The listing was unlikely to depend on market conditions, the Executive Chair, Yat Siu, added.

🇮🇳 Another Indian FinTech unicorn taps bankers for a $400-million IPO. Bengaluru-based Moneyview has appointed Axis Capital, Kotak Mahindra Capital Company, and others for the IPO. Primary capital will make up the majority of the issue.

🇺🇸 Coinbase is joining the S&P 500 days after bitcoin soared past $100,000. To join the S&P 500, a company must have reported a profit in its latest quarter and have a cumulative profit over the four most recent quarters. Last week, it reported net income of $65.6 million, down from $1.18 billion.

🇺🇸 Stripe’s billionaire Collison brothers say remote work solves the ‘two-body problem’ faced by working couples. Stripe has been a rare holdout against a broader remote-work pullback, with an estimated 40% of employees working remotely. Its cofounders have resisted landing firmly on either side of the debate, though, indicating it should be down to the context of each company.

🌍 FinTechs that raked in profits from high interest rates now face a resilience test. This is because higher rates boost what’s called net interest income, or the difference between the rates charged for loans and the interest paid out to savers.

🇬🇧 Treasury holds talks with FinTech unicorns about London IPO prospects. The summit comes amid a desperate quest by the LSE to attract prominent new listings, with leading tech names including Deliveroo and the cybersecurity software group Darktrace both having been the subject of takeover bids.

🇬🇧 UK Trading 212 revenue spikes as profit passes £50m. According to the new accounts, it paid a dividend of £13.6m in 2024 and £4m in March this year. The division earned £150m through investment brokerage services, up from £95.3m, while income from net client interest rose from £8.8m to £11.6m.

🇺🇸 eToro set to go public in key test for IPO market. The IPO is scheduled to price later Tuesday with the company offering 10 million shares at a price range of $46 to $50 each, according to a regulatory filing. Read more

PAYMENTS NEWS

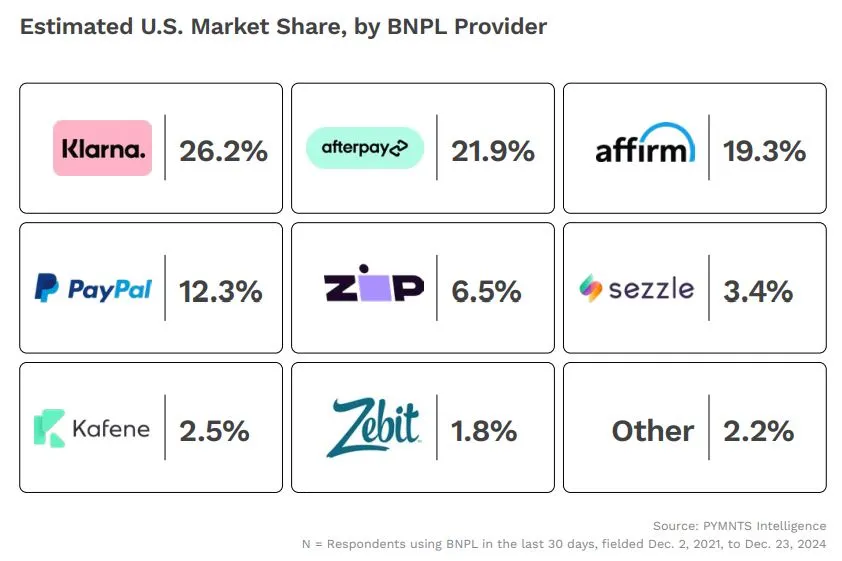

🇺🇸 US BNPL transactions hit $175 billion amid shifting consumer demands. The report, “Pay Later Revolution: Redefining the Credit Economy,” highlights this evolution, detailing an ecosystem where traditional banks, nonbank lenders, and FinTech startups are both competing and collaborating to offer flexible financing solutions.

🇸🇬 American Express cards can be used on public transport. Passengers will be able to use their cards to make contactless payments on public transport from May 15, with the current slate of accepted credit cards expanded. Those using these cards can also add them to their mobile wallets for easier access.

🇺🇸 Tether USDT supply surpasses $150 billion as stablecoins outpace mainstream giants, Visa, and PayPal. Tether described the milestone as the culmination of over a decade of development since its 2014 launch, attributing the growth to global demand for USDT from over 400 million users.

DIGITAL BANKING NEWS

🇧🇷 Neon adopts contactless Pix on Android phones. According to the company, users only need to connect their bank account to Google Pay once. The process is practically identical to paying with cards in your digital wallet: access the feature, use the system's authentication, and place your cell phone near the machine.

🇸🇰 Revolut to offer merchants in Slovakia a new payment terminal. Offering Wi-Fi, a SIM card, and a battery that lasts all day, the Revolu Terminal allows users to accept card payments, mobile wallets, and payments in 19 currencies in seconds. For Revolut, the terminal represents a new source of revenue.

🇺🇸 Chime Enterprise launches PayTV™, providing a purpose-built, real-time employee pay visibility solution for payroll. PayTV offers users visibility and predictive insights into their employees' payment status, eliminating the black box that's traditionally kept payroll teams in the dark and helping prevent potentially costly payroll errors.

🇺🇸 Chime files to go public on the Nasdaq under the ticker ‘CHYM’ as the IPO window reopens. According to the filing, Chime picks up revenue from interchange fees associated with purchases that members make with Chime debit cards and credit cards.

🇺🇸 BofA to open 150 financial centers by 2027, investing over $5 billion in its network since 2016. Bank of America’s continued investment in its financial center network reflects the company’s commitment to meeting clients where they are and how they prefer to bank.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto Giant wants to seize the opportunity for a US IPO. The realization of Coinshares' long-held plans to list its shares on a US stock exchange is now moving closer thanks to more crypto-friendly regulation. The company explained how it is preparing for this when it presented its quarterly figures.

🇪🇺 Vivid secures EU MiCAR license to expand regulated crypto services across Europe. The license makes Vivid one of the few platforms in Europe authorised under the new EU-wide crypto regulation, empowering it to expand its services for both retail and business customers.

🇦🇪 Dubai taps Crypto.com to enable crypto payments for govt services. The partnership will go a long way to achieve its goal of getting 90% of financial transactions fueled by cashless technology by 2026. Keep reading

PARTNERSHIPS

🇪🇺 ClearBank partners with Ozone API to accelerate open banking worldwide. This combination will empower ClearBank’s customers to use open APIs that comply with standards and regulations. They will have the tools to capitalise on the open finance opportunity, offering a scalable and future-proof approach.

🇺🇸 Rollee and AIprise partner to expand access to high-quality Income and Employment data. By naming AIprise as a strategic distributor of its API, the company is strengthening its presence in the U.S. and unlocking new opportunities to serve a broader range of FinTech innovators.

🌍 Adyen and JCB launch Card-on-File Tokenization to enhance payment security. The introduction of COF tokenization will further enhance the security of online payments, providing JCB’s cardholders and merchants with even greater peace of mind and safety.

🇫🇮 Froda and wamo partner to strengthen SME financing in Finland through Card-Based lending and instant loans. The partnership aims to close the SME financing gap by offering fast, flexible financing of up to €200,000 to Finnish businesses, with an ambition to support over 25,000 SMEs and drive nationwide economic growth.

🇺🇸 Bakkt Inks deal with DTR to become a crypto and stablecoin infrastructure provider. A pivotal alliance with Distributed Technologies Research aims to integrate AI and stablecoin payment infrastructure, positioning Bakkt at the forefront of agentic commerce and programmable money, with products expected by Q3 2025.

🌍 Innbucks Microbank selects Mambu to transform into Africa’s Next leading digital bank. The integration of Mambu’s platform will empower InnBucks to innovate faster, reduce operational inefficiencies, and expand its product offerings to meet the diverse needs of its growing customer base as it transitions to a fully digital bank.

🌍 Raiffeisen Bank and Wise Platform are transforming cross-border payments for customers in Central and Eastern Europe. The partnership enables fast, secure, low-cost, and transparent international payments for personal and business customers across the region.

🇺🇸 BitGo and Upexi announce strategic partnership to secure digital asset treasury holdings. By integrating BitGo’s institutional infrastructure, Upexi reinforces its commitment to responsible crypto asset management while capitalizing on the emerging opportunities in decentralized finance.

🇺🇸 Cleo and Paystand team to automate B2B payments. Cleo’s platform automates the creation of sales orders and invoices within customers’ ERP systems, after which Paystand takes over by automating accounts receivable processes through seamless fund reconciliation.

DONEDEAL FUNDING NEWS

🇺🇸 Addepar raises $230 million at $3.25 billion valuation in series G investment round. The proceeds from its Series G financing will primarily be used to provide liquidity to employees and other investors through a tender offer, allowing them to realize the value of their contributions.

🇺🇸 Finance automation startup Hyperbots raises $6.5 million from Arkam Ventures, Athera Venture Partners, others. The funds will support US expansion, new product development, and the launch of HyperLM, its finance-trained proprietary language model.

🇺🇸 FlexPoint raises $12M Series A funding to expand its partner-led B2B payments network. This latest round of funding will enable FlexPoint to double down on product development and further expand its MSP partner program. Continue reading

M&A

🇺🇸 Anchorage Digital to acquire Mountain Protocol. The acquisition will integrate the Mountain Protocol team, technology, and licensing framework into Anchorage Digital to expand Anchorage Digital’s stablecoin capabilities. Read more

🇮🇳 China's Ant Group to sell 4% stake in India's Paytm for $242 million, term sheet shows. Ant, an affiliate of Chinese conglomerate Alibaba Group, will sell the stake at 809.75 rupees per share, a discount of 6.5% to Paytm's closing price on Monday.

🇺🇸 SavvyMoney acquires CreditSnap to boost digital lending and onboarding solutions. The acquisition aims to expand SavvyMoney’s platform capabilities, reinforcing its mission to offer a unified, digital-first financial experience. The move is positioned as a major step in enhancing both companies’ offerings for financial institutions seeking scalable, integrated solutions.

🇨🇦 Robinhood To Acquire WonderFi. This strategic move aims to expand Robinhood's presence in the Canadian crypto market and enhance its international offerings. WonderFi will continue to operate its products after the acquisition closes.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()