Robinhood Steps Into the UAE for MENA Push

Hey FinTech Fanatic!

Robinhood’s expansion is picking up pace: The FinTech has applied to a Category 4 License with the Dubai Financial Services Authority, which would let it serve UAE clients from the Dubai International Financial Centre and reach the wider MENA region.

It’s the next step in its global push, coming after a recent license win and plans to launch in Singapore soon.

Keep scrolling to dive deeper into Robinhood's update and get today’s FinTech dose 👇

See you tomorrow!

Cheers,

INSIGHTS

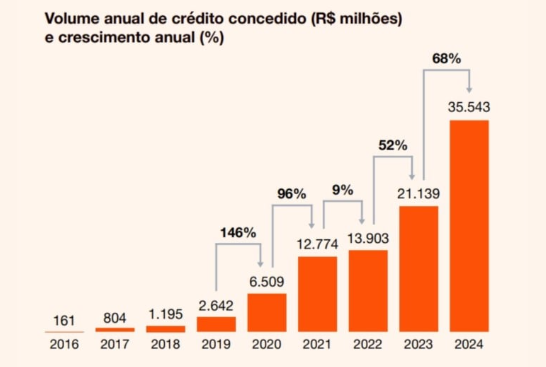

🇧🇷 Credit FinTechs lend R$35.5 billion in 2024; defaults among individuals rise. Despite high interest rates and an uncertain macroeconomic scenario, credit FinTechs in Brazil increased their loan volume in 2024 compared to the previous year. Default rates increased in loans to individuals, but declined in loans to legal entities.

FINTECH NEWS

🌍 The FinTech Running Club has expanded globally, marking a significant evolution from its origins. Originally launched as a casual run in Barcelona in November 2024, the initiative has grown into an international movement, now active in over 15 cities worldwide. It brings together individuals from diverse cultures and backgrounds who share a common interest in both FinTech and outdoor activity.

🇦🇪 Robinhood, applying for a Dubai DFSA license, hires Mario Camara. The company has applied for a Category 4 License from the Dubai Financial Services Authority, which, upon receipt, will enable the broker to commence operations in the UAE and the broader MENA region from its offices in Dubai’s special economic zone, the Dubai International Financial Centre.

PAYMENTS NEWS

🇨🇱 VTEX and Getnet simplify online payments for E-commerce businesses. This collaboration streamlines payment gateway integration by enabling both Web Checkout and Smart Checkout, offering customers a faster, more seamless, and secure shopping experience.

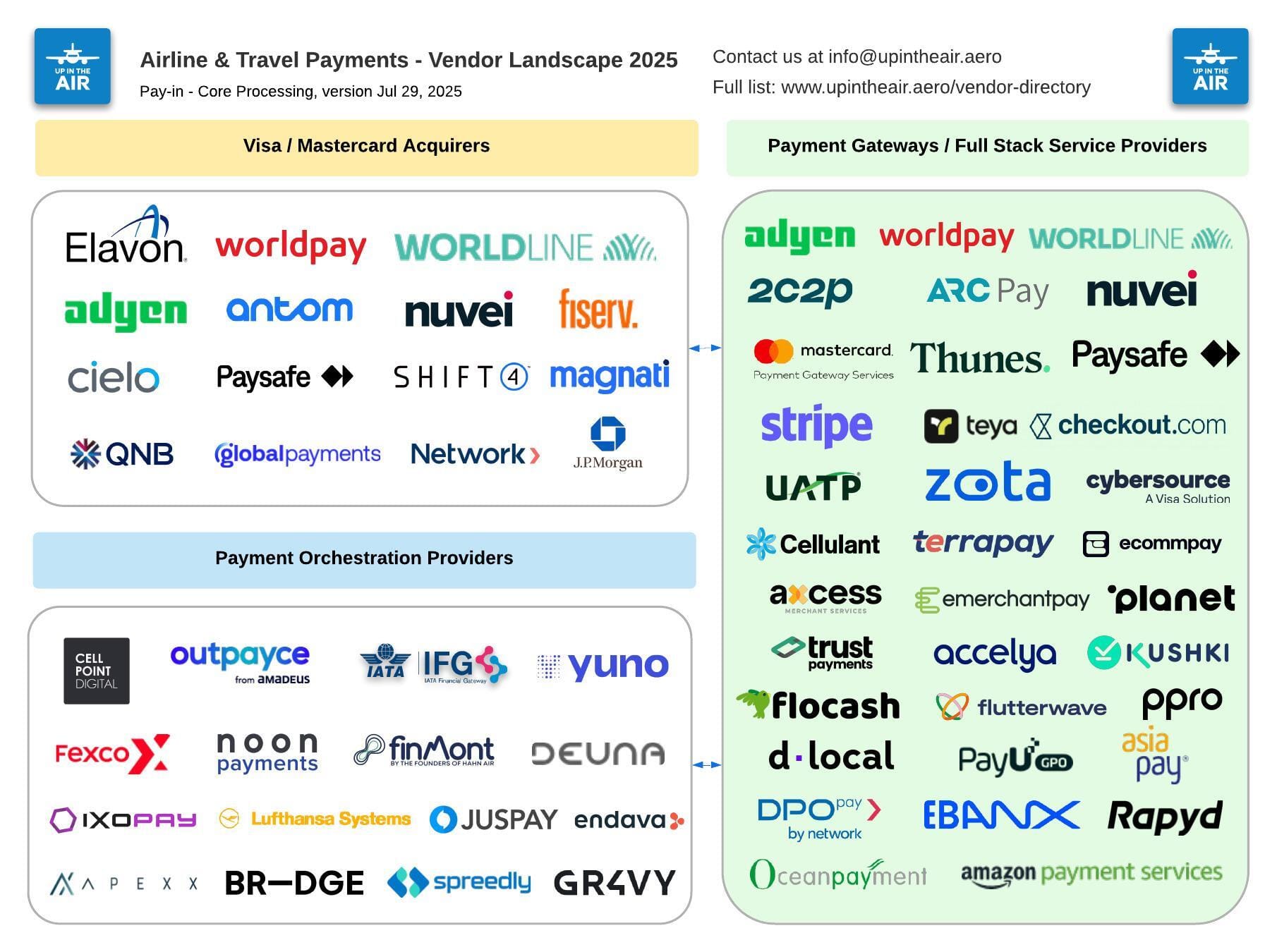

🌍 Airline & Travel Payments Vendor Landscape infographics👇

Are any companies missing on these maps?

🇺🇸 PayPal trial set for 2026 as judge blocks revived Ioengine claim. The lawsuit over portable data-storage technology used for secure online transactions will proceed on the two claims of US Patent No. 9,059,969 that survived earlier rulings, the Judge said in an opinion issued in the US District Court.

🇧🇭 TransferMate applies for a representative office license in Bahrain. This means partners and their customers doing business in Bahrain will be able to access TransferMate’s full suite of services, including payments, receivables, and stored funds globally, subject to regulatory approval.

🇬🇧 GoCardless launches industry-leading AI tool for faster, more reliable same-day payments. The tool, Same Day Settlement+, leverages proprietary machine learning algorithms and transaction data from over 38 million accounts to significantly cut payout times and reduce late payment failures by over 80%.

🇺🇸 Payoneer adopts Citi Token services to facilitate global intracompany transfers. With this capability, Payoneer can transfer funds between its global accounts in participating branches and currencies with greater speed, automation, and transparency, the companies said.

🇬🇧 Zilch boosts loss provisions as customer numbers soar in 'record year' for UK FinTech. The London-based company elevated provisions for credit losses, funds reserved to cover anticipated losses from defaulted repayments to £27.4m – a 116 per cent rise from £12.7m the previous year.

🇳🇬 Strowallet launches card issuing solution for Nigerian FinTechs and MFBs. The new platform allows partners to issue Physical Naira ATM Cards for cash withdrawals and in-store payments, Virtual Naira Cards for secure local online transactions, and Virtual Dollar Cards for international payments, subscriptions, and e-commerce.

🇦🇺 Zip launched the latest Google Wallet experience on iOS. In one seamless step, Zip Pay and Zip Plus customers can now access their Zip Visa Card across the entire Google ecosystem in one click, making it even easier to spend anywhere Visa is accepted, globally and in-store.

OPEN BANKING NEWS

🇬🇧 Payit™ by NatWest partners with Prommt. Through this powerful integration, corporate clients and merchants can now offer their customers a seamless digital alternative to manual bank transfers. Whether paying by card or bank, the experience is intuitive, merchant-branded, and optimised for conversion.

REGTECH NEWS

🇺🇸 Prove launches unified authentication solution with Passive, a modern authentication solution that passively and persistently recognizes customers, no matter where they appear or how often their devices or credentials change. Read more

🇬🇧 UK FinTech Privalgo gains Dutch regulatory approval for EU payment operations. The licence authorises Privalgo to provide payment accounts, issue electronic money, and execute payment transactions across Europe through its subsidiary Privalgo BV, which operates under the leadership of Managing Director Ronald Wallroth.

🇺🇸 New York Attorney General James sues Zelle parent company, alleging it enabled fraud. James’ office said in a press release that its investigation found that Early Warning Services, the owner and designer of the peer-to-peer money transfer company, designed Zelle “without critical safety features.”

DIGITAL BANKING NEWS

🇦🇺 CommBank and OpenAI embark on Australia-first strategic partnership to advance AI solutions. As part of this arrangement, CommBank employees will progressively get access to OpenAI’s advanced AI tools, including its enterprise-grade AI solution, ChatGPT Enterprise.

🇩🇪 Founders of the N26 bank may be facing replacement. Several investors are said to be pushing for a change in leadership. An N26 spokesperson declined to comment specifically on the possible change in leadership. He only said: "It is false to claim that the founders are facing pressure from investors to step down."

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Circle announces Arc, an open layer-1 blockchain. Fully compatible with the Ethereum Virtual Machine, Arc will use USDC as its native gas token, enabling transaction fees to be paid directly in the stablecoin. It will power the next generation of stablecoin-based payments, foreign exchange, and capital markets infrastructure.

🇺🇸 Mesh adds support for Ripple USD (RLUSD). Users now have RLUSD as a payment option alongside our 50+ other supported tokens, and merchants can easily accept it at checkout. With Mesh now supporting RLUSD, users can easily deposit, transfer, and pay using the stablecoin, and merchants can accept it at checkout.

🇺🇸 BurraPay secures U.S. patents to advance compliant cryptocurrency payments. The innovation allows cryptocurrencies to be seamlessly integrated with existing USD cashless wallets, opening up new channels for operators to engage with the growing number of players in the field.

🇬🇧 Wirex expands Web3 payments in Europe with Visa-backed EURC settlements. The integration of EURC settlement allows Wirex to further streamline cross-border payments and enhance the efficiency of its crypto-to-fiat conversion infrastructure, enabling fast, secure, and cost-effective transactions for users.

PARTNERSHIPS

🌏 Tuum selected by Uptex Bank to power e-banking expansion in the Middle East and Africa. The partnership marks Tuum’s first customer in the Middle East and reinforces its strategy to support innovation-led financial institutions in fast-growing, regulated markets.

🇶🇦 Al Rayan Bank goes live with Finastra to deliver a seamless digital banking experience for corporates. By modernizing its trade finance and cash management infrastructure, AlRayan Bank is now equipped to launch new mobile-first capabilities, accelerate time-to-funds, and open new business opportunities while strengthening client retention.

🇬🇧 Bluechain and Visa partner to launch B2B payments infrastructure for UK businesses. The partnership introduces a critical infrastructure layer, enabling businesses to pay any supplier with Visa cards while Bluechain handles billing, collection, reconciliation, and merchant-of-record requirements.

🇱🇹 Papaya partners with SME Bank to boost fund safeguarding. The collaboration will see the implementation of a dedicated safeguarding account, further reinforcing the company’s commitment to the secure and compliant handling of customer funds.

DONEDEAL FUNDING NEWS

🇺🇸 1Kosmos raises $57 million in Series B Funding for Identity-First Security. The company will use the investment, which includes a $10 million line of credit from Bridge Bank, to fuel product innovation, expand integrations with IAM, CIAM, PAM, and zero trust platforms, and accelerate global growth.

M&A

🇬🇧 Diginex announces MOU for US$305m acquisition of Findings, a leading cybersecurity and compliance automation company. Diginex believes this strategic acquisition aligns with Diginex’s mission to enhance its technological capabilities and expand its footprint in the cybersecurity sector, and build a global leader in compliance data verification and regulatory compliance automation.

🇿🇦 Nedbank acquires FinTech startup iKhokha for $90m to empower SMEs. The acquisition marks a significant milestone in Nedbank’s strategy to deepen its support for small and medium-sized enterprises (SMEs) through innovative digital solutions. Continue reading

🇦🇺 Tyro Payments receives acquisition Interest and maintains market transparency. However, the company has determined that the current offers do not reflect its intrinsic value. Tyro is committed to keeping the market informed in line with its disclosure obligations.

🇬🇧 Fiinu to acquire FX firm Everfex in £12M reverse takeover. The deal is valued at "up to £12 million", Fiinu says, comprising an initial £8 million consideration alongside a possible additional earnout for Everfex owners if its order book surpasses £650 million by year-end, payable in new equity at 20% ordinary share.

🇺🇸 US FinTech MeridianLink to be acquired by Centerbridge in $2bn deal. Under the terms of the all-cash transaction, which values MeridianLink at around $2 billion, shareholders will receive $20 for each share of common stock, representing a 26% premium over MeridianLink's closing price as of 8 August 2025.

🇺🇸 Fundwell acquires EveryStreet, Uniting Payments, Cash Flow, and Capital in One Platform. The acquisition expands Fundwell’s platform with EveryStreet’s receivables and payments technology, giving SMBs faster access to capital and greater control over cash flow.

MOVERS AND SHAKERS

🇺🇸 Top crypto VC Matt Huang to lead Stripe blockchain Tempo as CEO, stay at Paradigm. Through his role on Stripe’s board, Huang has long been a close partner to the FinTech firm, but his decision to lead the new blockchain represents a major bet on Stripe’s future dominance in the crowded stablecoin landscape.

🇩🇪 German investech Upvest bolsters technical expertise with new engineering SVP and board director. Adyen's Roberto Fajardo has been named SVP of Engineering, while Parloa's CTO Alexander Matthey has joined Upvest's board as a Non-Executive Director.

🇬🇧 Nomo Bank expands property finance team with two hires. Nomo has appointed Jeton Asani and Steven Griffiths as Business Development Managers. They join at an exciting time for the bank, which just reported its best three months on record for completions.

🇺🇸 NMI Ushers in next era of embedded payments with new CEO appointment. Steven Pinado brings nearly 30 years of experience in FinTech, embedded payments, and scaling growth-stage businesses. His diverse background spans payment processors, issuers, and SaaS platforms, uniquely positioning him to lead NMI into its next chapter of growth and innovation.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()