Robinhood Closes Largest Acquisition: Bitstamp for $200 Million

Hey FinTech Fanatic!

Robinhood is set to acquire crypto exchange Bitstamp for $200 million, marking its largest acquisition to date. This move will integrate Bitstamp’s globally-scaled crypto exchange, serving retail and institutional customers across the EU, UK, US, and Asia, into Robinhood’s platform.

This strategic acquisition enhances Robinhood’s ability to expand beyond the US and adds a trusted and reputable institutional business to its portfolio.

The deal is expected to close in the first half of 2025, pending customary closing conditions and regulatory approvals.

I also want to mention that my friends at Airwallex announced the launch of its Olympic Spirit Competition in partnership with Visa, and YOU can be a part of it!

Do you know a business leader who embodies the spirit of an Olympian? Whether it's a colleague, a friend or even yourself, we're on the lookout for individuals who demonstrate determination, excellence and a step changer mindset.

By nominating a business leader, you'll not only give them the chance to win an incredible prize package courtesy of Visa – including tickets to the Olympic Games Paris 2024– but you'll also be celebrating their achievements and they could be chosen to join the UK Step Changers 2024 list by Airwallex.

Ready to make someone's Olympic dreams come true? Nominate now and let's celebrate the Olympic spirit in all of us! The competition closes on 21 June at 12:00 so nominate yourself or another leader today.

Have a great weekend and I'll be back on Monday!

Cheers,

FEATURED NEWS

🏅 Airwallex, in partnership with Visa, are looking for extraordinary leaders who demonstrate the Olympic spirit, and give them a chance to win tickets to the Olympic Games Paris 2024. To nominate someone (or yourself), simply visit this link and share their story. Nominations close on 21 June at 12:00 BST so don’t miss out and apply today.

FINTECH NEWS

🇪🇸 Mangopay, a modular and flexible payment infrastructure provider for platforms, reinforces its commitment to the Spanish entrepreneurial ecosystem, announcing partnerships with three fast-growing businesses including Filmo, Kuarere and Webel.

🇺🇸 FinTech Torpago has a unique way to compete with Brex and Ramp: turning banks into customers. Torpago integrates with over 200 accounting systems and can issue virtual or physical cards in real-time. Additionally, it offers a dashboard to manage all aspects of both products.

🇬🇧 Barclays' global head of FIG banking says FinTechs need 88% fewer coders thanks to AI. Sabry Salman suggests that FinTech firms will need far fewer coders, potentially impacting job opportunities for developers. This shift comes as both FinTech firms and traditional banks are increasingly using AI to cut costs.

💳 ‘Mastercard For FinTechs,’ launched to support the dynamic FinTech ecosystem in Western Europe. As the network partner of choice for FinTechs, Mastercard’s collaboration with FinTechs offers education, expertise, networking and exclusive tools to help them thrive.

🇦🇺 Australia moves to rein in buy-now-pay-later with credit check law. The Australian government on Wednesday introduced legislation that would require BNPL firms to run credit checks on borrowers, aiming to regulate the rapidly growing sector popular among youth like other consumer credit products.

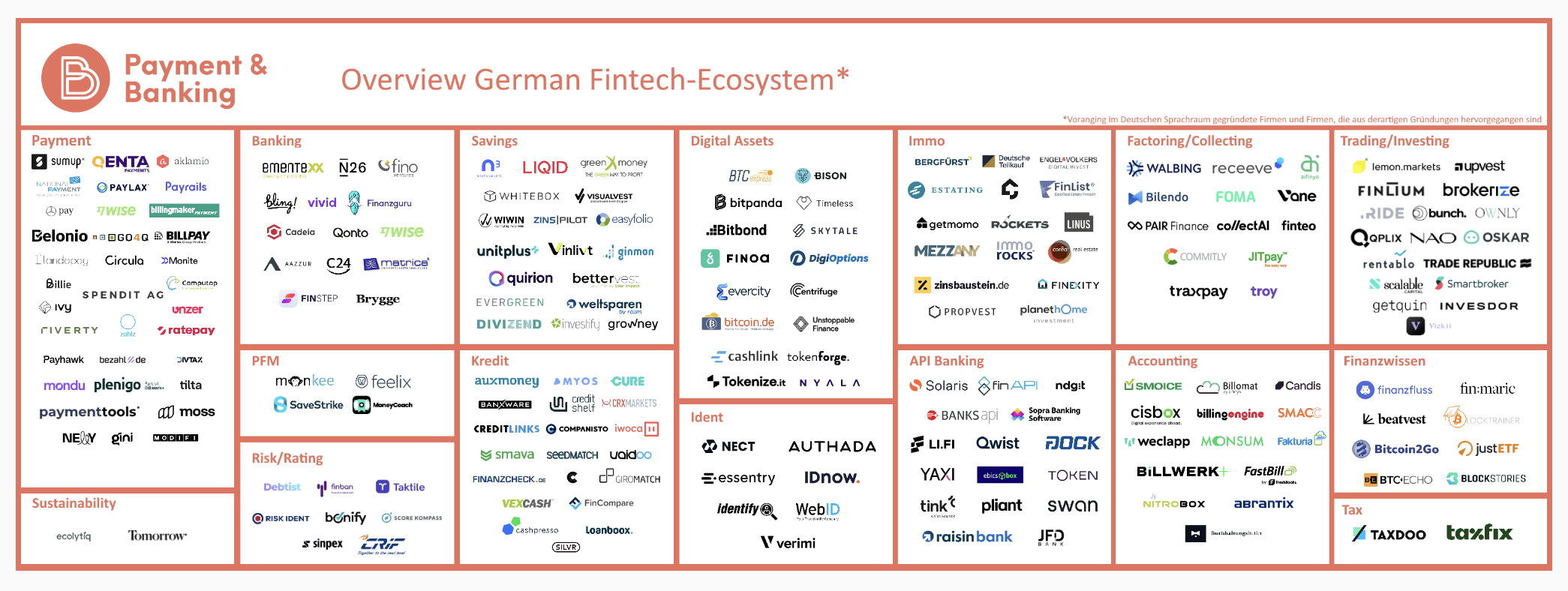

📊 Infographic: The German 🇩🇪 FinTech Ecosystem

Any companies missing in this overview?

PAYMENTS NEWS

🇳🇬 Nigerian payments company Zone recently announced the launch of a blockchain-powered point-of-sale payment gateway. This gateway facilitates transaction routing to issuers and aims to prevent chargebacks or chargeback fraud by promptly reimbursing customers for unsuccessful transactions.

🇺🇸 Buy now, pay later (BNPL) provider Affirm has launched two new payment options designed to offer customers more flexibility and affordability: Pay in 2 and Pay in 30. As the name suggests, the new offerings let consumers split their purchase into two interest-free payments per month or pay in full interest-free within 30 days.

🇮🇳 Paytm’s share of the unified payments interface (UPI) market in India fell for a fourth straight month as the FinTech pioneer struggles to recover from a regulatory setback. Paytm accounted for 8.1% of total UPI transactions in May, down from 13% in January, according to data released by the NPCI.

🇮🇳 UPI to be expanded to 20 countries by FY29, new payment features planned. The RBI also plans to explore multilateral linkages and collaborative opportunities for the Fast Payment System (FPS) with regions such as the European Union and the SAARC.

🇬🇧 Token.io and Prommt enhance Pay by Bank user experiences to maximise conversions. The launch of Token.io’s Hosted Pages will elevate Pay by bank user experiences, introducing new conversion-boosting features. More on that here

🇫🇷 BNP Paribas and Numeral have partnered to enable payment companies to seamlessly embed SEPA and local payments into their products, become SEPA participants, and optimise their payment operations at scale. WorldFirst, a one-stop digital payment and financial services platform for global businesses, will benefit from the partnership to reinforce its SEPA infrastructures in Europe.

🇦🇪 UAE's du Pay becomes principal member of Visa. This collaboration marks du Pay’s entry as a principal member to issue Visa cards, emphasizing its commitment to digital empowerment and financial inclusion. Customers can easily order digital or physical du Pay Visa prepaid cards via the du Pay app, providing secure and widely accepted payment solutions.

🇵🇱 Together with Empik and PayEye, Mastercard expands its Biometric Checkout Program to Poland. Thanks to the cooperation with PayEye FinTech and Planet Pay, customers can now test paying with a glance at five Empik stores in the country. This is the first Biometric Checkout Program pilot in Europe.

🇦🇺 A2A payments will likely challenge the dominance of cards in Australia. Currently, half of Australia's eCommerce transactions are settled via debit/credit cards, and bank transfers account for another 12%. A2A transactions offer faster, more secure payments with lower fees, moving funds directly between bank accounts without card processing.

OPEN BANKING NEWS

🇺🇸 Plaid launches Consumer Report, a new solution that brings businesses real-time, cash flow data and credit risk insights through Plaid Check. Consumer Report offers lenders, property managers, and BNPL providers real-time visibility into borrowers' finances using unique signals from its leading open banking network.

🇺🇸 On June 5, the CFPB announced the initiation of a “process” to establish data sharing and technical standards. As part of the announcement, the CFPB said, “The process must be open to all interested parties, including public interest groups, app developers, and a broad range of financial firms with a stake in open banking.”

🇺🇸 Ninth Wave, a leading enabler of secure data connectivity between financial institutions and third-party applications, recently announced an expanded relationship with Axos Bank to deliver Open Finance solutions to Axos’ customers via Ninth Wave’s Platform.

🇬🇧 Equifax becomes the first of the three main UK based credit reference agencies accepted onto Crown Commercial Service’s Open Banking DPS Framework. This development allows Equifax to bid to provide Account Information Services (AIS) to any UK public sector body that uses the DPS.

DIGITAL BANKING NEWS

🇪🇺 How European banks compare on readiness for EU payments regulations. An EY survey of 26 leading European banks and payment service providers (PSPs) shows that 63% anticipate the regulations will necessitate modifications or upgrades to their infrastructure. Find out more

🇹🇭 Boost Bank, a digital bank collaboration between Axiata Group Bhd's FinTech arm Boost and RHB Banking Group, has launched an embedded digital bank app that will allow users who do not have an existing bank account to be digitally onboarded.

🇪🇺 UK neobank Starling will not reapply for EU banking license. Instead, the company will try to expand internationally via its software business, incoming CEO Raman Bhatia told CNBC. Read more

🇮🇹 With 2 million customers, Revolut is now the biggest neobank in Italy. The digital bank exceeds the threshold of two million customers in Italy and is preparing to launch new products: from personal loans to the flexible account, moving to the current account with Iban Italian.

DONEDEAL FUNDING NEWS

🇺🇸 Torpago announces $10 Million series B funding round. The company will use the Series B funding to enhance implementation and compliance resources while continuing to expand Torpago’s product suite. More on that here

🇩🇪 re:cap raises Series A funding round of USD 14.6m and releases own SaaS platform to investors and businesses. With the new funding, the company is positioned to further expand its successful alternative debt financing business and marketplace and to scale its software platform.

🇺🇸 Kleiner Perkins leads $14.4M seed round into Fizz, a credit-building debit card aimed at Gen Z college students. In the last 12 months, Fizz grew from zero to having “tens of thousands” of customers. Its offering is available to students at over 300 colleges and universities.

🇬🇧 Slip, a female-founded FinTech startup which helps physical stores digitise receipts to unlock customer insights, has raised £2.5 million. The company intends to use the funds to enhance the technology package and grow its team. As part of this expansion Slip has welcomed Myles Dawson, former managing director of Adyen UK, as chief commercial officer.

M&A

🇺🇸 Robinhood will acquire crypto exchange Bitstamp for $200 million, its largest acquisition to date. This acquisition brings Bitstamp’s global crypto exchange, serving customers in the EU, UK, US, and Asia, to Robinhood. The deal, expected to close in the first half of 2025, will help Robinhood expand internationally and add a reputable institutional business.

MOVERS & SHAKERS

🇮🇳 Buy Now Pay Later (BNPL) startup Simpl on Thursday handed over pink slips to around 30 employees less than a month after it fired 160 people, according to three people aware of the development. This round, like the last one, has impacted people across departments.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()