Robinhood Challenges Apple Card with the Launch of its Gold Card

Hey FinTech Fanatic,

As I predicted last week 😉, Robinhood, the popular brokerage app FinTech, has launched its Gold Card, aiming to rival the Apple Card by offering unique cash-back rewards that can be invested directly into stocks.

Exclusive to Robinhood Gold members, who pay $5 monthly or $50 annually, the card features no annual or foreign transaction fees, providing a competitive edge in the credit card market.

The Gold Card offers 3% cash back on all purchases and 5% on travel through Robinhood's travel portal, with the innovative option to transfer cash back into brokerage accounts for investment.

This move, a first since acquiring credit card startup X1, marks Robinhood's entry into family-oriented financial products, allowing up to five additional cardholders per account to help build credit and monitor spending with customizable controls.

With security in mind, the card will be numberless, minimizing risks if lost or stolen, and will be supported by a separate app from Robinhood's investment platform.

What do you think about this new card? Can it challenge Apple Card?

Cheers,

#FINTECHREPORT

📋 Airwallex surveyed over 3,000 consumers and interviewed leading merchants across Australia, Hong Kong, China, Singapore, the UK and the US with the support of consulting firm Edgar, Dunn & Company in January 2024 to learn how businesses can drive global eCommerce growth. I highly recommend downloading and reading the complete report to learn more.

FINTECH NEWS

🇫🇷 Qonto rolls out its in-house financing offer 'Pay later' to extend its business banking products offering. This launch is another important milestone for the company, which has so far relied on strategic partnerships to provide financing to its customers. Read more

🇺🇸 Western Union has launched its global eSIM mobile data service, which will enable customers to have full controlover their connectivity needs and finances. Following this announcement, Western Union will launch an eSIM mobile data service by leveraging its Powered by Breeze solutions.

🇬🇧 Currensea hits 100k cardholders. This is the latest sign of Currensea’s strong growth, with monthly usage doubling from last year as travellers increasingly look to reduce foreign exchange (FX) fees and enhance value. Since its launch in 2020, Currensea has saved travellers over £4 million in FX fees.

🇸🇪 Juni Moves to direct issuing with Mastercard. As part of Juni’s offering, the company provides Mastercard cards in multiple currencies to its customers in digital commerce, ensuring businesses can control their spend while operating on a global scale.

🇦🇪 Alaan and Visa sign a five-year deal to help drive the cashless agenda of UAE and Saudi Arabia. The partnership also includes joint marketing initiatives aimed at accelerating the adoption of advanced spend management solutions in the Middle East. These efforts underscore the commitment of both Alaan and Visa to support the economic growth and digital transformation of the region.

🇬🇧 GoCardless eyes profitability in 2025 despite increased losses. According to figures covering the 12 months to June last year — which were shared with Sifted ahead of filing its annual report with the UK’s Companies House — global revenue grew 31% year-on-year to £91.9m and net losses increased to £79.6m from £62.9m in the prior financial year.

PAYMENTS NEWS

🇺🇸 ACI Worldwide will celebrate its 50th anniversary next year. Read the complete interview article where Debbie Guerra, ACI Worldwide’s Chief Product Officer, discusses the key takeaways from ACI’s 2024 Analyst Day with EPI editor Douglas Blakey. Link here

Riverty and Adyen Partner up to Offer 14-day Invoice Solution in DACH. Merchants on Adyen’s FinTech platform can now implement Riverty’s 14-day invoice BNPL payment method. Riverty’s solution is seamlessly integrated with Adyenand can be easily activated by merchants.

🇦🇪 Mercury granted in-principle approval for a Retail Payment Services license by UAE Central Bank. "With this license, Mercury is well placed to accelerate its growth trajectory and play a pivotal role in shaping the future of payments in the UAE. I would like to express my sincere gratitude to the Central Bank of UAE for their trust and confidence in Mercury," said CEO, Muzaffer Hamid.

🇧🇷 Brazilian payments and financial management FinTech Accesstage will become payment initiator. The company, specializing in B2B payments and financial management, has just received authorization from the Central Bank (BC) to operate as a payment institution (PI). The green light is for the company to act as a payment transaction initiator (ITP).

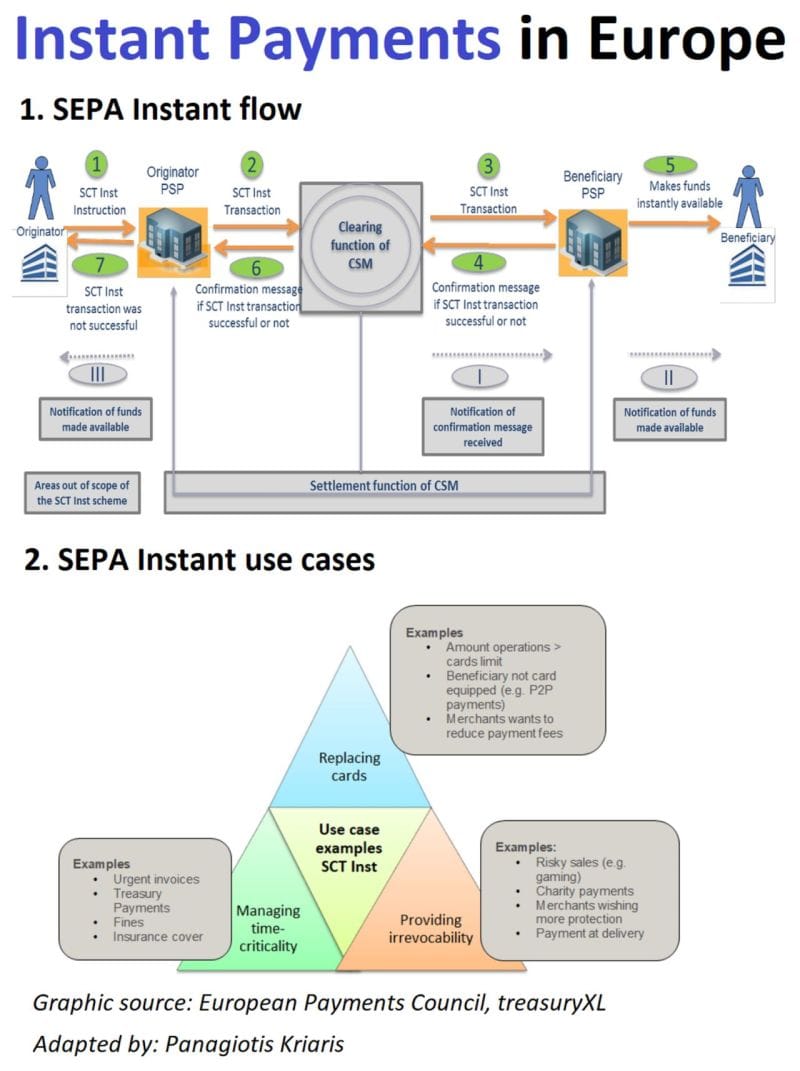

🇪🇺 The recently adopted Instant Payments regulation brings Big Changes to the European Payments Landscape

Let’s have a look at the 6 key changes:

OPEN BANKING NEWS

🇺🇸 Dwolla and MX partner to simplify A2A payments for businesses. Dwolla’s recently launched Open Banking Services take advantage of MX’s Instant Account Verifications (IAV) and account aggregation solutions to provide mid- to enterprise-sized businesses with bank verification and balance check capabilities.

Tink and Payop partner to roll out Pay by Bank across Europe. Payop and Tink are working together on promoting and growing the adoption of this payment method across Europe. Pay by Bank is available for Payop merchants across Europe including France, Germany, Netherlands, Spain and UK. More here

DIGITAL BANKING NEWS

🇹🇷 Turkish “neo-bank” Misyon Bank partners with Swiss tokenisation platform Taurus. Misyon Bank announced a partnership with Taurus, one of the most experienced companies in the world in the storage of digital assets. Misyon Bank will be able to offer this service to companies and institutions such as stock exchanges, FinTech companies and central banks.

🇬🇧 Monzo has joined 159, the phone service that connects people with their bank when they receive a suspect call out of the blue about a financial matter. If someone believes another person is trying to trick them into handing over money or personal details, they can hang up and call 159 to speak directly to their bank.

🇭🇰 HSBC launches tokenised gold for retail customers in Hong Kong as government pushes for publicly accessible digital assets. HSBC Gold Token, which will be available on the lender’s online banking and mobile app, is the first such retail product to be issued by a bank, according to HSBC. Read more

🇲🇽 Digital bank Nu Holdings will lower the yield on its high-yield savings accounts in Mexico after the country’s central bank cut its key rate for the first time since 2021. From April 16 through May 23, Nu’s new yield will be 14.75%, helping its customers reach their savings goals.

🇧🇷 In 2023, the Brazilian neobank PicPay achieved its first annual profit, turning around a loss from the previous year, and reached 35 million active customers.

Additionally, Picpay is set to start selling advertisements through its financial app, named PicPay Ads. The advertising tool has been under trial since September of the previous year and already boasts around 20 clients. The company's goal for this year is to increase the revenue from these ads tenfold.

🇬🇧 Paysend and Currencycloud sign major global expansion deal. Paysend customers now have access to multicurrency wallets, which let users hold up to 34 currencies in the same app. Paysend customers will also access payments via the Swift network adding further choice to Paysend’s extensive global coverage.

🇮🇱 Digital bank One Zero losses hit $170 million in two years. One Zero claims that they are meeting the business planand that they will reach profitability at the end of 2025. CEO Gal Bar Dea: "We expected more accounts to be opened, but it was a challenging year."

🇺🇸 Walmart can end Capital One credit card partnership early, US judge rules. A federal judge ruled that Walmart can end its credit card partnership with Capital One early because the bank failed to provide the required level of customer service. Read on

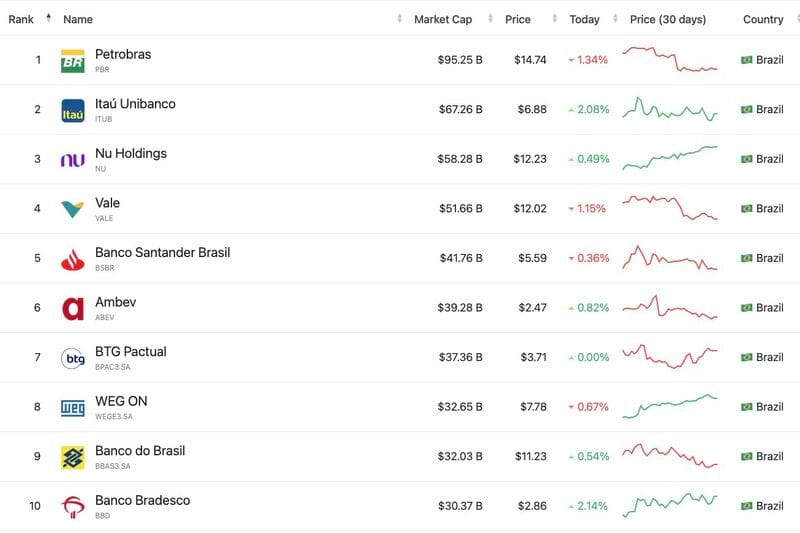

🇧🇷 Nubank becomes the 3rd largest public company by Market Cap in Brazil

BLOCKCHAIN/CRYPTO NEWS

Visa: Tokens Bring $2 Billion ‘Uplift’ to Asia-Pacific Economy. Visa said its token service has been a boon for the Asia-Pacific region’s digital economy. The region saw an “uplift” of more than $2 billion last year due to Visa token service (VTS) adoption, the company announced in a Tuesday (March 26) press release.

With Bitcoin’s upcoming halving in April 2024, financial firms like Robinhood and Revolut are preparing for potential market shifts. Access the full article for more details.

🇺🇸 Zero Hash secures Virtual Asset Service Provider registrations in both the Netherlands 🇳🇱 and Poland 🇵🇱 The VASP registrations deepen Zero Hash’s global regulatory stack which already includes licenses and registrations in the United States, Brazil, Canada, Australia and New Zealand. Zero

🇺🇸 US charges crypto exchange KuCoin with AML violations. Federal prosecutors have charged KuCoin and founders Chnu Gan and Ke Tang with conspiring to operate an unlicensed money transmitting business and conspiring to violate the Bank Secrecy Act by willfully failing to maintain an adequate AML programme.

🇺🇸 The Securities and Exchange Commission and crypto exchange Coinbase each scored partial wins in a Wednesday morning court ruling amid their ongoing legal fight. Judge Katherine Polk Failla denied most of Coinbase’s efforts to dismiss the SEC’s lawsuit.

DONEDEAL FUNDING NEWS

🇨🇦 ZayZoon raises $15m for earned wage access platform. The extension brings ZayZoon's total Series B to $49.5 million. The funding will be used to push expansion for a firm that says it has already grown its business by almost a factor of eight in the last two years.

🇧🇷 The Brazilian BNPL (Buy Now, Pay Later) FinTech company Koin has successfully raised $7.3 million to boost its service offering for the anticipation of receivables for retailers in the tourism sector. Structured and distributed by Itaú, the operation aims to grow the consumer credit business. Read full article

🇮🇩 PayPal invests in Indonesian insurtech Qoala. The funding enables the firm to expand its embedded insurance business (B2B2C) across Southeast Asia. The investment will empower Qoala to intensify its tech-driven initiatives, seamlessly integrate AI across all channels, and elevate the experience of customers, agents, and partners.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()