Ripple Acquires Stablecoin Platform Rail, Crosses $3B in M&A

Hey FinTech Fanatic!

Ripple’s acquisition streak keeps rolling. After Hidden Road's buy for $1.25 billion in April, the company is now acquiring Rail, a stablecoin-focused payments platform, for $200 million, pushing its total M&A spend past $3 billion. 🤯

“Over the last four years, Rail built the fastest way to settle business payments internationally using stablecoins,” said Bhanu Kohli, Rail CEO. Rail is projected to process 10% of the global B2B stablecoin volume in 2025.

Keep scrolling for more on Ripple and other FinTech updates 👇

See you Monday!

Cheers,

#FINTECHREPORT

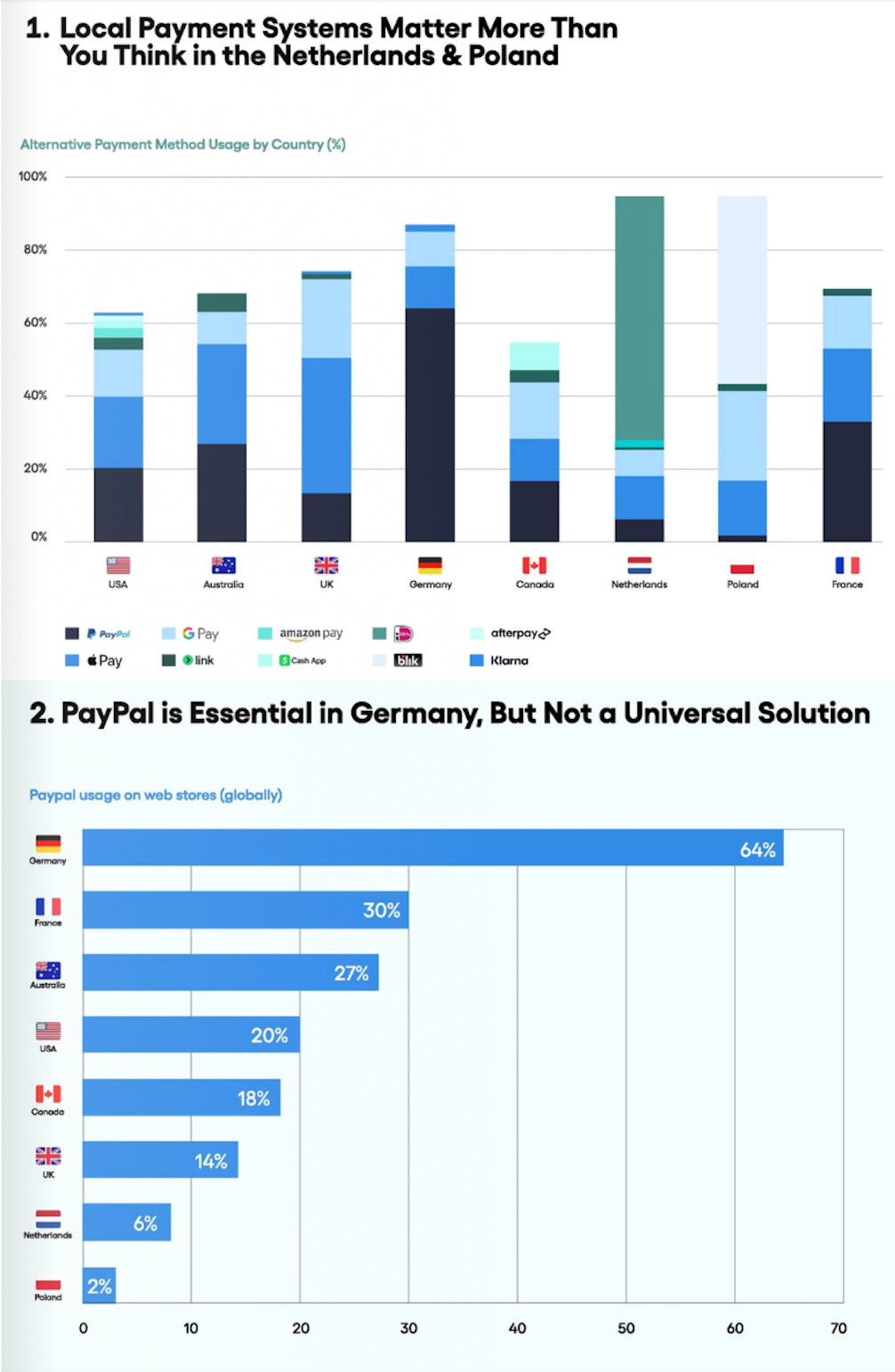

📈 PayPal dominates web store payments in Germany, but Apple Pay reigns in the UK. A new report has found that credit cards account for around 35% of web store transactions overall, but there is considerable regional variation in their use.

FINTECH NEWS

🇺🇸 Booking.com soft-launched its first credit card in the U.S., the Booking.com Genius Rewards Visa Signature Credit Card, which should help in its push for direct bookings. Rather than offering points and miles, the Genius rewards card, which is powered by Imprint, issues travel credits.

🇺🇸 BNPL outfit Sunbit closes $200m ABS transaction. The company announced the successful completion of its inaugural asset-backed securitization (ABS), a $200 million notes offering that achieved an AA rating for the senior tranche and was priced at an all-in fixed yield of 5.713%.

🇩🇪 NAO offers savings plans in alternative investments starting from €1 m, without a high minimum investment amount or manual orders. The new savings plans represent a logical evolution of NAO's business model and make previously exclusive investment vehicles such as private equity, venture capital, private debt, and infrastructure investments even more accessible to everyone.

FINTECH RUNNING CLUB

🇵🇦 Run in Panama with us!

PAYMENTS NEWS

🇺🇸 ACI Worldwide reports financial results for the quarter ended June 30, 2025. In Q2 2025, revenue was $401 million, up 7% from Q2 2024. Recurring revenue in Q2 2025 of $322 million was up 13% from Q2 2024 and represented 80% of total revenue. At the same time, the company is redefining payments with ACI Connetic, which brings together account-to-account (A2A), card payments, and AI-driven fraud prevention on a unified cloud-native platform.

🇲🇾 Sunrate gets initial nod for money services license in Malaysia. Sunrate has received approval-in-principle for a money services business license from Bank Negara Malaysia, the country's central bank. The Singapore-based company provides payment and treasury management services to businesses.

🇲🇾 Ant International’s WorldFirst accelerates SEA growth with Malaysia MSB Licence. The licence will enable WorldFirst to expand its product offerings and roll out new services, facilitating international payments, especially in receiving foreign currency payments globally, with a focus on supporting small and medium-sized enterprises to manage their cross-border transactions more efficiently.

REGTECH NEWS

🇺🇸 Visa extends cybersecurity expertise, prioritizing proactive defense strategies for clients. This new initiative, which is supported by Visa’s deep security expertise, offers cyber consulting services to help clients fight digital threats and payment fraud.

DIGITAL BANKING NEWS

🇪🇺 Brex secures EU payment institution license, unlocking next phase of global expansion. With this license, Brex is officially authorized to operate across the entire EU, offering direct issuance of commercial credit cards and payment origination capabilities, including direct debits and credit transfers.

🇩🇪 N26 SIM now available for business accounts in Germany. Users can now easily separate work and personal calls by using dual SIM functionality on a single device. The mobile plan can be conveniently set up directly within the N26 app, streamlining the process for business users who want an all-in-one banking and communication solution.

🇳🇴 Revolut offers a euro savings account for Norwegian businesses. The product is suitable for companies that want to invest surplus liquidity in euros. The player already offers currency accounts, international payment solutions, etc. Additionally, Revolut appoints EY to replace BDO as auditor. EY will become Revolut’s main auditor for the financial year to December 2026 after the Big Four firm won the mandate in a formal tender, the FinTech said.

🇲🇾 KAF Digital Bank has received approval from Bank Negara Malaysia to begin onboarding the public following the successful completion of its PERINTIS Phase. During the PERINTIS Phase, the bank tested its systems, security protocols, and user experience with a select group of participants.

🇬🇧 Tide Rewards launches to help small businesses save more on everyday spending. Members can earn cashback when using their Tide card in-store at participating UK retailers. The cashback offers, available through the ‘Rewards’ section of the Tide app, cover over 100 well-known brands.

🇬🇧 Challenger bank Zempler reports third consecutive year of profit. Customer deposits grew 15% to £626m, while Zempler recorded a slight increase in the number of business customers to just over 170,000 open accounts. Interest income was up from £34m to £37m over the year, while total income increased by more than seven per cent to £68.2m.

🇳🇿 Dosh New Zealand has announced a collaboration with Visa and Pismo aimed at developing its digital banking platform in New Zealand. Dosh will use Pismo's cloud-native core banking and payments platform, which Visa acquired in 2024, to underpin its expanding financial offerings.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 MetaMask proposal reveals plans for Stripe-issued stablecoin mmUSD. If the proposal receives community backing, the initiative could reshape the wallet provider’s position in the decentralized finance (DeFi) landscape and establish a new fiat-to-crypto onramp for millions of users.

🇰🇷 South Korea's KakaoBank explores stablecoin issuance and custody services. The bank leverages its technical experience from central bank digital currency projects and existing crypto infrastructure. With plans to actively participate in the fast-growing market valued at approximately $275 billion.

🇺🇸 Paxos pays $48.5m to settle NY charges over Binance USD. New York regulators accused Paxos of failing to conduct sufficient due diligence on its partner, Binance. Under the terms of the settlement, Paxos will pay a $26.5 million fine and invest $22 million to strengthen its compliance program.

PARTNERSHIPS

🇮🇹 Bluefin partners with Raiffeisen on payment security in South Tyrol. This collaboration brings a new level of payment and data security to All-In-One payment devices across Italy’s South Tyrol region. By leveraging the expertise of Bluefin, businesses will benefit from robust security and efficient payment processing.

🇺🇸 Wells Fargo enlists Google Cloud for agentic AI play. The expanded relationship will see employees, including branch bankers, investment bankers, marketers, and customer relations and corporate teams, with AI agents and tools, taking advantage of Google Agentspace, a unified platform to build, manage, and adopt agents at scale.

DONEDEAL FUNDING NEWS

🇮🇱 Israeli FinTech co Capitolis raises $56m. Capitolis founder and CEO Gil Mandelzis stated that the investments will support the company's continued growth and expansion in the capital markets, building on its strong business momentum. Continue reading

🇦🇪 UAE FinTech Alaan bags $48m Series A to expand AI-powered spend management platform. Alaan plans to use the fresh capital to further extend its presence across the MENA region. The company will also look to use the funds to enhance its product capabilities in bill payments, procurement, treasury, and travel services.

M&A

🇺🇸 Ripple to acquire rail for $200m, expanding leadership in stablecoin payments. With this deal, Ripple and Rail will deliver the most comprehensive stablecoin payments solution available in the market. This acquisition will boost Ripple's standing as the leader in digital asset payments infrastructure.

🇪🇸 Tether acquires minority stake in Bit2Me amid €30m investment push. The strategic investment is aimed at strengthening Bit2Me’s position in the European and Latin American markets, and comes at a pivotal moment for crypto regulation in the region.

🇦🇷 FinTech Cocos bought Voii Bank in Argentina. The financial company assured that with the banking license, it will be able to offer a greater quantity and quality of financial products. "We will no longer be limited by regulatory issues," said its president.

🇫🇷 BIGhub acquires French FinTech Qashflo and strengthens its position in the country. The transaction aims to consolidate the company's position in the French market and eliminate direct competition to its BIGcash solution. Read more

🇪🇺 Marqeta announces completion of TransactPay acquisition. With the combined capabilities of Marqeta and TransactPay, customers will be able to take advantage of card program management features in the UK and EU, and avoid the added complexity associated with engaging multiple partners.

🇬🇧 IFX Payments' Argentex takeover deal terminated. The companies had agreed to an emergency 3 million pound ($4 million) takeover in April after Argentex was rocked by swings in the currency markets triggered by U.S. tariffs. Continue reading

MOVERS AND SHAKERS

🌍 JPMorgan names Kara Kennedy as new Global Co-Head of Blockchain Division. Kennedy will oversee Kinexys Digital Assets, which focuses on asset tokenization, and Kinexys Labs, which helps clients prototype blockchain projects. Keep reading

🇩🇪 Alpaca names former Upvest and Wise Exec Juha Ristolainen as New Technology Chief. "As CTO, Ristolainen will lead Alpaca's technical architecture and engineering teams at scale to support the company's mission: opening financial services to everyone on the planet," the company said in a statement.

🇶🇦 Dr. Devid Jegerson appointed as PayLater Chief Executive Officer. As CEO, Dr. Jegerson will oversee the company’s next phase of growth, leading the national scale-up of Qatar’s first licensed BNPL FinTech. He brings over 30 years of international leadership experience in FinTech, digital banking, and payments innovation.

🇺🇸 Shift4 faces CFO and board departures. Shift4 Payments experienced leadership upheaval this week as the company’s CFO switched roles with a board member, and the founder’s father resigned from the board. CFO Nancy Disman resigned, and a member of the Allentown, Christopher Cruz, will take her place.

🇳🇱 Triodos Bank appoints new CTO and CIO. The Dutch bank has appointed former ABN Amro exec Suzanne Schilder as CTO, and promoted Barbara van Duijn to CIO. The appointments will come into effect after the bank's extraordinary general meeting on 26 September 2025.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()