Revolut's New Loyalty Program and Bond Trading Expansion

Hey FinTech Fanatic!

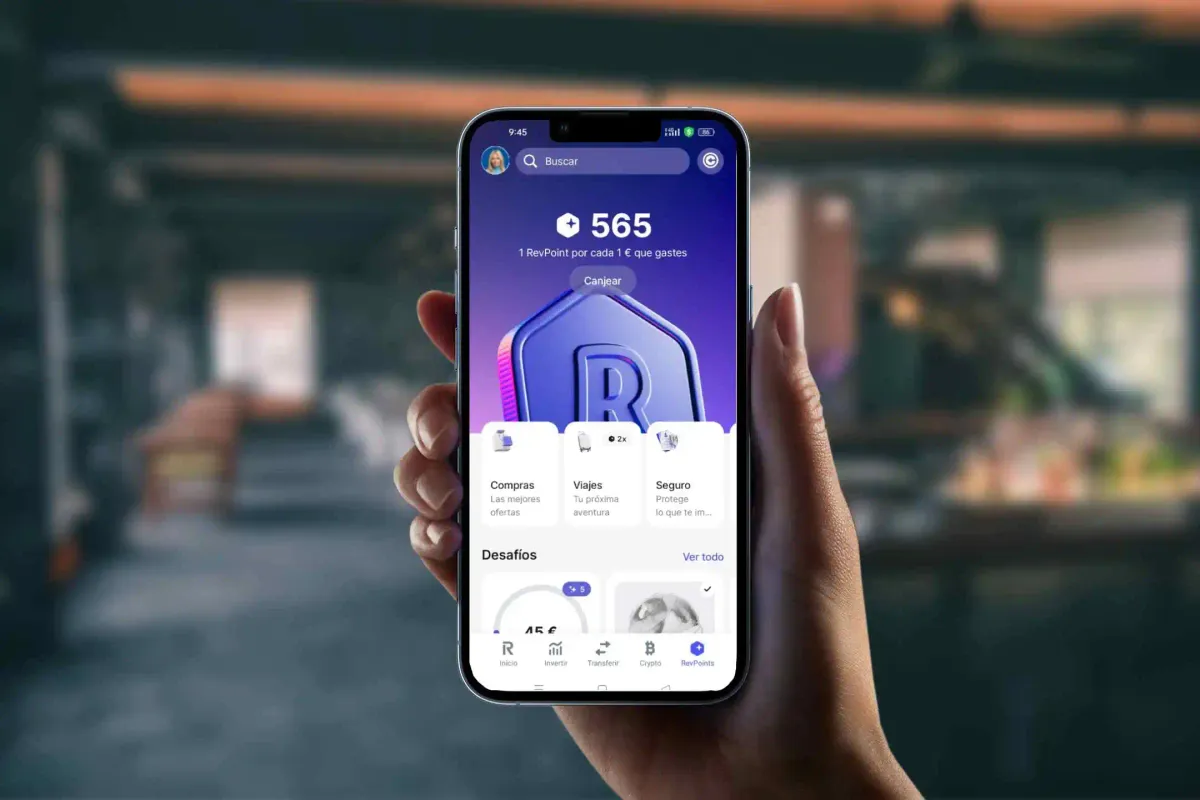

Two big updates today at Revolut: First, Revolut has introduced RevPoints, the first Pan-European debit loyalty card program.

This initiative allows users to earn points from daily spending, redeemable for airline miles, travel discounts, and more. Unlike traditional programs, RevPoints does not require a credit card, making it widely accessible. Points can be transferred to over 30 airline loyalty programs and used for discounts on accommodations and brands like French Connection.

Since its trial launch in September 2023, users have earned over 1 billion points, with nearly 120 million redeemed. Revolut plans to add more benefits for paid plan users, including partnerships with MasterClass and The Athletic.

Revolut has also partnered with GTN to offer bond trading for EEA customers through its app, with a minimum investment of €100. This integration aims to make the $100 trillion bond market more accessible to retail investors.

GTN's technology allows easy bond trading, similar to stocks. This expansion is part of Revolut’s goal to provide comprehensive investment options, catering to both advanced and beginner users.

Enjoy more FinTech news I listed for you below and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

FINTECH NEWS

🇺🇸 LatAm FinTech Prometeo enters US. Prometeo, a leading FinTech infrastructure company connecting global corporations with financial institutions in LatAm, announced the launch of its Bank Account Validation (BAV) offering for the US Market.

🏴 EY launches first Scottish FinTech lab with space agency tie. Located in EY’s Edinburgh office, the new lab is described as “a dynamic workspace designed for collaboration, experimentation, and rapid test-and-learn prototyping”. The launch follows EY’s opening in 2022 of a FinTech lab in London, its first in the UK.

🇦🇷 Belo, an Argentinian FinTech offering digital wallets to global freelancers and remote workers, announced a new feature that enables users to receive ACH transfers directly into their wallets. Belo’s solution makes it easier for Latin American-based workers earning income from the US, to get paid and manage their finances.

PAYMENTS NEWS

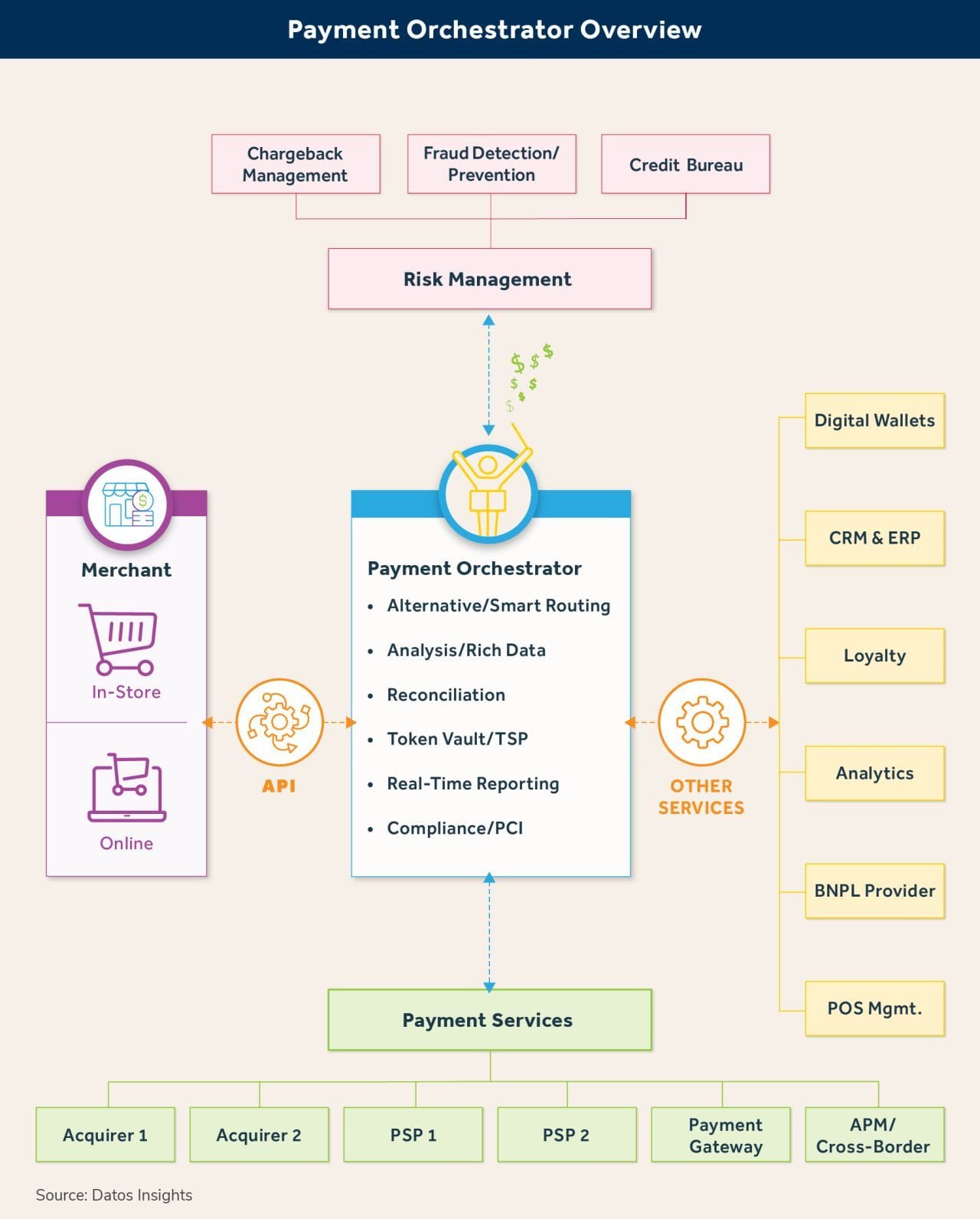

🤯 The Payment Orchestration market will be worth over $15 billion by 2026

Let's have a closer look:

💸 ACI Worldwide and STET: European Instant Cross-Border Transactions Reach New Record High. STET's platform utilizes ACI Low Value Real-Time Payments as a SaaS service, allowing its 20 member banks direct connection to European schemes TIPS and RT1. This ensures full pan-European reachability and interoperability for instant payments.

🇦🇺 BNPL firm Laybuy enters receivership. The New Zealand-based BNPL lender has entered receivership after failing to find a buyer for the ailing business. It listed on the Australian stock exchange in 2020 and shares traded as high as A$2.30. It delisted last year after the share price had plumetted to A0.6 cents.

🇺🇸 Stripe co-founder expects another employee stock tender offer. Stripe expects to again let employees cash out some of their shares according to John Collison, reiterating that the company is in no rush for an Initial Public Offering. Read more

🇬🇧 HSBC UK adds international payments tool to its Kinetic business banking app. HSBC Kinetic current account customers have previously been able to make international payments by phone and in branch, but can now self-serve up to the daily payment limit of £25,000. Doing so from over 200 countries and territories.

🇵🇭 Visa expands tokenized payments in Phl. While Visa has distributed 1 billion tokens across the Asia Pacific, Visa head for Product and Solutions for Southeast Asia Poojyata Khattar said the Philippines has yet to catch up on adopting the technology towards safer and more personalized online shopping.

OPEN BANKING NEWS

🇺🇸 Plaid launched a new sign-up feature called 𝗣𝗹𝗮𝗶𝗱 𝗟𝗮𝘆𝗲𝗿 that promises to increase end-to-end signup rates by 10 - 25%. Layer helps satisfy KYC requirements, link bank accounts, and onboard tens of millions of people who have saved their information with Plaid—just by collecting a phone number.

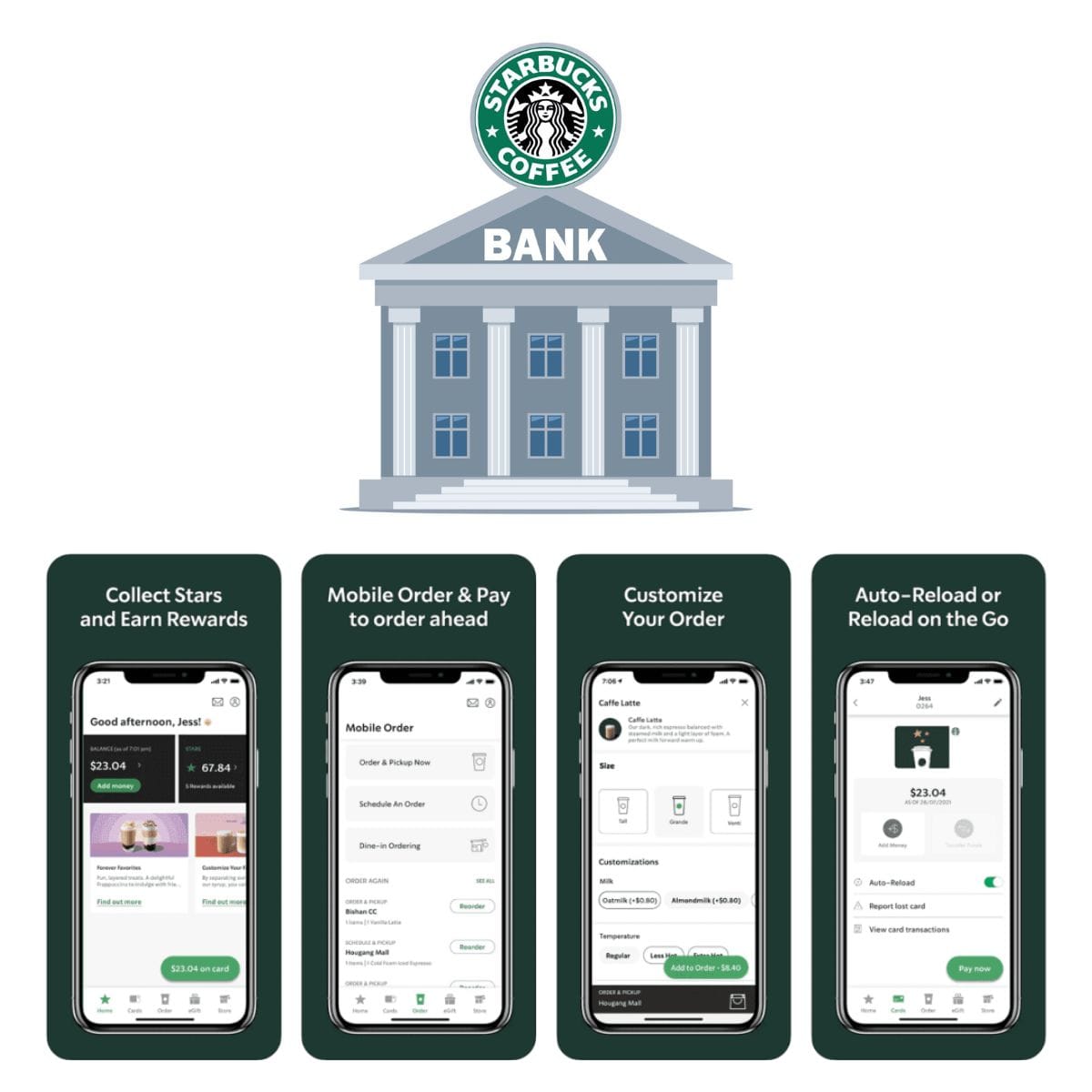

🏦 Starbucks' digital transformation in Southeast Asia using open finance.

A Case Study:

DIGITAL BANKING NEWS

🇸🇬 Revolut raises account limits amid growing investor demand. Users of Revolut in Singapore can now hold more funds in their e-wallets and spend more in a year, as the firm responds to increased demand from travellers and customers who are investing through the app.

🌐 Bonds are now available to all EEA customers on the Revolut trading platform. Link here

🇳🇱 Revolut Business is increasing its footprint in the Netherlands: Doubles customer base in a year and rolls out Dutch IBAN to simplify local payments. Building on this momentum, Revolut is doubling its efforts in the business vertical by introducing new products and localising existing ones for Dutch businesses.

🇨🇭 Swiss watchdog winds up challenger bank FlowBank. The Swiss Financial Market Supervisory Authority (Finma) is opening bankruptcy proceedings against investment banking challenger FlowBank following serious breaches of its capital requirements.

🇬🇧 Atom Bank reports first post-tax profit in firm’s ‘strongest’ year. The Durham-based digital bank credited the strong results to a 39% increase in lending and its “low-cost business model”, with staff and administrative costs remaining fairly steady as income increased.

🇪🇺 Bank-to-bank payment messaging network Swift is working to facilitate interoperability of Verifcation of Payee schemes across Europe as new research shows that 83% of SMEs across France, Germany, Italy and Spain rank upfront beneficiary checks as important to them in trading across borders.

🇩🇰 Danish neobank Lunar has launched a debit card with Scandinavian Airlines (SAS) that allows users to gain and use EuroBonus points. Through the new debit card, both new and existing users of the EuroBonus programme will be able to gain points through everyday purchases on the Lunar app.

🇬🇧 Monzo Bank is planning to go big on business customers and eyes 𝗚𝗹𝗼𝗯𝗮𝗹 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻 after doubling the amount of business customers in a year. Monzo, which started rolling out business banking products in March 2020, has now hit 450,000 business customers, up roughly 100% since May 2023.

DONEDEAL FUNDING NEWS

🇫🇷 French wealth management startup Ramify raises €11m. The firm's team of quantitative finance researchers, developers, and financial experts promises to offer seamlessly integrated finance, technology, and human expertise to deliver a premium client experience.

🇨🇱 Chilean paytech Shinkansen receives new investment from Corporate Venture Capital Krealo. he firm specializes in automating, via APIs, company payments to multiple recipients (payouts) and the automatic reception of payments (pay in). Read on

🇦🇷 FinTech Moonflow raises $1.74M to accelerate product development in Latam and Enhance Payment Platform. Founded in 2023, Moonflow has clients in 22 countries and aims to reach 1,000 corporate clients. Companies in various sectors already use Moonflow to improve their collections.

🇬🇧 Finbourne taps $70M for tech that turns financial data dust into AI gold. The firm, which has built a platform to help financial companies organize and use more of their data in AI and other models, will use the funds to expand its reach outside of the Square Mile.

🇧🇷 Financial underwriting platform a55 raised an undisclosed amount from payment orchestrator Paysecure. The investment comes after a55’s $16M Series B in January 2022. The firm will use the investment to expand its banking and credit offers, starting with SMEs in Latin America, as well as other initiatives.

🇲🇽 Mexico’s payments startup Clip has raised $𝟭𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. The investment will be used to continue growing in its home market of Mexico, said Clip Founder and CEO Adolfo Babatz in an interview. More on that here

🇧🇷 Brazilian Banking as a Service FinTech Celcoin announces US$125 Million investment led by Summit Partners. The new funding will support Celcoin’s expansion plans as the company works to continue delivering new and innovative products to strengthen its leadership position in the BaaS and embedded finance market.

MOVERS & SHAKERS

🇬🇧 TrueLayer appoints Lisa Scott as First Chief Strategy Officer to drive growth and consumer engagement. In this new role, Scott will oversee the company’s expansion into new markets, drive consumer engagement and accelerate the adoption of its innovative open banking solutions.

🇺🇸 US-based paytech Payzli has revealed a string of immediate “strategic changes” to its leadership team “to further accelerate revenue growth”. Arash Izadpanah, the firm’s former CEO, will assume the role of chief risk officer (CRO).

🇮🇱 Rapyd lays off dozens of employees, transferring positions from Israel to Eastern Europe, South America. The FinTech unicorn is cutting 30 positions in Israel and is moving them abroad due to the desire to cut costs. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()