Revolut's eSIM Revolution & Crypto Innovations

Hey FinTech Fanatic!

Fresh off the plane and back in Europe, and guess who's already making waves? Yep, Revolut's snatched the spotlight with not one, but two headline-grabbing updates.

First up, for all you globe-trotters and tech aficionados in Ireland 🇮🇪, say hello to a game-changer: Revolut's brand new digital eSIM card. This nifty little innovation means you can now jet off to over 100 countries and stay connected without the hassle of swapping SIM cards. It's all digital, all on your phone, making Revolut the first financial player in Ireland to dive into the eSIM pool.

No more fumbling for that tiny SIM card tool - eSIMs are all about the software, ready to go on your device's built-in chip. And it's not just for the tech elite; with most 4G/5G Apple and Android phones on board, Vodafone and Three have got some serious competition. Available now for over 2.5 million Irish Revolut users, regardless of your plan, it's all about keeping you connected effortlessly.

But wait, there's more! Revolut's stepping up its crypto game too. Teaming up with the giant MetaMask, they're rolling out Revolut Ramp - a sleek new gateway to the crypto universe for folks in the UK and the European Economic Area (EEA). It's not just another crypto feature; it's a full-on commitment to bringing you into the crypto fold with ease and security. Thanks to an integrated KYC process that's a breeze for newbies and non-existent for existing Revolut users, jumping into crypto with Revolut Ramp is as quick as a flash.

Whether you're into the latest in digital connectivity or diving deep into the crypto world, Revolut's making sure they've got something for everyone. Stay tuned for more details down the email – trust me, you won't want to miss out on this.

Catch you soon!

Cheers,

#FINTECHREPORT

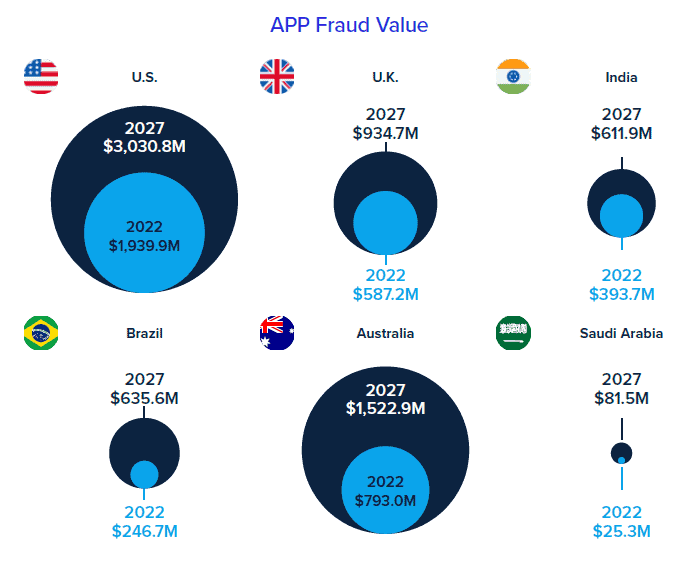

ACI Worldwide's report reveals how banks can tackle new payment scams👇

INSIGHTS

🇺🇸 Ex-Brex exec Sam Blond is already leaving Founders Fund just 18 months after he joined. In a recent tweet, he thanked the chance to work at Peter Thiel’s VC firm and explained, “Full time investing / being a VC isn’t the right fit for me and I’ve decided to go back to operating,” which suggests he’s either accepted or is about to accept a position at a startup or another tech company, or is in the process of founding one.

FINTECH NEWS

🇸🇬 Bitstamp receives In-Principle License Approval in Singapore. This paves the way for them to provide digital payment token services in Singapore in compliance with the republic’s Payment Services Act. This strategic move reflects Bitstamp’s commitment to compliance and supporting the growth of the evolving global landscape.

🇨🇦 Uber partners with Mastercard and Payfare to launch the new Uber Pro Card in Canada. The Uber Pro Card will be available via mobile wallets and enables seamless contactless payments, so drivers and delivery people can begin spending immediately.

🇺🇸 Green Check, CTrust and Whitney Economics partner to produce report on cannabis debt financing. This first-of-its-kind report, expected to be released in Q2 2024, will assess the total amount of debt invested in the cannabis industry and the percentage of debt financing required to support the industry’s continued growth.

PAYMENTS NEWS

🇫🇷 Allianz Trade launches Allianz Trade pay, a new range of services fully dedicated to B2B e-commerce activities. Allianz Trade pay brings simplicity, security, flexibility and competitiveness to the e-commerce ecosystem thanks to comprehensive and easy-to-set-up products. Read more

DIGITAL BANKING NEWS

🇮🇪 Revolut has launched a digital eSIM card for Irish customers to access data plans in more than 100 countries, making it the first financial institution in Ireland to enter the eSIM market. eSIMs, unlike traditional SIM cards, are digital and consist of software that is installed onto a permanent chip that is already part of a compatible device.

🇺🇸 Monzo plots US return after fresh funding. It withdrew its application for a US banking licence in 2021 – months after a ‘soft launch’ in the country – after regulators informed it that the bid would be unlikely to succeed. It hired Conor Walsh as US CEO late last year and this time plans to enter the US via a banking partnership which would allow it to bypass a licence application.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Revolut has joined hands with the popular crypto wallet MetaMask, revealing Revolut Ramp. According to the press release shared with Cryptonews, Revolut Ramp is the latest crypto offering available to users in the UK and European Economic Area (EEA). With this feature, said Revolut, the company is “doubling down on its commitment to the world of cryptocurrency.”

DONEDEAL FUNDING NEWS

🇲🇽 Mexican FinTech platform YoFio, known for providing digital financial solutions, has successfully closed a $10 million funding round led by social investor Oikocredit. YoFio, with its focus on working capital for micro-stores and utilizing an AI-driven credit scoring model, is active in key metropolitan areas of Mexico.

🇺🇸 Remofirst raises $25 million. The HR startup, which helps businesses hire full-time remote employees from around the world, is proving demand for global tech talent is far from waning. The company announced $25 million in a Series A round, which will be used to market themselves to more international clients, like in the UK, and to hire new executives.

M&A

🇺🇸 Synchrony completes acquisition of Ally Lending. Through this acquisition, Synchrony deepens its presence and reach in the home improvement and health and wellness sectors including high-growth specialty areas such as roofing, HVAC, and windows, as well as in cosmetic, audiology, and dentistry.

MOVERS & SHAKERS

🇫🇮 Enfuce appoints Philip Mikal as chief product and technology officer. By sharing a unique product vision, goal and timeline, Philip will enable Enfuce to continue developing exceptional products and services and further enhance its offering, taking the company from strength to strength.

🇨🇦 Visa names Michiel Wielhouwer as President and Country Manager for Canada. Wielhouwer joins Visa Canada at a time of growth and opportunity as the company establishes new secure ways to pay, driven by its innovation and FinTech strategy. More on that here

Reno Mathews joins due diligence startup Spektr as CCO. Over the past two decades, Mathews has served at a host of FinTech, tech and banking firms, including Citi, Google, Robinhood, Meta and Trulioo. His appointment comes a month after Spektr raised €5 million to help financial sector firms with their due diligence processes.

🇺🇸 FIntegrate Technology welcomes industry veteran, Jeff Harper as Chief Growth Officer. This addition marks a significant step in the company’s ongoing efforts to expand its market presence, bolster its direct sales organization, foster partnerships and drive strategic growth initiatives. Harper will report to FIntegrate’s Founder and CEO, Kris Bishop.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()