Revolut Unveils UK ISA, Mubadala Eyes $100M Stake

Hey FinTech Fanatic!

Revolut this, Revolut that… and yet, it’s hard to look away. Abu Dhabi's Mubadala is back at the table, reportedly in advanced talks to pump another $100M into its Revolut stake 🤑

From the Gulf to the Far East, Revolut is now connected to China, now allowing users to send money in Yuan through Alipay.

Meanwhile, in Europe, a staking partnership with France-based Morpho just dropped, ISA accounts are now live in the UK, and Spain hit 5 million Revolut customers.

Scroll down to dive deeper into Revolut’s latest moves and all the FinTech headlines 👇 I’ll be back tomorrow!

Cheers,

INSIGHTS

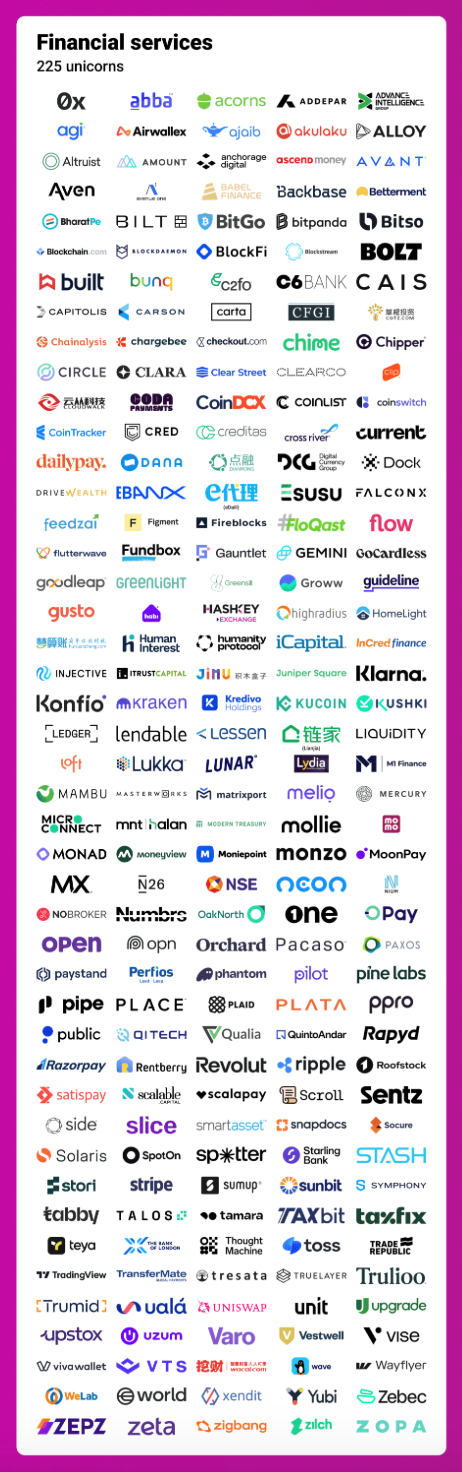

📈 225 FinTech Unicorns 🦄… and counting.

Here is a market map of a FinTech Startup valued at $1B+ today:

🇺🇸 How cryptocurrency is powering Robinhood's stock surge. The firm is providing tokens tied to the valuation of privately owned companies, such as OpenAI and SpaceX, for E.U. clients. Additionally, the company completed its acquisition of the global cryptocurrency exchange operator Bitstamp.

FINTECH NEWS

🇨🇭 Okoora and DashDevs partner to deliver seamless embedded FX infrastructure for FinTechs. The partnership brings Okoora's FX360 engine, an AI-powered infrastructure layer for real-time FX risk management, liquidity routing, and cross-border execution, with DashDevs' end-to-end FinTech product development expertise.

🇬🇧 Finmo, the Treasury and Payments Platform, secures UK EMI license and expands its global footprint. With the EMI license, Finmo is now authorized to issue electronic money and offer a range of payment services in the UK, including account issuance, domestic and cross-border fund transfers, and foreign exchange transactions.

🇬🇧 FCA fines Monzo £21m for failings in financial crime controls. Monzo failed to design, implement, and maintain adequate customer onboarding, customer risk assessment, and transaction monitoring systems to mitigate the risk of financial crime.

🇪🇺 Robinhood stock tokens face scrutiny in the European Union after the OpenAI warning. The Bank of Lithuania said it is “awaiting clarifications” regarding the structure of the company’s OpenAI and SpaceX stock tokens. Robinhood says its stock tokens give users the ability to invest in shares in the form of blockchain-based tokens.

🇦🇪 Abu Dhabi sovereign Mubadala fund in talks to buy $100M Revolut stake. If completed, the transaction would add to a smaller stake in Revolut, which was bought by the Abu Dhabi fund last year as part of a wider secondary transaction. Read more

🇬🇧 Ziglu Limited enters special administration. Ziglu Limited is authorized by the FCA to issue electronic money and provide payment services. It also offers its customers cryptoasset products, including a lending product. The FCA’s actions provided significant protection for customer money and other assets the firm held.

🇬🇧 JPMorgan-owned Nutmeg posts £40M loss. The robo-adviser, which was launched in 2012, has not yet turned a profit. However, losses at the company have narrowed slightly from £44M in 2023, according to results for the year ended 31 December 2024.

PAYMENTS NEWS

🇨🇴 PayJoy chose Pomelo for its successful launch in Colombia. The PayJoy card, powered by Pomelo, serves as an additional credit solution designed to enhance customer access to flexible payment, usage, and loyalty options. The card is available in physical and virtual formats, ensuring secure, fast deployment.

🇨🇱 Getnet Expands Presence in Chile’s Iconic Food Scene with Grupo Cadaqués. Getnet’s technology now supports fast and secure transactions at establishments that have defined Chile’s food culture for generations. The mobile solution streamlines the customer experience, delivering quick and seamless payments from table to counter.

🇪🇺 Broadridge enables compliance with EU instant payment regulations. This move follows robust take-up by European banks, reflecting Broadridge’s commitment to enhancing the speed and efficiency of financial transactions across the continent.

🇨🇳 Vietnamese users can link UnionPay cards to Alipay and WeChat Pay for convenient payments in China. This partnership enables Vietnamese travelers, students, and professionals to make secure and efficient payments via QR codes at numerous locations, including retail, dining, transportation, and tourist attractions.

🌍 MoonPay introduces Apple Pay integration for instant and fee‑free crypto top‑ups. This new integration marks a significant step in MoonPay’s mission to simplify and democratize access to digital assets. Continue reading

🇨🇦 Adyen launches capital for Canadian platform customers. With Capital, Adyen enables platforms to offer customers quick funding through a simple request process, helping Canadian businesses manage pain points and capitalize on opportunities to grow their businesses.

🇦🇺 Worldpay expands platforms offering to meet embedded finance demand. The expansion brings Worldpay for platforms to Canada and the U.K. and deepens the company’s presence in Australia. The offering lets software providers embed “highly secure, scalable” payment experiences into their platforms.

🇧🇩 Pathao launches digital wallet Pathao Pay. The digital wallet is designed to redefine how users transact, access, and manage money in their everyday lives. Users can seamlessly handle their everyday finances, whether it's ordering food, booking rides, splitting dinner bills, or sending money to friends.

🇪🇬 LemFi extends its payment services to Egypt. This strategic expansion positions it to provide its service offerings to Egypt’s massive diaspora community, building on the country’s growing adoption of the digital payments market. The expansion also positions LemFi as a reliable partner across the North Africa corridor.

🌍 Flutterwave’s send app returns to Europe and boosts remittance options for the African diaspora. The relaunch includes new security upgrades, expanded payment options, and coverage across multiple European countries. Keep reading

🌍 Zimpler introduces ID+, a Next‑Gen identification layer for digital payments. It announced the launch of Zimpler ID+, a new identity layer designed to simplify compliance and accelerate user conversion within digital payment environments.

REGTECH NEWS

🇸🇬 ShopBack goes beyond rewards with MAS Nod for payments license. This allows ShopBack to enable merchants to accept payments and let customers pay using ShopBack Pay, all under its licensed infrastructure. The approval marks a key step in ShopBack’s efforts to deepen its payment capabilities in Singapore.

🇨🇳 Hong Kong to launch stablecoin licensing in August. Its stablecoin licensing regime, set to begin on August 1, is drawing significant interest from the region’s financial and tech heavyweights, with local media in China reporting that over 40 applications have been received.

🇧🇭 Pay10 secures a payment services license from the Central Bank of Bahrain. The license, issued under the Ancillary Services Provider framework, enables Pay10 to integrate directly with Bahrain’s domestic payment systems, including the Fawri+ real-time payments network.

DIGITAL BANKING NEWS

🇨🇳 Revolut has partnered with Ant International using Alipay to enable its customers to send money to China in Chinese Yuan. The partnership aims to provide compliant and efficient cross-border remittance services for users. Additionally, Revolut reaches 5 million customers in Spain and surpasses 3 billion in deposits. The total number of transactions grew by 120% y-o-y, highlighting the growing reliance on the platform for day-to-day financial management.

🇬🇧 UK neobanks double spending on staff, marketing, and legal fees as sector booms. This challenger banks’ results season saw the FinTechs consolidate their profitability streak, with Monzo and Revolut both in the green for the second year running.

🌍 Marc Bürki, CEO of Swissquote, wants to develop Yuh internationally. He said, "After all, foreigners, companies like Revolut or N26, also come to us." Switzerland is certainly a good market for Yuh, which is now profitable. "But it only has nine million inhabitants." And size is crucial in the mass-market sector in which the startup operates.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Revolut has selected the French protocol Morpho to power a new DeFi yield product. The move is aimed at offering Revolut’s millions of users a crypto-based alternative to traditional savings accounts. Revolut launches stocks and shares Isa and UK-listed ETFs to get Britons investing in home-grown companies. Customers will be able to invest in a few taps using the bank's app, starting from £1.

🇨🇭 Tether holds an $8 billion pile of gold in a secret Swiss vault. The El Salvador-based crypto company now holds nearly 80 tons of gold, it said. The vast majority of that is owned by Tether directly, making it one of the largest gold holders in the world outside of banks and nation-states.

PARTNERSHIPS

🇬🇧 Yaspa to provide business accounts and payment services for merchants with Vialet integration. The partnership builds on VIALET’s deep experience as a European FinTech, offering specialized business accounts and a full suite of payment services designed for digital businesses.

🇬🇧 Loqbox credit-building tool integrates with the Jaja Finance app. The partnership will further enable Jaja to provide simple, fair, and efficient credit options to those who need it most, while introducing innovative ways to make credit more inclusive, empowering customers who have historically faced barriers to access and helping them build their credit scores.

🇦🇺 Commonwealth Bank and Westpac reveal major payment changes for millions of customers. Mastercard’s Click To Pay allows customers to pay online without having to manually type in all their payment details and is designed to stamp out card-related fraud, which costs Aussies more than $2 billion a year.

🇷🇴 Zen.com has announced a partnership with Romanian-based Libra Internet Bank. Clients will be able to access accounts with local IBANs. As part of the partnership, Zen will gain access to accounts held in Romanian lei. It will also generate virtual IBANs in this currency for individual and business customers.

🇺🇸 PayJunction integrates with Twilio for AI-driven voice payments. Through this integration, PayJunction merchants can now deploy AI-driven Interactive Voice Response solutions that securely process payments over the phone and eliminate manual processes, saving time and money.

DONEDEAL FUNDING NEWS

🇺🇸 Monzo alumni Gradient Labs raise $13M for AI customer service agents for financial services. The company plans to use the funding to finance a US expansion and to court customers. It is looking to hire a sales and marketing person stateside and plans to double its currently 20-strong team by the end of the year.

🇦🇪 UAE mortgage FinTech Huspy takes in $59M ahead of Saudi entry. Huspy will be adding a new market, Saudi Arabia, this year. To support its expansion, the company is hiring for expansion and technology-specific roles. Continue reading

M&A

🇳🇱 Flow has been acquired by Snelstart. The two companies had previously collaborated on integrating Adyen’s payment infrastructure into Snelstart’s accounting platform. The acquisition is described as a strategic move, with both companies aiming to benefit from each other’s networks. Flow will continue to operate under its name as part of the Snelstart Group.

MOVERS AND SHAKERS

🇺🇸 Neon hires ex-Google Ben Serridge as Chief Product Officer with a focus on AI. The executive will be responsible for leading the AI strategy applied to the company's products. The focus is on personalizing the user experience and gaining operational efficiency.

🇳🇱 Finom appoints Tijana Kovacevic as Chief People Officer. She is joining Finom as the company accelerates its expansion across Europe following its recent €92.3 million growth investment from General Catalyst's Customer Value Fund. Read more

🇬🇧 PPRO appoints Michelle Eischeid as Chief Financial Officer to support its next growth phase. In her role, Michelle will spearhead PPRO’s global financial strategy, financial planning and operations, and investor relations, as the company continues to scale its platform and expand its international reach.

🇦🇺 Bridgit appoints Nick Ognenovski as CRO. In this newly created role, Nick will be responsible for leading Bridgit’s end-to-end revenue strategy. He will drive the execution of go-to-market plans, optimize performance across third-party distribution and direct-to-consumer channels, and oversee the sales organization.

🇦🇺 GoCardless appoints Ian Boyd to power expansion in Australia and New Zealand. In his new role, Boyd will be responsible for driving the company’s continued growth across the market, with a strong focus on strengthening strategic partnerships, accelerating revenue growth, and developing the company’s PayTo offering

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()