Revolut Secures EU Crypto Approval 🇪🇺 while I Prep for the Big Run in NYC

Hey FinTech Fanatic!

Revolut just got the green light to roll out its crypto services across Europe. The British FinTech received approval from the Cyprus Securities and Exchange Commission (CySEC), allowing it to offer digital asset products in up to 30 countries within the EEA.

“It’s no secret that we have ambitious plans for the crypto sector in the future, and our MiCA license is fundamental to all of that,” said Costas Michael, CEO of Revolut Digital Assets Europe.

It caps off a breakout year for Revolut’s crypto unit, with its wealth division, which includes crypto trading, up 298% year-over-year to $674 million in revenue 🤯

Next up: Crypto 2.0, a revamped product offering 280+ cryptocurrencies, zero-fee staking, and spread-free stablecoin conversions.

As mentioned in my earlier notes, I was planning to join the FinTech Running Club in New York yesterday since I love catching up with the local runners when I’m around and supporting Pedro d’Avila, who always brings together an amazing crew.

It was great meeting the group (and even speaking a bit of Dutch with Francesco Falcone from Checkout.com — are all Checkout people runners?? I meet them at every event 🤣).

Unfortunately, I didn’t actually run. My knee wasn’t too happy after the Amsterdam Marathon last weekend, so I’m taking some rest before my next big goal: the New York Marathon.

A huge thanks to Mastercard for making that dream start possible!

I’ll be in New York for a few more weeks after the race, so if the knee cooperates, I’ll join the next FinTech Run here soon.

Hope to see some of you there, or cheering along the course on Marathon day. I could use the support 😉

Now enjoy more FinTech updates below, and I'll be back in your inbox on Monday!

Cheers,

POST OF THE DAY

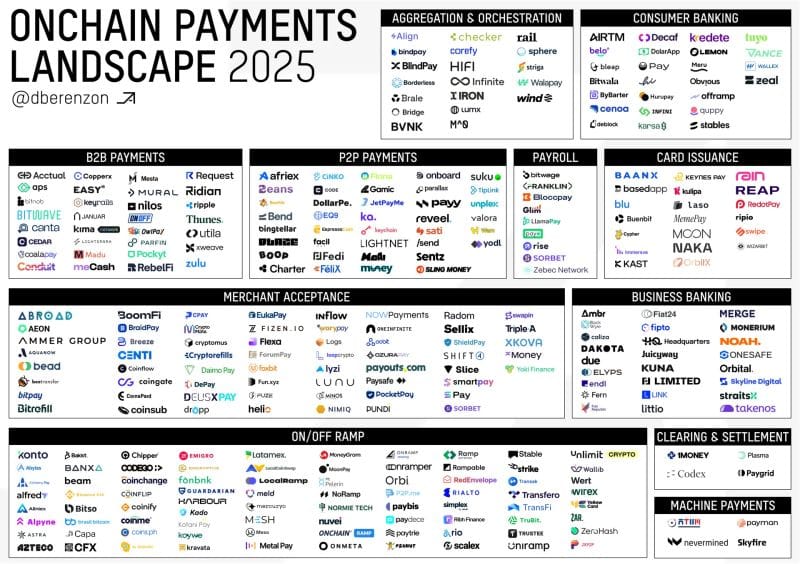

➡️ There are currently ~320 payment companies building on cryptorails 👇

Which company is missing from this map?

PAYMENTS NEWS

🇬🇧 Solidgate Billing Dashboard. As companies expand across products and regions, tracking subscription KPIs becomes complex and fragmented. Solidgate simplifies this with its new Billing Dashboard. Integrated within the Solidgate HUB, the dashboard centralizes subscription analytics, giving teams clear visibility into growth, churn, and revenue trends.

🇫🇷 French digital bank Fortuneo has partnered with Wero, a European digital payment solution, allowing its customers to send and receive money instantly and securely between friends and family directly from their mobile banking app. With this launch, Fortuneo customers become part of Wero’s growing network of 45 million active users.

🇺🇸 PayPal to drive engagement in the post-transaction experience with Rokt. This integration populates advertisements following peer-to-peer (P2P) transactions on "Thank You" pages across PayPal and Venmo, as well as on merchant confirmation pages through Honey.

FINTECH RUNNING CLUB

🏃➡️ Join FRC Munich’s debut run!🎉

Meet the new host, Cosima Karmann, and celebrate Germany’s 3rd FRC chapter!

DIGITAL BANKING NEWS

🇬🇧 UK Digital Bank Monzo is said to weigh a fresh share sale. The digital lender is working with bankers at Morgan Stanley to prepare for a potential new round and gauge interest from investors. The sale is still at an early stage, and Monzo has not yet decided on the structure or set a valuation target.

🇩🇪 Vivid Money launches AI assistants. The goal is to make generative AI usable not just as an abstract potential, but as a concrete productivity gain for small businesses. The AI assistants would work with documents, communicate like real colleagues, connect with existing tools, and securely leverage corporate data to deliver faster results.

🇨🇭 UBS merges mobile banking and Circle One into a unified wealth app. The integration combines trading, portfolio management, and investment insights into a single platform designed to enhance client accessibility and convenience. The move reflects UBS’s broader push to align its digital offerings with changing client behaviour.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase is launching Payments MCP. Payments MCP extends this vision by giving AI agents the same on-chain financial tools humans use, from wallets and onramps to stablecoin payments, all accessible through natural language. Model Context Protocol is a framework that lets AI models safely access external tools and services.

🇰🇷 Binance faces the heat in South Korea over frozen $106m GOPAX GoFi funds. South Korean lawmaker Min Byung-dug pressed regulators on whether Binance will compensate investors affected. He argued that repayment should have been required for Binance’s 2023 GOPAX acquisition, which initially faced scrutiny over the company’s past anti-money laundering issues in the U.S.

🇺🇸 Kraken Q3 2025: financial highlights. Throughout the quarter, Kraken introduced new product categories, enhancing client experiences, and expanding platform-wide capabilities to strengthen our full product suite. Q3 2025 revenues (net of trading costs) rose to $648.0 million, increasing 50% quarter-over-quarter.

🇨🇾 Revolut has secured a MiCA licence from the Cyprus Securities and Exchange Commission, allowing it to expand its crypto services across the European Union. The licence enables the UK-based challenger bank to offer and market crypto products in 30 countries within the European Economic Area.

🇬🇧 Wirex brings Google Pay to the UK for faster, safer, stablecoin and fiat spending. By integrating with Google Pay, Wirex enables users to manage and spend money securely, combining modern technology with the stability and familiarity of traditional finance.

🇺🇸 BitGo and Crescite announce strategic collaboration to explore faith-based blockchain initiatives. As part of this strategic collaboration, the parties aim for BitGo to potentially provide secure custody, reserve management, and issuance infrastructure for Crescite’s proposed Catholic USD™ stablecoin and related projects.

PARTNERSHIPS

🇺🇸 Splitit and DXC collaborate to offer installment payments via bank debit cards. This partnership harnesses DXC’s Hogan core banking platform, presenting an opportunity for hundreds of millions of cardholders worldwide to manage their cash flow more effectively. It aims to simplify consumer access to pay-over-time plans without the need for separate credit lines.

🇦🇷 dLocal partners with Alchemy Pay to streamline crypto-to-fiat payments in Latin America. By integrating with dLocal’s platform, Alchemy Pay further enhances its on and off-ramp capabilities, adding faster and more localized payment options while reducing the complexities of cross-border transactions.

DONEDEAL FUNDING NEWS

🇨🇦 Cybrid raises $10M to power stablecoins for financial institutions. The funding will accelerate Cybrid’s mission to drive stablecoins as the preferred choice for financial institutions, cross-border remittances, and B2B payments. Cybrid has grown rapidly to help financial institutions, FinTechs, and companies in the U.S. and Canada.

🇸🇬 Endowus closes $70M round to deepen AI, regional expansion. The new capital will fund expansión across Asia, deepen its AI-driven advisory capabilities, and support new pension and retirement solutions in Singapore and Hong Kong. It is also expanding its B2B offering for financial advisors and external asset managers.

🇸🇬 Pave Bank raises US$39 million to scale programmable banking platform. The funds will be used to expand its regulatory reach, enhance product development, and scale its client base globally. The company plans to expand into the United Arab Emirates, the United States, Hong Kong, and the European Economic Area.

🇺🇸 Kard secures $15M growth capital from Trinity Capital. The funding represents a strategic collaboration aimed at helping Kard scale its platform and enter new markets. Kard operates an API-first rewards infrastructure that allows banks, FinTechs, and loyalty programmes to create deeply tailored and dynamic rewards ecosystems.

🇺🇸 Paygentic raises a $2M pre-seed round to provide payments infrastructure to AI-native businesses. Paygentic will use the investment to grow the team, accelerate product development, support ever more innovative agentic billing patterns, and reinforce their payments infrastructure to serve their growing customer base.

🇬🇧 Rightcharge bags £1.6M to simplify EV charging payments for Europe’s fleets. This funding supports Rightcharge’s expansion across Europe, initiated through a white-label partnership with Octopus Electroverse. Keep reading

🇺🇸 Fundamento raises $1.9 million in pre-Series A funding. The funds raised will be used to expand its product suite, enhance its agentic AI build and data capabilities, and scale globally. Another area of focus will be to scale multi-agent orchestration, delivering intelligent voice and cross-channel engagement.

M&A

🇺🇸 Shift4 to acquire Worldline’s North American subsidiaries. Shift4 CEO Taylor Lauber described the acquisition as a classic Shift4 move, bringing in a large base of gateway customers and payment volume to integrate into its global acquiring platform. He noted that this acquisition will help rapidly expand Shift4’s customer base.

🇬🇧 Credit Clear to acquire UK-based debt collection agency ARC Europe for $10.8 million. By combining ARC Europe’s operations with Credit Clear’s advanced technology platform, the company aims to boost efficiency through its scalable digital-first model and achieve stronger results in the UK and European collections markets.

🇬🇧 LSEG to sell 20% of post-trade unit to banks, including JPMorgan and Barclays. A group of 11 banks, some of the biggest users of LSEG’s clearing services, will acquire the stake for a total of £170m in a deal which values the post-trade unit at £850m, LSEG said in a statement.

🇮🇱 Fireblocks acquires Dynamic, a16z-backed wallet platform, for $90 million. Dynamic’s technology simplifies wallet creation, authentication, and user onboarding. By combining that with Fireblocks’ Wallet-as-a-Service platform, the merged offering will allow developers and enterprises to integrate crypto payments, stablecoins, and tokenization more seamlessly.

MOVERS AND SHAKERS

🇺🇾 DEUNA has appointed Andrés Spósito as its new Head of Account Management, reinforcing its mission to turn payments into performance. With over nine years of experience in the payments industry, including leading strategic partnerships at dLocal across Latin America and emerging markets, Andrés brings strong commercial and operational expertise.

🇮🇳 BharatPe appoints ex-Paytm exec Ajit Kumar as CTO. The company said he will be responsible for scaling its payments and lending platforms with a focus on reliability and product excellence. Read more

🇺🇸 Butter Payments appoints industry leaders to drive next phase of growth: Sofya Pogreb as CEO and Charles Rosenblatt as CCO. These appointments signal a period of accelerated growth for Butter, as the addition of two seasoned leaders deepens its commitment to innovation and scaling its technology to meet growing demand across industries.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()