Revolut Secures $3B at $75B Valuation

Hey FinTech Fanatic!

Europe’s FinTech crown jewel just got shinier.

Revolut and its backers are wrapping up a $3 billion fundraising spree that pegs the company at $75 billion — a 66% jump from last year’s $45B secondary sale.

The round was so oversubscribed that some investors reportedly got smaller allocations than they wanted.

Revolut managed the entire process in-house — no bankers, no middlemen — as it gears up for the next phase:

🏦 Expanding into 30 new markets

💰 Investing $13B to hit 100M users (from 65M today)

🇬🇧 Securing that long-awaited full UK banking license

CEO Nik Storonsky says the goal is clear: reach a $150 billion valuation and stand shoulder-to-shoulder with Europe’s largest banks.

The question now: can Revolut double its worth again before it even goes public?

Cheers,

FEATURED NEWS

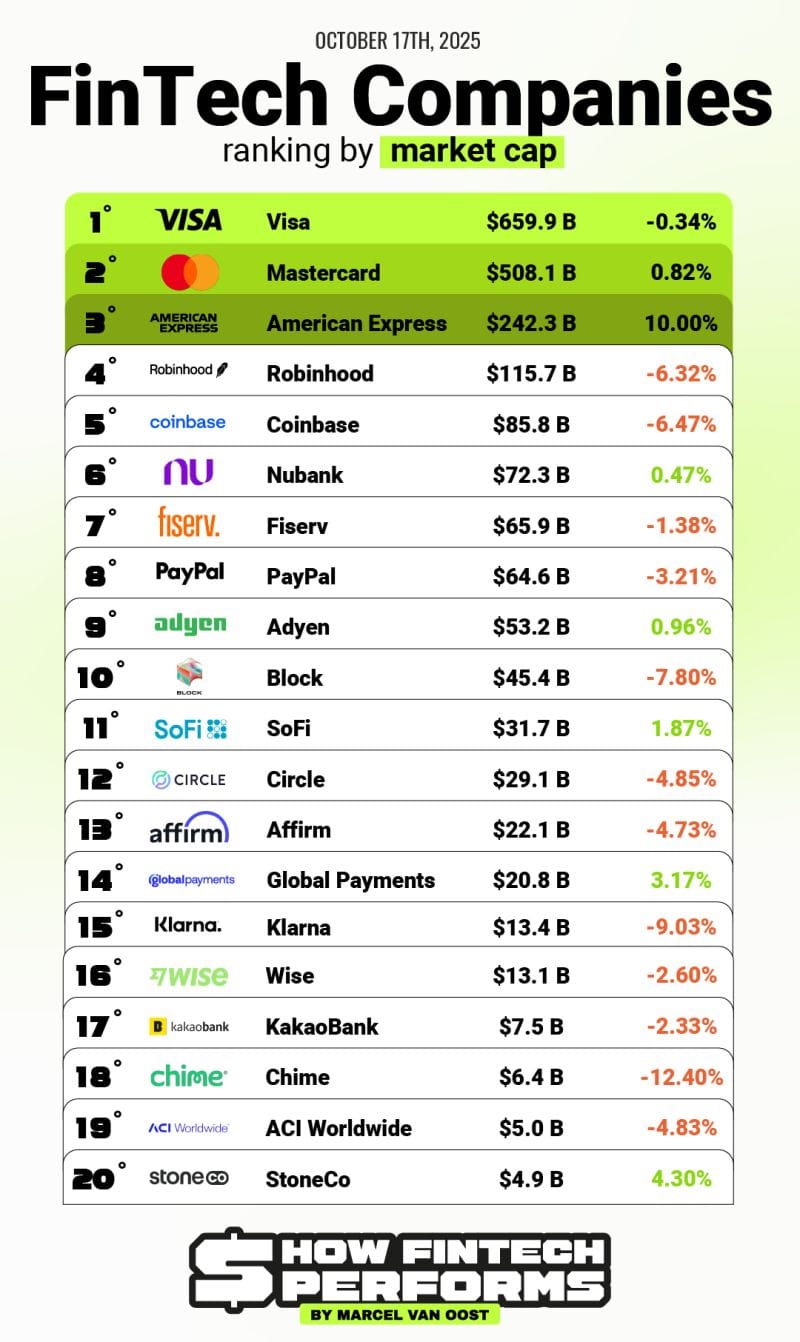

💰 The Public FinTech Market Landscape - End-of-Week Market Recap.

🇺🇸 BondIT sues JPMorgan for theft of AI and other technology, breach of contract, and bad faith dealings. According to the complaint, JPMorgan did so after top executives allegedly made repeated promises and misrepresentations that induced BondIT to engage with the bank over the course of nearly two years. The bank abruptly terminated negotiations based on a pretext in breach of binding agreements.

#FINTECHREPORT

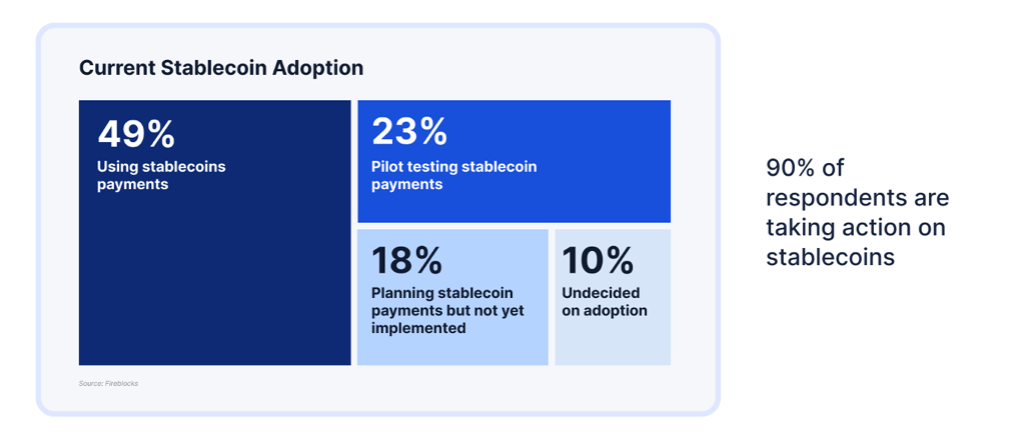

The State of Stablecoins by Fireblocks.

FINTECH NEWS

🌍 The FRC is a BIG family! The FinTech Running Club is looking for leaders in the FinTech industry in Singapore, Paris & Lisbon. The club looks for an informal, inclusive, and energetic setting to discuss the best of FinTech topics! Expand your network with us and apply!

🇺🇸 Alpaca secures Nasdaq exchange membership, advancing full-stack brokerage infrastructure. Nasdaq membership allows Alpaca to connect directly to the exchange’s order book, providing streamlined access to its full depth of liquidity and comprehensive suite of order types.

🇬🇧 FinTech Affiliate Zilch builds retail media network. Its new Intelligent Commerce platform will provide retailers access to its vast first-party data set, comprehensive reporting, and campaign tools. Continue Reading

PAYMENTS NEWS

🇬🇧 Ecommpay focuses on VAMP. Visa’s new VAMP program monitors fraud, disputes, and suspicious activity, penalizing merchants with dispute rates exceeding 2.2% and those with high levels of enumeration attacks. Marija Solovjova of Ecommpay notes the increased responsibility for acquirers and merchants, emphasizing Ecommpay’s use of advanced tools to maintain compliance and combat fraud.

🇧🇷 Brazilian FinTech CloudWalk hits $1.2 billion annualized revenue as of September and recently completed a tender offer valuing the company at $3 billion. While the company has no official IPO timeline, CEO Luis Silva said they would consider going public if market conditions are favorable.

🇯🇵 UPI payments launch in Japan, QR codes will now make payments instant! FinTech’s reach expands. The integration of UPI will enable merchants in Japan to offer faster customer payments, thereby increasing customer satisfaction and growing their business.

🇺🇸 Faster payments gain momentum at Nacha and The Clearing House. Nacha reported a 15% year-over-year increase in same-day ACH payments in Q3, totaling $970.4 billion. Meanwhile, TCH's Real-Time Payments network reached a single-day record on October 3, with nearly 1.81 million transactions worth $5.2 billion.

OPEN BANKING NEWS

🇮🇹 Enable Banking and A-Tono join forces to expand open banking infrastructure in Italy. The collaboration will see A-Tono’s digital payments platform DropPay integrate Enable Banking’s PSD2-compliant infrastructure, allowing users to access Account Information Services (AIS) and Payment Initiation Services (PIS) directly within their accounts.

REGTECH NEWS

🇫🇷 Binance among crypto firms hit by French money-laundering checks. France is expanding its anti-money laundering checks on crypto exchanges, as regulators aim to determine which of the more than 100 entities registered to offer crypto services in the country will be granted European Union-wide permits in the coming months.

DIGITAL BANKING NEWS

🇲🇽 Nu México surpasses 13 million customers, driving financial inclusion beyond major cities. With this new customer base, the company reaches around 14% of the adult population and approximately 23% of all banked individuals, consolidating its position as the leading digital player in expanding financial access in the country.

🇧🇷 Mercado Pago announces AI-powered financial assistant. The service will be able to personalize interactions, suggesting budget organization and creating piggy banks based on the customer's spending profile and goals, according to the company. The Personal Assistant is initially available to customers in Brazil, but will soon be rolled out to all Mercado Pago locations.

🇨🇭 Alpian reports milestone in customer growth. This segment generally refers to clients with investable liquid assets between around USD 100'000 and 1 million, as well as above-average household income. Currently, the bank reports a customer retention rate above 90% and a growing share of new clients acquired through referrals.

🇬🇧 Revolut launches joint savings accounts as demand for shared money tools soars. The launch comes as Revolut research highlights a shift towards financial openness in relationships. Nearly three-quarters (71%) of Brits feel comfortable discussing money with their partner, while two in five (39%) believe joint accounts are the best way to manage shared expenses.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase Business introduces global payouts and payment links, enabling businesses to send and receive USDC with low fees, instant settlement, and global reach. These tools simplify vendor payments, eliminate chargebacks, and offer seamless API integrations, empowering businesses to scale efficiently.

🇦🇪 Sygnum Bank announced the launch of Sygnum Validators, a new service launched from Abu Dhabi Global Market (ADGM), which includes operating institutional-grade validator nodes for select blockchain networks that enable non-custodial staking.

🇧🇷 Bitpanda acquires Onda Finance, its first customer in South America, with its B2B arm. Onda plans to offer trading, custody, and liquidity services in the digital asset sector based on the Bitpanda solution. To this end, it is also collaborating with the Brazilian crypto association Abcripto.

🌎 Tether announced it has open-sourced its Wallet Development Kit (WDK). With WDK by Tether, developers, organizations, nations, AI Agents, and even autonomous systems can create cross-platform experiences by leveraging a single solution to develop secure, production-ready wallets and integrate wallet functions such as DeFi, payments, savings accounts, prediction markets, gaming, and tipping.

PARTNERSHIPS

🇬🇧 Juspay collaborates with HSBC to create a full-stack acquiring solution designed to serve digital-first global merchants. The platform is tailored to consolidate the whole payment value chain into a unified stack and provides users with access to multiple payment methods through a single provider.

🇦🇺 Thredd powers ANNA Money’s super-app business account in Australia. The collaboration delivers instant virtual cards and physical commercial debit cards, with the platform engineered for secure wallet support, so customers can add cards to leading mobile wallets (when available), all backed by Thredd’s real-time authorisation and settlement.

🇺🇸 Euronet chooses Fireblocks to support cross-border stablecoin payments. Fireblocks enables Euronet to integrate stablecoin technology into its global payments infrastructure, accelerating partner settlements, reducing pre-funding needs, and enhancing liquidity management.

DONEDEAL FUNDING NEWS

🇬🇧 Revolut Secures $3B at $75B Valuation. The fundraiser, which will likely hand the FinTech fresh cash in addition to giving some of its early backers and employees liquidity, will help the company as it seeks to enter dozens of new markets in the coming years.

🇺🇸 Stripe-backed blockchain startup Tempo raises $500 million round at $5 billion valuation, representing one of the highest valued blockchain venture rounds over the past few years. The Tempo blockchain is primarily designed for stablecoins and represents a bet that the dollar-backed cryptocurrencies will become the new infrastructure layer for global payments.

🇺🇸 Tria raises $12M to be the leading self-custodial neobank and payments infrastructure for humans and AI. As part of its commitment to build with the community, not just for it, Tria is said to be preparing a public allocation round. The offering would give users a chance to own a stake in the neobank they use.

🇲🇽 Mexico’s Plata raises $250 million at $3.1 billion valuation. The FinTech seeks to expand its business and transition into a full-fledged bank. The company received approval for a banking license from the country’s regulators in December 2024 and is now in the final stage of audits before starting operations.

🇧🇷 Brazilian FinTech Bull raises $1.8M pre-seed round. Bull will use the funding for product development and market expansion. Through Bull, businesses can originate, manage, and collect worker credit, turning their customer base into a revenue engine via secure, streamlined processes.

M&A

🇬🇧 Omnipresent has been acquired by Deel. The CEO, Guenther Eisinger, said that Omnipresent is joining Deel to redefine the future of global work, empowering companies everywhere to hire, pay, and support talent seamlessly, no matter where they are. Keep reading

🇺🇸 S&P Global strikes a $1.8 billion deal for private markets firm With Intelligence, as it looks to expand its products for the fast-growing segment of financial services. The deal is set to close in 2025 or early 2026, and is expected to be added to the company's adjusted profit per share in 2027, S&P Global said.

🇺🇸 Ripple pays $1 billion for GTreasury to enter the corporate treasury. The acquisition strengthens Ripple’s ability to connect with Fortune 500 chief financial officers and treasurers to manage and provide additional liquidity for tokenized deposits, stablecoins, and other digital assets, the blockchain tech company said in a press release.

MOVERS AND SHAKERS

🇸🇦 Hala announces that Yasser Al-Mussirii has joined as its new Chief Executive Officer. His appointment marks an exciting step forward for HALA Payments, one focused on accelerating innovation, strengthening partnerships, and driving sustainable growth across the Kingdom’s FinTech landscape.

🇬🇧 UBS appoints Daniele Magazzeni as Chief AI Officer. Daniele is tasked with advancing UBS's AI strategy, helping to reshape business capabilities to improve the client experience and enhance employee productivity. Based in London, he will also be responsible for ensuring the effective deployment of AI-powered tools and processes at scale, maintaining consistent standards.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()