Revolut Moves Into Employer of Record, Setting Up a Direct Challenge to Deel

Hey FinTech Fanatic!

Revolut is getting close to launching GlobalHire, its Employer of Record service, with a standalone app expected to go live soon.

GlobalHire will allow companies to hire talent in 160 countries without setting up local entities. Revolut acts as the legal employer, handling payroll, benefits, tax, and local compliance.

The goal is simple: remove friction from global hiring. And yes, this puts Revolut squarely into territory already dominated by players like Deel.

Revolut first signaled this move around ten months ago. Back in April 2025, Revolut was briefly drawn into the public dispute between Rippling and Deel, highlighting just how competitive the Employer of Record space has become.

From Revolut to Deel: a conversation worth watching 👇

Before you move on, I want to highlight a conversation that fits perfectly with today’s news.

I recently watched this interview with my friend Dan Westgarth, COO of Deel, hosted by Miguel Armaza, whom I’ve had the chance to meet a few times. Dan previously worked at Revolut, which makes the timing of this conversation particularly interesting.

If Revolut is stepping into Deel’s arena, this interview is essential context...

You can watch the full conversation here 👇

How Deel Built a $17 Billion Company in 7 Years - Dan Westgarth, COO

Curious where FinTech is heading next? Dive into today’s updates 👇 I’ll be back next week with more stories shaping the FinTech industry.

Cheers,

#FINTECHREPORT

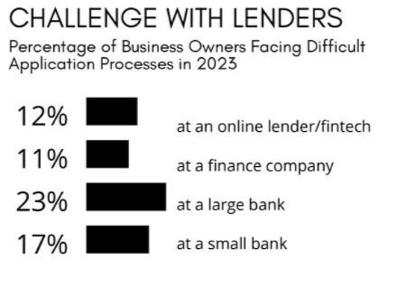

🇺🇸 The State of US 2025. This report is based on a comprehensive survey of more than 800 C-level executives at U.S. banks, providing a detailed view of investment plans for 2025 and 2026.

FINTECH NEWS

🇬🇧 Mastercard, Visa, and Revolut lose UK case over proposed cross-border card fees cap. Mastercard, Visa, and Revolut argued that the PSR did not have the power to impose price caps. The judge, however, rejected the challenge and ruled that the PSR does have the power to impose its proposed price caps on interchange fees.

🇮🇱 Tipalti is laying off dozens of employees. The FinTech company is not publishing the number of employees included in the layoff process, but according to industry estimates, it is more than 100 employees. Read more

PAYMENTS NEWS

🇫🇷 Worldline empowers agentic commerce with new AI capabilities. Worldline is introducing new capabilities to connect AI agents to its global payment ecosystem, making payments agent-ready and enabling merchants to experiment with AI-powered workflows and commerce experiences.

🇰🇷 K Bank launches digital asset-based remittance and payment services between Korea and the UAE. This agreement aims to jointly develop a next-generation remittance and payment network connecting Korea and the UAE, the financial hub of the Middle East, based on digital assets, and to discover new business models utilizing blockchain technology.

🇮🇱 Neema unveils global push-to-card payments for instant, and bank-less business transactions. The Push-to-Card enhancement to Neema’s cross-border payment platform, however, enables businesses to send funds directly to a recipient’s card, without requiring bank account details or traditional bank transfers on the receiving side.

🇨🇳 Visa teams up with Apple to enable overseas Apple Pay payments for Chinese cardholders. The initiative reflects rising demand for mobile and interoperable payments and builds on Visa’s expanded investment in tokenization and cross-border payment security.

🇺🇸 PayEngine partners with ServiceTitan to bring tap-to-pay to the $6 billion field service industry. The integration enables ServiceTitan customers to accept contactless card payments directly on their existing mobile devices, eliminating the need for separate payment terminals, Bluetooth dongles, or manual card entry.

FINTECH RUNNING CLUB

🇵🇦 Our New Panama host is here!💪🏼 Meet our new host, Mauricio Villareal, and join the next run!

DIGITAL BANKING NEWS

🇨🇴 Revolut prepares full-scale launch in Colombia for 2026. After receiving initial approval in late 2025 to establish a local bank, Revolut plans to invest about €32 million and is now awaiting its final operating license, while building local teams and integrating domestic payment infrastructure.

🇳🇿 Revolut launches RevPoints rewards scheme in New Zealand. The said RevPoints has no cap on the number of points customers can earn. The company positioned the programme as an alternative to traditional rewards schemes linked to credit cards. Additionally, Revolut's Chairman is listed as a Swiss resident in local filings. Martin Gilbert has disclosed a long-standing residence permit in Switzerland’s low-tax canton of Zug in filings linked to the creation of Revolut Swiss NewCo SA, though he remains a UK tax resident with no plans to relocate.

🇬🇧 Standard Chartered completes first ICC-Swift API standards digital bank guarantee transaction through Komgo. Fully compliant with ICC-Swift API standards for bank guarantees, the transaction marks a significant step towards creating a fully interoperable and integrated digital bank guarantee ecosystem, reducing friction and supporting the digital transformation in global trade.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 MoonPay powers Myriad’s in-app wallet and USD1 prediction markets. With this launch, MYRIAD users can seamlessly deposit crypto or fiat through MoonPay and participate in prediction markets across assets like BTC, ETH, BNB, and more.

🇦🇷 Lemon launches Bitcoin-backed credit card in cash-hoarding Argentina. By letting users post Bitcoin as collateral for local credit lines, Lemon is effectively trying to turn a favored savings asset into day-to-day spending power, without forcing savers to unwind their BTC or their stash of hard currency.

🇬🇧 London Stock Exchange Group debuts tokenized deposit settlement platform. The platform is designed to allow real-time settlement without the need to depend on traditional banking hours. Keep reading

PARTNERSHIPS

🇬🇧 PhotonPay expands UK local payment rails via new collaboration with ClearBank. Through this collaboration, PhotonPay’s business customers will gain access to a wider range of financial services, including virtual accounts, GBP collections, payouts, and Confirmation of Payee (CoP) functionality.

🇵🇹 Nickel integrates Mastercard's Click to Pay to revolutionize the online shopping experience. With Click to Pay, Nickel customers can make payments on compatible e-commerce websites through a faster and more intuitive process. This consolidates Nickel's position as an accessible, inclusive, and technologically advanced alternative in the Portuguese financial market.

🇦🇪 Ziina becomes the first in the UAE to execute live Open Finance payments with Lean. Ziina app users can now complete instant, account-to-account bank payments through regulated Open Finance APIs that connect directly to their bank accounts, giving them a faster, more transparent, and secure way to move money.

🇺🇸 Edenred Pay expands B2B payments network through Bottomline partnership and Paymode integration. By connecting Edenred Pay's platform with Paymode's network, the partnership drives higher digital payment adoption, delivers rich remittance data to vendors, and increases customer and vendor satisfaction through a streamlined experience.

🇺🇸 STS Digital joins BitGo’s go network as a new exchange partner for off-exchange settlement. Through this integration, institutional clients can trade with STS Digital while keeping assets protected in regulated, qualified custody with BitGo Bank and Trust.

🇦🇺 Thredd and Paywith team to launch Australian card programs. The collaboration is designed to help businesses launch “flexible, customer-centric card programs” with the help of Paywith’s technology and Thredd’s local market expertise and infrastructure.

DONEDEAL FUNDING NEWS

🇨🇳 WeLab completes $220 million Series D strategic financing, marking the largest digital banking capital raise in Asia in 2025. The investment will fuel WeLab’s expansion in Southeast Asia, while deepening its leadership in Hong Kong through a richer, more diversified product ecosystem and accelerated customer acquisition.

M&A

🇺🇸 Stripe has completed its acquisition of Metronome, strengthening its capabilities in orchestrating complex usage-based billing models. Stripe CEO Patrick Collison said the deal supports a broader shift toward usage-based monetization, positioning metering and billing as the critical link between product and business.

MOVERS AND SHAKERS

🇺🇸 Bolt appoints Olta Andoni as SVP of Legal and People to support platform expansion across checkout, identity, and payments. In this role, Andoni will oversee Bolt's legal, regulatory, compliance, and people operations as the company continues to expand its platform across digital commerce, identity verification, and payments, including crypto-enabled checkout.

🇲🇾 Fasset to appoint a Digital Banking CEO, Rafiza Ghazali. In her new role, Rafiza will drive Fasset’s global stablecoin-led banking strategy with a focus on retail, private, SME, and trade finance segments. She will also be responsible for scaling digital banking operations from Malaysia.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()