Revolut in Talks With Bank of Israel for 'Lean Bank' License

Hey FinTech Fanatic!

Revolut is making headlines again, this time for its discussions with the Bank of Israel to secure a "lean bank" license. The British FinTech first entered the Israeli market less than a year ago, obtaining a unique identification code that allowed it to operate within the country’s regulated payment system.

Now, Revolut is looking to expand its reach. A "lean bank" license would grant it limited banking privileges, enabling the company to accept deposits and provide credit, marking its closest step yet toward a full banking presence in the Middle East.

The move comes months after Revolut appointed Uri Nathan as CEO of its Israeli operations. It also aligns with recent efforts by the Bank of Israel and the Ministry of Finance to foster competition in the deposit and credit sectors.

But Revolut isn’t the only FinTech making moves in the country. Israel-based Rapyd, which a couple of months ago raised $500 million at a $4.5 billion valuation, could soon join the fray.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FINTECH NEWS

🇺🇸 Chime is set to launch its IPO on Thursday, aiming for a $11 billion valuation. It plans to offer 32 million shares with an initial public offering (IPO) price expected to be between $24 and $26 per share. It was reported that at the top of that range, Chime’s valuation would be lower than the $25B it reached in 2021.

🇺🇸 Uphold exploring IPO while courting XRP-avid US consumers, CEO says. Simon McLoughlin said the company’s board has appointed FT Partners to look at strategic options that include a potential IPO in the U.S. or a sale to a payments company. The company is seeking a valuation of over $1.5 billion.

🇺🇸 Binance CEO Richard Teng responds to IPO plans. Teng says any public listing must be approved at the highest levels, leaving timing open for Binance. He added that any decision of this scale “is a very important corporate decision that they have to discuss at the board of directors level and discuss with the shareholders what the intention is.”

🇦🇺 Visa and Chainlink complete CBDC and a stablecoin swap between Hong Kong and Australia. This enabled an Australian investor to exchange an AUD-backed stablecoin for e-HKD and use the digital Hong Kong dollar to purchase a tokenized money market fund offered by asset managers in Hong Kong.

🇬🇧 iFOREX announces IPO delay. The company stated that a routine thematic compliance inspection commenced earlier this year in the BVI, as disclosed in the Company’s Registration Document, requires additional time to finalize ahead of the IPO.

🇺🇸 Sezzle lawsuit accuses Shopify of stifling BNPL options. Sezzle said in a news release that it is seeking an injunction to block Canada-based Shopify from continuing this alleged conduct, with the suit asking for treble damages, or damages three times the amount awarded by a jury.

PAYMENTS NEWS

🇧🇷 Mastercard Brazil expands in open finance and B2B card solutions. Mastercard, partnering with Lina Open X, will have exclusive rights to distribute Lina’s open finance services within the payments segment. Mastercard Brazil president Marcelo Tangioni said that although data sharing in open finance has matured, payments remain a largely untapped area.

🇺🇸 Payments FinTech Navro acquires first US licence. The Delaware license means that Navro can now operate under full regulatory governance in the state, providing US firms access to its payments curation platform. Read more

🇦🇺 Afterpay and Zip Pay changes for millions of Australians. Stricter government regulation of delayed payment services may hurt users’ credit scores. Providers will be required to hold a credit license and comply with credit laws regulated by the Australian Securities and Investments Commission.

REGTECH NEWS

🇰🇷 South Korea’s ruling party unveils plan to allow stablecoins. South Korea’s new President is moving quickly to deliver on his campaign pledge to allow local companies to issue stablecoins, giving a further boost to one of the world’s most active digital-asset markets.

DIGITAL BANKING NEWS

🇪🇸 Revolut prepares an offensive in corporate banking for 2026. The 'neobank' will offer credit lines and loans, among other services. Between 2026 and 2027, it will bring the mortgage service to Spain. Meanwhile, Revolut eyes Israel expansion and is in talks with the Bank of Israel to acquire a “lean bank” licence in the country. The licence is a limited banking licence that allows non-bank entities to receive deposits and provide credit.

🇬🇧 Starling launches AI chatbot Spending Intelligence in UK banking first. The chatbot, called Spending Intelligence, uses LLMs to answer questions customers pose about their spending. It's available to all customers, both personal and business accounts. Spending Intelligence can only draw insights from Starling accounts and gives answers based on this data.

🇬🇧 Barclays to roll out Microsoft Co-Pilot to 100,000 staff. Microsoft 365 Copilot will be integrated into the bank’s staff productivity tool, creating a single agent for employee self-service, such as booking business travel, checking policy compliance, or finding answers to HR-related questions.

PARTNERSHIPS

🇳🇱 Plumery partners with Salt Edge to power smarter banking journeys. Through the partnership, Plumery has integrated Salt Edge’s open banking gateway, enhancing its digital banking experience platform with real-time access to account aggregation and payment initiation capabilities across thousands of banks worldwide.

🌍 Deutsche Bank and Ant International announce strategic partnership to provide integrated cross-border payment solutions to global merchants. The bank will collaborate with Ant International’s Embedded Finance unit on a series of global treasury management and cross-border payment innovations.

🌍 Conferma expands virtual card services with JPMorgan Payments. This expansion offers European-based businesses the opportunity to issue and manage virtual cards effortlessly, unlocking multi-currency capabilities and providing greater flexibility to streamline payments across the region.

🇨🇳 XTransfer partners with BNP Paribas to simplify Eurozone-China trade payments. The partnership will enable Chinese clients of XTransfer to collect payments in Euros more efficiently by making use of BNP Paribas’ network across Europe.

🇬🇧 Guavapay to provide financing to SMEs with YouLend. The collaboration is aimed at breaking down traditional barriers to finance by offering quick, data-driven credit decisions and seamless access to working capital, enabling MyGuava Businesses’ clients to grow, invest, and thrive in a challenging economic landscape.

🇨🇦 Flinks partners with Trask to accelerate Open Banking adoption in North America. Trask’s pre-integration with Flinks provides a powerful accelerator for clients wishing to save money and increase speed to market, and the Flinks and Trask teams work seamlessly to support their clients.

🇬🇧 BR-DGE partners with AstroPay to scale APM coverage. AstroPay got integrated with BR-DGE’s platform, making it available as an APM for the latter’s merchant customers across several sectors, including ecommerce, travel, gaming, and digital goods.

🇬🇧 ANNA Money taps Episode Six to expand SME business debit card offering. The UK-based mobile business banking account selected Episode Six to deliver a more reliable, scalable, and configurable platform that supports growing product needs, global expansion, and seamless integration.

DONEDEAL FUNDING NEWS

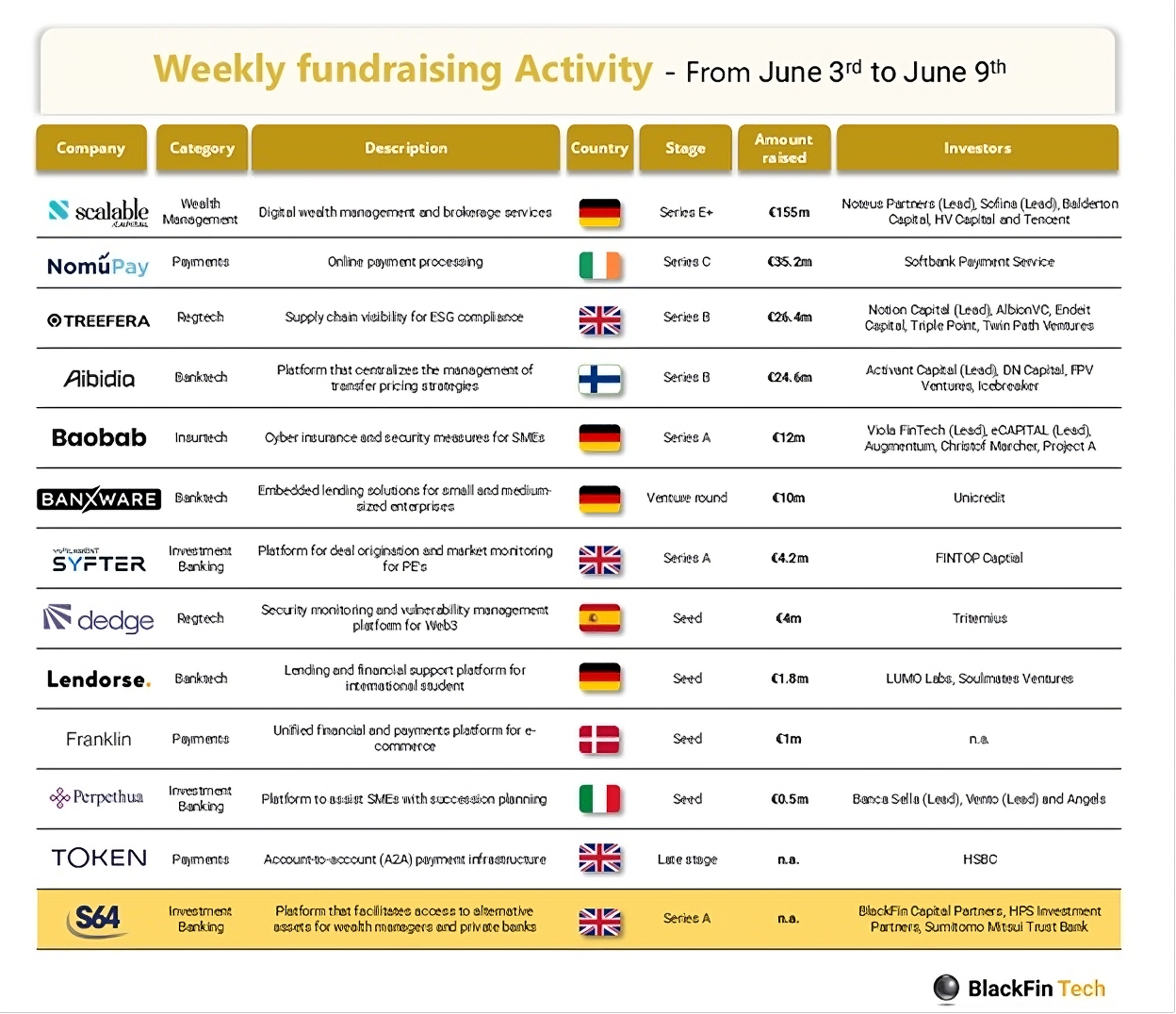

💰 Over the last week, there were 13 FinTech deals in Europe, raising a total of €275 million, with four deals in the UK and Germany, and one deal each in Finland, Italy, Ireland, Spain, and Denmark.

🇬🇧 Payroll data FinTech Teal closes £1.4m pre-seed round. The new funding will support Teal’s goal of expanding its data infrastructure beyond payroll to incorporate additional income and financial sources for a more complete view of borrowers. Keep reading

🇦🇺 SG FinTech firm Sleek nets $23m series B. The new funding will be used to enhance Sleek’s automation-driven technology and expand its range of digital services. The company plans to strengthen its presence in Australia and the UK while continuing to support its core markets in Singapore and Hong Kong.

🇮🇳 CRED valuation falls to $3.5 billion after $75 million Series G fundraising. CRED cash+ allows members to borrow against their mutual fund investments without disrupting long-term growth. Continue reading

🇺🇸 Turnkey raises $30M for crypto open infrastructure layer. The capital will help to scale Turnkey’s engineering, product, go-to-market, and operations teams. Areas that will receive attention include modular infrastructure for payments, AI agents, and decentralized finance.

🇮🇱 Crypto security startup Hypernative raises $40M. This investment highlights the ongoing importance of security as a critical barrier to widespread crypto adoption, given the industry's exposure to increasingly advanced hacks and exploits. Read more

🇳🇱 Tebi, the new startup by Adyen’s departed co-founder, raises a fresh €30M from Alphabet’s CapitalG. This means that Tebi has a wealth of competitors, from POS systems to reservation platforms and analytics-driven solutions for inventory optimization. But it hopes to have an advantage by tying this all together.

🇬🇧 Stablecoin startup Noah raises $22 million and adds Adyen vet as cofounder. The startup was founded by Thijn Lamers and Shah Ramezani. The duo aims to address the challenges of existing stablecoins, such as regulatory scrutiny, centralization, and scalability issues.

M&A

🇺🇸 S&P Global acquires FinTech firm TeraHelix to enhance AI. The acquisition, which was finalized on June 6, 2025, aims to bolster S&P Global’s data and artificial intelligence capabilities by integrating TeraHelix’s advanced data modeling frameworks, enhancing the company’s customer AI offerings.

🇧🇷 Afinz acquires D3 Pagamentos and expands its offering for small and medium businesses. Afinz said that the operation represents a milestone and consolidates a new business front, “Afinz Empresas”. With this move, it sees that there is an opportunity in the market and intends to reach 500 thousand customers by 2030.

MOVERS AND SHAKERS

🇬🇧 Barclays set to cut 200 investment bank jobs in cost reduction plan. The UK bank is trying to up its competition with Wall Street giants. The bank is preparing to reduce headcount in the unit by around 3%, with cuts likely to impact its dealmaking, trading, and research arms.

🇬🇧 FCA appoints Sarah Pritchard as first deputy CEO. Pritchard will work under CEO Nikhil Rathi. The move, effective immediately, would ensure the “right leadership bandwidth at the top of the organisation” as the FCA’s remit grows, Rathi said.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()