Revolut Hits $75B While Joining Abanca in Talks to Buy Singular Bank

Hey FinTech Fanatic!

A lot is happening in the FinTech world this week!

Waking up in Curaçao today, one headline caught my attention right off the bat… and not by chance: Revolut’s latest valuation milestone.

Revolut has reached a $75 billion valuation after completing a long-running share sale led by Coatue, Greenoaks, Dragoneer, and Fidelity.

The round also brought in NVentures, Andreessen Horowitz, Franklin Templeton, and accounts advised by T. Rowe Price. According to the company, the valuation mirrors a combination of strong growth, solid profitability, and investor demand.

Revolut now counts around 65 million users and plans to invest $13 billion as it works toward 100 million. The next phase includes entry into 30 new markets and continued efforts to secure a full UK banking licence.

Meanwhile, both Abanca and Revolut are examining a possible bid for Singular Bank. Reporting from Intereconomia suggests the valuation could sit around €100 million.

Scroll down for more FinTech stories shaping the week, and I’ll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

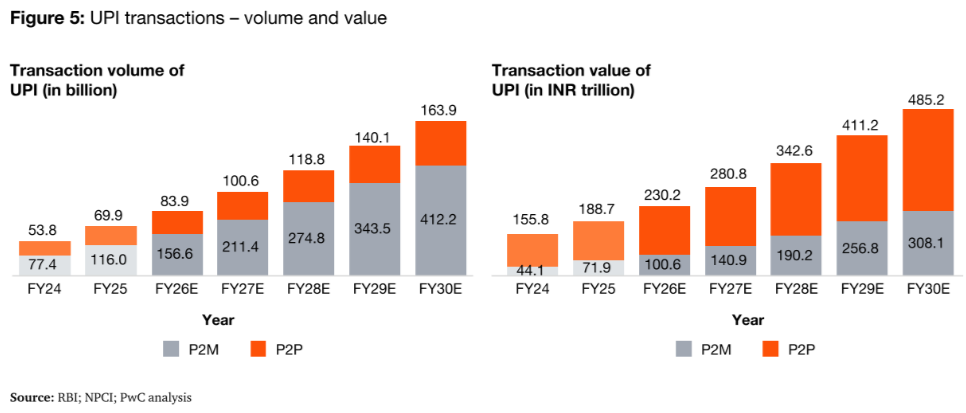

🇮🇳 India’s payments story has entered its next chapter, from scale to sophistication.

FINTECH NEWS

🇬🇧 Revolut notches $75 billion valuation in latest share sale. The company is crafting plans to enter 30 new markets across almost every major geography and plans to undergo the costly process of securing regulatory authorisations in each one. CEO Nik Storonsky is also laser-focused on ensuring a full banking license in Revolut’s home country of the UK.

🇪🇸 Abanca and Revolut are considering buying Singular Bank to boost their private banking business. Warburg Pincus has launched the sale of Singular Bank, valued at about €100 million. Abanca sees the deal as a way to draw Latin American wealth, while Revolut views it as a quick entry into private banking, though it has not set a timeline.

🇺🇸 Smith Ventures to acquire Green Dot in $1.1b cross-sector megadeal. Under the plan, Green Dot shareholders will receive $8.11 in cash plus 0.2215 shares of a new publicly traded bank holding company that will absorb CommerceOne’s existing operations.

🇦🇷 Inter's global account reaches 5 million customers and targets new markets in Argentina. The platform brings together services such as dollar accounts, debit and credit cards, global investments starting from US$5, and even US mortgage loans. The bank is also considering adding an insurance vertical.

PAYMENTS NEWS

🇬🇧 TerraPay launches Xend to power borderless payments for billions of wallet users. TerraPay’s collaboration with inclusion-led powers Xend to unlock seamless global interoperability, allowing wallet users to receive funds from any bank worldwide and make payments across extensive merchant networks.

🇧🇷 Pix gains a new tool to recover money for victims of fraud, scams, or coercion. With the new rules, which will become mandatory for all banks starting in February 2026, the PIX refund system will more accurately track the path of the money and allow diverted funds to be recovered, even after they have left the scammer's original account.

🇮🇳 PayU India clocks $397 Mn revenue in H1 FY26. PayU India reported 20% year-on-year revenue growth during the six months ended September 2025, while adjusted EBITDA margins improved from -6% to breakeven, turning profitable in Q2 FY26.

🇺🇸 Worldpay accelerates the future of agentic commerce with model context protocol, a publicly available server powering AI-driven, agent-enabled payments. Developers and merchants can download, modify, and deploy the protocol immediately, enabling the rapid creation of AI agents and direct payment integrations with Worldpay’s API.

🇧🇷 PicPay's solution grows by more than 30% in the number of customers. This increase reflects the expansion of the use of the PicPay Wallet, which brings together different forms of integration for e-commerce and applications and is gaining ground as a practical and secure checkout alternative.

🇲🇽 Shein launches co-branded credit card with Stori. According to information published by Stori, the product aims to expand access to credit among first-time users and is not available to customers who already hold a Stori card. The initiative aligns with Mexico’s accelerating digital-payment adoption.

REGTECH NEWS

🇧🇷 PicPay blames Apple for the lack of contactless Pix payment on the iPhone. According to the FinTech company, Apple holds significant economic power in relevant markets, allowing it to impose onerous obligations on card issuers and digital wallets. This would prevent the offering of Pix via contactless payment, unlike what happens on Android.

DIGITAL BANKING NEWS

🇧🇷 Proposed Tax Increase on FinTechs. The proposed legislation would raise the corporate tax rate for FinTech companies in Brazil from 9% to 15%, an increase of about 66%. Experts warn that FinTechs are likely to pass the cost on to consumers through new fees, higher pricing, or reduced benefits.

🌍 Finom launches premium business cards for SMEs across Europe. The card consolidates payment needs into a single solution, allowing savings of up to €20,000 annually compared to managing multiple card products. Finom Prime is launching initially in Germany and Italy, with additional European markets to follow.

🇦🇪 Wio Bank launches Wio Family. Wio Family offers shared banking, built in response to a growing need among households for a more collaborative, transparent, and intuitive way to manage money. The new experience brings every household member into one connected financial space, helping them make better decisions, reach shared goals, and build healthier financial habits.

🇺🇸 Digital-first VALT bank seeks de novo charter in Idaho. VALT Bank's founders aim to build a digital business banking platform focused on lending, deposits, cash management, and advisory tools. Keep reading

🇺🇸 AI-First Nubank is seeking a U.S. charter, and domestic players should be worried. Its application indicates plans to begin with checking accounts, credit cards, unsecured personal loans, and digital-asset custody. Already serving 60% of Brazil’s adults and expanding rapidly among teens.

BLOCKCHAIN/CRYPTO NEWS

🇨🇳 Thai Crypto Exchange Bitkub is said to consider an IPO in Hong Kong. Founded in 2018, Bitkub has previously considered an IPO in Thailand, but the country’s stock market has been among the world’s worst-performing in 2025, with listings generating a weighted average decline of more than 12%.

🇺🇸 Cross River launches stablecoin payments with infrastructure to power the future of on-chain finance. Integrated directly with Cross River’s real-time core, the offering unifies fiat and stablecoin flows through a single, interoperable system, enabling companies to move value across chains and traditional rails, leveraging bank-grade compliance.

PARTNERSHIPS

🇬🇧 VALR adds multi-currency fiat capabilities through OpenPayd. Through the integration, VALR expands its offering to enable customers to fund their accounts in euros, pound sterling, and US dollars, via OpenPayd’s dedicated virtual IBANs and extensive global payment network.

🇺🇸 PayTrace has partnered with TreviPay to enable B2B merchants to extend net-terms financing and invoicing capabilities to commercial buyers through TreviPay’s Universal Acceptance solution. The integration leverages the Mastercard acceptance network, aiming to streamline trade credit processes and reduce friction in B2B transactions.

🇯🇵 Binance Japan and PayPay launch PayPay Money Linkage Service for crypto trading. The service allows users to buy crypto with funds from PayPay Money and withdraw proceeds from crypto sales back to their PayPay Balance. Keep reading

🇧🇭 BENEFIT and Ant International partner to launch Alipay+ in Bahrain to achieve global e-wallet connectivity. Partnership will integrate Alipay+ with BENEFIT, Bahrain’s national QR payment scheme, to enable all Bahraini merchants to accept cross-border digital payments from leading digital wallets and explore outbound payment capabilities.

🌏 TransBnk and DigiAlly team up to speed SME lending across Asia. The unified solution is designed to support banks, NBFCs, corporates, and FinTechs in delivering fully digital, compliant, and scalable financial services, particularly in SME lending, a sector where manual documentation, legacy onboarding processes, and limited risk visibility continue to hinder credit access.

🇬🇧 Solflare partners with Mastercard to launch Solana's first self-custody debit card. The new digital card allows users to make instant debit card payments with USDC while maintaining full control of their assets, without preloading or prior conversion. The Solflare card will initially be available to those in the UK and the European Economic Area (EEA).

DONEDEAL FUNDING NEWS

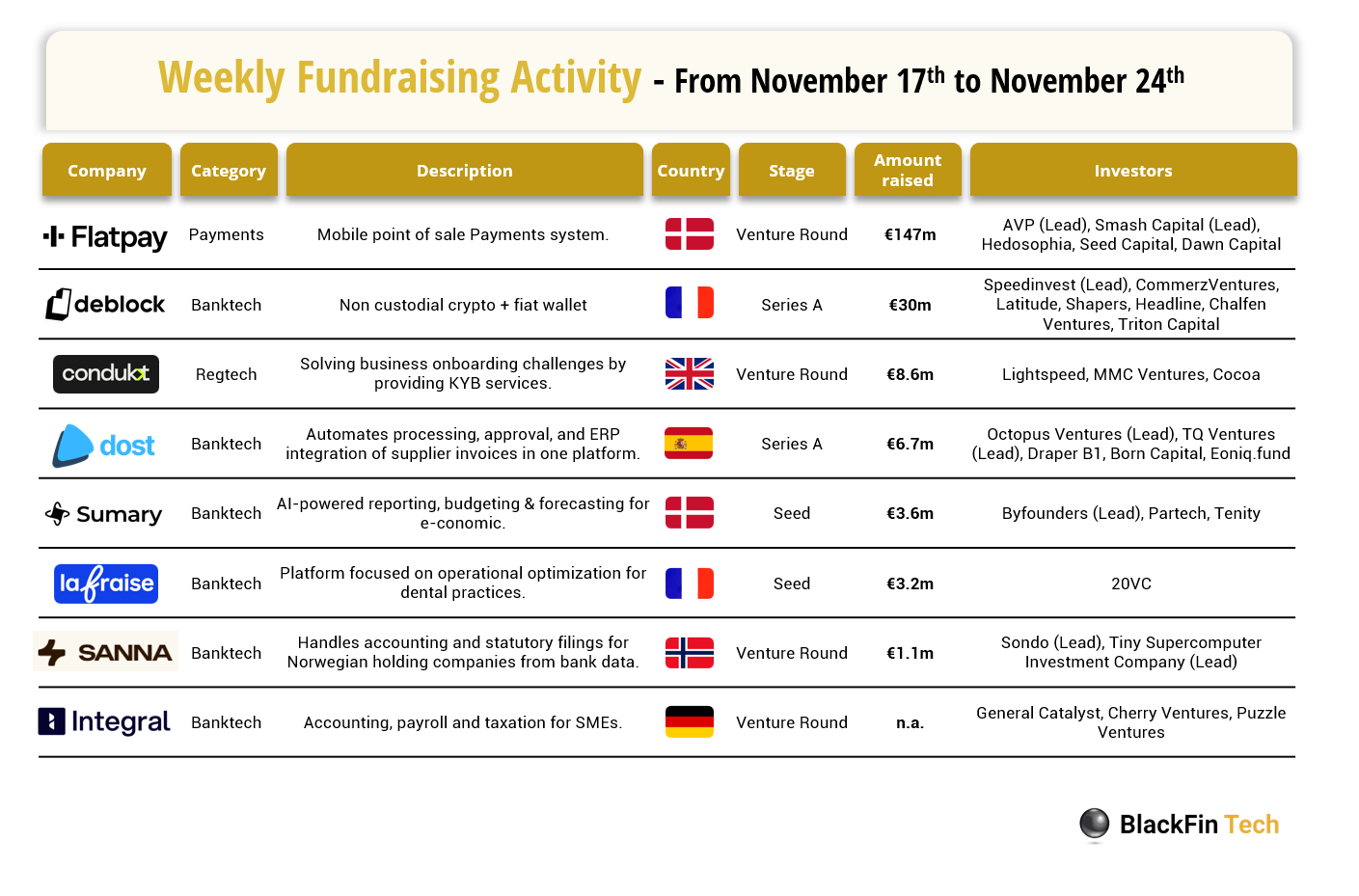

💰 Over the last week, there were eight FinTech deals in Europe, raising a total of €200 million, including two transactions each in France and Denmark and one each in the UK, Spain, Norway, and Germany.

🇺🇸 Pay.com.au hits $633 million valuation after $25 million raise. The funds are earmarked for local expansion alongside international expansion in the US market, with partners including Amex, as well as improvements to the core payments and rewards offering.

🇳🇬 Trade payments FinTech JuniGo closes oversubscribed pre-seed round. This funding enables the company to launch in Nigeria and expand across Africa-Asia corridors, unlocking billions in working capital that’s currently trapped in slow, expensive banking systems.

🇺🇸 Numerai raises $30m in Series C funding at $500m post-money valuation. The company intends to use the funds to expand its physical presence, moving into a larger headquarters in San Francisco, with plans to open a new office in New York City.

🇮🇳 Wealthtech startup Wealthy raises Rs 130 crore. The company aims to fuel a new wave of independent wealth professionals as India’s household participation in equities grows. Read more

🌍 Model ML raises €65 million as its AI beats McKinsey and Bain benchmarks with under-3-minute output checks. This new financing will be used to accelerate global expansion and deepen AI capabilities across key financial hubs. The company will build out dedicated onboarding and customer success teams in San Francisco, New York, London, and Hong Kong.

M&A

🇨🇴 Colombia's financial superintendency approves the integration of Scotiabank and Davivienda. With the integration of Scotiabank´s business, Davivienda´s total assets are projected to reach approximately US$60 billion, representing growth of nearly 40%. Regionally, assets are expected to increase by around 30% in Colombia, 9% in Costa Rica, and 180% in Panama.

🇺🇸 Soulpower and SWB unveil Soul World Bank in $8.1 billion futuristic merger to launch AI bank with tokenised yields. Soulpower will combine with SWB, bringing together the SPAC sponsor’s capital markets access with SWB’s FinTech capabilities, including its AI infrastructure, compliance stack, and tokenisation systems.

MOVERS AND SHAKERS

🇬🇧 3S Money appoints Cyber Security Expert Don Randall MBE as Non-Executive Director. In his new role on the 3S Money Board, Don will provide strategic guidance on strengthening cybersecurity and data practices, ensuring that the company continues to champion client safety and trust.

🇧🇷 Mercado Bitcoin announces Lucas Lopes as the new president in Brazil and aims for expansion in Europe. Lucas worked at Serasa Experian, where he led product, technology, and data teams. In Brazil, he drove the growth of credit and retail products, which grew from zero to US$100 million in revenue in five years.

🇮🇳 Veefin Solutions appoints global banking technology leader Niraj Vedwa as Senior Advisor. Mr Vedwa brings over 40 years of experience in banking technology, digital strategy, and global enterprise transformation. Recognised as a FinTech Guru and a leading voice in modernising banking across continents.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()