Revolut hit $2bn of revenue and $350m net income in 2023

Hey FinTech Fanatic!

At the Dubai FinTech Summit, John Doran, interviewed Nik Storonsky, Founder and CEO of Revolut, and he started with an interesting statement:

"Revolut hit $2bn of revenue and $350m net income in 2023."

This is the first time the net income figure has been mentioned.

You can check out the complete interview here:

Enjoy more FinTech industry news below and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

ARTICLE OF THE DAY

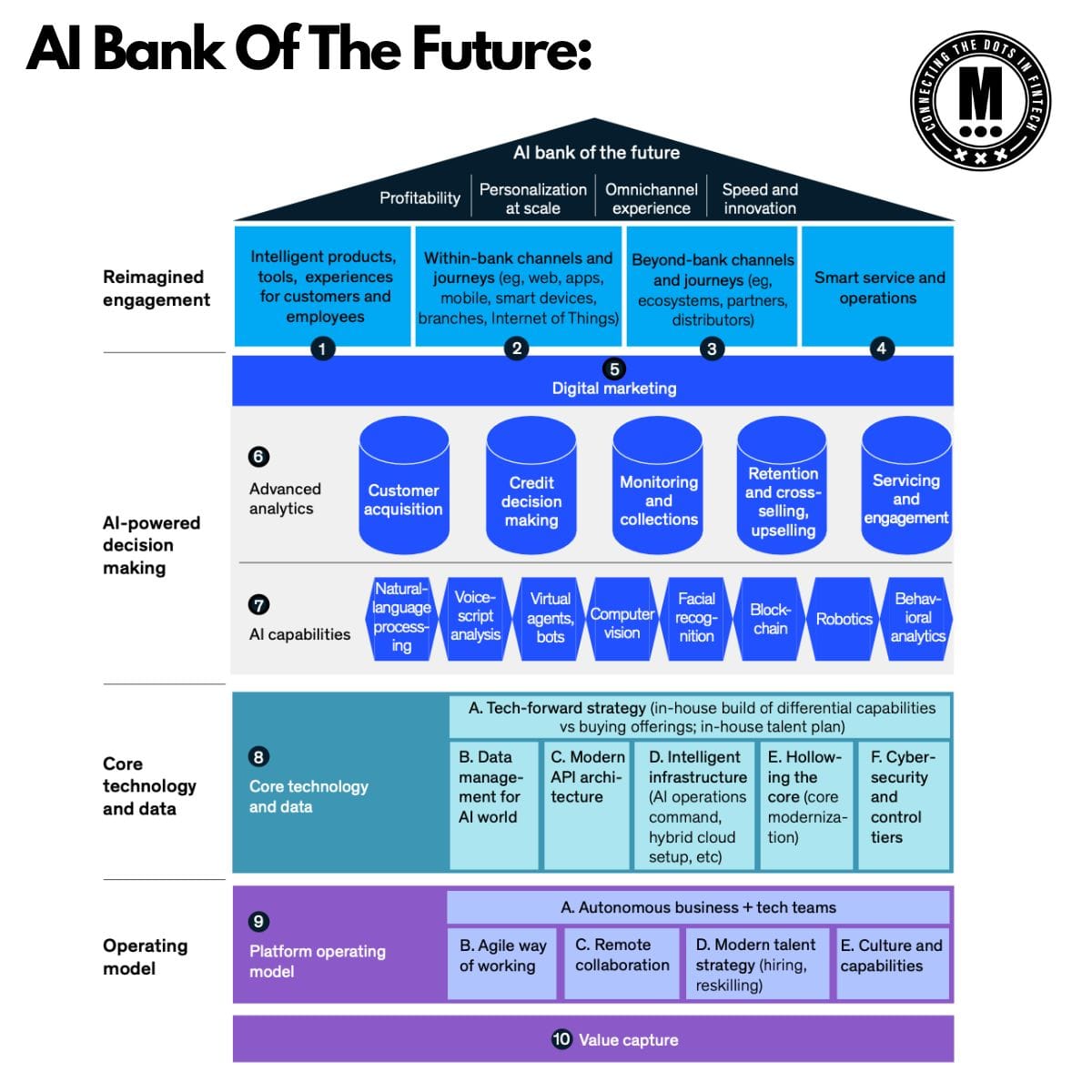

🏦 How does a Bank transform into an AI-first financial institution?

This transformation requires a shift across 4️⃣ interconnected layers:

#FINTECHREPORT

📊 Realizing the Potential of FinTech in Saudi Arabia 🇸🇦 by Arthur D. Little👇 Click here for more

PODCAST

🎙️ What are the top trends in payments for 2024/2025? In this podcast episode, Robin Amlôt of IBS Intelligence speaks to Romain Mazeries, Chief Executive Officer of Mangopay about trends in payments for 2024 and 2025. Listen to the full podcast episode here

FINTECH NEWS

🇺🇸 TabaPay ends planned acquisition of Synapse. A TabaPay spokesperson told TechCrunch on May 9 that the company had “pulled out” of the deal and had sent “termination notice of the purchase agreement this morning based on failure to meet the purchase agreement closing conditions,” the publication reported.

🇵🇪 FinTech Máximo and Banco Alfin introduced a savings account in Peru, using a Banking as a Service model. The partnership aims to enhance Máximo’s customer acquisition, while allowing the bank to position itself as a specialized entity for FinTechs in a country where regulation for new digital players is just starting to develop.

🇩🇪 Raisin moves into net profit. The German savings and investment products marketplace has almost doubled revenues for 2023 and moved into net profitability for the first time. Founded in 2012, revenues hit €158 million and achieved an Ebtda of €20 million and a net profit of €1 million.

🇮🇳 Paytm launching ride-hailing services? All you need to know about the FinTech major's new offering. The feature is still in testing mode and visible only to select users across several metros like Delhi, Bengaluru and Chennai.

🇬🇧 American Express and Worldpay have signed a new agreement which makes it even easier for small businesses to welcome loyal and high-spending American Express Cardmembers. Continue reading

OPEN BANKING NEWS

🇺🇸 New Experian tool empowers financial inclusion through open banking insights. Cashflow Attributes™, is a groundbreaking solution to help expand fair and affordable access to credit, particularly for thin-file and credit invisible consumers. Read on

DIGITAL BANKING NEWS

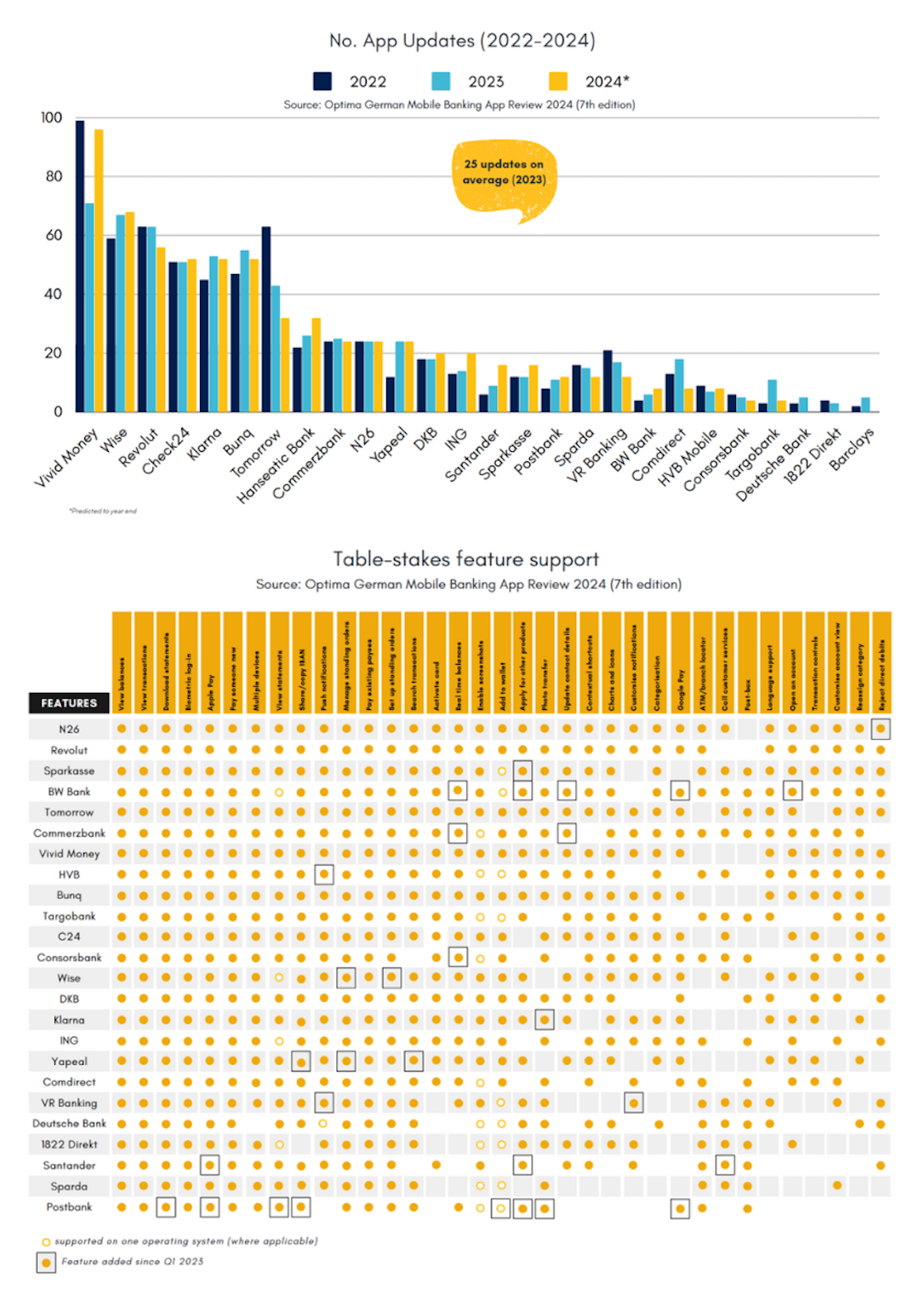

🇩🇪 The 7th edition of the German Mobile Banking App Review 2024 is out👇

🇬🇧 Engine, the technology Starling Bank was built on, has been busy - and quietly - launching banks around the world, from Australia to Romania. Engine sells its banking technology to start-ups to launch their own digital banks. The move, alongside a new boss at Starling, could help it grow internationally, an important step to a potential future Initial Public Offering.

🇺🇸 Chime agrees to CFPB Consent Order over refund delays. Click here for further details

🇱🇺 Banque Internationale à Luxembourg goes live with Temenos to modernize core banking and payments. The move will enable BIL to launch new products quickly and improve the customer experience with personalization driven by data, while also saving costs and driving up performance and productivity.

🇺🇸 MoneyLion reported it's Q1 2024 results and once again put up record numbers. Read the complete earnings report here

🇦🇺 A1 Bank goes live with Avaloq’s core banking platform, marking what it describes as a “major milestone” for its digital transformation journey. The online bank’s selection of Avaloq was first announced last June, when it was then known as Paybox Bank.

🇨🇴 Colombia's banking sector braces for a shake-up. Colombia’s banking sector is facing a major overhaul as economic pressures lead to losses, stirring a flurry of potential mergers and acquisitions. Click here to learn more

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 Blockchain intelligence platform Chainalysis opened its regional headquarters in Dubai, amid close cooperation with the local UAE government. The Dubai operation will serve Southern Europe, Middle East, Central Asia, and Africa, the company said in a news release.

🇹🇭 Gulf Binance aims for crypto supremacy. In a landscape where digital assets are gaining traction, Gulf Binance has emerged as a new player among the 17 licensed exchange and broker operators in Thailand. Read more

DONEDEAL FUNDING NEWS

🇺🇸 Outpave raises $1.2M in seed funding. The company intends to use the funds to further enhance its expansion, go-to-market strategies, sales channels, and product features.

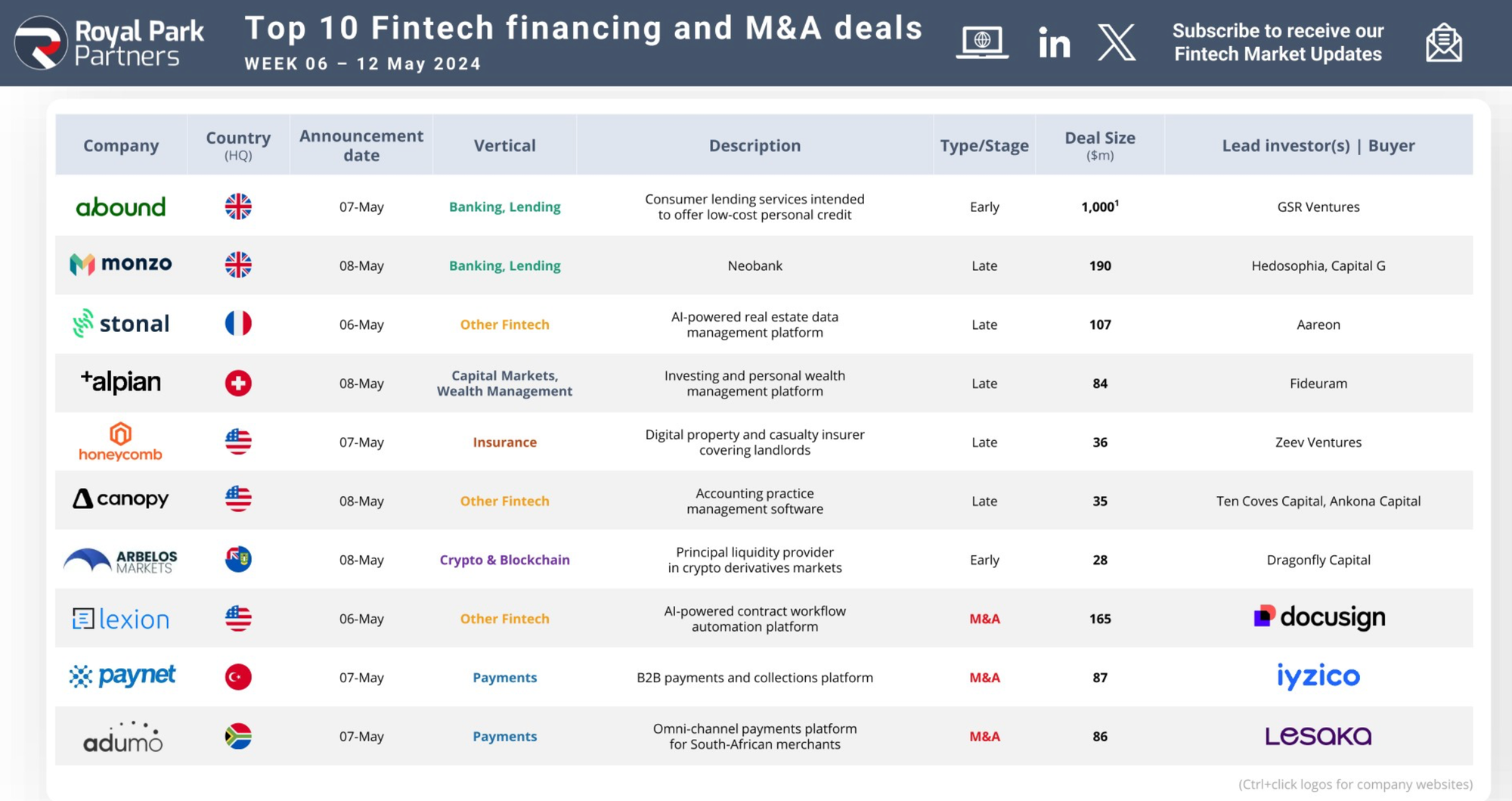

🇺🇸 Canopy, the firm-wide operating system that helps accountants, announced the successful raising of $35 million in an oversubscribed round. The funding will be channeled towards doubling down on Canopy’s vision for leveraging AI to make firms exponentially more efficient.

🇺🇸 Sikich secures $250 Million minority growth investment from Bain Capital. This investment positions Sikich to leverage Bain Capital's resources, accelerate growth, enhance operational excellence, and solidify its leadership in an industry undergoing rapid consolidation.

🇯🇵 Revolut investor SoftBank posted a 724.3 billion Japanese yen ($4.6 billion) gain on its Vision Fund in the fiscal year ended March, the first time the flagship tech investment arm has been in the black since 2021. More on that here

🇸🇦 Saudi FinTech firm Rasan and its shareholders seek up to $224 Million in IPO. The kingdom’s stock exchange expects the burst of activity to continue, with more than 10 companies waiting in the wings, its chief executive officer said on Thursday.

🇮🇳 Sequoia-backed ShopUp to expand reach as revenue tops $129m. ShopUp merges finance, transaction processing, and supply chain services. This model builds a link between brands, factories, and small businesses with its microfulfillment centers.

M&A

🇦🇺 Perpetual said last Wednesday that buyout giant KKR & Co would acquire its wealth management and corporate trust businesses for A$2.18 billion ($1.43 billion), sending the Australian financial services firm's shares to a five-month low.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()