🚨 Revolut Eyes $75B Dual Listing in London + New York

Hey FinTech Fanatic,

London calling? Revolut might just pick up.

The $75B FinTech juggernaut is weighing a historic dual listing in both London and New York — a move that could finally give the City the IPO buzz it’s been craving.

If it happens, Revolut would instantly rank among London’s top 15 most valuable firms and mark the first time ever a company lists in New York while entering the FTSE 100.

Founder Nik Storonsky — who once called London a no-go thanks to its pesky 0.5% stamp duty — is softening his tune, buoyed by fresh reforms and a shiny new Canary Wharf HQ.

UK leaders are already hyping it as proof Britain can still compete for global FinTech giants.

But don’t pop the champagne yet. Revolut’s execs insist they’re in no rush.

VP David Tirado told Negócios the company “does not need to raise capital at this time” and that Klarna’s $17B IPO is “no influence” on their plans.

In his words: $75B doesn’t even reflect Revolut’s true potential.

For now, Storonsky’s eyes are on rolling out that long-awaited UK bank and hitting 100M customers worldwide.

But if the dual listing happens? It won’t just be a financial milestone; it’ll be a symbolic win for London’s IPO dreams.

Cheers,

PODCAST

🎤 Digital Fraud & Payments: From Card Theft to AI. In this episode, Arthur and Jordan Harris, Head of Fraud and Payments at iHerb and host of the Fraud Boxer podcast, explore the evolution of fraud, from early physical scams to today’s digital threats. He discusses modern tactics like bots and friendly fraud, the strategic role of payments, and future challenges such as deepfakes and biometrics. You can also listen to us on Spotify and Apple Podcasts

Digital Fraud & Payment: From Card Theft to AI

FINTECH NEWS

🇸🇬 Airwallex is seeking problem-solvers with founder-like energy who are driven to make a real impact. Co-founder and President Lucy Yueting Liu emphasizes that mindset is just as important as experience. The company values grit, curiosity, ownership, and the ability to turn ambiguity into action, qualities explored in their latest blog.

🇮🇳 PayNearby plans to tap the IPO market next financial year to fuel expansion. The FinTech firm has already initiated the process and has held talks with three merchant banks, and will soon select a banker to proceed with the IPO process. As part of the expansion, the company aims to recruit around 550-600 new employees by the end of the current fiscal year.

🇮🇳 Tata Capital trims valuation to around $15.7 billion ahead of IPO launch. The flagship financial services firm of the diversified Tata Group has decided to reduce its post-money equity valuation by 5 percent ahead of the launch of the mega issue between October 6 and October 8.

🇬🇧 Revolut's "undervalued" status rules out a stock market listing. Revolut is "in no rush" to launch an IPO and" does not need to raise capital at this time, "revealed David Tirado, Revolut's Vice President of Global Business and Profitability. Even with rival Klarna going public, the Executive said in an interview that " this decision does not affect the plans."

PAYMENTS NEWS

🇬🇧 Card account updater (CAU): How it works, and why businesses need it by Solidgate. Missed payments in SaaS and subscription-based businesses can lead to lost revenue and increased churn. The services address this by automatically refreshing payment information, allowing seamless retries without customer involvement. With 99% of Solidgate merchants using CAU services, the tool has proven effective in reducing payment failures and boosting customer retention.

🇧🇪 Swift is to add a blockchain-based ledger to its infrastructure stack in a groundbreaking move to accelerate and scale the benefits of digital finance across more than 200 countries and territories worldwide. The ledger will extend Swift's financial communication role into a digital environment, facilitating banks’ trusted and scalable movement of regulated tokenised value across digital ecosystems.

🇧🇷 Central Bank may postpone launch of Pix Installments. The launch schedule was impacted in early September due to hacker attacks on companies that connect the financial system to Pix itself. Continue reading

🇸🇬 Thunes empowers banks to deliver faster cross-border payments to bank accounts via existing SWIFT connectivity. Banks can now leverage their existing SWIFT connectivity to send business and consumer payments via the Thunes Network globally, ensuring fast bank account transfers in over 130 countries. This meets the demand for real-time payments and enhances the customer experience.

🇺🇸 Visa announces general availability of VCS hub; ushers in a new era of AI-powered commercial payments innovation. The VCS Hub represents a transformational leap forward, engineered to deliver a smarter, more seamless experience for all users.

🇪🇸 Amazon customers in Spain can now defer their purchases with Santander. Zinia, Santander's consumer financing platform, allows Amazon customers in the country to defer purchases of more than 60 euros for between four and 40 months. This agreement means that Zinia will be available to customers in Spain for the first time.

🇵🇭 GCash shifts cash-in transactions to InstaPay under the Bangko Sentral ng Pilipinas mandate to standardize interoperability and transparency across the digital payments ecosystem. The move is part of the central bank’s effort to enhance the country’s digital finance infrastructure by ensuring faster, safer, and more transparent fund transfers.

OPEN BANKING NEWS

🇺🇸 DashDevs: FinTech innovation is all about building products that are scalable, reliable, and impactful across industries. This edition explores the mechanics of open banking, the critical importance of uptime for FinTech apps, and how digital transformation drives real business growth.

REGTECH NEWS

🇺🇸 From ISO 20022 regulatory milestone to modernization: banking’s next chapter with ACI Worldwide. The event frames modernization as a strategic imperative, examining the risks of postponing system upgrades, the divide between legacy and modern institutions, and architecture decisions that shape sustainable growth.

🇸🇦 Saudi Central Bank approves use of Visitor ID to open bank accounts. The “Visitor ID” serves as an official identification document for visitors and can be verified through authorized digital platforms. SAMA said the decision will allow banks to serve new consumer segments and enhance the visitor experience during their stay in Saudi Arabia.

🇱🇹 iDenfy launches a new AI-generated report feature on its Know Your Business (KYB) platform. A new tool embedded within its innovative compliance dashboard should help analysts quickly assess risks, verify legal company data, and spot potential red flags, simplifying Know Your Business (KYB) compliance challenges.

DIGITAL BANKING NEWS

🇬🇧 Revolut weighs $75bn dual listing in New York and London. If such a deal were to take place, it would make history as the first time a company has simultaneously listed in New York and entered London’s flagship FTSE 100 index. Additionally, Revolut launches a high-yield savings account to lure US customers. The new offering will yield 4% for standard Revolut users’ deposits and 5.50% for fee-paying Metal users, according to a statement.

🇮🇳 India launch at the heart of UK FinTech Revolut's 100 million customer base target. With RBI approvals for forex and UPI, Revolut plans a localised, all-in-one app. Over 350,000 Indians have already joined its waitlist. Also, Revolut plans to double its headcount in Singapore as it eyes growth to 100 million users worldwide.

🇻🇳 Digital banking startup Tyme plans expansion into Indonesia and Vietnam. Digital banks typically provide their services through smartphone apps. Lacking a brick-and-mortar branch network, they operate at lower costs using artificial intelligence and cloud computing.

🇧🇷 Nubank launches credit card for teenagers linked to 'Caixinhas'. FinTech has created a warning system, in the form of a lighthouse, to guide young people on how to use credit; guardians can monitor transactions, and access to online betting sites is blocked.

PARTNERSHIPS

🇩🇪 Solaris selects ACI Worldwide Connetic to future-proof payments infrastructure. Migrating its instant payments infrastructure to ACI Connetic enables Solaris to increase the agility and performance of the banking services it offers. Read more

🇩🇪 Corpay and Mastercard move extend near real-time payments to new markets. Mark Frey, Group President of Corpay Cross-Border Solutions, stated that the company’s expanded collaboration with Mastercard is helping to shape the future of cross-border payments by delivering greater efficiency, affordability, and real-time capabilities.

🇮🇳 PhonePe and Mastercard collaborate to power contactless payments through smartphones for millions of Indians. The collaboration is designed to offer secure and frictionless Tap & Pay experiences at physical retail outlets, while also supporting tokenized e-commerce transactions, all through NFC-capable Android smartphones.

🇸🇬 Coinbase and StraitsX partner to bring Singapore dollar stablecoin XSGD to global users. According to Coinbase, the integration of XSGD will empower entrepreneurs, investors, and consumers to participate in faster, cheaper, and more compliant transactions.

🇦🇪 eToro partners with Lean Technologies to enable instant AED bank transfers in the UAE. This partnership makes eToro one of the first global multi-asset investment platforms in the UAE to leverage a locally regulated open-banking provider to offer secure, instant AED funding.

🇬🇧 Coconut and Zempler Bank team to help sole traders meet new tax rules. The joint offering will simplify and streamline tax preparation, completely free of charge. The partnership sets a new benchmark for the FinTech and finance industries to collaborate to support Britain’s self-employed ahead of the Government’s upcoming changes.

DONEDEAL FUNDING NEWS

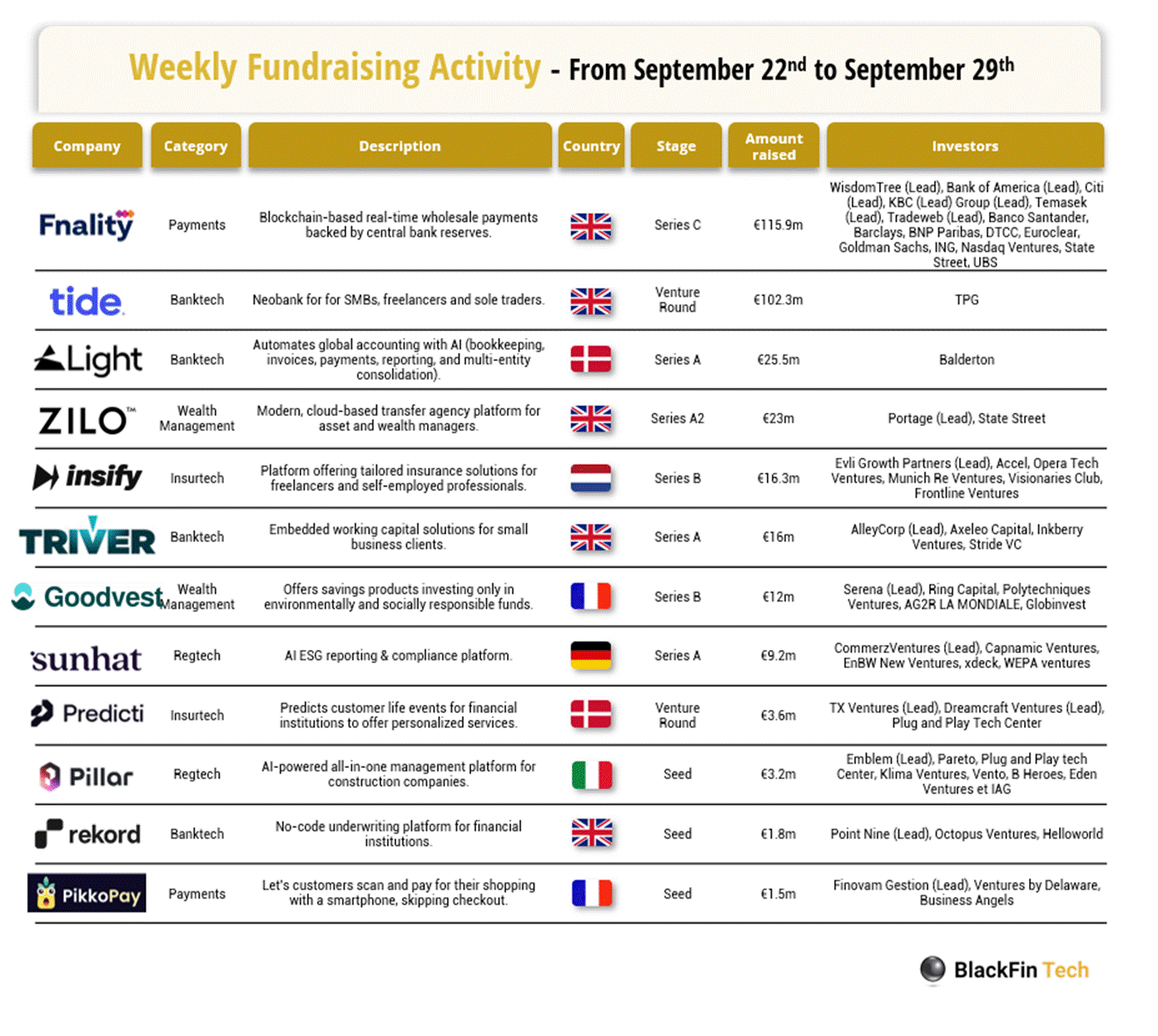

💰 Over the last week, there were twelve FinTech deals in Europe, raising a total of €330 million, including five transactions in the UK, two in France, two in Denmark, one in the Netherlands, one in Germany, and one in Italy.

🇺🇸 AI accounting start-up Light targets US expansion with $30m Series A. With partners JP Morgan, Adyen, and BDO Global, the company statement adds that the funds from the Series A will be used to accelerate Light's geographic expansion by setting up a new office in New York to meet client demand.

🇺🇸 Kraken is in talks with a strategic investor at $20 billion valuation. The funding, which is not yet finalized and remains subject to market conditions, would consist of a $200 million to $300 million commitment from a strategic investor. Read more

M&A

🇸🇬 Zoth acquires Neemo Finance, accelerating path to $1B market cap. The acquisition extends Zoth’s StableFi stack by integrating Neemo’s liquid restaking and vault infrastructure, unlocking new yield opportunities for stablecoin issuers, holders, and DeFi users.

🇺🇸 Fiserv signs definitive agreement to acquire StoneCastle Cash Management. This acquisition enables Fiserv to become a technology-enabled source of billions of dollars of institutional deposits, including from Fiserv’s enterprise customers. This helps financial institutions strengthen their balance sheets by integrating insured deposit products.

MOVERS AND SHAKERS

🇺🇸 Nubank appoints Michael Rihani, a former Coinbase employee, to lead the crypto division. At Nubank, Rihani will be tasked with strengthening the crypto asset buying, selling, and custody platform, which already has 6.6 million users. Keep reading

🇺🇸 Global Payments announces board additions to enhance shareholder value creation. Global Payments announced the appointment of Patricia “Patty” Watson and Archana “Archie” Deskus as independent Board directors, effective immediately. Both Mses Watson and Mr. Deskus possess deep financial technology and payments industry expertise.

🇨🇳 Visa appoints Greater China General Manager, Elaine Chang. Chang has more than 30 years of experience in senior leadership positions at Amazon, AWS, and Intel. Continue reading

🇺🇸 PayPal’s Head of Capital Markets, David Knox, leaves for a crypto treasury. Knox, 36, said he spent about 1-1/2 years at PayPal, where he was also head of finance for credit and financial services. Before then, he was a vice president at SoFi Technologies Inc. and was a director for asset-backed finance at Cantor Fitzgerald.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()