Revolut Announces New HQ in London and 9 Million UK Customers

Hey FinTech Fanatic!

Revolut is set to open its new Global Headquarters in London at the former Thomson Reuters building in May 2025.

The company will relocate to one of Canary Wharf’s most iconic buildings, continuing its expansion despite not yet securing a full banking licence in the UK.

Revolut will be the first occupant of the newly refurbished 'YY London' building in Canary Wharf.

The company confirmed it will increase its office space by 40 percent, reaching a total of 113,000 square feet.

Founder and CEO Nik Storonsky expressed excitement about the move, stating the company was “delighted to be committing to a new global headquarters in the centre of London’s financial district” which would “serve as Revolut’s home as we expand across the globe.”

Francesca Carlesi, who joined Revolut as UK chief executive in December to guide it towards securing its banking licence, remarked that the new headquarters “strengthens our commitment to the UK, our home country, while also establishing the foundation to support future growth.”

In addition to its expansion plans, Revolut has significantly increased its marketing efforts, spending £129 million on advertising in 2022 — up from £52 million the previous year.

On the same day, Revolut announced a major milestone: reaching 9 million (!) customers in the UK 🤯

Revolut’s achievements in the UK are impressive. The next big announcement could be the long-anticipated UK banking licence..?

Meanwhile, tucked away in Starling Bank's annual report is the disclosure that the FCA is investigating the digital-only lender over its compliance with anti-money laundering rules.

Financial Conduct Authority had started its inquiry in November and the potential impact of the investigation could be “material” but at this stage was “unquantifiable”. The news takes the shine off another year of profits at the company…

Cheers,

FEATURED NEWS

📜 Statement by Haris Karonis, CEO VIVA:

“The Viva team welcomes today’s court ruling, which paves the way for a proper valuation of Viva. The ruling holds that Viva should be valued according to its full market potential, which includes its lucrative U.S. expansion plans." Read the full release

INSIGHTS

➡️ UPI 🆚 PIX. India’s UPI and Brazil’s Pix are the world’s leading instant payment platforms. Both are transforming how people make payments, from small street vendors to large shopping malls. Take a look at this comparison by Nuclei

FINTECH NEWS

🇺🇸 FinTech startup Brex has restructured its leadership team in preparation for a potential IPO. Henrique Dubugras, previously co-CEO, has transitioned to the role of chairman of the board.

Pedro Franceschi, who has been co-CEO alongside Dubugras since Brex's founding in 2017, will now serve as the sole CEO of the company. Dubugras stated that these changes are essential as Brex moves “closer to an eventual IPO.” Earlier this year, Brex experienced significant shifts, including laying off approximately 20% of its workforce and the departure of both the chief operating officer and chief technology officer. Keep reading

🇫🇷 Merge, a FinTech that provides embedded payments and banking infrastructure via a single API, has secured approval in-principle for an EMI license in France. This means that Merge can significantly widen its operational scope and provide a new range of financial services.

🇬🇧 Wise shares tumbled after forecasts disappoint. Wise shares tumbled after its profit forecast disappointed and the UK FinTech said it would step up spending to win more customers. Continue reading

🇨🇳 Ant Group spent a record 21.2 billion yuan ($2.9 billion) on research last year as the FinTech giant increased its investment in technology including artificial intelligence. Ant Group has been boosting its research and development investment over the past three years, according to its 2023 sustainability report released Thursday.

🇸🇦 Saudi FinTech Rasan jumps by 30% in Riyadh trading debut. Rasan, which operates online insurance platforms such as Tameeni and Treza, will be among the first FinTech firms to go public in the kingdom, which has only seen a few tech listings so far.

🇨🇳 Global FinTech Currencycloud and Pyvio to enable cross-border payments for Chinese firms. The partnership will allow Pyvio to leverage Currencycloud’s technology in order “to collect and pay funds in over 180 countries and more than 30 currencies, including CNH and CNY.”

PAYMENTS NEWS

🤔Understanding Payment Orchestration. This system blends multiple payment processes, offering an efficient and streamlined transaction route. Let me break it down for you. Continue on to get all the insights

🇬🇧 Flexys adds new payment methods with Acquired.com. Flexys and Acquired.com have begun their partnership journey by working together to provide Flexys’ platform with Google Pay, Apple Pay, and Open Banking powered payments.

🇬🇧 BVNK has enabled Swift payments on its platform, so businesses can move easily between US dollars, Euros and stablecoins like USDT, USDC and PYUSD. With these new capabilities, BVNK customers can tap into more efficient global settlement and do business with global partners more easily.

🇸🇪 Trustly launches AI-powered recurring payments. This cutting-edge technology enables businesses to seamlessly accept recurring transactions directly from customers’ bank accounts, circumventing the limitations of time-consuming traditional payment methods such as cards.

🇬🇧 Muse teams with Xero and Allianz Trade to launch musePay, its new BNPL service. The integration between musePay and Xero simplifies financial management for businesses, offering more payment options through BNPL services for tailored repayment plans. More here

🇮🇹 Nexi and Mediobanca credit arm Compass extend BNPL to e-commerce segment. The partnership enables Nexi to leverage the business opportunities offered by BNPL. According to the companies, users will receive the result of their application within a few minutes thanks to a simple, intuitive process.

🇺🇸 eBay is expanding payment method choice at checkout by adding Venmo. The ability to pay with Venmo will be available to U.S. buyers on eBay and the eBay app in the coming week, providing them with even more choice and flexibility during the checkout experience.

🇶🇦 Mastercard and Doha Bank join forces to boost digital payments in Qatar. This partnership aligns with Doha Bank’s "Himma" roadmap, which seeks to redefine how the bank operates and serves its clients. The collaboration is one of the largest deals of its kind in Qatar.

OPEN BANKING NEWS

🇺🇸 Bud, a data intelligence platform, has announced it is connected to Akoya, a FinTech in the growing U.S. open banking ecosystem, to enhance financial services with hyper-personalized digital experiences, cashflow analytics, and new growth opportunities.

DIGITAL BANKING NEWS

🇮🇳 Neobanking platform Jupiter has received Prepaid Payment Instruments (wallet license) from the Reserve Bank of India (RBI), according to a notification by the apex banking body. The move will allow Jupiter to offer digital wallets to its users for making UPI payments.

🇬🇧 Starling Group has said it is ‘very committed’ to future plans for a London stock market listing as the digital lender revealed higher interest rates helped annual profit surge by 55%. The bank’s Interim CEO stated that while the IPO timing is undecided, the board and shareholders regularly discuss the plans.

Tucked away in Starling’s annual report is the disclosure that the FCA is investigating the digital-only lender over its compliance with anti-money laundering rules.

🇬🇧 Revolut's new Global HQ will open in London in the former Thomson Reuters building in May 2025. Revolut will move its headquarters to one of Canary Wharf’s most prominent buildings as it presses ahead with expansion plans despite its failure so far to win a full banking licence in the UK.

🇿🇦 TymeBank, a South African digital bank backed by China’s Tencent Holdings, is raising $150 million to build scale as it prepares for an Initial Public Offering, co-founder and CEO Coenraad (Coen) Jonker said. The digital bank expects to complete the round by Q4, to fund expansion plans.

BLOCKCHAIN/CRYPTO NEWS

🇹🇷 Garanti BBVA rolls out crypto wallet. This is the first time in Turkey that a bank subsidiary has developed and implemented a crypto currencies wallet with its own resources. Garanti BBVA Digital Assets now allows customers to transfer and store bitcoin, Etherum and USD coin assets on its mobile platform, Garanti BBVA Crypto.

🇺🇸 Digital assets outfit Paxos has laid off 20% of its staff. A Bloomberg report says the company will have an increased focus on tokenization. The company plans to gradually phase out its settlement services for commodities and securities, shifting its focus towards asset tokenization and stablecoins.

DONEDEAL FUNDING NEWS

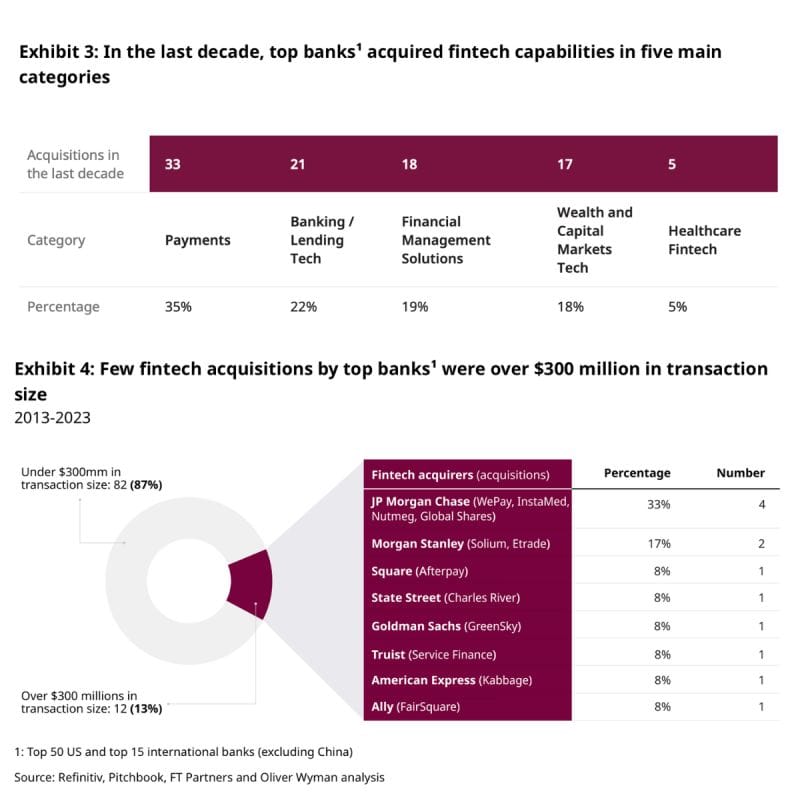

📊 Among the approximately 500 whole-company acquisitions undertaken by the top 50 US 🇺🇸 and top 15 International and Canadian 🇨🇦 banks since 2013, only 94 or less than 20% were FinTech acquisitions. Read the full piece here

🇬🇧 Wealth management startup Sidekick raises £8.5 million in debt and equity round. The combined £8.5 million will see the startup continue scaling its team and expanding its product lineup while securing a European license. Read on

🇮🇪 AccountsIQ secures €60m to embed AI into accounting platform. The company says the funds will be used to “move to the next level of its development,” including “enhancing its AI capability” and “growing its resources to more than double its team to over 200 people over the next few years”.

🇺🇸 Ex-CEO of failed FinTech Synapse nabs $10 Million for new robotics startup, Foundation. Sankaet Pathak has secured $10 million in commitments for a new robotics startup incubated with Tribe Capital. The company is seeking a valuation between $100 million and $200 million, a source familiar with the financing said.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()