Revitalizing PayPal: Alex Chriss's Vision for a Seamless Checkout Experience

Hey FinTech Fanatic!

Alex Chriss, the newly appointed CEO of PayPal, is focusing on enhancing the company’s branded services to reignite growth and profitability. Since taking over in September, Chriss has emphasized the importance of improving the PayPal branded checkout experience, addressing issues that have affected the company's performance.

At an investor conference last week he highlighted strategies to reduce the friction in transactions, making the payment process smoother for both consumers and merchants. Chriss plans to leverage PayPal's unbranded services, like Braintree and PayPal Complete Payments, to attract more users to the branded options.

By utilizing data and offering incentives such as auto-filling customer information and promoting rewards, PayPal aims to convert guest checkout users into loyal PayPal consumers.

Chriss’s vision for PayPal focuses on ubiquity, ensuring PayPal is a preferred payment option everywhere.

“I want to make sure that PayPal is available and is a choice for every purchase everywhere, every time,” Chriss said.

Do you think PayPal can pull this off? Are they really going to "shock" the world as Chriss promised recently?

Let me know in the comments👇

Cheers,

POST OF THE DAY

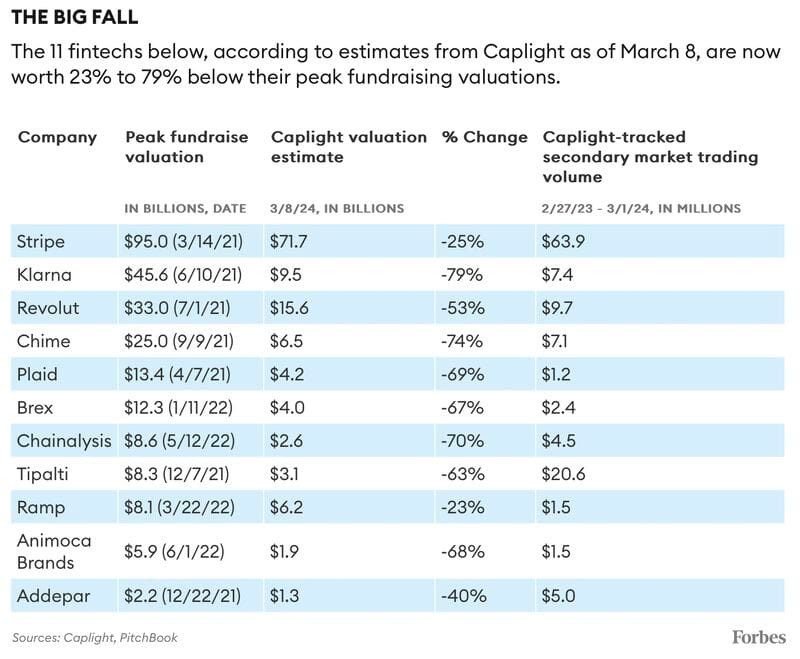

The extraordinary boom and bust in Venture Capital funding for the FinTech industry has left a puzzle in its wake:

What are these startups really worth today?

FINTECH NEWS

🇩🇪 Bafin fines German FinTech Solaris SE €6.5M for late filing STRs. Bafin, the financial supervisory authority, announced it had set the fine of €6,500,000 because the company “had systematically submitted suspicion of money money loss reports.” The fine notice is legally binding.

Meet the 17 startups founded by former Monzo employees. Here’s a list of some of the former Monzo employees looking to make their own dent in Europe’s startup ecosystem. Access full article

🇨🇴 Wallib, a FinTech company in Colombia, recently announced the launch of its first VISA debit card. This development signifies a major step forward in making Bitcoin access more democratic and creating a fairer financial system. The company is opening an exclusive waiting list for the first 1,000 users who wish to experience the revolution of the Wallib VISA debit card.

🇰🇷 Toss Securities to throw U.S. bonds into mix ahead of IPO. Toss Securities will enable the trading of U.S. equity and foreign derivative products as part of the company's plans to diversify its services ahead of the planned listing of its parent company. Read on

🇬🇧 Silverbird, the digital payments platform for international trade, has been confirmed to have gone into special administration by the Financial Conduct Authority (FCA). On 13 March 2024, Silverbird Global Limited (SGL) entered special administration under the Payment and Electronic Money Institution Insolvency Regulations 2021.

PAYMENTS NEWS

🇺🇸 Stripe officially launches Apple Pay Later support, now enabled by default for merchants. Apple Pay Later officially started rolling out a year ago. The feature gives users a way to easily split in-app and online Apple Pay purchases into four equal payments across six weeks, with no fees or interest.

🇯🇵 The Japanese government has started talks with Southeast Asian countries to enable joint use of QR code payment services, which would let international travelers make purchases abroad using their own payment methods. The initiative aims to ensure QR code systems are compatible globally by fiscal 2025, starting in April of that year.

🇩🇪 SAP has launched an open payments framework for merchants to tap into numerous third-party payment service providers with just a few clicks, including the likes of Stripe, Adyen, WorldPay and Airwallex. The payment framework is currently in beta and SAP customers can join now. It is planned to be generally available in H2 2024.

🇮🇹 Italian banking group Cassa Centrale has entered into exclusive negations with Worldline for a long-term payments partnership. The deal would see Worldline provide payment acceptance and acquiring for Cassa Centrale's 66 bank affiliates. Partnering would significantly enhance Worldline's presence in Italy, doubling its merchant and terminal count in the country.

🇺🇸 Federal Reserve Financial Services (FRFS) introduced the new FedNow User Group to continue promoting collaboration among the 607 participating financial institutions and their service providers on the FedNow Service network. The group aims to facilitate regular engagement between FRFS and FedNow participants to promote innovation and inform the continued evolution of the service.

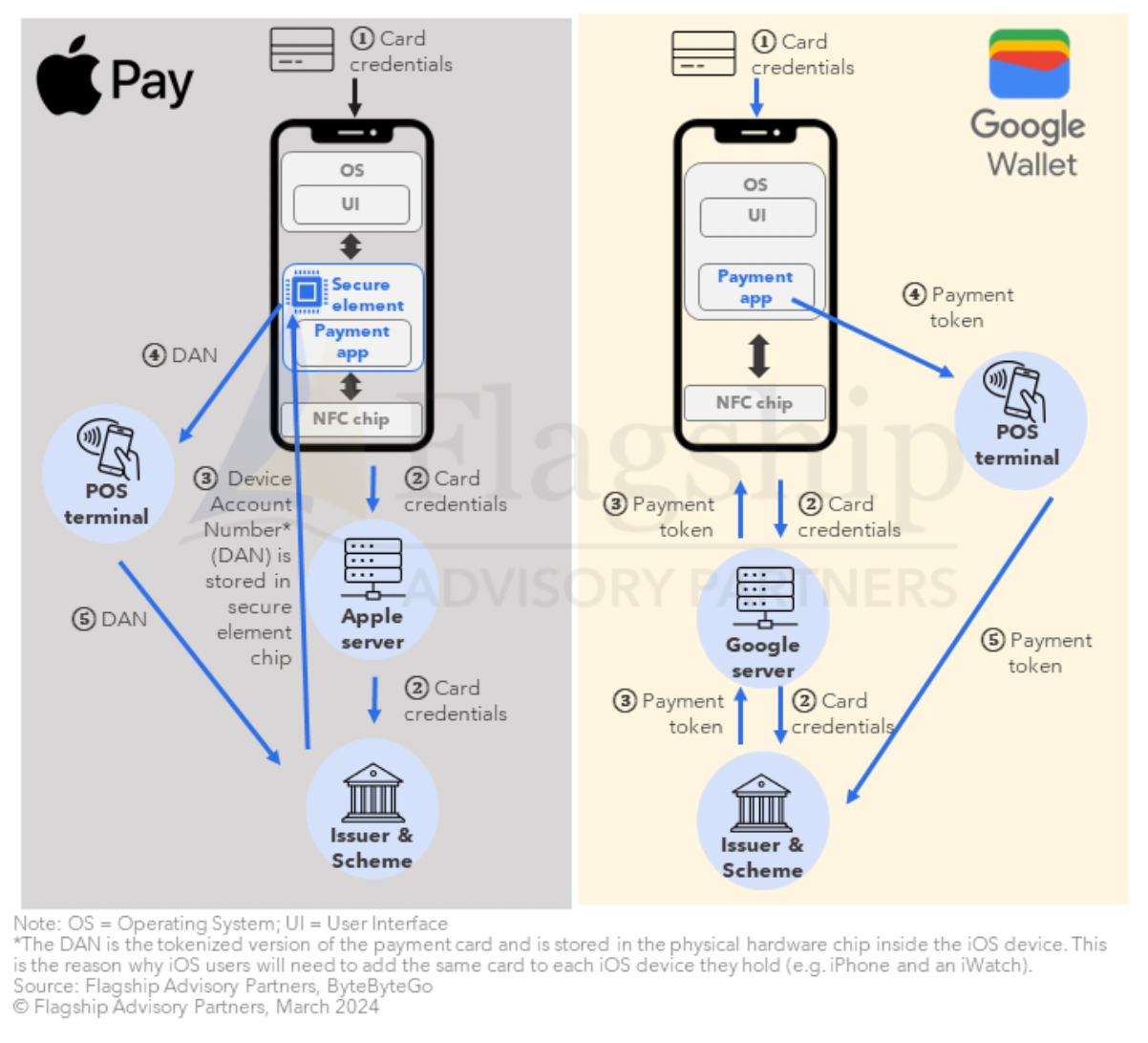

Apple is opening up iOS NFC in Europe.

DIGITAL BANKING NEWS

🇺🇸 JPMorgan hit with nearly $350 million fine for compliance failures in trading. The Federal Reserve said JPMorgan didn’t adequately surveil trading and order activity through the firm’s corporate and investment bank across 30 exchanges and other trading venues. The trades were for the firm and for clients.

🇿🇦 Small businesses next in line for PayShap. With 2.5 million users adopting the rapid payments system, BankservAfrica is preparing to expand the service to small businesses. The service enables instant digital payments between banks via a real-time clearing system that processes transactions within 60 seconds.

🇺🇸 Chime expands availability of In-App tax filing pilot program. After a successful pilot launch, the new tax feature is now available to millions more eligible Chime members, the banking app said in a press release. Eligible Chime members who will be using the feature as part of the pilot will receive an in-app notification, according to the release.

🇸🇪 Swedish Central Bank calls for legislation to protect cash. Even as cash usage continues to fall in Sweden, legislation is needed to ensure that people can pay with notes and coins, says the central bank governor. Read on

🇺🇸 Morgan Stanley names a head of artificial intelligence as Wall Street leans into AI. The bank is elevating Jeff McMillan, a veteran of the New York-based bank, to help guide its implementation of AI across the firm, according to a memo sent last Thursday from co-presidents Andy Saperstein and Dan Simkowitz.

BLOCKCHAIN/CRYPTO NEWS

🇿🇦 South Africa’s Financial Sector Conduct Authority (FSCA) has approved operating licences for 59 cryptocurrency firms as of March 12, 2024. This was stated by a representative of the FSCA at the ongoing FSCA Industry Conference in Johannesburg. According to the regulator, 355 applications for crypto licenses were received, 59 of which were approved, while 262 are still being vetted.

Binance announced the integration of the Solana network with its Web3 Wallet. This much-anticipated integration marks the latest update on Binance Web3 Wallet, solidifying the company’s commitment to continually enhancing the user experience and making Web3 more accessible.

DONEDEAL FUNDING NEWS

🇬🇧 Emerging from stealth, SAPI secures £7.5M equity fundraising for small business lending. SAPI enables payment companies to offer business loans and other financing products to their clients, earning a revenue share while growing their payment ecosystem. Keep reading

M&A

🇬🇧 GoCardless has announced its agreement to acquire Nuapay, with the transaction being subject to regulatory approvals. The acquisition will significantly scale GoCardless’ indirect channel proposition, consolidating its position as a key payment provider to existing and new customer segments including Independent Software Vendors (ISVs) and Payment Service Providers (PSPs).

MOVERS & SHAKERS

🇺🇸 Former Wells Fargo head of SMB banking, Derek Ellington, joins Uplinq as strategic advisor. In this role, Ellington will work closely with current and prospective Uplinq clients, as well as Uplinq’s internal team, to help advance the company’s mission of expanding access to fair and ethical credit for small businesses globally.

🇺🇸 Intuit has acquired intellectual property (IP) and hired talent from financial data platform and tools provider Proper Finance. The team members will join Intuit’s FinTech and Small Business and Self-Employed Group (SBSEG) Money teams, helping to “accelerate innovation,” Intuit said in a March 11 blog post. Link here

🇺🇸 Amount welcomes Len Eschweiler as Chief Revenue Officer. Amount, a FinTech powering banking technology for consumer and small business account opening, loan origination and financing, announced Len Eschweiler as CRO. With 25 years in tech sales and GTM leadership, Eschweiler has a track record of success in high-growth environments.

🇺🇸 David Bai joins Mercury from crypto giant Opensea, where he was a director of engineering for its core product team. While it's not clear exactly what Bai's role will entail, the Mercury's "expansion" indicates that the firm is going to be growing its engineering contingent.

🇺🇸 Fiserv appoints Ajei Gopal to Board of Directors. Gopal has served as president and chief executive officer of engineering simulation solution provider ANSYS, Inc. since 2017, helping accelerate the company’s growth and revenues both organically and through strategic acquisitions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()