Reports Suggests Jio Financial & HDFC Bank Are In Talks To Buy Paytm Wallet

Hey FinTech Fanatic!

Waking up at home in Amsterdam always brings me happiness, especially after a lengthy journey abroad. I will soon return to the US to kick off event season at FinTech Meetup in Las Vegas.

If you happen to be around as well, I highly encourage you to register for the event's highlight happy hour: "Fin and Juice," hosted by my friends at Caliber and The FR. It would be a great opportunity for us to meet in person!

Despite feeling a bit jetlagged, I've compiled a list of the most crucial updates in the FinTech industry for you below. Enjoy!

Cheers,

FEATURED NEWS

Jio Financial Services Shares Jump 14%: Who Is Buying Paytm?

POST OF THE DAY

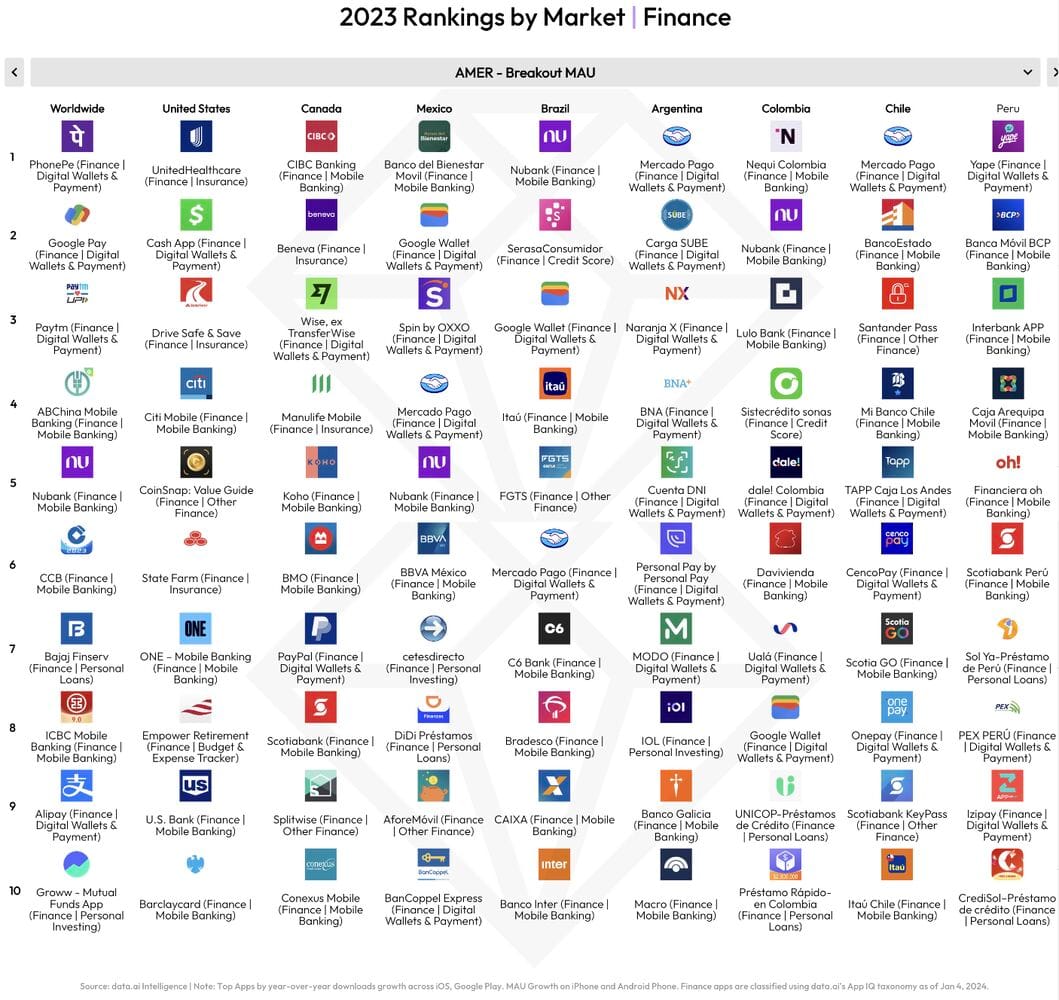

2023 Financial App Ranking in Monthly Active Users.

#FINTECHREPORT

Fintechs: A new paradigm of growth. The FinTech sector is on a rapid ascent though, predicted to surge to more than $400 billion by 2028, which would mark a 15% annual growth rate from 2022 to 2028, vastly outpacing the broader banking industry's growth rate of approximately 6%, according to McKinsey & Company. Read the complete report here

Insights into the 2023 Gig Economy Workforce. Recent estimates peg the gig economy at more than $1 trillion annually in the United States, with an average annual growth rate of 16%-17% and projected to involve nearly 100 million gig workers by 2027. Access the full report

FINTECH NEWS

🇮🇳 Youth-focused neobanking startup Muvin has reportedly shut its operations. The decision was a fallout of the Reserve Bank of India’s order last year forbidding UPI in a co-branding arrangement. A notification on the Muvin app said that the muvin card programme has been closed and any available balance is being migrated to issuer Livquik app.

🇮🇳 Nium secures in-principle approval from RBI for the Payment Aggregator Licence and the Prepaid Payment Instruments License. The two licences will allow the global payments company to offer and improve upon a variety of financial products in the country, from prepaid cards to merchant payment acquiring. Nium continues to expand its licence portfolio to meet global payments evolution.

The McLaren Formula One motor racing team has signed up FinTech “unicorn” Airwallex as its latest partner. Airwallex, valued at $5.6 billion in its last funding round, is expected to be ready for an initial public offering within three or four years. McLaren also will use Airwallex to streamline its supply chain payments for all grands prix.

🇸🇬 Alipay+ adds six more international e-wallets for use in Singapore. The additions bring the total number of overseas e-wallets that can be used when making purchases to 12. E-wallets, though not as common in Singapore, are a popular payment method in the region. Read more

🇬🇧 UK wealth app Chip has launched its first Cash ISA to help members maximise the potential returns from cash savings amid higher interest rates. The new account, powered by ClearBank, is fully flexible, allowing savers to instantly deposit and withdraw their money with no restrictions without affecting their ISA allowance.

🇬🇭 Bank of Ghana approves RightCard (LemFi) to operate remittances to Ghana. This aligns with RightCard’s (LemFi) commitment to offering secure and efficient services within the regulatory framework set by the Bank of Ghana. More on that here

PAYMENTS NEWS

Visa says it blocked $40 billion in fraud transactions last year. Visa Inc. said it blocked a record amount of suspected fraud last year, culminating in a boom in criminal activity during the holiday season. Globally over the whole year, Visa said it blocked $40 billion-worth of suspected fraud, nearly double the $23 billion seen in the year before.

DIGITAL BANKING NEWS

🇬🇧 Allica Bank completes over £2 billion of business lending, with 80% of that being to businesses outside of London. The bank, which made its first loan on the eve of the covid lockdown in March 2020, said over 40% (£820 million) of its total lending was achieved in 2023 alone. Keep reading

🇬🇧 HSBC installs first of ten 'Cash Pods' in town with no bank branches. The Cash Pods enable all residents and businesses to withdraw cash. HSBC UK customers can also deposit cash, check their account balance, activate a card, reset the PIN, and make payments linked to their credit card.

🇺🇸 LendingClub exited the standard operating agreement for a new bank with the Office of the Comptroller of the Currency, meeting all the specified requirements. The company now has more autonomy and flexibility in how it runs the business and deploys capital, while it continues to work closely with regulators.

🇬🇧 Cashplus boss: More challenger banks to go up for sale as big lenders see ‘brain drain.’ The consolidation of mid-sized challenger banks will likely ramp up in 2024 and more lenders will start winding down, the chief executive of digital bank Cashplus has told City A.M., as the market becomes increasingly crowded.

🇲🇽 Mexico-based neobank Hey has announced that it will go independent from Banregio by year 2025. In road to independence, Hey Banco is in the process of securing necessary operational authorisations from various government bodies, alongside permissions for incorporating banking correspondents.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple senior director and head of product marketing W. Oliver Segovia revealed on social media that the firm intends to grow its payment services across the U.S. To kick off this phase, Ripple will be organizing a fintech meetup at its newly inaugurated San Francisco headquarters.

Coinbase and LHV Bank celebrate decade-long partnership. 2024 marks ten years since Coinbase selected LHV Bank as its European banking partner. The partnership has evolved significantly to now allow Coinbase customers to instantly top up or withdraw from their wallets to bank accounts all over Europe.

DONEDEAL FUNDING NEWS

🇬🇧 London FinTech firms KoinKoin and SR FINANZMANN, have closed a $2 million private funding round in a major boost to their corporate OTC business for foreign exchange and digital assets. The funding will support the growth and expansion of the technical FX across both businesses.

🇧🇷 Agricultural FinTech company Traive has successfully raised $20 million to enhance its technology, introduce a new product, and expand its operations within Brazil. "The next step would be to expand to other countries, with the goal of consolidating our risk diversification thesis," says CEO, Fabricio Pezente.

M&As

Tembo announces acquisition of Lifetime ISA provider Nude Finance. The acquisition allows Tembo to further develop its unique proposition to help the next generation of future homeowners get on the property ladder sooner. Under the terms of the deal, recently approved by the FCA, Tembo will acquire 100% of the shares in Nude Finance Limited.

MOVERS & SHAKERS

🇺🇸 Revolut might be known more than most other fintechs for its alumni to spin off into their own startups, but rival digibank Monzo has its share too. The most recent example is Zain Hussain who, after four years as a Monzo fraud investigator in London, is starting his own firm... in San Francisco.

🇵🇭 Wise expands into the Philippines, appoints Isabel Ridad as its Independent Director and Chairman. Wise’s expansion under the guidance of Isabel Ridad signifies a strategic move to enhance its service offerings and deepen its footprint in the Asian market, promising a new era of financial solutions for its users in the region.

Santander appoints Petri Nikkilä as new global CEO of Openbank. Among his main priorities will be to lead the Openbank business in its current markets and continue to promote its international expansion. He will also manage Digital Consumer Bank’s non-auto consumer business and the buy-now, pay-later business (including Zinia).

🇺🇸 Mike Clayville, a former Amazon Web Services executive who became a marquee Stripe hire three and a half years ago, left the payments giant last month, The Information has learned. Clayville’s LinkedIn profile says he is “taking a break to help AI Startups.”

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()