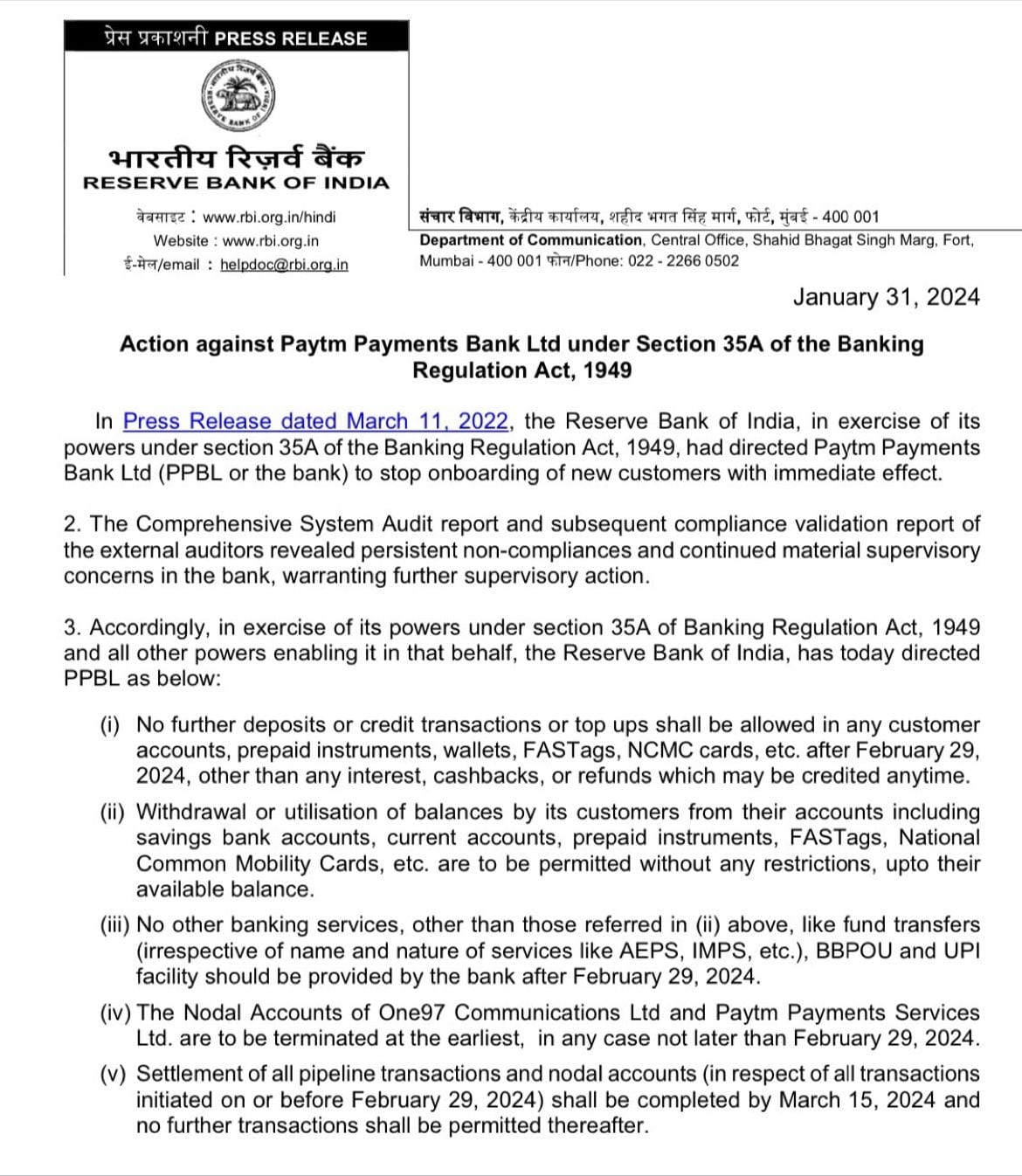

The Reserve Bank of India Halts Paytm Bank's Operations: What the Consequences?

TGIF!

In a significant regulatory move, the Reserve Bank of India (RBI) has directed Paytm Payments Bank, a key player in India's digital payment sector, to halt new deposits and wallet services starting March.

This decision has led to a sharp 20% drop in Paytm's stock, signaling potential concerns over the bank's operational license.

Established in 2015 and operational since 2017, Paytm Payments Bank is known for its digital wallet services, holding up to 330 million accounts, with ownership split between Paytm and its CEO Vijay Shekhar Sharma.

The RBI's directive, citing ongoing non-compliance and supervisory issues, marks a continuation of previous restrictions placed on the bank in 2022. Paytm has announced its intention to comply with the RBI's orders by discontinuing operations with its payments bank and shifting to other banking partners, anticipating a financial hit of up to 5 billion rupees to its EBITDA.

The move underscores deeper regulatory and compliance challenges within Paytm, with analysts pointing to significant impacts on the company's reputation and regulatory standing.

Despite these hurdles, the bank's liquidity is reportedly secure, given its investments in government securities and deposits with other banks, alleviating immediate concerns over meeting withdrawal demands.

I'm heading back to Amsterdam tomorrow, after enjoying a couple of weeks in NYC. I'll be back in April, so definitely shoot me a message if you like to meet for a coffee or a beer when I'm around!

Cheers,

SPONSORED CONTENT

FEATURED NEWS

🇳🇱 MessageBird is now Bird . Your next generation CRM for Marketing, Sales and Payments. Check out CEO Robert Vis blog for more info:

PODCAST

Tokyo: Asia’s next FinTech hub, and an overview of the credit card and payments markets in Japan, with Morris Iwai. In this episode, Brendan Le Grange sat down with Morris Iwai to learn about Japan's credit and payments landscapes; about BNPL, Digital Wallets, and Open Banking; and more. Listen to the full podcast episode here

FINTECH NEWS

🇺🇸 Upstart expands AI-powered vehicle financing nationwide. The leading AI lending marketplace, yesterday announced it will expand its auto retail financing capability nationwide to reach 90% of consumers in the U.S. by the end of the first quarter 2024, up from 70% in the third quarter last year.

🇸🇬 AXS taps Aleta Planet to launch remittance service through UnionPay to provide remittance services to China, the first solution to help consumers plug a gap following a ban on remittance houses transferring funds to China through non-banks and non-card channels.

🇺🇸 PayPal’s AI project: Inside the First Look strategy. Last week, PayPal released a First Look keynote that saw CEO Alex Chriss unveil a six-point strategy for the brand. But when can we expect them to actually launch? And what's the role of AI in these updates? Find out more.

Adyen partners with BILL to provide advanced card issuing capabilities. Adyen’s embedded financial product suite now supports BILL’s card products and services for its AP and AR solutions. Adyen provides BILL with technology to drive further innovation and opportunities to help SMBs thrive through seamless payment experiences.

🇺🇸 Green Check, the leading FinTech connector, and technology and insights provider in the emerging cannabis market, yesterday announced a series of milestones and achievements from 2023 that reflect its continued momentum and leadership position in the industry.

PAYMENTS NEWS

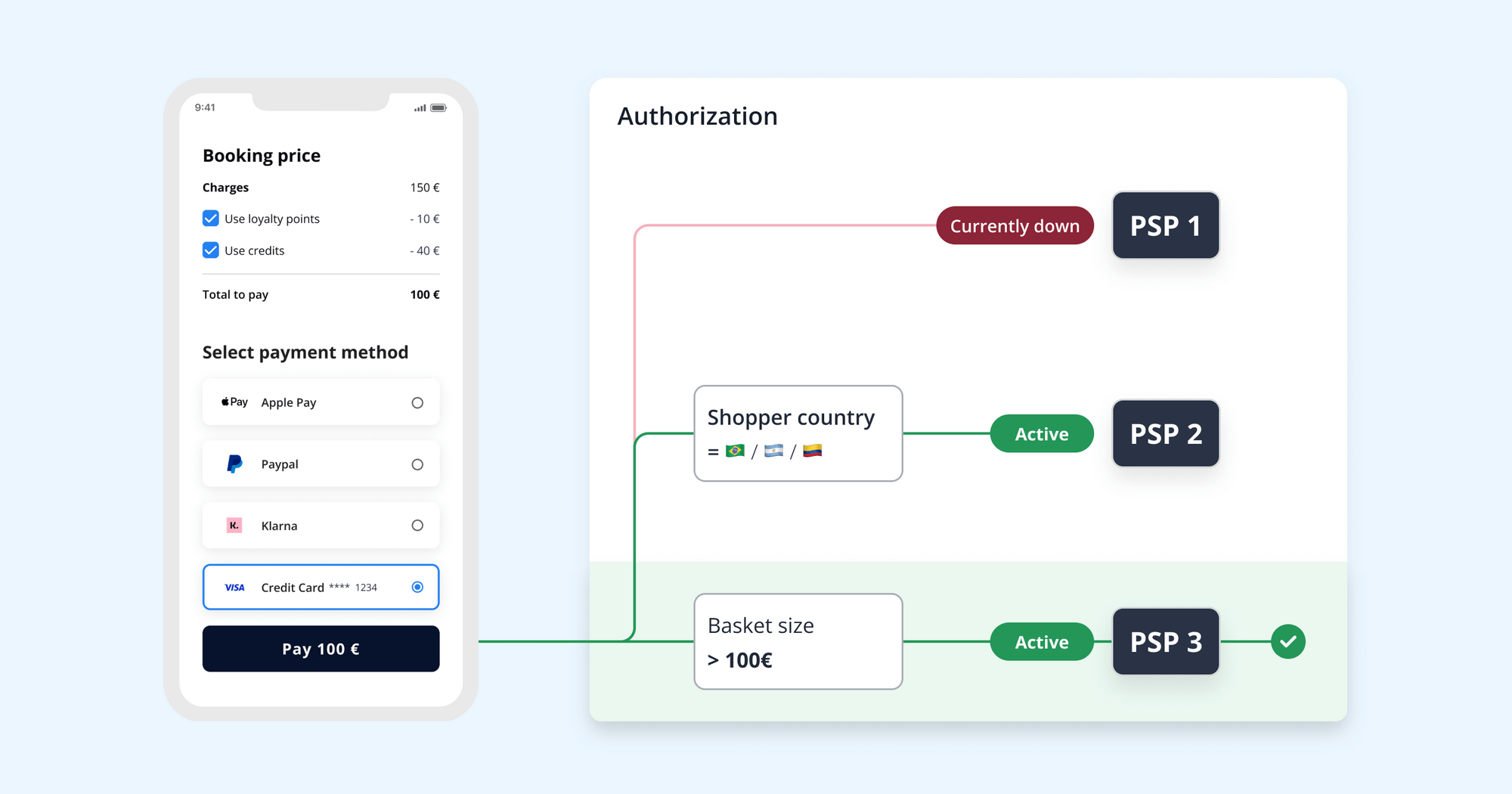

Relying on a single Payment Provider poses a risk of a single point of failure. Here are 4️⃣ reasons why 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗥𝗼𝘂𝘁𝗶𝗻𝗴 is a great solution:

🇺🇸 Nuvei announces that it has partnered with Cash App, a payment method that enables U.S. customers to make online payments either by scanning a simple QR code or by tapping Cash App Pay during the checkout process. Partners in the U.S. can seamlessly add Cash App Pay to their online checkout through their existing integration with Nuvei.

Shares of Mastercard touched an all-time high after the credit card giant posted higher-than-expected earnings and revenue for the final quarter of 2023. The stock jumped to $462 after the market opened, its highest level on record, according to FactSet. Shares are up 5% from where they started the year.

🇳🇴 Biometric card pioneer Zwipe is backing out of the payments market following disappointing uptake of its fingerprint-powered contactless cards. The Norwegian firm is commencing a restructuring and a new strategic direction, turning its attention instead to the biometric access control market.

🇧🇷 Uruguayan Fintech Datanomik and Muevy receive Central Bank approval to operate as Payment Institutions in Brazil. Datanomik defines itself as a multi-bank treasury management platform. The API developed by the startup accesses information directly from banks and other institutions, such as payment service providers and e-commerce platforms.

OPEN BANKING NEWS

🇬🇧 Kikapay goes under. Kikapay, an early startup in the UK's open banking scene, has become the latest fintech to fall victim to changing economic conditions. Kikapay's demise follows the winding up last weeek of business app Paysme, which also cited the tough macro-economic climate.

Volt and Bumper partner to bring open banking to major car dealerships in the UK and Europe. This partnership comes amidst a rebound in UK car sales, as more were sold in the UK in 2023 than in any year since the Covid-19 pandemic, with used car sales particularly booming, experiencing 5.5% year-on-year growth in Q3 2023.

DIGITAL BANKING NEWS

🇺🇸 Cross River’s Commercial Real Estate Team achieves strong growth across diverse asset classes in 2023. The Group’s Lender Finance, Construction and Healthcare teams achieved 48 percent, 34 percent and 16 percent YOY growth in originations, respectively. Combined, the team originated $803 million across 68 loans nationwide for various asset classes.

Despite glimmers of profit, most African neobanks remain in the red: What TymeBank, Carbon and FairMoney’s numbers say about neobank profitability in Africa. An increase in credit loss expense reflects growth in the neobanks’ lending portfolios. Read full article

🇱🇹 The Bank of Lithuania has imposed a fine of 200,000 euros on UAB Revolut Bank for breaching the large exposure limit requirement. The bank itself reported to the Bank of Lithuania about temporarily exceeding the large exposure limit. Revolut has taken steps to prevent the recurrence of such a violation in the future.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple co-founder's personal XRP accounts hacked. Co-founder Chris Larsen says several of his personal XRP accounts have been hacked but dismissed speculation that the company's network was compromised. Read more

DONEDEAL FUNDING NEWS

🇳🇱 Amsterdam’s newest unicorn: DataSnipper raises $100M at $1B valuation to empower auditors with AI. This development comes after DataSnipper claims to have doubled its customer base and revenue in a year. With recent funding, DataSnipper aims to expand into internal audit, tax advisory, forensic accounting, and other sectors.

🇬🇧 Kriya FinTech secures £50m in debt financing to revolutionise B2B payments. The new funding will be instrumental for Kriya in doubling down on its existing services. The plan is to significantly scale the volume of payments processed and to expand the support provided to merchants, not just within the UK but also to exporters dealing in multiple currencies across 45 different markets.

M&As

🇺🇸 Worldpay, a global industry leader in payments technology and solutions, announced that it has closed upon its previously announced sale and will now operate as an independent company. The Company will be overseen by leading private equity firm GTCR, with a 55% majority ownership interest, while FIS, a global leader in financial services technology, will retain a 45% ownership interest.

🇳🇱 a.s.r. announces that it has reached an agreement to sell Knab to BAWAG Group for a total amount of € 510 million. Following a thorough strategic review of Knabs activities, in conjunction with an assessment of the proposal put forward by BAWAG, a.s.r. believes that the future of Knab and the service proposition to its customers is better served by being part of BAWAG.

MOVERS & SHAKERS

🇬🇧 Leonardo Lins has joined Mangopay's growing Product team as Head of Fraud, bringing over ten years of fraud prevention knowledge with hands-on expertise in implementing robust strategies and safeguarding online businesses. Read on

🇬🇧 UK-based BaaS provider and licenced bank Griffin is on the hunt for a new chief operating officer (COO) following the announcement that Maria Campbell is set to depart the firm this quarter. The company posted a job listing seeking candidates with experience in “scaling operations in technology-driven companies” and “operational payments and cash management”.

🇮🇱 Fintech startup Brex is planning to close its Israel R&D center as part of the global layoffs it announced last week. Brex only set up the center two-and-a-half years ago when it acquired Israeli startup Weav for $50 million. The center employs around 20 people in total.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()