Rain Jumps to a $1.95B Valuation after Closing a $250M Series C

Hey FinTech Fanatic!

Rain just closed a $250M Series C, pushing its valuation to $1.95B. That’s a 17x jump in just 10 months.

Total funding now sits above $338M. And the operating metrics are catching up fast. More than $3B in annualized transaction volume and over 200 enterprise partners already live.

The bigger signal here is infrastructure. Rain is building the full stack that lets enterprises issue compliant stablecoin cards, move on-chain money globally, and keep the end-user experience boringly familiar.

Rain’s cards work anywhere Visa is accepted. The active card base is up 30x, with payment volume growing 38x year over year. Clients already include Western Union and Nuvei.

CEO Farooq Malik summed it up clearly. Stablecoins may be the rails, but cards and apps that just work are what drive real adoption. This round is about scaling that layer into new markets.

Before you dive into today’s news, a special invite for you 👇

If you’re in Stockholm this Saturday at 10:00 AM, I’d invite you not to miss the FinTech Running Club run hosted by Ihor Harkusha.

Super casual, no pressure, just a great way to meet people from FinTech, tech, finance, and beyond while getting a run in.

Make sure to register and save your spot. You can also sign up to FinTech Running Club so you don’t miss future runs, including a future run that could happen in your city.

Now, curious where FinTech is heading next? Dive into today’s updates 👇 Stay tuned, I'll be back tomorrow with the latest updates!

Cheers,

FEATURED NEWS

🇺🇸 X is preparing to launch built-in price tracking for crypto tokens and stocks directly within its timeline, reflecting the platform’s growing influence on financial markets. The new Smart Cashtags feature will let users tag specific assets or smart contracts in posts, enabling readers to tap through for real-time prices and related discussions.

FINTECH NEWS

🌍 New January FRC runs! The FinTech Running Club is back with new runs! If you’re into FinTech, community, and networking, why not join the chapter in your city? Are you curious? 👉 Sign up for a run here!

🇮🇳 Razorpay reportedly plans $500m IPO. The company has invited merchant bankers to pitch for the IPO mandate, with Kotak Mahindra and Axis Capital among the leading contenders for the underwriter role. Read more

🇵🇱 XTB launches stock options trading. XTB said that investors on its app have gained the ability to purchase call and put options on the shares of the world’s most popular companies. In the first stage, XTB will be offering vanilla options on shares of the 100 most popular companies listed in the United States.

🇧🇷 Brazilian FinTech Agibank faces a hurdle in its plan for IPO in the US. Brazilian FinTech Agibank’s plan to go public in the US is facing hurdles after the nation’s social security system suspended the firm from making new payroll-deduction loans for retired workers, one of its main businesses.

PAYMENTS NEWS

🇺🇸 PayPal Powers Microsoft’s launch of copilot checkout, enabling shoppers to discover, decide, and pay, without ever leaving the Copilot experience. PayPal will power surfacing merchant inventory, branded checkout, guest checkout, and credit card payments, starting with Copilot.com.

🇺🇸 Fiserv launches Unknown Shopper at NRF, helping merchants better understand in-store customers. Unknown Shopper from Fiserv is a new analytics capability designed to help merchants and their marketing partners better understand in-store customer behavior and build actionable customer segments from card-present transactions.

🇫🇷 Worldline CEO open to further disposals after payment scandal. Chief executive Pierre-Antoine Vacheron noted that activities outside Europe, including in Australia and Asia, remain under review, following recent divestments such as PaymentIQ.

🇧🇷 New payments startup PagAmerican bets on AI to compete in the market. PagAmerican has entered the market with an AI-driven, vertically integrated platform for global sales of physical products. The company generated $233,000 in its first month and aims to scale rapidly by enabling Brazilian merchants to sell internationally without opening foreign entities.

🇨🇳 PhotonPay raises tens of millions in Series B to pioneer stablecoin-centric financial infrastructure. The funds will enable PhotonPay to accelerate the expansion of its next-generation stablecoin financial rails, hire key talent, and broaden its global regulatory footprint.

DIGITAL BANKING NEWS

🇦🇷 Mercado Pago launched its new integrated AI assistant. The new Personal Assistant, an integrated smart tool, is designed to simplify users' daily financial management. It can quickly handle everyday tasks, combining automation, expense analysis, and security features in one convenient platform.

🇫🇷 HSBC accepts $313 million fine to settle France tax-fraud claims. French authorities said lender HSBC agreed to pay a fine of nearly 268 million euros ($312.9 million) in connection with an investigation into accusations of tax fraud relating to dividend payments.

🇧🇷 Influencers received millions to promote the owner of Banco Master on social media. The strategy consisted of defending the banker's image and raising doubts about the Central Bank's actions regarding the financial institution. Read more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Gemini Predictions™ unveils contracts for sporting events. Gemini Predictions™ offers event contracts that are simple yes or no questions on future events. Customers in the United States can trade event contracts using USD in their Gemini Exchange account on web and iOS, with Android to follow shortly.

🇦🇺 Binance adds 100m users in 18 months as Bitcoin holdings leave exchanges. The growth coincides with digital assets shifting from speculative trading to broader institutional adoption, according to the company. Binance reported a 14% year-over-year increase in institutional users and a 13% rise in institutional trading volumes.

🇺🇸 BNY launches tokenized deposits in digital assets expansion. The service enables clients to move funds over blockchain rails, offering an on-chain representation of bank deposits. It can be used for payments, collateral, and margin transactions, supporting faster settlement.

🇬🇧 Ripple receives FCA permissions to scale Ripple Payments in the UK. Through its fully licensed solution, Ripple handles the underlying blockchain and operational complexity so businesses can launch digital payment services quickly, without taking on the cost or burden of infrastructure management.

🇺🇸 BitGo announces custody and transaction support for iPower’s digital asset treasury. The transactions were executed using BitGo Prime’s over-the-counter (OTC) trading services, enabling iPower to access institutional liquidity and discreet execution while leveraging BitGo’s custody platform for the long-term storage of its digital assets.

PARTNERSHIPS

🇺🇸 AWS and Ripple exploring Amazon Bedrock AI for the XRP Ledger. The initiative aims to cut XRPL incident investigation times from days to minutes by automating log and code analysis. Keep reading

🇨🇴 Clinng Payments signed an alliance with Kamin to enable interoperable payments. The alliance will allow companies and FinTechs throughout the region to operate payments and collections in the country in a modern way, integrating technology, security, and even regulatory compliance into a solution.

🇸🇬 Crypto.com exchange expands collaboration with CryptoStruct to deliver advanced high-frequency trading solutions. The partnership provides clients with tick-level orderbook data, normalized low-latency feeds, configurable rate-limit replication, and a parallelized runtime capable of supporting thousands of strategies.

DONEDEAL FUNDING NEWS

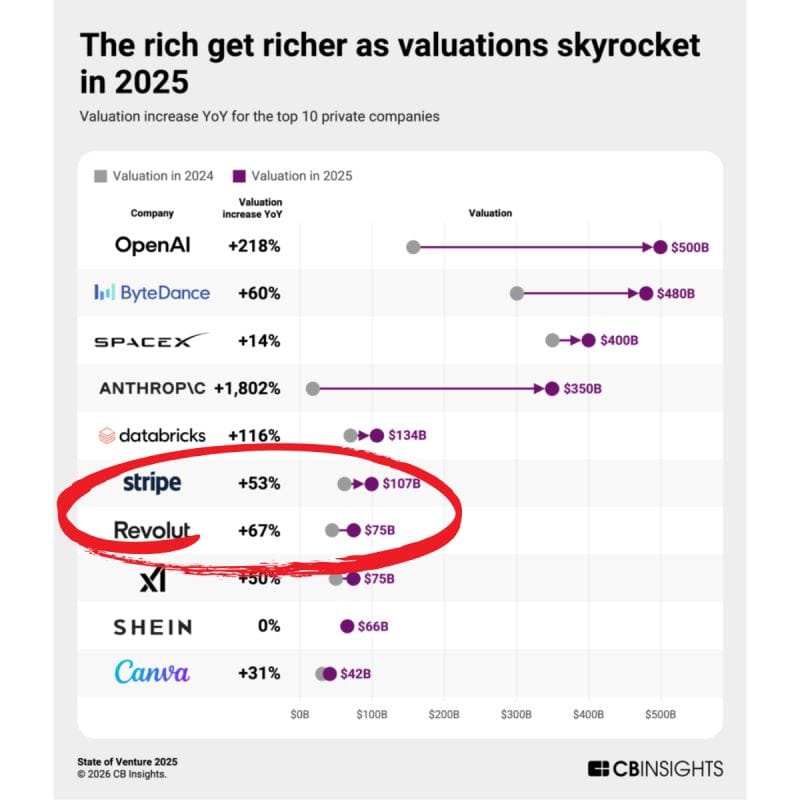

📊 The top 10 private companies are worth over $2T combined 🤯

🇮🇳 Indian FinTech firm Varthana secures $6m loan from WaterEquity. The funding will be used for school improvement loans that include water, sanitation, and hygiene (WASH) infrastructure. Read more

🇺🇸 Rain raises $250m Series C to scale stablecoin-powered payments infrastructure for global enterprises. The new funding enables Rain to scale its global, compliant footprint, deepen platform capabilities, and invest in new products that redefine how payments work worldwide.

🇫🇷 Worldline shareholders back 500 million euro capital raise plan. The capital raise will begin with a 110 million euro share sale to Bpifrance, Credit Agricole, and BNP Paribas, followed by a 390 million euro rights issue open to all shareholders. Continue reading

🇨🇴 Monet raised US$24 million in Series A funding to fight loan sharking. The new capital will allow the company to strengthen its technology, expand national coverage, and optimize its risk assessment tools to reach more users. The FinTech company also announced plans to issue 3.5 million loans this year and expand into Mexico as part of its growth strategy.

🇫🇷 Quideos raises €5.2 Million in follow-on funding led by Breega. The funding will support the company’s next growth phase after enabling it to structure operations, build premium-pricing tools, and launch its first hedging contracts. Keep reading

MOVERS AND SHAKERS

🇺🇸 Plaid has appointed Jelena McWilliams as President of Corporate and External Affairs. The company said her background in regulation, consumer protection, and innovation will support Plaid’s role in advancing open banking, data rights, and innovation amid rapid technological and regulatory change.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()