Qashio Buys Sanad Cash + Tamara Gets UAE Licence

Hey FinTech Fanatic!

Big moves out of Dubai this week, and both point to the Gulf’s rapid FinTech transformation.

🇸🇦 Qashio just acquired Saudi expense platform Sanad Cash, giving the UAE-based startup a local foothold to issue Saudi-regulated corporate cards and roll out its spend management tech across the Kingdom.

It’s a big step in supporting Saudi Vision 2030 and shows how fast regional FinTechs are scaling beyond their home turf.

🇦🇪 Meanwhile, Tamara secured a full Central Bank licence in the UAE — clearing the way to expand its “buy now, pay later” and digital credit products under local regulation.

With this milestone, Tamara joins a growing list of regional players getting the green light to build financial super-apps across the Gulf.

The Middle East’s FinTech scene is heating up, and this is just the beginning.

If you want to keep up with the deals, the licences, and the next wave of innovation shaping MENA’s digital economy, sign up for my new weekly MENA FinTech Newsletter.

Cheers,

FEATURED NEWS

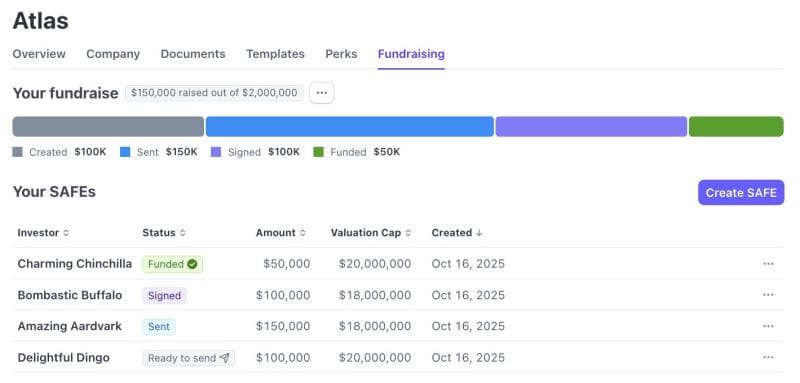

🇺🇸 Startup founders can now manage SAFEs end-to-end within Stripe Atlas, thanks to a new feature that enables sending, signing, and tracking documents in just a few clicks

FINTECH NEWS

🇳🇬 Flutterwave invites FG to invest $75M in $250M initial public offer on NGX. Analysts said Flutterwave’s IPO could mark a defining moment for Nigeria’s capital market, opening the door for more tech-driven enterprises to list locally and attract broader public investment. The proposal was part of Flutterwave’s strategic effort to secure sovereign endorsement.

#FINTECHREPORT

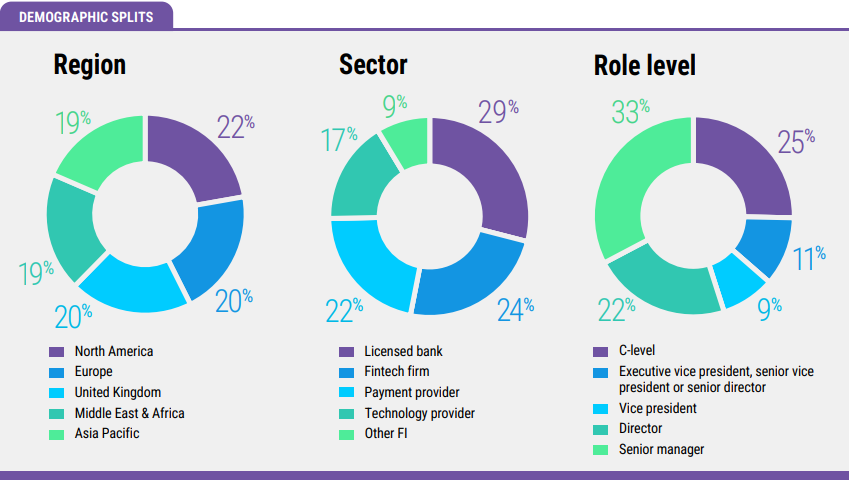

📊 The Payments 2030 Report by Finextra and ACI Worldwide provides a clear roadmap for financial institutions to future-proof their modernization strategies. Based on insights from 162 senior leaders across banks, FinTechs, and payment providers, it explores the shift to cloud and hybrid infrastructures, the rise of A2A and instant payments, and the impact of regulatory pressures on innovation. Download the report here

PAYMENTS NEWS

🇺🇸 Airwallex plots bigger US presence. The payments platform will use its recent acquisition of U.S. startup OpenPay to build out a billing platform in the Americas. By integrating OpenPay, Airwallex said it will create the first truly global billing platform by merging a global FinTech infrastructure with billing and subscription management.

🇨🇴 dLocal enables instant transfers via Colombia’s Bre-B platform. This marks a significant milestone in the country’s financial modernisation journey, enabling seamless, always-on digital payments that connect banks, wallets and consumers across the nation.

🇨🇴 Bre-B debuts strongly. With more than 32 million registered users and 17 million transactions in its first week, the Bre-B Instant Payment System marks a turning point in the way money is transferred in Colombia. This system allows for real-time money transfers between different entities, 24/7, regardless of the user´s bank.

🇦🇺 Afterpay impacted by major outage in Australia. The outage began around 2 pm on Monday and affected services across Australia, New Zealand, Canada, and the United States. According to its website, every part of the platform was impacted. The issue was resolved shortly after 4 pm, though investigations are ongoing.

🇦🇪 Tamara secures Central Bank of the UAE approval. Yamen Fakhreddine, CEO of Tamara UAE, stated that this milestone fundamentally strengthens the company’s entire operation and acts as a catalyst for its ambitious future in the region. He emphasized that the path is now clear for Tamara to achieve its mission of empowering people to own their dreams.

🇸🇬 Alipay+ expands digital services as SGQR payments surge. Singapore ranked first for tourism spending growth in 2025 amongst global travel hotspots. In line with this, cross-border payment acceptance for Alipay+ now includes more than 100 markets, and is expanding its partner ecosystem to 40, representing 1.8 billion users.

REGTECH NEWS

🇰🇪 CBK strips PayU Kenya of payment licence. PayU Kenya Limited has been stripped of its operating licence by the Central Bank of Kenya, days after the company entered liquidation, drawing a close to the Prosus-owned payment firm’s attempt to break into Kenya’s e-commerce gateway market.

🇲🇽 Revolut gets green light to launch bank in Mexico. The FinTech said it received final authorisation from Mexico’s National Banking and Securities Commission, with approval from the Bank of Mexico, to begin operations as a “multiple banking institution” in the country. The neobank is now preparing to launch its product to people in Mexico who have signed up on the waiting list.

DIGITAL BANKING NEWS

🇫🇷 Can Revolut continue to grow without a French banking licence? Revolut’s Western Europe CEO, Béatrice Cossa-Dumurgier, said the neobank’s growth doesn’t depend on a French banking licence, though it would help localize services and build trust. Keep reading

🇬🇧 Tencent-backed Uzbek start-up Uzum considers London listing. Co-founder Nikolay Seleznev revealed that the bank is exploring multiple locations for its planned 2027 IPO, including London, New York’s Nasdaq, Abu Dhabi, and Hong Kong. He noted that while it is too early to discuss a target valuation, a potential London listing would likely involve consideration for inclusion in the FTSE 100.

🇬🇧 Starling Bank readies ground for public listing. The bank has set in motion changes to its corporate structure. Filings at Companies House show that it has created a holding company to own the banking business and also created an intermediate holding company, which is necessary to comply with Bank of England rules around the financial safety of banks.

🇳🇬 Meltwater Founder Jorn Lyseggen reimagines African banking with AI-driven FinTech, BMONI. Officially launched in Nigeria on October 13, BMONI represents Lyseggen’s most personal mission yet, to revolutionize how Africans spend, save, and transfer money both locally and internationally.

🇬🇧 AWS outage hits UK banks' online services. Downdetector, a website that monitors platform outages, has reported that thousands of customers of UK banks are experiencing problems with card payments as well as the inability to access their online bank accounts.

BLOCKCHAIN/CRYPTO NEWS

🇯🇵 Japan’s regulator weighs letting banks hold and trade Bitcoin. This potential Japan crypto regulation reform could enable Japanese banks crypto operations to expand in ways that weren’t possible before, with FSA crypto policy discussions expected to begin soon.

PARTNERSHIPS

🇬🇧 Tink and SplitWise extend European partnership. Building on strong momentum in the UK, the expansion means users in France, Germany and Austria can now send money to friends and family instantly and securely, directly within the Splitwise app using Pay by Bank, powered by Tink.

🇺🇸 Socure and Docusign bring identity certainty to every signature with a frictionless experience for every signer. Socure’s comprehensive identity solutions will be embedded into Docusign Identify, making identity verification and risk-based authentication readily available to Docusign’s millions of users worldwide.

🇦🇪 MoneyHash and Tabby collaborate to simplify flexible payments. This collaboration offers merchants seamless access to flexible Tabby payments across the UAE and KSA through MoneyHash’s unified API. Businesses can activate Tabby’s buy now pay later service, reducing time-to-market and elevating the checkout experience.

🇨🇦 Mesh and Peoples Trust bring AI-powered corporate expense management to Canada. By combining Peoples’ expertise in payments infrastructure and compliance with Mesh’s customer-first approach, the collaboration offers Canadian enterprises a secure, scalable platform for managing corporate payments: from travel booking to reconciliation and reimbursement.

🇵🇭 UnionDigital Bank partners iProov for authentication upgrade. By deploying iProov’s Dynamic and Express liveness solutions, UnionDigital now powers a risk-based authentication strategy that balances strong protection for high-risk transactions with a seamless user experience.

M&A

🇦🇪 UAE FinTech giant Qashio acquires Sanad Cash to fast-track Saudi expansion. The acquisition brings together Qashio’s advanced spend management technology with Sanad Cash’s established local expertise, creating a fully localised and compliant platform for Saudi businesses. The integration will enable clients in the Kingdom to issue locally regulated corporate cards and manage expenses seamlessly.

🇬🇧 Worldpay’s global payments deal cleared by UK antitrust watchdog. Worldpay’s $24.3 billion deal with Global Payments Inc. to create a payment processing behemoth avoided a deeper investigation as the UK watchdog found the deal will not weaken competition in the UK.

MOVERS AND SHAKERS

🇸🇬 Alin Dobrea joins Airwallex to drive challenger FinTech growth across SEA. Dobrea, who has held senior roles across retail, tech, and e-commerce, joins Airwallex with a mission to build a marketing engine that unites data-driven precision with creative boldness.

🇸🇦 HALA announced that Co-founder Maher Loubieh will transition from CEO of Hala Payments to Group Chief Executive Officer of HALA. In his expanded role, Loubieh will oversee Hala Financing, Hala Payments, and HALA’s venture initiatives, while leading the company’s inorganic and international expansion in preparation for its IPO journey.

🌏 10x banking appoints Philip Barnett as Executive Vice Chair. In his role, Barnett will provide strategic counsel to the Board and Management, lead major customer engagements and help drive 10x Banking’s global growth plans, including in key markets such as Asia Pacific.

🇺🇸 Plaid names Seun Sodipo CFO as it enters next phase of FinTech growth. At Plaid, Sodipo will lead the company’s global finance function as it moves beyond core data infrastructure to a broader suite of intelligence services, offering products in identity, payments, credit, and fraud.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()