Elon Musk's X Expands Payment License, Plus UK's Big Move on Interchange Fees

Hey FinTech Fanatic!

Elon Musk's social media platform X, took a step closer to offering payment features after receiving a money-transmitter licence from a 13th US State this week.

Recent developments have seen X successfully obtaining a payment processing license in 13 US states, including Pennsylvania, a move that signals the company’s commitment to becoming a significant player in the FinTech arena.

This strategic state-by-state expansion is crucial, as full nationwide coverage is necessary for X to offer comprehensive payment services across the US.

This approval empowers X to facilitate money transfers in a manner akin to established systems like PayPal's Venmo.

Payments are also tied into X’s broader move into the creator economy, where X users with at least 500 followers and 5 million organic impressions on their posts over the past three months can become eligible for ad revenue sharing.

Meanwhile, a major development has emerged from the United Kingdom, impacting neobanks and the broader FinTech sector.

The UK's Payment Systems Regulator (PSR) has proposed new caps on cross-border interchange fees, a move that could significantly alter the revenue models for many neobanks.

In its recent review, the PSR suggests capping fees at 0.2% for consumer debit transactions and 0.3% for consumer credit transactions between the UK and the European Economic Area (EEA). This change aims to reduce costs for UK businesses engaged in EEA transactions, marking a critical shift in the financial transaction landscape.

This proposal could disrupt the traditional revenue streams for neobanks, which often rely heavily on interchange fees from debit and credit card transactions. The recommendation for a "lasting cap" on these fees indicates a significant potential shift in how these banks will operate financially.

While these changes are still in the recommendation phase, they signal a broader movement towards more regulated interchange fees.

To be continued...

Don't forget to check out the extra FinTech news I've got lined up for you below 👇. I'll be back with more hot updates tomorrow.

Cheers,

SPONSORED CONTENT

POST OF THE DAY

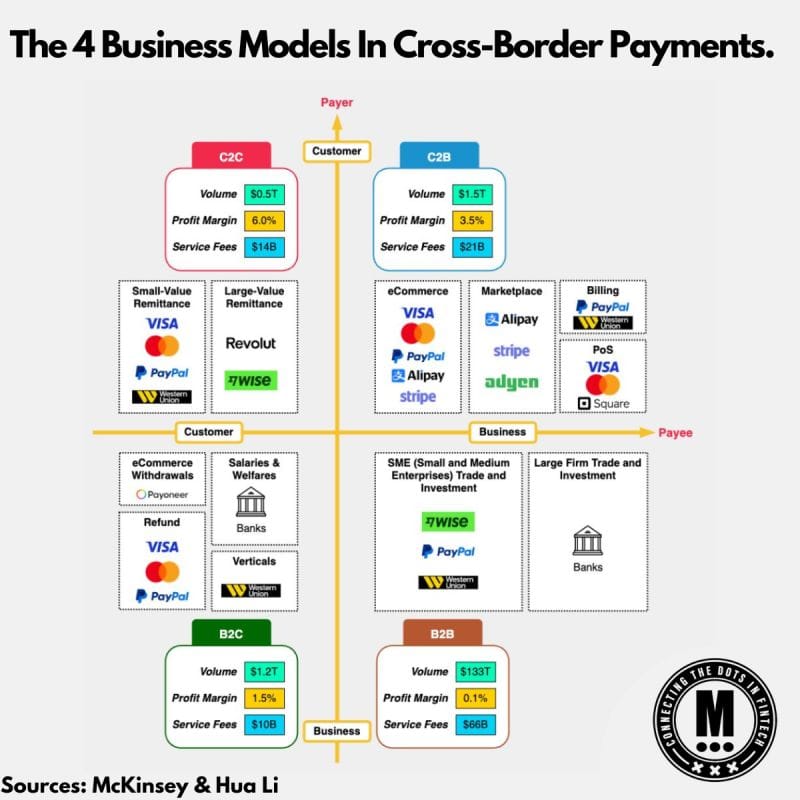

What does each business model mean in cross-border payments? Here are the 4️⃣ Business Models

ARTICLE OF THE DAY

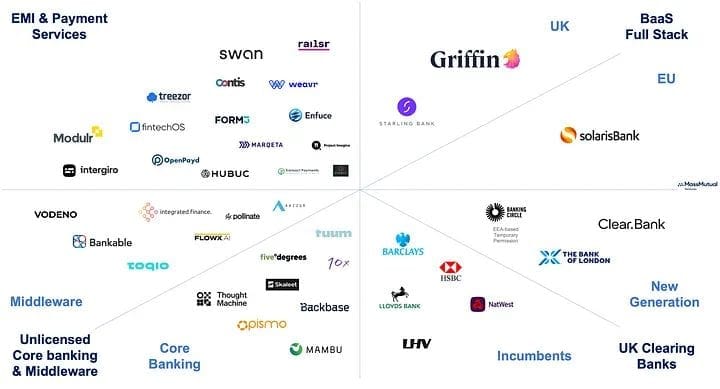

Banking-as-a-Service: the €100 billion opportunity in Europe 🇪🇺 🇬🇧. The BaaS market is mainly driven by developments in 2️⃣ areas:

FEATURED NEWS

🇺🇸 The US Securities and Exchange Commission denied Coinbase’s 2022 petition for rulemaking. The SEC opposes the petition’s view that using existing securities laws to enforce crypto regulation is “unworkable.” Read more about this topic here

FINTECH NEWS

🇬🇧 Freetrade launches Treasury bills offering a 5.2% yield. Like bonds, Treasury bills are issued by the government to finance its operations, but they have largely been the preserve of wealthy investors with a typical minimum investment of £500,000.

🇺🇸 Mercury seeking $30M from Synapse, emergency court filing reveals. The lawsuit aims for a temporary protective order, a right to attach, and a writ of attachment, as it seeks to recover some $30 million from the embattled company, Fintech Business Weekly has exclusively learned..

🇬🇧 Curve slips further into the red as losses widened in 2022. In September 2023, Curve raised an additional £58m in funding, bringing its 2021 Series C round to more than £133m in total. The all-your-cards-in-one fintech says it is now aiming for profitability in early 2024

Mastercard partners with Further Ventures next generation payments and asset management infrastructure, accelerating the development of local fintech capabilities in the UAE and the wider MENA region. Read more

🇮🇪 Swedish fintech Treyd expands to Ireland. The expansion will provide Irish SMEs with new options for financing inventory, giving them the option to free up capital that can then be invested in growth

🇨🇴 EBANX partners with Bancolombia Bank. Customers in the region of Colombia will be enabled to pay for products and services globally with the security and ease of a bank transfer. The partnership also focuses on streamlining and optimising the bank transfer experience within the digital economy in the country.

PAYMENTS NEWS

How do consumers pay around the world? Mastercard and Visa are dominant in most countries. AMEX’s presence is mainly in the US and UK. In China, India and Brazil they have developed their own payment ecosystem and they are highly successful. Read the full article

🇺🇸 FedNow may have spurred RTP adoption. The increase in real-time payments activity is a potential boon to the U.S. economy. As payments move faster, commerce does too. With real-time payments, transactions can be completed in minutes as opposed to days.

OPEN BANKING NEWS

🇨🇦 TD Bank Group (TD) and Plaid announced that they have entered into a North American data-access agreement that will enable TD customers in Canada and the U.S. to more securely connect to and share financial data with Plaid's data network of over 8,000 + apps and services.

DIGITAL BANKING NEWS

🇺🇸 MoneyLion reaches settlement with Colorado over membership fee requirement. Last month, MoneyLion reached an agreement with the administrator of Colorado’s UCC, which regulates the terms and conditions of consumer credit in the state, including setting permissible rates and charges.

🇶🇦 Lesha Bank partners with Temenos. Following this announcement, the core banking platform of Temenos is expected to enable Lesha Bank to increase its speed to market Shari’a-compliant investment capabilities.

🇵🇭 Maya launches stock trading service. The digital bank has launched Maya Stocks, the first retail investing service in the Philippines integrated in a digital bank app that offers real-time transactions and instant earnings growth through its diverse wealth-building options.

🇬🇪 Paysera bank opens in Georgia. Paysera Georgia has commenced operations with the opening of its inaugural bank branch in Tbilisi. Having obtained a banking license in Georgia last year, the company is poised to provide a diverse range of financial services to the local community.

🇧🇷 Nubank expands its investment product portfolio in the app with real estate and agriculture credit bonds. Gradually, over the next few weeks, the company’s customers in Brazil will be able to access and trade Real Estate Credit Bonds (LCI) and Agricultural Credit Bonds (LCA) directly in the Nubank app.

🇨🇦 Synctera launches embedded banking platform in Canada. The Canadian platform will launch with bank account, card, and electronic fund transfer functionalities, with more features like bill payment planned for the future. Read more

Citi shuts muni business that once was envy of rivals. The bank decided the business, which has tumbled in the rankings for underwriting state and local debt, is “no longer viable given our commitment to increase the firm’s overall returns,” according to a memo to staff seen by Bloomberg News.

DONEDEAL FUNDING NEWS

🇲🇽 Mexican Fintech Kapital raises financing led by Tribe Capital. Kapital, which combines banking and tech on its platform, raised $40 million in equity and $125 million in debt in a series B financing, co-founder and CEO Rene Saul said. The company hasn’t disclosed its valuation in the financing.

Open Finance and Data FinTech Investplay, has recently secured an investment of R$ 3.3 million from BRQ, Osten Moove funds, and Darwin Startups accelerator, which counts B3 among its corporate partners. More here

M&A

🇺🇸 Global Payments considers acquisition of US peer Shift4. Atlanta-based Global Payments has been working with an adviser to study the feasibility of a deal for Shift4, according to people familiar with the matter, who asked not to be identified discussing confidential information.

🇲🇽 Visa to acquire a majority interest in Prosa to accelerate digital payments adoption in Mexico. The acquisition will allow an important percentage of payment transactions happening in Mexico to benefit from being more efficient and secure by leveraging Visa’s network infrastructure and technological expertise.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()