Plata Shoots for $3.3B Valuation

Hey FinTech Fanatic!

Mexico’s Plata is raising fresh funding at a jaw-dropping $3.3B valuation. This is more than double its $1.5B one from its Series A in March. Demand? Already twice the available supply.

The startup has pulled in nearly $1B so far in combined equity and debt financing. Its flagship credit cards now count 1M+ active users.

Next stop: Plans for LatAm scale-up with Colombia as its springboard. With its thin-file credit scoring and cloud-native banking stack, Plata wants the Nubank playbook: Mexico edition.

Full story on Plata’s 2026 mega-round plans below. Don’t miss more big FinTech updates ahead 👇

See you Monday!

Cheers,

#FINTECHREPORT

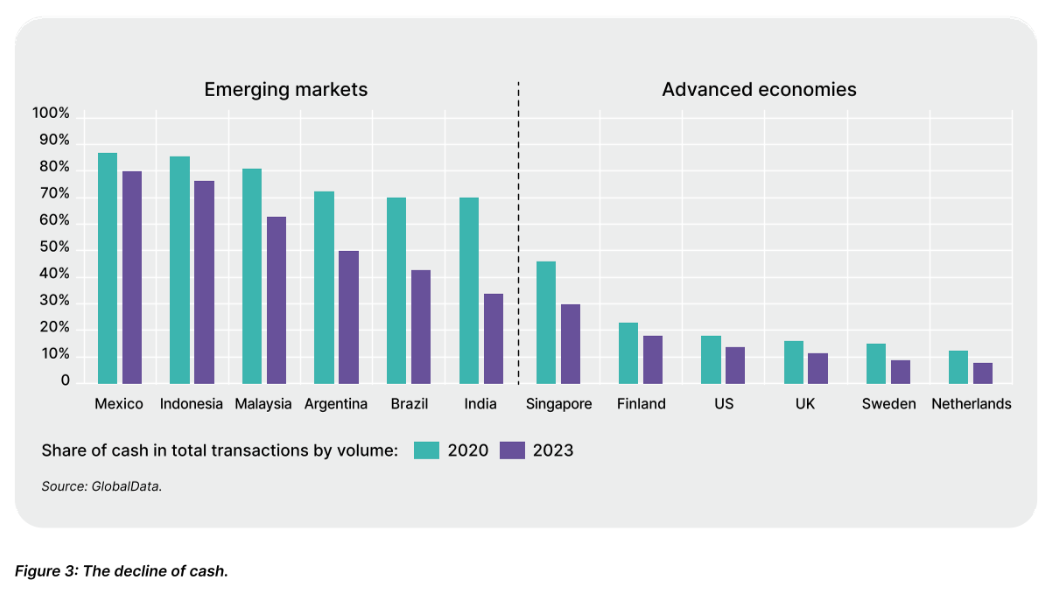

📊 Navigating Digital Payments Report.

FINTECH NEWS

🇸🇬 Singapore FinTech firm Nium reports $50 billion in annual transactions, with most activity coming from enterprise clients. Prajit Nanu, CEO of Nium, said this was the company’s highest month for both revenue and transaction volumes since its founding ten years ago.

🇵🇰 Jaish's FinTech Terror: Inside Masood Azhar's digital fundraising empire. A Times Now investigation has uncovered a staggering new method being deployed by Pakistan-based terror outfit Jaish-e-Mohammed (JeM) to bypass global scrutiny and continue its operations.

🇮🇳 PayNearby plans to go public next year. Indian FinTech firm PayNearby plans to launch an initial public offering in the next financial year to fund expansion, its Chief Executive said, making it the latest to target a red-hot market that raised record sums in 2024.

🇬🇧 CredAbility unveils credit score builder. The new feature offers step-by-step actions, showing how many points each move could be worth and when results could start to show. It gives people complete visibility over how to improve their credit score.

FINTECH RUNNING CLUB

🇸🇻 Meet the FRC San Salvador crew and our amazing host! 🏃♂️☕ Discover the best spots to network and run right in the heart of Zona Rosa, join us and be part of the movement!

PAYMENTS NEWS

🇺🇸 How stablecoins could impact payments: Philip Bruno, ACI Worldwide’s Chief Strategy and Growth Officer, offers insights. In an interview, He talked about how ACI has been advising clients in the new stablecoin regulatory regime and how customers are reacting to the opportunities and challenges cryptocurrencies present.

🇨🇭 More than 6 million people in Switzerland rely on TWINT. People in Switzerland use TWINT to pay easily, quickly, and securely with their smartphones and to send money to friends, family, or acquaintances. The company also offers users and retailers a degree of independence from global tech corporations.

🇵🇭 Wise integrates with PESONet. Parents can now effortlessly transfer substantial amounts for their children’s overseas education in a single transaction, and overseas foreign workers can send significant amounts home without worrying about daily caps or multi-day processing times.

🇨🇦 Zum Rails launches suite of Mastercard-powered prepaid card programmes in Canada. These reloadable cards will enable businesses to offer seamless expense management, faster wage access, consumer rewards, and real-time disbursements and spending flexibility, empowering the business and its customers to control funds with speed, security, and precision.

🇨🇳 Indonesian QR code payments to launch in China by the end of 2025. The central bank has tested QRIS in China since August 2025 with partners including the Indonesian Payment System Association, UnionPay International, and payment providers.

🇵🇰 State Bank declares 1LINK a designated payment system. The SBP has further strengthened oversight of the country’s payment ecosystem, recognizing 1LINK’s role as Pakistan’s only interbank network operator. The platform facilitates ATM withdrawals, bill payments, interbank fund transfers, and a wide range of digital financial services used by millions nationwide.

DIGITAL BANKING NEWS

🇸🇬 DBS expands crypto offerings with tokenized structured notes on Ethereum. DBS announced that the bank is opening the door to traditionally high-barrier financial products in smaller denominations through tokenization. By issuing them in $1,000 denominations, DBS said the products will become more flexible, tradable, and easier for investors to manage in portfolios.

🇫🇷 French neobank Qonto doubles profits with second year in the black. The Paris-based unicorn saw net profits surge to a record €144m in 2024, doubling the amount it posted in 2023 (€71m) and marking the scaleup’s second year of profitability, according to company accounts.

🇬🇧 Shawbrook Bank goes live on Thought Machine's Vault Core. Shawbrook will use Vault Core to scale up its commercial SME lending, introduce new features quickly, and increase automation across back-end processes. Thought Machine’s banking platform, Vault Core, is to accelerate product innovation in commercial SME lending.

🇺🇸 Grasshopper Bank adopts Narmi's MCP server for AI business insights. Narmi’s MCP server enables Grasshopper’s small business and startup clients to query their financial information securely. The new functionality consolidates various streams of financial data and simplifies outputs, providing personalized insights in a conversational setting.

🇱🇹 Artea Bank migrates to the BPC SmartVista platform. Leveraging BPC technology, Artea Bank obtains guaranteed near-zero downtimes on operations and achieves international compliance with PSD2, RTS, PCI-DSS, GDPR, and DORA standards.

🇬🇧 Moneybox’s wealth focus helps treble inflows to a record high. The investment platform‘s net inflows more than tripled to £5.8bn, from £1.7bn the year prior, a jump of over 241%. Assets under management also more than doubled to £11.7bn as the FinTech’s wealth segment boomed.

BLOCKCHAIN/CRYPTO NEWS

🇨🇳 China is considering yuan-backed stablecoins to boost global currency usage. The plan is expected to include targets for the usage of the Chinese currency in the global markets and outline the responsibilities of domestic regulators, adding that the roadmap will also include guidelines for risk prevention.

🇳🇱 Fiat Republic launches ENEUR and ENGBP with MiCAR approval, ENUSD in development. With this launch, Members can access compliant, instant liquidity across EUR, GBP, and USD, enabling 24/7 operations under the EU’s Markets in Crypto-Assets Regulation (MiCAR).

🇺🇸 Kraken completes full DVT integration for Ethereum staking using SSV. DVT decentralizes validator operations by splitting responsibilities across multiple independent nodes that cooperate to perform attestations and block proposals. Continue reading

🇺🇸 Crypto wallet provider MetaMask to offer a stablecoin with Stripe's Bridge. The wallet’s stablecoin is called MetaMask USD (mUSD). The plan is for mUSD to integrate into MetaMask’s wallet for users to hold, spend, and transact across the web3 ecosystem, including lending markets, decentralized exchanges, and custodial platforms.

PARTNERSHIPS

🇳🇿 Corpay partners with New Zealand Football as official FX provider ahead of World Cup. The arrangement will give the soccer body access to currency risk management tools and international payment processing through Corpay's platform. Keep reading

🇲🇾 PayNet and Ant International expand their tie-up to boost DuitNow QR’s global reach. The agreement will allow Malaysian travellers to use their local e-wallets or banking apps across Alipay+’s global merchant network of 100 million. The partnership will also focus on strengthening fraud defences, talent development, and sustainability initiatives.

🇮🇩 Collaborate with BNI and JCB to launch the JCB corporate card in Indonesia. This premium credit card is thoughtfully designed to meet the diverse needs of Japanese corporations operating in the country, supporting both their business operations and collaborations with local partners.

🇨🇭 Sygnum and Incore Bank expand partnership to strengthen B2B digital asset banking. Under the expanded partnership, Incore will leverage Sygnum’s modular B2B digital asset platform and institutional-grade infrastructure to enhance its digital asset services.

🇱🇧 Whish Money collaborates with Mastercard Move to bring seamless cross-border payments to Lebanon. With the collaboration, Whish Money users in the country will be able to start sending money cost-effectively through the Whish Money mobile application to 50+ countries in near real-time.

🇦🇺 Invoice finance FinTech FundTap transforms eSigning processes with Annature. The integration includes a tailored witnessing feature built by Annature to meet FundTap’s unique compliance needs. FundTap provides on-demand invoice finance, helping business owners access money when they need it most.

🇺🇸 Cash App, Afterpay, and Caleres step into fall with an expanded partnership. Through this partnership, U.S. shoppers can use Afterpay's Pay in 4 and Pay Monthly options to purchase from beloved brands. The collaboration also brings Afterpay's in-store payment solution to select retail locations.

🇺🇸 Mastercard and Alloy combine to speed onboarding. The new Mastercard Alloy joint onboarding solution will leverage identity verification and open finance to streamline the end-to-end onboarding process while combating fraud. Alloy intends to leverage Mastercard’s best-in-class global digital identity verification capabilities.

🇺🇸 Robinhood partners with Kalshi to launch NFL and College Football prediction markets. Customers can now trade on the outcomes of the most popular pro and college football games, including all regular-season pro matchups, and all college Power 4 schools and independents.

DONEDEAL FUNDING NEWS

🇲🇽 Plata aims for $3.3B valuation as Mexico’s “Nubank for credit” scales across LatAm. The company is offering just under 1.5% of its equity in this round, with demand already twice the available supply. Continue reading

M&A

🇧🇷 Evertec to acquire controlling stake in Tecnobank, a FinTech Company in Brazil. The parties have agreed to a transaction valued at R$787 million, representing approximately $144 million at current exchange rates, for a 75% ownership stake, which the Company expects to finance with existing liquidity.

MOVERS AND SHAKERS

🇲🇽 Nubank appoints Amex vet Armando Herrera as Mexico CEO. In his new position, Herrera will focus on preparing Nu Mexico to operate as a fully licensed bank. He joins Nubank from small business lending platform Konfío, where he has served as GM of financial products and payments since January 2024.

🇺🇸 DriveWealth CEO leaves for former NYSE owner, succeeded by Industry Veteran Naureen Hassan. Hassan, who left UBS Group AG last year after serving as president of its Americas unit, has more than two decades of financial industry experience, including a stint at the Federal Reserve Bank of New York.

🇮🇳 FincFriends appoints Vishal Bhatia as CFO to strengthen financial planning, strategy & compliance. He will be responsible for enhancing cost efficiencies and implementing robust financial controls with growth targets. He will also play an instrumental role in overseeing investor relations, budgeting, audit readiness, and capital structuring to support expansion.

🇬🇧 Pirum appoints Ben Challice as CEO. In his new role as CEO, Challice will accelerate the adoption of Pirum’s unique and transformational Complete Lifecycle offering, which automates the Securities Finance trade process end-to-end. Another key focus for Challice will be the development of impactful next-generation technologies that solve real-world problems.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()