PicPay Reignites US IPO Push After Doubling Revenue

Hey FinTech Fanatic!

PicPay disclosed a sharp jump in revenue and profit in new US IPO filings, as the Brazilian FinTech renews its push to list shares in New York.

For the nine months ending September 30, PicPay reported profit of R$313.8M, up from R$172M a year earlier. Revenue and financial income reached R$7.26B, nearly double year over year.

This marks PicPay’s second attempt at a US listing after pulling its IPO plans in 2021 amid weak market conditions. The timing now looks different as public markets slowly reopen.

The company operates a broad financial platform built around payments, savings, and credit, with Pix and QR codes at the core of daily usage for consumers and small businesses.

What’s clear here is the wider signal. IPO momentum is expected to pick up in 2026, with more FinTech and crypto companies preparing to test the market again. PicPay is now firmly back in that group...

Curious where FinTech is heading next? Dive into today’s updates 👇 Back tomorrow with more stories shaping the industry.

Cheers,

Marcel

INSIGHTS

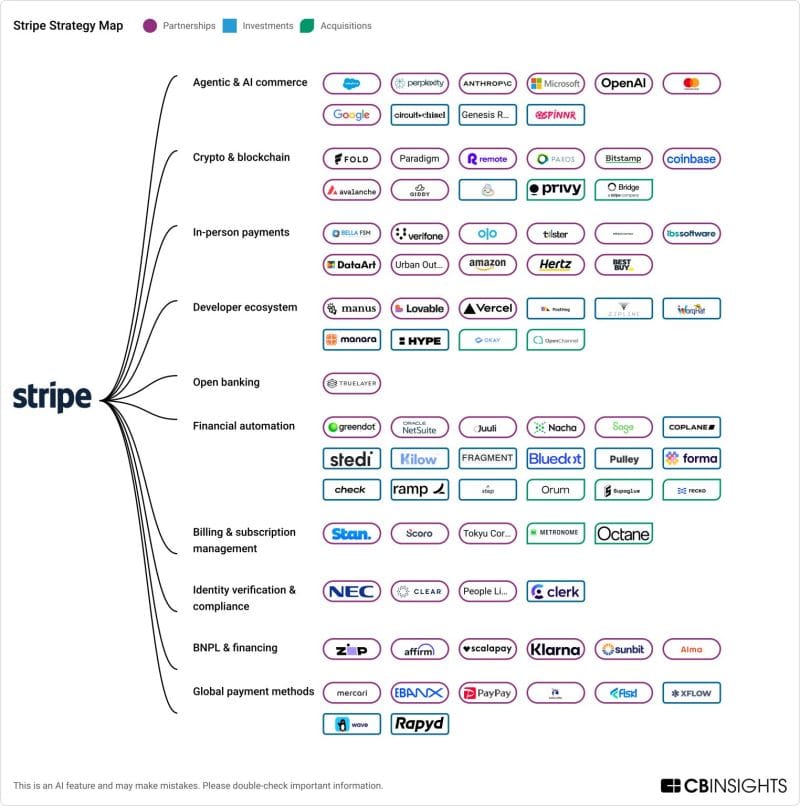

➡️ Stripe Strategy Map 👇

Stripe’s latest strategy signals one thing clearly:

FINTECH NEWS

🌍 Your Chance to Host in 2026! The FinTech Running Club is growing fast, and this could be your moment to lead! If you’re passionate about FinTech, community, and networking, why not start your own chapter in your city? Are you curious? 👉 Sign up to become a host!

🇧🇷 Brazilian FinTech PicPay discloses revenue jump in US IPO paperwork. The move comes as the IPO market shows signs of recovery following years of weakness, with analysts expecting further momentum in 2026 despite recent market volatility.

🇺🇸 Pluto launches AI-powered lending platform to unlock liquidity in private markets. Pluto’s flagship Wealth Equity Line of Credit is designed to let investors borrow against private market assets at competitive rates, with repayment from future fund distributions and no monthly interest payments, keeping their capital working while unlocking liquidity.

🇧🇷 StackAI, a US startup, arrives in Brazil to serve large companies. In Brazil, the company plans to invest over R$1 million in corporate roadshows over the next three months, focusing on clients in the financial, industrial, healthcare, construction, and service sectors.

PAYMENTS NEWS

🇦🇪 Ziina introduces Violet, every day benefits from the UAE’s most loved brands, plus zero currency fees. Designed around the habits that shape life in the UAE, Ziina Violet provides practical, recurring value through benefits that fit naturally into how people already eat, shop, commute, exercise, and live.

🇧🇷 Pix will accelerate its expansion to other countries this year. PagBrasil CEO and co-founder Alex Hoffmann said Pix’s flexibility and private-sector innovation are driving its global adoption, noting that dozens of countries have drawn inspiration from the system and that momentum is unlikely to slow.

🇮🇳 GlobalPay launches prepaid card suite and expands push into cross-border travel payments. According to the company, the cards support tokenisation on Samsung Wallet and Google Wallet, allowing users to make contactless payments across international markets.

🇮🇳 Amazon Pay rolls out fixed deposits to deepen its financial service offerings. Amazon Pay would allow customers to open FDs starting from INR 1,000, without the need to open separate savings accounts with its partner institutions.

🇮🇳 Zepto rolls out in-app UPI as delivery platforms bring payments in-house. The move comes as large consumer internet platforms increasingly seek to bring payments in-house to streamline checkout flows, reduce transaction failures, and lower dependence on external UPI apps.

🌍 Citi and CredAble launch a platform to digitize trade finance. This platform aims to streamline business operations and bring efficiency through technological advancements in trade finance. By implementing a digital approach, Citi seeks to enhance operational transparency and efficiency for its corporate clients.

🇬🇧 Wirex launches TRON-Native payment infrastructure for agentic payments. By combining TRON's massive user base and sophisticated technology with Wirex's payment rails, the collaboration delivers the speed, affordability, and reliability to bring blockchain payments further into everyday use.

OPEN BANKING NEWS

🇹🇷 Turkey’s central bank has granted iyzico and Ödeal authorization to expand into open banking. The approval enables users to initiate payments directly from their bank accounts and access consolidated account information across multiple banks, marking the companies’ formal entry into a key growth area of the financial ecosystem.

REGTECH NEWS

🇱🇹 iDenfy launched a Secretary of State (SOS) verification tool for its business verification platform. iDenfy announced a new partnership with FTMO. Through this collaboration, FTMO has implemented iDenfy’s Know Your Business (KYB) solution, which enhances verification speed for corporate clients and strengthens risk management across its onboarding processes.

DIGITAL BANKING NEWS

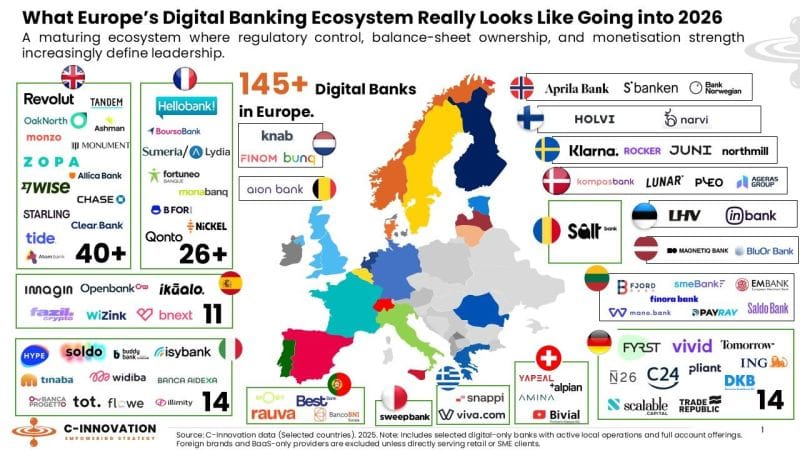

🌍 Europe's Digital Banking Ecosystem going into 2026👇

Which neobank is missing in this overview?

🇺🇸 Stablecoin neobank Kontigo hit by $340K USDC hack, vows 100% reimbursement. The company stated that it will fully reimburse affected users on a case-by-case basis, following user reports of unauthorized access attempts and coming shortly after Kontigo closed a $20 million seed funding round.

🇧🇷 Avenue has received a license from the Central Bank of Brazil (BC) to operate as an investment bank. This authorization represents a significant regulatory milestone and reinforces the company's long-term strategic positioning within the financial system.

🇮🇳 Axis Bank launches ‘Safety Centre’ on its mobile banking app to give customers control over key features. The Safety Centre enables customers to tailor security settings based on their usage and comfort, the private sector bank said in a statement.

🇮🇳 Fino Payments Bank implements a new core banking system, Finacle. The new core banking system will serve as the Bank's digital backbone, enabling enhanced operational efficiency, greater system resilience, and improved scalability.

🌍 IMF urges stronger cyber risk rules as digital finance expands across Africa. The IMF warns that cyber threats to the financial sector are becoming more frequent, sophisticated, and damaging, posing growing risks to financial stability, consumer trust, and economic activity.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Remittix to launch global crypto payments platform next month. In a statement, the company said the Remittix Platform is scheduled to go live on 9 February 2026, making the core platform layer available to users worldwide. The February launch is intended to expand access to services that facilitate crypto payments.

🇫🇷 Ledger reveals payments partner leaked customer names, contact information in new data breach. These attacks involve scammers using fake emails, texts, or calls to trick customers into revealing sensitive information, clicking links that install crypto-stealing malware, or inadvertently sending them their crypto.

🇺🇸 Blink Charging adds cryptocurrency payments at DC fast charging sites. The company plans to expand crypto payment availability to additional Blink-owned sites throughout 2026. Read more

🇰🇾 Crypto.com receives conditional approval for a virtual asset service provider license from the Cayman Islands Monetary Authority. This approval will enable it to further its product and service portfolio in the Cayman Islands, particularly through the Crypto.com Exchange, Crypto.com’s institutional-grade offering for advanced traders and institutions.

🇺🇸 Circle's USDC outpaces the growth of Tether's USDT for the second year running, driven by increased demand for dollar-pegged tokens that meet regulatory requirements. Continue reading

🇮🇪 Forex.com owner StoneX adds crypto offering under MiCA Licence. The authorisation allows the firm to provide digital asset execution and custody services across the European Union. These services will operate under the MiCA regulatory framework.

🇺🇸 Morgan Stanley files for Bitcoin and Solana ETFs in a digital assets push. The move will deepen the bank's presence in the cryptocurrency space and comes two years after the SEC approved the first U.S.-listed spot bitcoin ETF. Continue reading

PARTNERSHIPS

🇦🇪 Crypto.com and Changer.ae partner to expand regulated digital asset services in the UAE. By combining Crypto.com’s global infrastructure and compliance capabilities with Changer’s FSRA-licensed and ADGM-authorised platform and local market expertise, the collaboration aims to support the responsible adoption of digital assets.

🇦🇪 Yuze and Zand partner to deliver AI-driven digital business banking for UAE SMEs. The partnership aims to make financial services easily accessible to eligible businesses through fast onboarding, an IBAN account, digital banking products, and advanced business tools through Yuze’s platform to manage and grow their businesses.

🇳🇬 Sterling Bank joins Thunes' direct global network to transform cross-border payments for Nigerian expatriates. By leveraging Thunes' Direct Global Network, Sterling Bank is rolling out this enhanced capability across multiple European markets, giving customers abroad a more consistent way to support their families and manage finances.

🇦🇪 Network International partners with MBank to launch regulated stablecoin payments. The partnership will see the integration of AE Coin into Network’s POS and E-commerce payment platforms, enabling merchants to accept AE Coin seamlessly across physical and digital channels.

DONEDEAL FUNDING NEWS

🌍 Mylapay raises $1m to expand payment infrastructure. Mylapay plans to use the funding to strengthen its core infrastructure, expand its product suite, deepen partnerships with banks and payment aggregators, and support its geographic expansion across the Middle East, Africa, and the US markets.

🇵🇰 Veon pumps $20m in Mobilink Microfinance Bank. Veon said the funding will support growing demand for digital and Islamic banking services, as well as broader development of Pakistan’s digital economy. Keep reading

M&A

🌎 GTreasury acquires Solvexia. The acquisition expands GTreasury’s platform to automate reconciliation and regulatory reporting across treasury, finance, and compliance operations, addressing one of the most persistent challenges facing finance teams: manual, spreadsheet-driven processes that increase operational risk and audit exposure.

🇬🇧 Bridgepoint opens negotiations to acquire a majority stake in Interpath. According to a company statement, Interpath says that Bridgepoint's support would enable it to focus on accelerating its international expansion, continuing to attract and retain top talent, and broadening its service offering across existing and new geographies.

🇺🇸 Solutions by Text acquires Triple Play Pay. This strategic acquisition will combine SBT's trusted communication expertise with TPP's modern payment orchestration platform to deliver a unified, compliant, and seamless payment experience for consumer finance businesses and their customers.

MOVERS AND SHAKERS

🇦🇺 Airwallex names James Teodorini as new ANZ head & records volume. The FinTech said Teodorini will oversee its regional strategy and commercial activities in the two markets. The business has reported annualised transaction volume of more than USD $235 billion, an increase of 127% year on year.

🇺🇸 Robinhood ups institutional crypto, adding B2C2 sales head Zeke Vince. Before his time at B2C2, Zeke worked at Bank of America Merrill Lynch as Global Head of eFX and Algo Sales. He has also previously worked at JP Morgan, Credit Suisse, and Bloomberg, over a 20-year career in the FX trading industry.

🇩🇪 Solaris names Steffen Jentsch to lead embedded finance platform. “Jentsch brings a proven track record in scaling digital financial platforms, along with deep expertise in regulatory transformation and digital banking solutions,” the announcement said.

🇲🇽 Clara boosts growth leadership by appointing Jorge de Lara as President for Mexico. As President for Mexico, Jorge will play a cross-functional role, leading growth and acquisition strategies in the Mexican market, where the company was founded before expanding regionally.

🇸🇬 Tonik appoints former TNEX CEO, Bryan Carroll, to a Senior Role. Carroll joins Tonik with extensive experience in the digital banking sector, having previously served as the CEO and Co-Founder of TNEX, Vietnam’s digital-only bank.

🇨🇭 radicant bank appoints Matthias Kottmann as Chairman. In his new role, Kottmann will oversee the orderly wind-down of the bank’s activities, which is expected to be completed by April 2026. A key priority under his leadership will be the execution of a recently signed agreement with Alpian, a Swiss digital bank.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()