PhotonPay Secures U.S. MTL License as Its Global Payments Strategy Comes Together

Hey FinTech Fanatic!

PhotonPay just secured a U.S. Money Transmitter License, a key regulatory milestone that anchors its long-term expansion across the Americas.

The approval strengthens PhotonPay’s ability to offer compliant payment and funds transfer services under one of the most demanding regulatory regimes globally.

This comes right after the update from last week, where PhotonPay expanded its UK payments stack through ClearBank, unlocking local rails like Faster Payments, BACS, and CHAPS.

UK local rail yesterday. U.S. licensing today. The pattern is clear: PhotonPay is methodically building a regulated, local-first infrastructure market by market.

With both FinCEN registration and state-level MTL approval now in place, PhotonPay is positioning itself for deeper localization, tighter liquidity control, and scalable growth across global corridors...

Also, quick heads-up:

from now on, I'm on TikTok! 👀

For the next generation… and yes, for the seasoned the veterans who are still curious 😉 Expect sharp takes, daily signals, and the stories shaping FinTech right now. Don’t miss it.

Curious where FinTech is heading next? Dive into today’s updates. I'll be back tomorrow with more stories.

Cheers,

ARTICLE OF THE DAY

📰 Why Cross‑Border Payments Can Make or Break Modern Travel: A Case Study from 3S Money. Payments have become a core operational layer in travel rather than a back-office function, as failures directly impact bookings, suppliers, and customer experience. This article examines why payment infrastructure now warrants greater strategic attention and what factors are crucial when it is designed for the realities of travel operations.

BREAKING NEWS

🇺🇸 The Federal Reserve Board has approved Banco Inter to open a state-licensed branch in Miami. The approval authorizes Inter to establish a Florida branch based in Miami, expanding the company's cross-border capabilities and broadening its range of financial services for individuals and businesses.

PODCAST RECOMMENDATION

🎤 Banking Transformation and Human-Centered Service with David M. Brear by DashDevs. In episode 130 of FinTech Garden, Igor Tomych and Dumitru Condrea speak with David M. Brear, Group CEO of 11:FS Holdings, who emphasizes that meaningful innovation in banking is driven not only by technology but also by culture, empowered teams, and a focus on service-led experiences that can scale despite legacy constraints. Watch the full episode

Banking Transformation and Human-Centered Service with David M. Brear by DashDevs

FINTECH NEWS

🌍 New January FRC runs! The FinTech Running Club is back with new runs! If you’re into FinTech, community, and networking, why not join the chapter in your city? Are you curious? 👉 Sign up for a run here!

🇺🇸 PhotonPay secures U.S. MTL license to anchor its global regulatory framework. Through the successful approval of the state-level payment license, PhotonPay strengthens its localized service capabilities and broadens its operational reach, laying a solid foundation for sustained growth across the Americas and global markets.

🇨🇳 Toss Payments parts ways with Chinese capital. Viva Republica announced, “Viva Republica will acquire all shares of Toss Payments held by Chinese Ant Group, while allocating shares of Viva Republica to Ant Group through a third-party allotment of new shares with consideration.”

🇬🇧 eToro partners with the BWT Alpine Formula One Team. eToro will become the team’s exclusive trading and investment partner. The partnership brings together two brands united by a focus on innovation and community. Keep reading

🌍 Flanks and finReg360 launch EDX, Europe's first standardised financial data exchange protocol. EDX establishes a common standard for the secure exchange of financial data between financial institutions, banks, wealth managers, and advisors, and fills a fundamental gap in Europe's wealth management infrastructure.

PAYMENTS NEWS

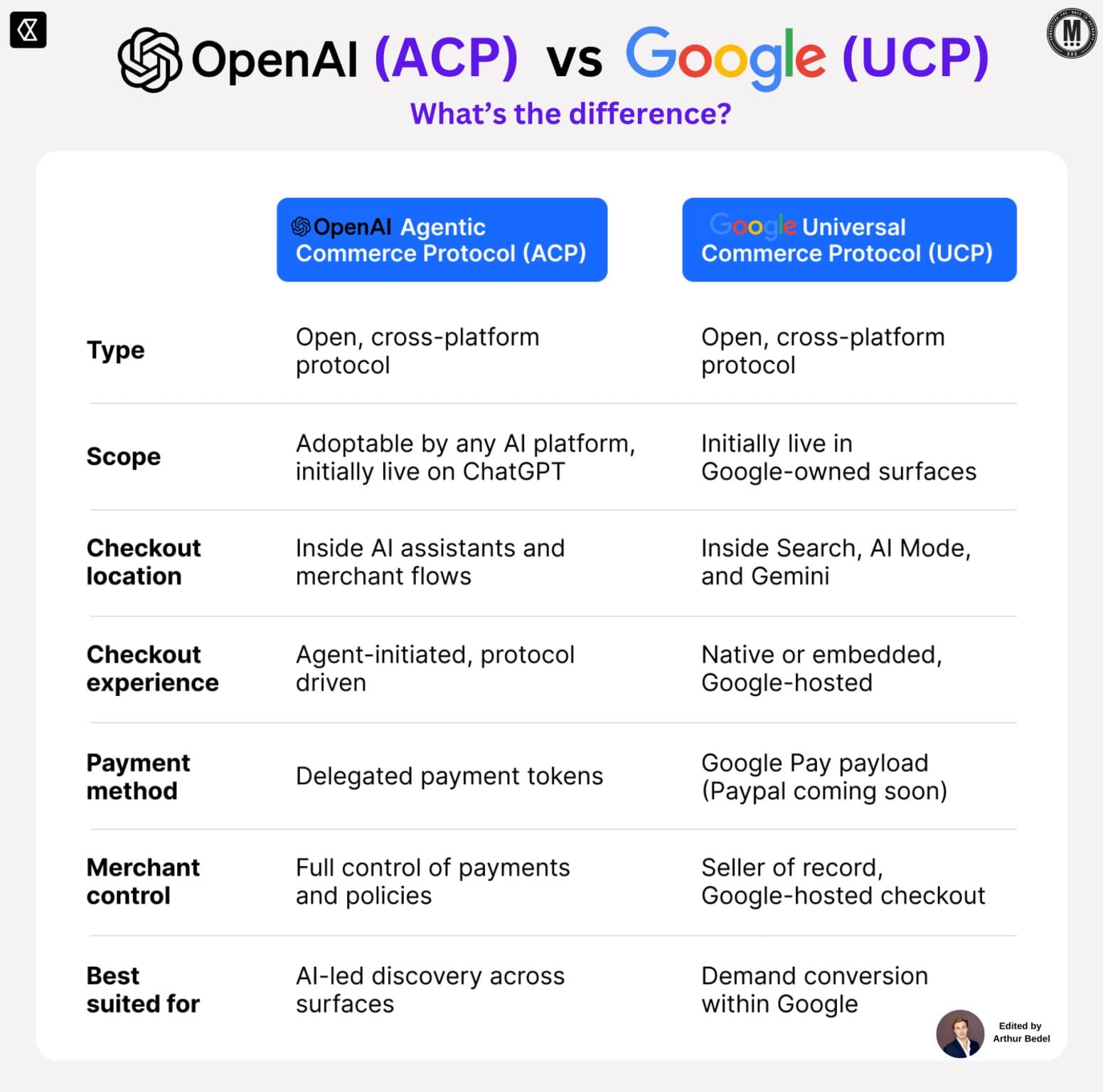

➡️ OpenAI (𝐀𝐂𝐏) 🆚 Google (𝐔𝐂𝐏)

Two visions for Agentic Commerce:

🇺🇸 Affirm to offer BNPL for rent. Affirm will make those services available through a partnership with Esusu. This New York-based financial technology company offers financial education, credit reporting assistance, and emergency zero-interest loans to tenants.

🇨🇴 Wompi announced that it processed $50 billion and recorded 130% growth. Wompi explained that, thanks to its successful results, it managed to venture into new lines of business by putting its technology at the service of Bancolombia branches, along with processing 60 million transactions for more than $18 trillion in this segment.

🇺🇾 Xsolla implements Mercado Pago in Uruguay, and now developers can access more than 60 million active users. This new integration strengthens Xsolla's presence in Latin America, enabling developers to offer players reliable payment experiences that prioritize mobile payments in one of the region's most digitally advanced markets.

DIGITAL BANKING NEWS

🇳🇬 Digital Asset and FinTech Operators face higher capital requirements under SEC review. The move is anchored on the Commission’s mandate under the Investments and Securities Act, 2025, and is aimed at strengthening the resilience, stability, and long-term sustainability of Nigeria’s capital market.

🇺🇸 Swiss bank UBS closer to getting national bank charter for US franchise. “This milestone marks a significant step toward securing final approval of our National Bank Charter, reinforcing UBS’ commitment to growth and strengthening our position as the premier global wealth manager in the US,” a UBS spokesman said.

🇰🇿 Kazakhstan grants official status to the digital tenge as currency. The digital tenge is now officially recognized as a legitimate means of payment in Kazakhstan. The National Bank has been designated as the sole issuer, and transactions will be conducted through licensed financial market participants.

🇺🇸 Bank of America CEO Brian Moynihan says stablecoins could drain trillions in bank deposits. Bank of America CEO expressed confidence that the bank will adapt to the rise of stablecoins but warned of potential risks to the broader banking system.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Nexo to pay $500K fine to California regulator over risky loans. The California Department of Financial Protection and Innovation (DFPI) said that Nexo made at least 5,456 consumer and commercial loans to Californians without a valid license.

🇩🇪 Audi Revolut F1 team welcomes Nexo as official digital asset partner. Ambitious and performance-driven, both brands are aligned around a shared trajectory of innovation and disciplined execution, underpinned by a common engineering mindset and a focus on performance at the highest level.

🇧🇪 Belgium's KBC Bank launches Bitcoin trading through Bolero under the MiCA framework. Bolero operates on an execution-only basis without providing investment advice, requiring customers to complete knowledge and experience tests assessing understanding of volatility risks and potential total loss before trading.

🇺🇸 Polygon slashes 30% staff in pivot to stablecoin payments. The move marks a definitive pivot from general-purpose scaling to a vertically integrated, regulated stablecoin payments platform. Continue reading

🇧🇾 Belarus moves to regulate crypto banking through licensed institutions. The new rules place crypto-related banking activity firmly under state supervision, signaling a controlled but deliberate expansion of digital finance within the country. Read more

PARTNERSHIPS

🇺🇸 Feedzai and Matrix USA launch global partnership to modernize financial-crime prevention with AI-native defenses. The collaboration aims to address rising AI-driven fraud while minimizing operational disruption, including the launch of a joint Center of Excellence to deliver repeatable, market-ready deployments.

🌍 Swift partners with Chainlink to drive multi-bank digital asset settlement solutions. Swift completes a successful trial, enabling seamless tokenized asset transactions across multiple global platforms. Read more

🇬🇧 LMAX Group and Ripple announce partnership. LMAX’s clientele, including banks, brokers, and buy-side institutions, will be able to leverage RLUSD for both enhanced cross-collateralisation and margin efficiencies, within spot crypto, perpetual futures, and CFD Trading.

🇬🇧 Paysafe and Pay.com launch strategic partnership. Pay.com will offer Paysafe as one of its acquirer options for card payments, allowing merchants to benefit from the company’s 30 years of experience as a processor across diverse industry verticals.

🇧🇭 BBK partners with Binance Bahrain to integrate crypto-as-a-service. The integration allows BBK customers to trade and manage crypto assets directly through the bank’s mobile app, streamlining the process. BBK’s in-app dashboard will combine crypto and traditional banking services, providing a unified experience for customers.

🇱🇹 Axiology partners with iDenfy to streamline onboarding for DLT-based capital markets. The collaboration integrates iDenfy’s biometric identity verification and adverse media checks into Axiology’s onboarding process, supporting faster access for new users while reinforcing compliance standards across issuance, custody, trading, and settlement.

DONEDEAL FUNDING NEWS

🇺🇸 Meld secures $7m to expand global stablecoin network. This strategic funding allows the company to expand the Meld Network and make digital assets as accessible as traditional payment methods, while enabling product managers and developers to build the next generation of financial applications.

🇧🇷 Magie snags $5 million and brings financial services to businesses' WhatsApp. This capital supported the validation of the product for the end consumer and now finances the expansion of the corporate offering and the business account, within the strategy of growing via WhatsApp.

M&A

🇨🇴 Koa seeks to consolidate its position in the FinTech ecosystem through the merger with ExcelCredit. The merger between the two brands aims to develop a more financially inclusive environment. The companies stated at the time that they had overcome several challenges.

🇧🇷 Mercado Bitcoin announces the acquisition of Banco Mercantil's brokerage firm. In a statement, MB affirms that the new acquisition will allow for a more robust presence in the digital financial market, reinforcing the platform's pioneering role in the segment, which already has other regulated companies in its ecosystem.

MOVERS AND SHAKERS

🇳🇬 Nigerian FinTech AlHuda CIBE taps Shariah expert Muhammad Zubair Mughal for its AI-driven Islamic banking services. He will guide Open Space on Shariah governance structures, compliance frameworks, product validation processes, and the overall alignment of its Non-Interest Financial offerings.

🇬🇧 Lendscape appoints Brett Promisel as new CEO. Promisel joins from FIS Global, where he led the Investor Services business after it acquired Deep Pool Financial Solutions, and brings almost 35 years of experience from senior roles across financial services.

🇬🇧 Nomura taps former Stanchart Executive Mark McMillan to lead electronic FX. In his new position, McMillan will oversee Nomura’s electronic FX trading business and the associated sales teams that distribute the platform to clients. His new post spans e-trading and sales, which allows Nomura to align platform development, pricing, and distribution under one senior manager.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()