Paytm's New Banking Partnership with Axis,Visa & Mastercard Face RBI Halt in India

Hey FinTech Fanatic,

In a strategic move to navigate regulatory challenges, Paytm has partnered with Axis Bank Ltd., transitioning from its previous collaborator, Paytm Payments Bank, which faced regulatory scrutiny. This partnership aims to stabilize Paytm's merchant payments settlement business amidst tightening oversight from the Reserve Bank of India (RBI).

Concurrently, the RBI has directed Visa and Mastercard to halt card-based commercial payments for businesses over KYC compliance concerns, affecting the broader fintech sector, including companies facilitating payments for rent and tuition fees through cards.

Visa confirmed communication from the RBI, highlighting an industry-wide review of business payment solution providers (BPSPs) and their compliance with payment guidelines.

The move has prompted a pause in certain transactions, underscoring the regulator's focus on strengthening FinTech oversight. Despite these challenges, traditional banking transactions remain unaffected, showcasing the dynamic regulatory environment facing India's FinTech industry.

This collaboration between Paytm and Axis Bank, led by Paytm's founder Vijay Shekhar Sharma, reflects a pivotal effort to ensure the company's resilience in the face of regulatory pressures, marking a significant development in India's evolving FinTech landscape.

To be continued...

Have a great start to the week and I'll be back in your inbox tomorrow.

Cheers,

ARTICLE OF THE DAY

Check out my latest Q&A article with Adam Willems to learn all about the "why" in FinTech, and my colab with The Financial Revolutionist:

INSIGHTS

Here is the official response from Temenos regarding the shocking Hindenburg Research Report, which caused a significant drop in share price and led to multiple trading halts last week: Click here to learn more.

FINTECH NEWS

🇮🇳 PayNearby launches Digital Naari programme to support underserved women in India. The platform will work alongside the government’s ‘Lakhpati Didi’ programme to support female business owners, single women, and literacy-challenges women with financial and digital services that cater to their needs.

🇬🇧 Coenseo Ventures announces the launch of FundIQ, a platform designed to transform the early-stage investment market in the UK. FundIQ is set to build on the data from over 2000 Capital Pilot reports to increase the use of artificial intelligence and data analytics to provide a more nuanced and comprehensive assessment of startup potential.

🇸🇪 Klarna’s CEO embraced AI by telling OpenAI’s Sam Altman, “I want Klarna to be your favorite guinea pig.” In 2023, the payments and shopping company rolled out a range of AI features, including AI-powered image search and highly personalized shopping feeds.

🇵🇰 Keenu, a player in digital payment services and an Electronic Money Institution (EMI), entered into a new chapter recently with a transformative management buyout that saw Saad Niazi assuming the mantle of acting CEO. The management buyout will enable Keenu to operate more nimbly under the current owners.

🇺🇸 Episode Six joins Mastercard Engage Programme. This will provide Episode Six with fast and easy access to qualified technology partners. Participants in the Engage program also receive opportunities to boost their growth, gain access to exclusive resources and perks as well as enhance their brand’s visibility.

PAYMENTS NEWS

🇳🇱 Starting April, the iDeal Payment platform in the Netherlands will update to include new features like saving banking details and a Buy-Now-Pay-Later option. The update will be available for all users from April 2024 and will allow users to access new features that make shopping online even more convenient.

🇦🇺 Afterpay says it has no plans to shake up its Australian brand, despite reports its American operation will be merged with peer-to-peer payments platform Cash App, and payment experts flagging significant regulatory changes at home in 2024.

🇺🇸 Trice announced its launch as a technology provider and real-time payments gateway for the RTP® network from The Clearing House, with TransPecos Banks as Trice's partner for the bank's real-time payments. Trice's APIs and cloud-native platform make it easy for development teams of all sizes to incorporate real-time payments for A2A bank deposits and payouts.

Navigating cross-border payments: Insights from Mangopay. James Butland, VP of Payment Network at Mangopay, discusses the future of cross-border payments, and how they can be processed seamlessly by companies to boost conversion rates. Read the complete article here.

🇬🇧 Payments platform Checkout.com has reportedly suffered a £100.5 million loss in its UK company. The net losses of Checkout.com’s 2022 accounts are up 400% compared to the $25 million loss in 2021. The London-based fintech reported a revenue of $246 million in 2022, a slight drop from $260 million in 2021.

REGTECH NEWS

iDenfy, a Lithuania-based RegTech company best known for its identity verification solutions, has announced a new partnership with BlueMonks, a Dutch anti-financial crime boutique specializing in end-to-end compliance solutions. This partnership is a pivotal step towards elevating security standards in response to the increasing frequency of financial fraud.

DIGITAL BANKING NEWS

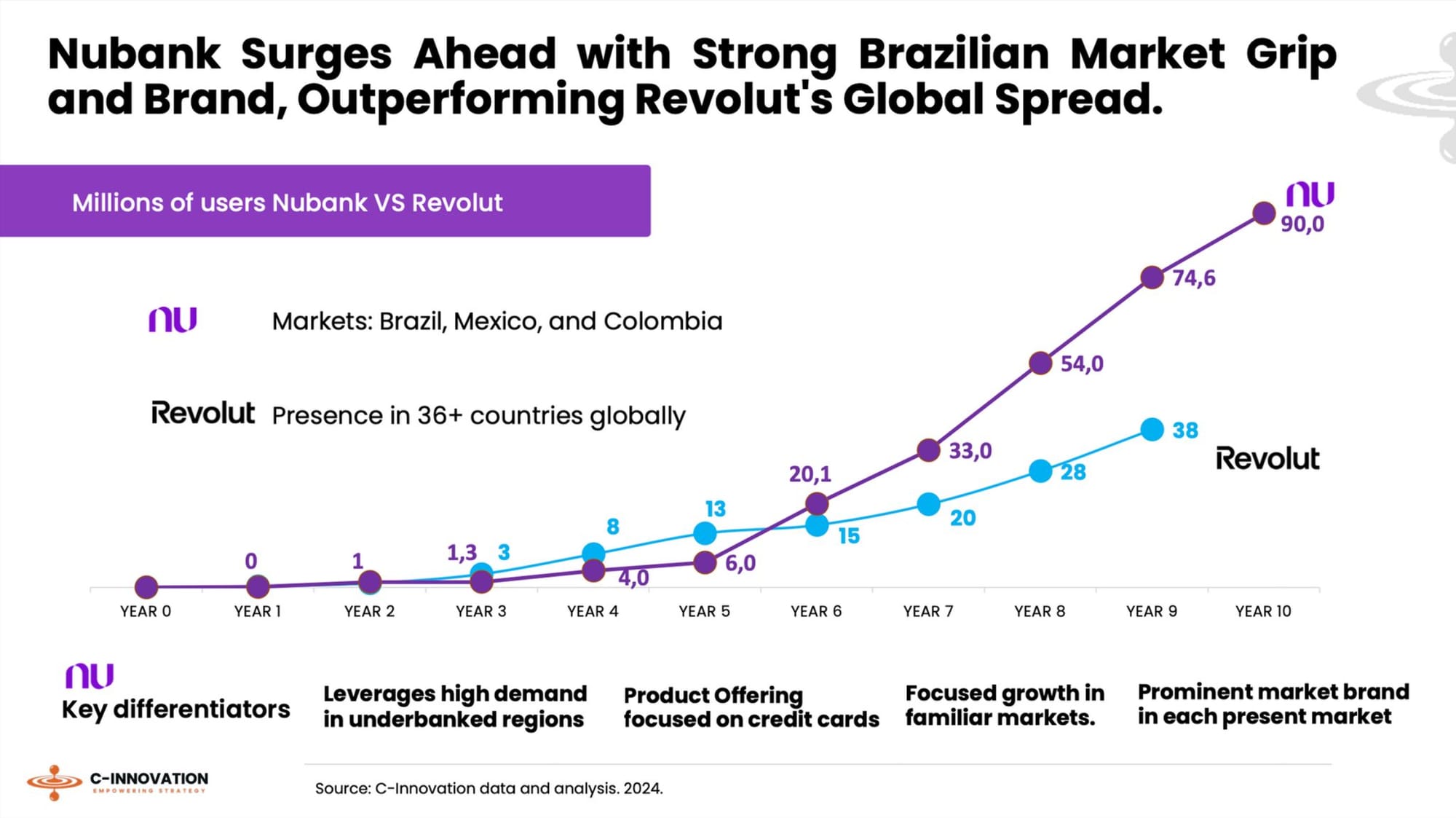

Nubank 🆚 Revolut. Both neobanks have achieved astonishing growth over the years and both are targeting the US for future growth. Learn more by reading the complete overview article here

🇺🇸 Better introduces VA loan programme. This offering allows qualified Veterans to secure a home loan for up to 100% of their purchase price with no down payment requirement, improving the homeownership experience for individuals who served their country.

🇺🇸 Apple’s recent move to boost the interest rate for its Apple Card Savings Account to 4.5% is now prompting a competitor to do the same. Cash App announced it will now offer “up to” a 4.5% APY (annual percentage yield) for its Cash App Savings customers, with a few caveats.

🇺🇸 Bank of America and Starbucks launch loyalty partnership. The companies announced a new partnership that offers millions of Bank of America cardholders and Starbucks Rewards® members in the U.S. the ability to earn even more benefits by linking accounts.

BLOCKCHAIN/CRYPTO NEWS

Revolut is testing a beta version of a cryptocurrency exchange targeted at "advanced traders." The exchange will offer lower fees than trading through the Revolut app alongside enhanced market analytics. Read the complete article here.

🇺🇸 RockWallet has announced its acquisition of Wyre’s full customer base after the cryptocurrency payment platform shut down in June 2023. Rockwallet announced that Wyre customers will receive direct communication from Wyre regarding login details and reactivation guidelines.

DONEDEAL FUNDING NEWS

🇺🇸 PayPal Ventures has co-led a $30 million Series C funding round for generative conversational AI platform Rasa, which powers AI assistants for a host of major firms, including two of the world's top three banks and several insurers. Read more

🇺🇸 Ribbon raises $2.7M to automate inheritance claims. Ribbon’s technology empowers the bereaved by enabling financial institutions to launch their own inheritance center. Link here

MOVERS & SHAKERS

🇺🇸 FinWise Bancorp, parent company of FinWise Bank, announced the promotions of Chief Fintech Officer Robert Keil and Chief Technology Officer Richard Thiessens to the added title of Executive Vice President. Read on

🇺🇸 Toast to cut about 550 employees in restructuring. About 10 percent of staff will be laid off as the business seeks profitability. The company, which creates software for restaurants, will also reorganize certain facilities and operations.

🇬🇧 Bevan Money, a new bank with a focus on providing mortgages for public sector workers, has appointed Brian Brodie as CEO. Brian joins Bevan from Freedom Finance, where he was group CEO and, most recently, chairperson. More on that here.

🇫🇷 Sopra Banking Software hires former Temenos and Fiserv exec Andrew Steadman as CPO. As CPO, Steadman will lead the company’s Software-as-a-Service (SaaS) product strategy and manage all business functions that contribute to product management and innovation.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()